Reg BI (Regulation Best Interest) Explained

Feb 2, 2026

·

10 min read

Contents

Reg BI (Regulation Best Interest) has become a defining rule for broker-dealers serving retail investors. If your fintech product offers securities recommendations, whether directly through advisors or indirectly through algorithms, you are likely operating under Reg BI’s jurisdiction.

And yet, despite its prominence, many fast-moving teams still misunderstand where the boundaries are, what’s required, and how to build programs that actually meet expectations.

This article covers who Reg BI applies to, what “best interest” really means, and how the rule compares to the fiduciary standard for RIAs. We will also walk through each of the rule’s four core obligations, look at recent enforcement trends, and outline practical steps for building a Reg BI-aligned compliance program.

InnReg is a global regulatory compliance and operations consulting team serving financial services companies since 2013. If you need assistance with compliance or fintech regulations, click here.

What Is Reg BI?

Reg BI, or Regulation Best Interest, is a rule the SEC issued to set a standard of conduct for broker-dealers when making recommendations to retail customers.

It requires firms and their registered representatives to act in the best interest of the retail customer at the time a securities recommendation is made. That’s a step beyond the old “suitability” standard many firms were used to.

The rule went into effect on June 30, 2020. It applies to both individuals and firms registered as broker-dealers who offer investment recommendations to natural persons for personal, family, or household use. If your firm suggests investment products, directly through reps or through an app interface, the rule likely applies.

Reg BI was designed to improve transparency and raise the standard of care for broker-dealers without turning them into fiduciaries. The aim is to close the behavioral gap between broker-dealers and RIAs, especially around conflicts of interest, product selection, and cost considerations.

Who Reg BI Applies To

Reg BI applies to SEC-registered broker-dealers and their associated persons when making recommendations to retail customers. This includes traditional firms as well as fintech platforms that deliver investment suggestions through advisors, algorithms, or hybrid models.

The rule is triggered any time a securities recommendation is made to a natural person for personal, family, or household purposes. That includes high-net-worth individuals, small-dollar investors, and even some family offices, depending on structure. Sophistication or portfolio size does not exempt a customer from being considered “retail.”

If your fintech platform presents model portfolios, sends trade suggestions, or nudges users toward account types or investment actions, you may be in scope. The standard applies regardless of whether your firm uses human reps, automation, or a blend of both.

The Four Core Obligations Under Reg BI

Reg BI is built on four key obligations that broker-dealers must meet when recommending securities to retail clients. They form the backbone of what regulators look for when evaluating compliance:

Core Obligations Under Reg BI | |

|---|---|

1. Disclosure Obligation: Disclose all material facts, fees, services, and conflicts in plain language at the time of recommendation. | 2. Care Obligation: Evaluate every recommendation against the customer’s profile to act in their best interest. |

3. Conflict of Interest Obligation: Identify, reduce, or mitigate any conflict that could sway a recommendation, especially those tied to revenue or incentives. | 4. Compliance Obligation: Develop and enforce written policies, training, and oversight systems tailored to how your platform delivers investment guidance. |

1. Disclosure Obligation

Firms must disclose all material facts about the recommendation and the client relationship before or at the time the recommendation is made. This includes the capacity in which the broker is acting, fees and costs, services offered, and any material conflicts of interest.

That also means clearly stating whether you’re acting as a broker-dealer, what compensation structures exist, and how those structures might influence recommendations. Disclosures must be written in plain English, not buried in dense legal text or hidden in fine print.

Fintech platforms often face challenges here. If your app suggests trades or allocations, those nudges may qualify as recommendations under Reg BI. Disclosures need to be timely, visible, and meaningful, especially when your platform includes dynamic features or monetizes through payment for order flow, margin lending, or partner arrangements.

2. Care Obligation

The care obligation requires firms to exercise reasonable diligence, care, and skill when making a recommendation. That means understanding the potential risks and rewards of a product, and making a judgment that aligns with the retail customer’s investment profile.

It’s not enough for a recommendation to be “suitable.” Under Reg BI, it must be in the best interest of the client at the time of the recommendation. That includes considering alternatives, cost, complexity, and the customer’s financial situation, goals, and risk tolerance.

For fintech firms offering model portfolios, investment screens, or automated trade ideas, this obligation raises important design and documentation questions. If your system pushes a product that carries more risk or higher fees than alternatives, there needs to be a reasonable basis for that choice and a way to prove it.

3. Conflict of Interest Obligation

Firms must identify and either eliminate or mitigate conflicts of interest that could influence a recommendation. This applies both at the individual advisor level and at the firm-wide level, including compensation models, sales incentives, and proprietary product preferences.

Disclosing a conflict is not enough. There needs to be a control framework that reduces the risk of the conflict compromising the client’s best interest. That might involve restructuring incentives, limiting certain practices, or increasing supervisory oversight.

This is often where fintech firms hit friction. Business models built around payment for order flow, margin lending, or affiliate revenue need to be evaluated closely. If a conflict cannot be eliminated, it must be actively managed (ideally through written policies, clear escalation procedures, and compliance monitoring systems).

4. Compliance Obligation

Firms must establish, maintain, and enforce written policies and procedures designed to achieve compliance with Reg BI.

That includes training, supervision, surveillance, and documentation. Regulators want to see a structure that supports compliance at every stage of the recommendation process, from product due diligence to ongoing monitoring. Generic templates or policies that are not tailored to your business model will not hold up under scrutiny.

For fintech companies, this often means building compliance into the product lifecycle and operational workflows. Some startups address this by outsourcing compliance to specialized partners who can bring both regulatory insight and process-driven execution. This is especially valuable when internal resources are lean but regulatory expectations are not.

See also:

What Counts as a Recommendation Under Reg BI?

Reg BI applies only when a broker-dealer makes a recommendation to a retail customer, but that term is interpreted broadly. It is not limited to direct advice from a human advisor. It includes any communication that could reasonably be viewed as a call to action based on the customer’s profile.

That means product nudges, trade suggestions, portfolio rebalancing prompts, or account-type suggestions can all trigger Reg BI if they are personalized. If your system tailors investment content to individual users, it may be making a recommendation.

This is particularly relevant for fintech firms that rely on algorithms or UI-based guidance. If your app pushes a specific action or set of securities, regulators may treat that as a recommendation, even if it is not labeled that way. That distinction matters for how you design, monitor, and document your flows.

Need help with broker-dealer compliance?

Fill out the form below and our experts will get back to you.

Who Qualifies as a Retail Customer?

Under Reg BI, a retail customer is any natural person who receives and uses a recommendation for personal, family, or household purposes. This includes individuals regardless of their net worth, investing experience, or level of sophistication.

Sophisticated investors and high-net-worth individuals are still considered retail if they are acting in a personal capacity. Family trusts, personal accounts, and even some family offices may fall under the rule, depending on structure and use.

The definition is intentionally broad. Fintech platforms working with both accredited and everyday investors should treat all individual users as retail unless there’s a clear reason not to. Misclassifying users here can lead to compliance gaps.

Reg BI vs. Fiduciary Duty: Key Differences

Reg BI and the fiduciary standard share similarities but are not the same. Both require acting in the client’s best interest, but they differ in scope, duration, and legal classification.

Reg BI applies at the time of each recommendation and is specific to broker-dealers. The fiduciary duty applies continuously and governs registered investment advisors across the entire client relationship.

While both frameworks focus on loyalty, care, and conflict mitigation, only RIAs have a legal fiduciary obligation under the Investment Advisers Act. Broker-dealers operating under Reg BI are held to a best interest standard but are not fiduciaries in the legal sense.

Reg BI (Broker-Dealers) | Fiduciary Standard (RIAs) | |

|---|---|---|

Applies to | Broker-dealers | Investment advisors |

Legal Standard | Best interest | Fiduciary |

Scope | Per recommendation | Ongoing client relationship |

Conflict Handling | Disclose and mitigate | Avoid or fully disclose |

Compensation Flexibility | Commissions allowed | Typically fee-based |

Enforcement Authority | SEC, FINRA | SEC |

Read our article to learn more about Reg BI and Fiduciary Standard →

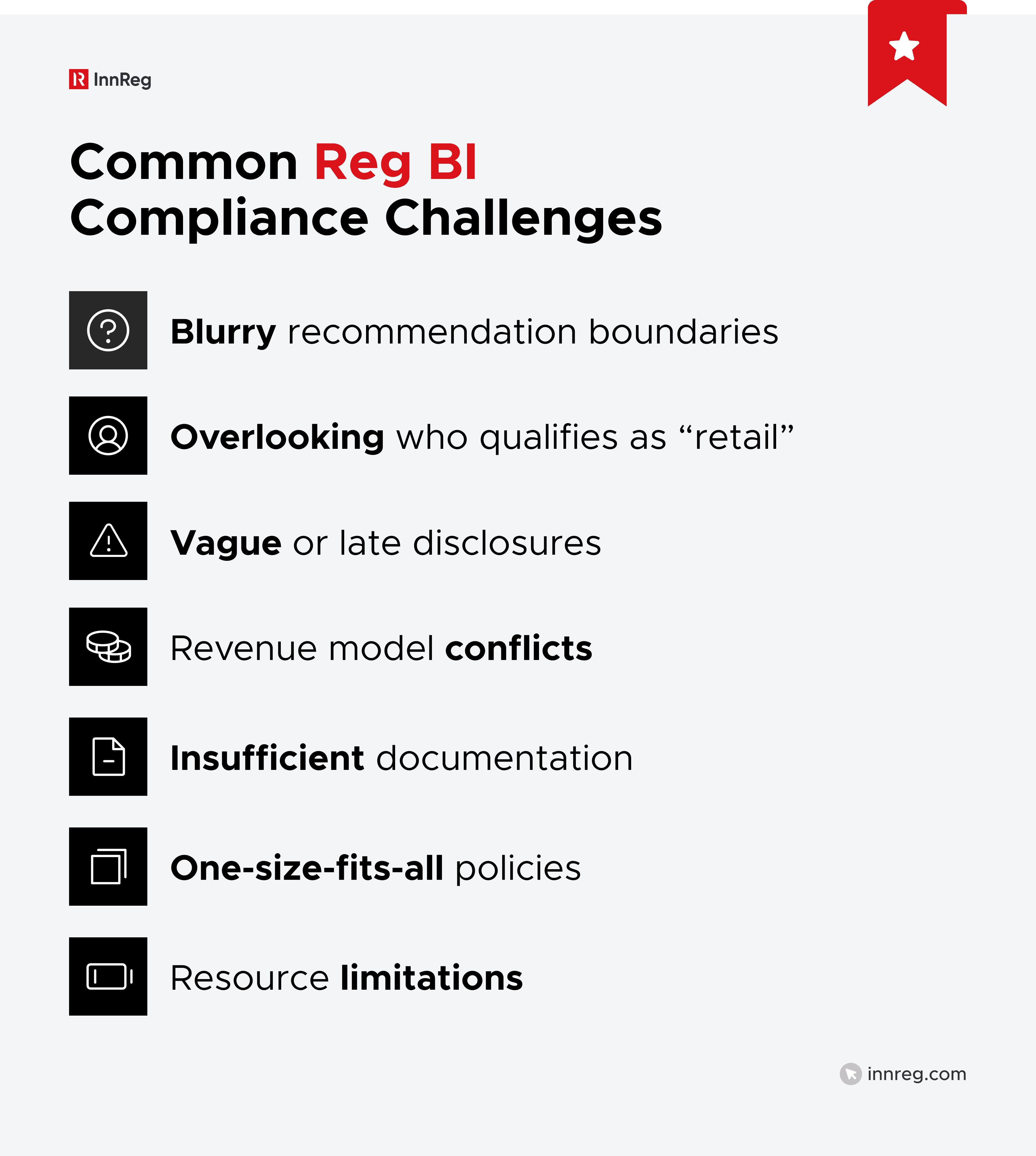

Common Reg BI Compliance Challenges for Fintechs

Reg BI is not just a legal requirement. It is a layered operational challenge, especially for startups, balancing speed, scale, and evolving product features.

Blurry Lines Around Recommendations

Seemingly innocuous features, such as trade suggestions, pre-filled allocations, or portfolio prompts, can qualify as personalized recommendations under Reg BI.

Without a clear internal framework, your platform may cross regulatory lines without intending to.

Misclassifying Retail Clients

It is a common misconception that high-net-worth individuals or seasoned investors don’t qualify as retail. But if they are acting in a personal capacity, Reg BI still applies, regardless of income, sophistication, or investing experience.

Disclosure Gaps and Timing Issues

Disclosures must be delivered clearly and before or at the point of recommendation, not buried in legal fine print or user agreements.

Late, vague, or overly generic disclosures risk regulatory scrutiny and break user trust.

See also:

Revenue-Driven Conflicts of Interest

If your business model includes payment for order flow, margin lending, or third-party product promotion, you’re inherently exposed to conflicts.

Reg BI requires that these be either removed or actively mitigated with controls, not just disclosed.

Lack of Documentation Trail

Regulators expect a clear record of why each recommendation was made, what alternatives were considered, and how the decision aligned with the user’s investment profile.

Without that paper trail, your platform is exposed during exams or enforcement actions.

Off-the-Shelf Compliance Policies

Using generic templates that do not reflect your platform’s actual structure is a red flag for regulators.

Policies and procedures must be tailored to your operational model, product delivery, and user experience to withstand review.

Limited Internal Compliance Capacity

Early-stage fintechs often lack in-house teams with deep Reg BI knowledge. This can lead to critical delays in implementation or reliance on outdated practices that no longer meet evolving expectations.

These issues are solvable, but they require practical compliance design, not just legal theory.

Founders and product teams partner with InnReg when they need to solve complex regulatory problems without slowing down product velocity.

Our team at InnReg builds compliance strategies tailored to Reg BI requirements, but structured for fintech realities to avoid retrofitting outdated models into modern platforms.

Learn more about our broker-dealer compliance services →

How Reg BI Affects Fintech Innovation

Reg BI does not block fintech innovation, but it does shape how product design, messaging, and operations must evolve. Fast-moving teams often underestimate how easily features like nudges, curated lists, or portfolio suggestions can cross into recommendation territory.

This impacts everything from UX to monetization strategy. Revenue models based on margin lending, payment for order flow, or third-party product promotion require clear disclosures and active conflict mitigation. Otherwise, your platform may end up recommending products in ways that are not Reg BI-compliant.

Innovative models, including fractional investing, embedded trading, or social investing, can work under Reg BI. But they require early-stage compliance design, not back-end retrofits. Aligning your product roadmap with regulatory expectations up front helps you avoid reengineering later, when the stakes are higher.

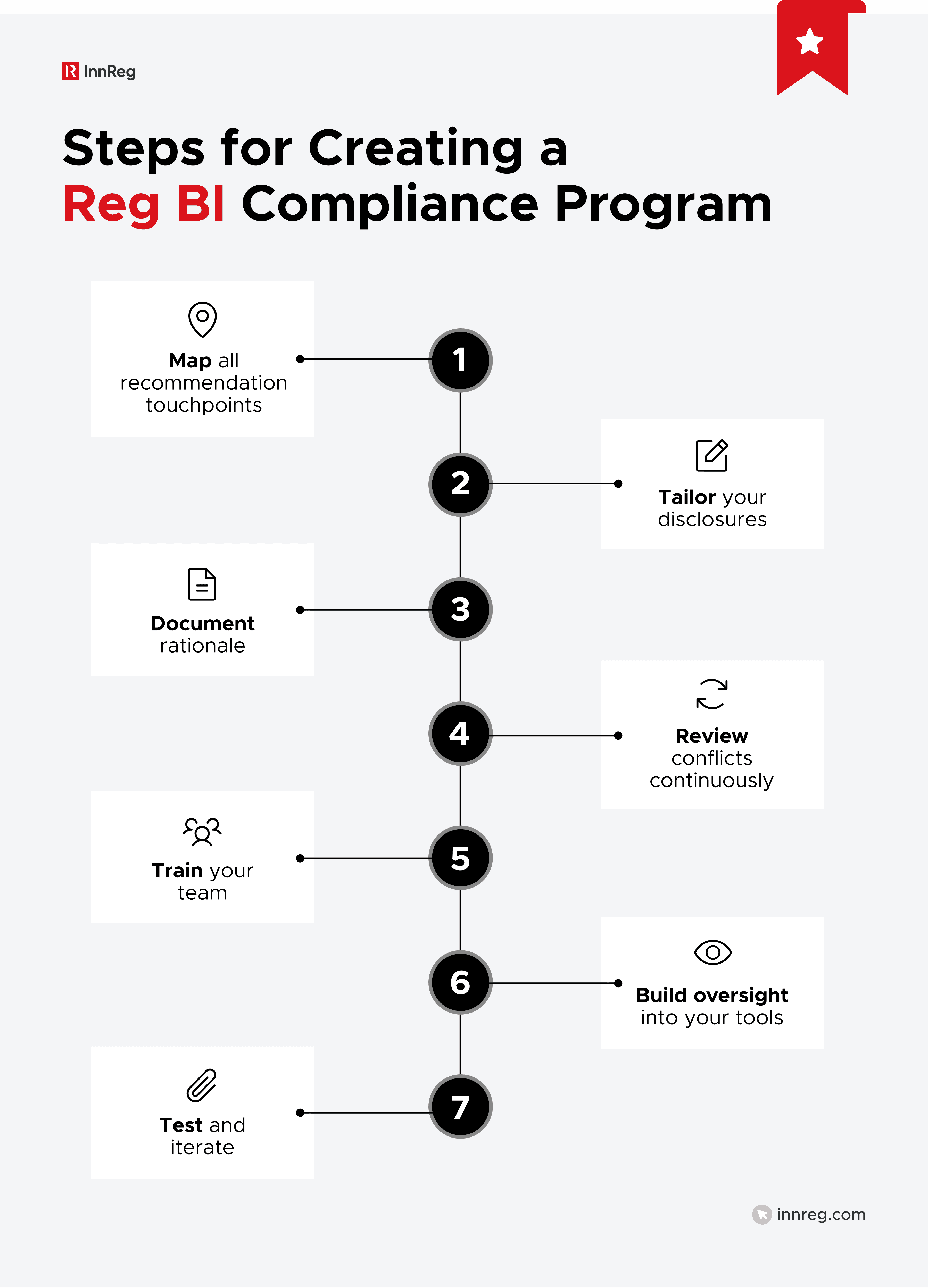

Practical Tips for Building a Reg BI Compliance Program

Meeting Reg BI requirements is about how a team operates day to day. A good compliance program is integrated into product, operations, and legal workflows, not bolted on afterward.

Startups do not need to overbuild. But they do need a structure that matches how they deliver investment guidance, how they generate revenue, and how they supervise activity.

To create an effective Reg BI compliance program, follow these steps:

Map all recommendation touchpoints: Review every part of your product where users might encounter personalized prompts, suggested actions, or pre-filled investment decisions. This includes advisor conversations, automated workflows, account onboarding, and in-app messaging, each of which may trigger Reg BI obligations.

Tailor your disclosures: Generic disclosures won’t cut it. Disclosures should reflect your actual revenue model, service limitations, and conflicts, and they should be written in plain language that’s accessible within the user flow, not buried in a footer or post-trade confirmation.

Document rationale: Every recommendation should be backed by documented reasoning that ties the product or strategy to the customer’s investment profile. Include notes on alternatives considered, cost comparisons, and why the selected option was in the client’s best interest at that moment.

Review conflicts continuously: Conflicts change as your product evolves, so review them regularly, not just at launch. Set up a cadence (monthly or quarterly) to revisit how you earn revenue, how your reps or systems are incentivized, and whether mitigation measures are still working.

Train your team: Human advisors need ongoing training on Reg BI expectations, especially when product lines or compensation structures shift. If your firm relies on algorithms, the development and compliance teams should work together to document how outputs align with Reg BI’s care and conflict standards.

Build oversight into your tools: Integrate compliance into daily workflows using project management platforms, alerts, or dashboards that track open issues and flag risks. Real-time visibility helps prevent drift and gives compliance teams a direct line into operational execution.

Test and iterate: Compliance programs shouldn’t be static. Treat policies, workflows, and monitoring like product features, test them, track performance, and adjust as your firm learns what works best for its business model and regulatory risk exposure.

—

Reg BI has redefined how broker-dealers and fintechs offering investment recommendations must operate. It goes beyond suitability, introducing clear obligations around disclosure, care, conflicts, and compliance infrastructure.

For fintech teams, the challenge lies in applying Reg BI to fast-moving, product-driven environments. Personalized features, monetization strategies, and UX flows can all trigger the rule, often in ways founders do not expect.

The key is to build compliance into the business's operations. Whether in-house or outsourced, the goal is a program that fits your model and evolves with it, not one that lags behind or adds friction later.

How Can InnReg Help?

InnReg is a global regulatory compliance and operations consulting team serving financial services companies since 2013.

We are especially effective at launching and scaling fintechs with innovative compliance strategies and delivering cost-effective managed services, assisted by proprietary regtech solutions.

If you need help with broker-dealer compliance, reach out to our regulatory experts today:

Last updated on Feb 2, 2026