Series 65 Exam and License Guide for Advisory Firms

Dec 10, 2025

·

13 min read

Contents

The Series 65 exam is a critical milestone for anyone looking to provide investment advice in the United States, whether as part of a traditional advisory firm or a fast-moving fintech platform.

It’s not just another test; it’s the regulatory foundation that allows individuals to become licensed Investment Adviser Representatives (IARs) and legally offer fee-based investment advice.

This article breaks down everything you need to know about the Series 65: who regulates it, what’s on the exam, who needs it, and how it connects to broader compliance requirements.

At InnReg, we help advisory firms and fintech platforms navigate Series 65 licensing, state registrations, and ongoing compliance operations. Our team supports you through registration, supervisory workflows, and multi-state expansion. Contact InnReg to learn more.

What the Series 65 Exam Is

The Series 65 exam, formally known as the Uniform Investment Adviser Law Examination, is the qualification test required for individuals who want to provide investment advice for compensation. Passing it allows someone to register as an IAR under state securities laws.

While the Financial Industry Regulation Authority (FINRA) administers the test, the exam itself is designed and maintained by the North American Securities Administrators Association (NASAA), which represents state securities regulators. The collaboration between FINRA and NASAA allows the test to be delivered on FINRA’s platform while aligning its content with state law requirements.

The Series 65 assesses a candidate’s understanding of:

Financial markets

Investment products

Ethics

Legal responsibilities of an investment advisor

The goal is to confirm that anyone providing investment advice can interpret regulations and act in the client’s best interest.

This exam is relevant for fintechs, as any technology-driven platform that recommends or manages portfolios must have licensed personnel to meet regulatory standards. Understanding where this exam fits into your business model is essential for building a compliant advisory framework.

FINRA and NASAA: Who Regulates What

The Series 65 exam involves two key regulatory organizations: FINRA and NASAA. While their roles overlap operationally, they serve distinct purposes within the investment advisory ecosystem:

The Role of FINRA in the Series 65 Exam

FINRA administers the Series 65 exam and manages the testing infrastructure.

It handles scheduling, proctoring, and reporting results through the Central Registration Depository (CRD) system, typically linked to Form U4 filings. FINRA’s role is primarily procedural, focusing on maintaining a consistent and accessible exam process nationwide.

The Role of NASAA in the Series 65 Exam

NASAA creates and maintains the content of the exam. NASAA represents state securities regulators, which means its focus is on aligning exam material with state-level laws, ethics, and investment advisory standards.

It also defines the competencies and passing requirements for IARs.

In practice, NASAA sets the rules, and FINRA delivers the test. After passing, individuals must register with state regulators to obtain a license. For firms, especially fintech companies, this structure can cause confusion, since the registration process involves multiple systems and agencies.

That’s where experienced compliance partners, such as InnReg, help navigate filings, state coordination of registrations, and timing to avoid operational gaps during onboarding or licensing transitions.

Series 65 Exam at a Glance

The Series 65 exam is designed to test both technical knowledge and regulatory awareness. It’s a comprehensive assessment that measures whether an individual is qualified to act as an IAR under state law.

The exam is structured, timed, and standardized, offering a clear path for professionals entering the investment advisory space.

Key FINRA Series 65 Exam Details | |

|---|---|

Category | Details |

Exam Name | Uniform Investment Adviser Law Examination |

Administered By | FINRA (on behalf of NASAA) |

Question Count | 130 scored questions + 10 unscored pretest items |

Time Limit | 180 minutes (3 hours) |

Passing Score | 92 correct answers (approximately 70%) |

Exam Fee | $187 |

Eligibility | Open to anyone 18 or older; no sponsorship required |

Retake Policy | 30-day wait after the first two attempts; 180-day wait after the third |

Validity | Indefinite, as long as registration remains active and in good standing |

The exam’s design reflects the realities of modern financial advisory work. Questions span investment vehicles, economic analysis, portfolio management, and ethical practices, testing candidates on both technical and legal aspects of the profession.

For fintech founders or compliance leads, this exam often represents more than just an individual credential. It is part of a broader compliance structure that connects personnel licensing, state registration, and advisory oversight into a unified regulatory framework.

Exam Content and Structure

As mentioned before, the Series 65 exam is structured to evaluate both the technical and ethical dimensions of investment advisory work. It measures whether a candidate understands not only how to analyze investments but also how to apply regulations and fiduciary principles when advising clients.

Core Areas of the Series 65 Exam

NASAA divides the exam into four weighted content sections, each designed to mirror the day-to-day responsibilities of an IAR:

Content Area | Focus | Approximate Weight |

|---|---|---|

1. Economic Factors and Business Information | Covers economic concepts, financial reporting, and how macro trends affect markets. | 15% |

2. Investment Vehicle Characteristics | Tests knowledge of securities, including equities, fixed income, mutual funds, ETFs, derivatives, insurance, and alternative assets. | 25% |

3. Client Investment Recommendations and Strategies | Focuses on portfolio construction, risk analysis, and suitability standards. | 30% |

4. Laws, Regulations, and Guidelines (Including Ethics) | Examines federal and state laws, fiduciary duties, conflicts of interest, and ethical standards. | 30% |

See also:

Practical Implications for Fintech Firms

For fintech platforms offering portfolio recommendations, algorithmic advice, or crypto investment options, Series 65 directly influences how compliance teams design internal controls and supervisory systems.

Advisors and compliance leads who understand this framework can better interpret how automated or hybrid advice models fit within regulatory boundaries. This is particularly important when integrating digital assets or new advisory technologies into client offerings.

Need help with fintech compliance?

Fill out the form below and our experts will get back to you.

Who Needs the Series 65 and Why

The Series 65 exam is required for anyone who provides investment advice for compensation, whether through traditional advisory services or digital platforms. It establishes the minimum qualification for professionals acting as IARs under state law.

Passing the Series 65 is mandatory for:

Investment advisors who give personalized advice or manage client portfolios.

Robo-advisor operators and fintech founders whose platforms recommend specific securities or build customized portfolios.

Financial planners who charge fees based on advice rather than commissions.

Hybrid firms that combine digital advice with human oversight or customer support.

If a platform’s model includes selecting, allocating, or recommending investments for users, someone on the team (often the compliance lead or portfolio strategist) must hold the Series 65 or equivalent qualification.

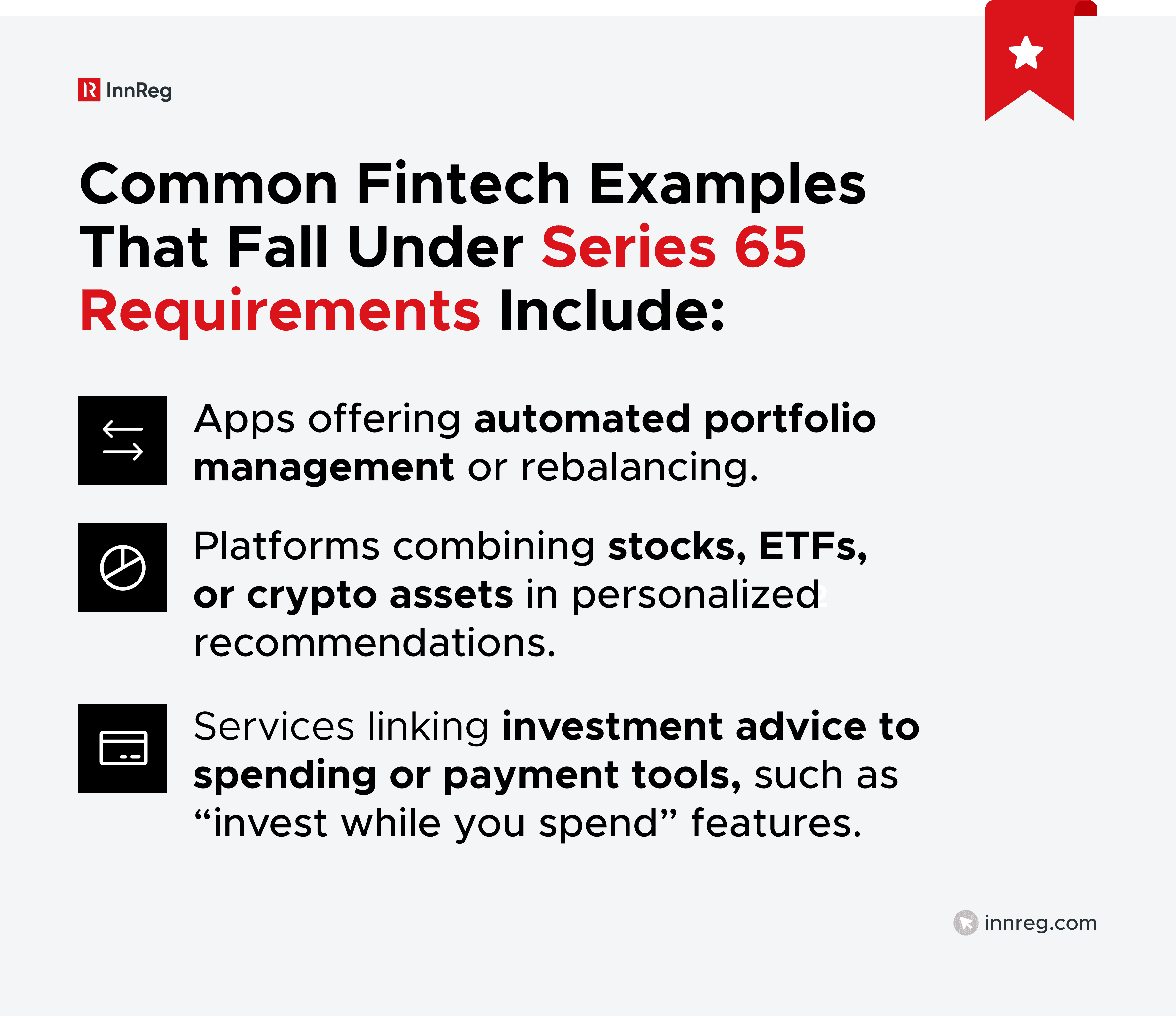

Why Series 65 Matters for Fintechs

Fintech founders often underestimate the relevance of early licensing. Even algorithm-driven recommendations can trigger advisory obligations if the system tailors investment suggestions to individual users.

Under state law, that’s considered providing investment advice, which means the firm and its key personnel must be licensed.

Licensing is only the first step. Once a firm employs or contracts IARs, it must also handle Form U4 filings, state registrations, recordkeeping, and supervisory procedures. For fintech companies, managing this across multiple jurisdictions can quickly become complex.

InnReg provides licensing services to help RIAs navigate these challenges →

Differences Between RIA and IAR

Understanding the difference between a Registered Investment Adviser (RIA) and an IAR is critical for anyone preparing for or managing Series 65 compliance.

These two roles are connected but distinct, each with its own regulatory obligations.

An RIA is the entity or firm that provides investment advice for compensation. It registers either with the Securities and Exchange Commission (SEC) or with one or more state securities regulators, depending on assets under management (AUM) and client base.

On the other hand, an IAR is the individual who provides the advice on behalf of the RIA. Each IAR must pass the Series 65 exam (or hold an approved equivalent, such as Series 7 + 66) and register in every state where they conduct advisory business.

Read our article to learn more about the difference between RIA vs. IAR →

Registration Process After Passing

Passing the Series 65 exam is only the first step toward becoming a fully licensed IAR. After receiving a passing score, candidates must complete several administrative and regulatory actions before they can legally provide investment advice or manage client portfolios.

Step 1: File Form U4

To become registered, individuals must submit Form U4 (Uniform Application for Securities Industry Registration or Transfer) through the Investment Adviser Registration Depository (IARD) system.

The form captures personal, employment, and disciplinary background information, and connects the individual’s Series 65 results to their advisory firm. Both the firm (RIA) and the state regulators review the filing before approval.

Note: For fintechs with distributed teams or hybrid work models, maintaining accurate Form U4 records is critical. Errors in addresses, job titles, or supervisory relationships can delay registration or cause regulatory findings during exams.

Read our guide to learn more about Form U4 →

Step 2: State Registration

Once Form U4 is accepted, the next step is registering in each state where the IAR conducts business or has clients. Most states require registration if the advisor has five or more clients in that state (known as the “de minimis threshold”).

Each jurisdiction sets its own fees, renewal dates, and continuing education rules, so multi-state operations need organized tracking.

Registration Component | Responsible Party | Typical Frequency |

|---|---|---|

Initial State Filing | RIA or Compliance Team | One-time per state |

Renewal | RIA or IAR | Annually |

Continuing Education (IAR CE) | Individual IAR | Ongoing per state rules |

Step 3: Ongoing Recordkeeping and Supervision

Once registered, IARs must follow strict books and records requirements, maintain accurate and current disclosures, and operate under a consistent system of supervision. Regulators expect firms to have clear, well-documented processes that demonstrate how compliance obligations are being met in daily operations.

State examiners frequently review these materials during audits or routine exams. They check for accuracy, timeliness, and completeness, particularly when firms manage accounts across multiple states or use automated systems to deliver investment advice.

For fintechs, this obligation often extends to digital environments. Records from client communications, trading algorithms, or portfolio rebalancing systems must be accessible and retained according to regulatory timeframes.

Compliance teams should establish procedures for capturing this data systematically, whether it resides in CRM platforms, chat tools, or investment dashboards.

See also:

Series 65 Exam Waivers and Alternatives

Not everyone has to take the FINRA Series 65 exam to qualify as an Investment Adviser Representative (IAR). NASAA recognizes certain professional designations and alternative exam combinations as equivalent to passing the Series 65.

NASAA allows several credentials to substitute for the Series 65 exam:

Credential | Full Title |

|---|---|

CFA® | Chartered Financial Analyst |

CFP® | Certified Financial Planner |

ChFC® | Chartered Financial Consultant |

PFS | Personal Financial Specialist (CPA designation with specialty) |

CIMA® | Certified Investment Management Analyst |

To qualify for an exemption, the designation must be current and in good standing, and the state regulator must accept it. Advisors should confirm eligibility with each jurisdiction before skipping the exam, as state interpretations can differ slightly.

Alternative Exams: Series 7 and 66 Combination

Another common path to qualification is through FINRA’s Series 7 and Series 66 exams.

Series 7 covers securities products and trading knowledge, while Series 66 combines elements of the Series 63 (state law) and Series 65 (advisory law).

Together, they satisfy the requirements to act as an IAR in most states. This route is often chosen by professionals moving from a broker-dealer environment into an advisory role, since they already hold the Series 7 license.

Considerations for Fintech Firms

For fintech leaders building advisory or hybrid platforms, knowing which team members qualify through waivers or prior licenses can streamline staffing and registration.

However, state regulators may still require documentation or proof of active standing for credential-based exemptions.

A practical approach is to maintain a centralized compliance record that tracks all personnel licenses, expirations, and supporting credentials. This helps mitigate delays during audits or expansion into new states.

Key Updates to the Series 65 Exam

NASAA periodically revises the exam’s content and scoring criteria to keep it aligned with current industry practices and investor protection standards.

The most significant recent changes include:

Lower Passing Score

In mid-2023, NASAA lowered the passing score from 94 correct answers to 92 out of 130 (approximately 70%). The change was based on an updated psychometric analysis of question difficulty and better reflects the intended competency threshold for IARs.

While this adjustment made the exam slightly more accessible, it still demands a strong comprehension of state and federal securities laws, ethics, and portfolio management principles.

New and Updated Exam Topics

The 2023–2024 exam content includes major updates in areas that reflect today’s financial landscape:

Digital assets and cryptocurrencies: Candidates must now understand how various digital assets are classified and regulated under securities law.

ESG investing: Questions test knowledge of how environmental, social, and governance factors influence investment analysis.

SPACs and alternative products: Reflecting market trends and investor demand.

Regulation Best Interest (Reg BI): Exam takers must distinguish fiduciary obligations from best-interest standards under Reg BI.

Protection of vulnerable investors: Focus on detecting financial exploitation and maintaining ethical conduct.

These updates highlight NASAA’s goal of testing for practical, current knowledge, not just traditional investment theory.

Continuing Education and Ongoing Relevance

In 2024, NASAA also integrated questions on continuing education (IAR CE) requirements, reinforcing that passing the exam is only the start of a longer compliance journey. Once registered, IARs must complete ongoing CE training in ethics and professional development to maintain active status.

Common Misconceptions About Series 65

The Series 65 exam is widely recognized across the advisory industry, but it is also one of the most misunderstood qualifications.

The most common misconceptions include:

Series 65 Equals a License: Passing the Series 65 exam doesn’t automatically make someone licensed to give investment advice. To become licensed, the individual (or their firm) must still file Form U4, pay state fees, and complete registration through the IARD system.

A CPA or MBA Automatically Waives the Exam: Having a professional background in finance or accounting doesn’t replace the Series 65. NASAA grants exam waivers only for specific credentials: CFA®, CFP®, ChFC®, CIMA®, and the CPA’s PFS designation. A standard CPA or MBA does not qualify for exemption.

Once You Pass, You’re Set for Life: While Series 65 results remain valid indefinitely, registration must be actively maintained through continuing education, renewal filings, and adherence to each state’s regulations. Inactivity or missed renewals can result in losing registration status.

Series 65 Covers Broker-Dealer Activities: The Series 65 authorizes investment advisory work, not securities sales. Activities like executing trades, selling investment products, or earning transaction-based commissions require a broker-dealer license, most commonly the Series 7.

Fintech firms often operate in hybrid spaces where technology, advice, and transactions overlap. Misunderstanding how Series 65 fits into that structure can lead to unlicensed activity or noncompliance across state lines.

State Registration and Multi-State Licensing Challenges

Passing the Series 65 exam qualifies an individual to register as an IAR, but each state has its own rules for maintaining that registration.

For firms operating across multiple jurisdictions, especially fintechs with clients in several states, this creates one of the most persistent compliance challenges: tracking and maintaining state-level licensing obligations.

How State Registration Works

After passing the Series 65 and filing Form U4, an advisor must register in every state where they have a physical office or base of operations, or serve more than a small number of clients (usually more than five, under the de minimis rule).

Each state regulator sets its own:

Filing fees and renewal schedules

Disclosure and reporting requirements

Continuing education expectations

Even when an RIA is federally registered with the SEC, its IARs must still register individually with the states in which they operate.

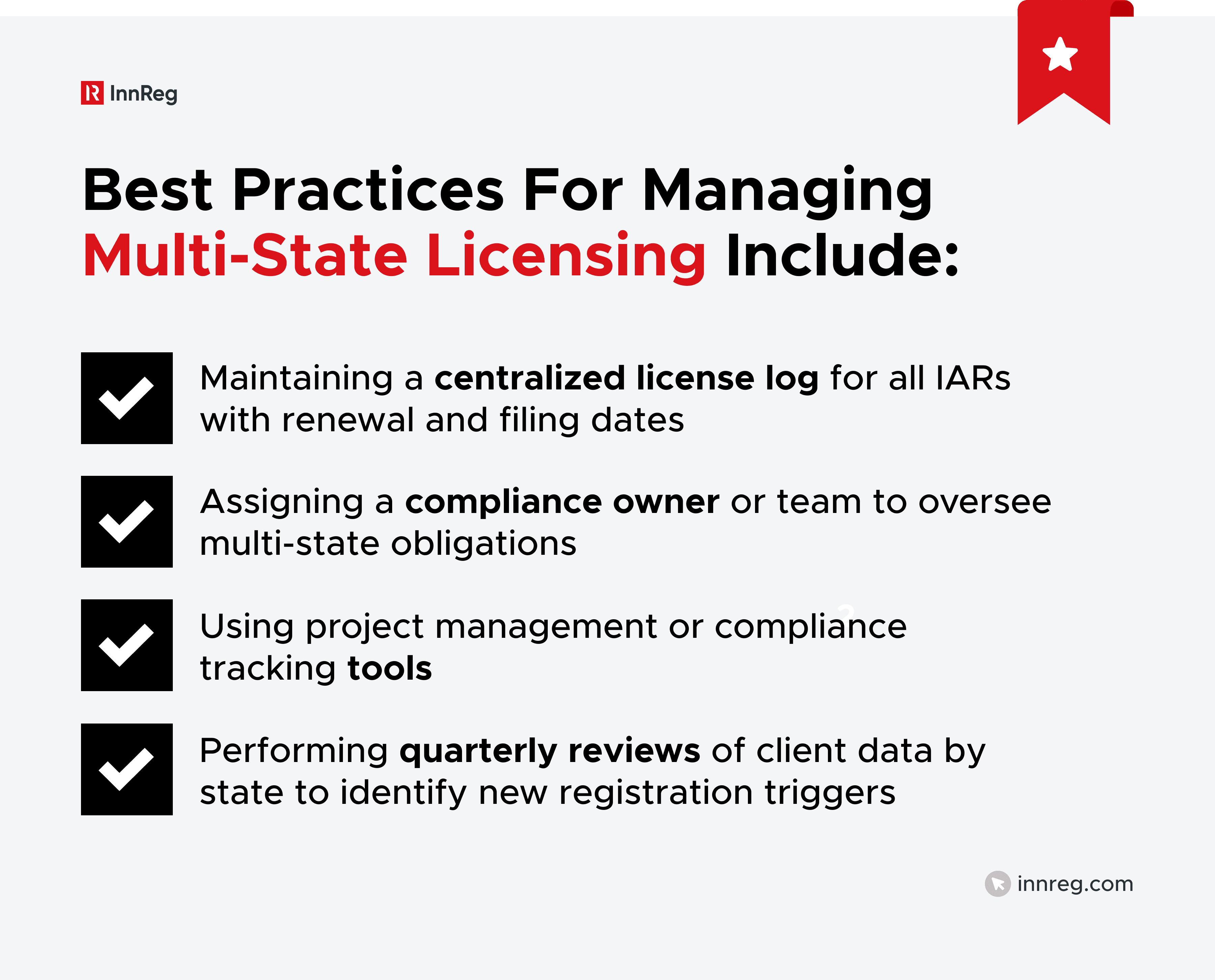

Best Practices for Managing Multi-State Licensing

Fintech platforms and digital advisors often scale quickly, adding clients across state lines before realizing they’ve triggered new registration obligations. A structured compliance process helps mitigate the risk of oversight.

Maintaining Compliance After Series 65

Passing the Series 65 exam and registering as an IAR is just the beginning.

Once licensed, an advisor is responsible for ongoing compliance that includes continuing education, supervision, documentation, and adherence to ethical standards.

Continuing Education (IAR CE)

Most states now follow NASAA’s Investment Adviser Representative Continuing Education (IAR CE) model rule.

It requires IARs to complete 12 hours of annual continuing education, divided into:

Six hours of Products and Practices, covering investment trends, risk management, and regulatory developments.

Six hours of Ethics and Professional Responsibility, focused on fiduciary conduct and client protection.

States adopting this rule expect IARs to complete CE annually to maintain active registration. Missing deadlines can result in administrative suspensions until the training is complete.

Supervision and Oversight

Every IAR must operate under an RIA’s supervisory framework, which includes periodic reviews of client communications, account management, and suitability documentation.

Supervisors are responsible for identifying conflicts of interest, monitoring recommendations, and addressing compliance exceptions. For fintechs, supervision often extends to digital tools and automated systems.

Compliance officers should review: how algorithms produce investment recommendations, whether disclosures match how the platform operates, and how client data is stored, shared, and protected.

Recordkeeping and Documentation

State and federal regulators expect firms to keep detailed records of all advisory activities, including client agreements, trading records, correspondence, and marketing materials. Retention timelines vary by state but typically range from five to seven years.

For fintechs, this includes both human and automated interactions. Chat logs, algorithmic adjustments, and performance data can all be subject to examination.

A well-structured data retention policy makes it easier to demonstrate compliance during audits.

See also:

—

The Series 65 exam defines who can legally provide investment advice and how advisory businesses operate within regulatory boundaries.

Understanding how Series 65 fits into the broader structure of state registration, continuing education, and supervisory oversight is critical for any firm offering investment-related products or advice.

For fintech founders, this knowledge bridges the gap between innovation and regulation. Whether a platform provides algorithmic portfolio recommendations, hybrid advisory services, or crypto-linked products, Series 65 licensing connects directly to your ability to scale responsibly and meet state and federal expectations.

How Can InnReg Help?

InnReg is a global regulatory compliance and operations consulting team serving financial services companies since 2013.

We are especially effective at launching and scaling fintechs with innovative compliance strategies and delivering cost-effective managed services, assisted by proprietary regtech solutions.

If you need help with compliance, reach out to our regulatory experts today:

Last updated on Dec 10, 2025