The Fintech Founder’s Guide to AML/CFT Policy

Feb 12, 2026

·

15 min read

Fintech products move money quickly, which also makes them attractive targets for financial crime. That’s why a clear Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) policy is essential for any company offering payments, lending, crypto, or investment services. It’s the document regulators and banking partners rely on to understand how your business identifies and responds to suspicious activity.

It defines your approach to customer due diligence, transaction monitoring, recordkeeping, and regulatory reporting. For fintech founders and compliance officers, this document is the backbone of your compliance program and the first thing regulators, partners, or investors will ask to review.

In this guide, we’ll break down exactly what an AML/CFT policy is, which fintechs need one, and how to build and maintain it effectively under US law. You’ll learn which regulators oversee AML compliance, what policies and controls to implement, and how to avoid the mistakes that have cost other fintechs millions in fines.

InnReg is a global regulatory compliance and operations consulting team serving financial services companies since 2013. If you need assistance with compliance or fintech regulations, click here.

What is an AML/CFT Policy?

An AML/CFT policy is the formal document that explains how your fintech identifies, reviews, and responds to activity that could involve money laundering or terrorist financing. It stands for Anti-Money Laundering and Countering the Financing of Terrorism.

It outlines the procedures your team follows, the controls you rely on, and the responsibilities assigned across your organization. An effective policy assists with keeping your operations consistent and supports informed decision-making as your business grows.

The policy covers several core areas, including:

How you verify customer identities and assess risk at onboarding

How you monitor transactions and identify unusual or suspicious behavior

How you document investigations and escalate concerns

How you file Suspicious Activity Reports, Currency Transaction Reports, and other required reports

How you maintain and organize records that support your compliance decisions

Regulators and banking partners expect the policy to match your actual practices. That means the document must reflect your products, customer segments, and risk profile. A generic or outdated AML/CFT policy often signals weak oversight, so fintech teams should revisit it as they launch new features or enter new markets.

Why Most Fintechs Need an AML/CFT Policy

Fintech companies that engage in regulated financial activity often handle fast, high-volume transactions, which can create real exposure to financial crime risks. An AML/CFT policy gives your team a structured way to identify and manage those risks where required and respond consistently. It protects the business by setting clear expectations for how suspicious activity is handled and how compliance decisions are documented.

Regulators expect regulated fintechs to operate with the same level of discipline as traditional financial institutions. Banking partners also review your AML framework before approving or expanding a relationship. A clear policy signals that your company understands its applicable obligations and has the internal structure to meet them.

A practical AML/CFT policy also helps teams make faster, more confident decisions. As customer activity scales or new products launch, the policy becomes the reference point for how investigators review alerts, how managers escalate issues, and how compliance leads communicate with regulators or banking partners. Without a documented approach, gaps develop, and those gaps are often what lead to fines, delays, or partner concerns.

Fintechs working in complex models such as combining payments with crypto, or embedding financial features into non-financial apps, benefit even more from a robust policy. These models draw closer scrutiny, and a well-built program helps reduce confusion during audits or diligence processes.

For companies that outsource parts of compliance to firms like InnReg, the policy also provides the structure that external teams follow when managing daily operations.

When Do Fintechs Become Subject to AML/CFT Rules?

Fintechs become subject to AML/CFT rules when their activities fall within the definitions of a “financial institution” under the Bank Secrecy Act. This can happen earlier than many founders expect. If your company moves money, holds customer funds, or facilitates financial transactions, you are likely in scope.

Several common fintech models trigger AML obligations:

Payment platforms and money transfer apps

Crypto exchanges, wallets, and on/off-ramps

Online lenders and credit products

Investment or trading platforms

Banking-as-a-service or embedded finance products

Most fintechs qualify because they meet the criteria for a Money Services Business or operate in partnership with a regulated institution. In both cases, regulators expect a formal Anti-Money Laundering framework. Banking partners will also expect alignment with their own AML standards, even if your company is not directly examined.

Fintechs entering higher-risk areas such as cross-border payments, digital assets, or business accounts often face these obligations early on. As soon as your product involves the transmission, safeguarding, or conversion of funds, AML/CFT rules apply. Founders should evaluate these triggers early, ideally before launch, to avoid having to rebuild controls under pressure.

Core Components of an Effective AML/CFT Policy

An effective AML/CFT policy gives your company a structured way to manage financial crime risk. Below are the core elements every fintech should include, beginning with the five required AML pillars and followed by the internal controls that bring those pillars to life:

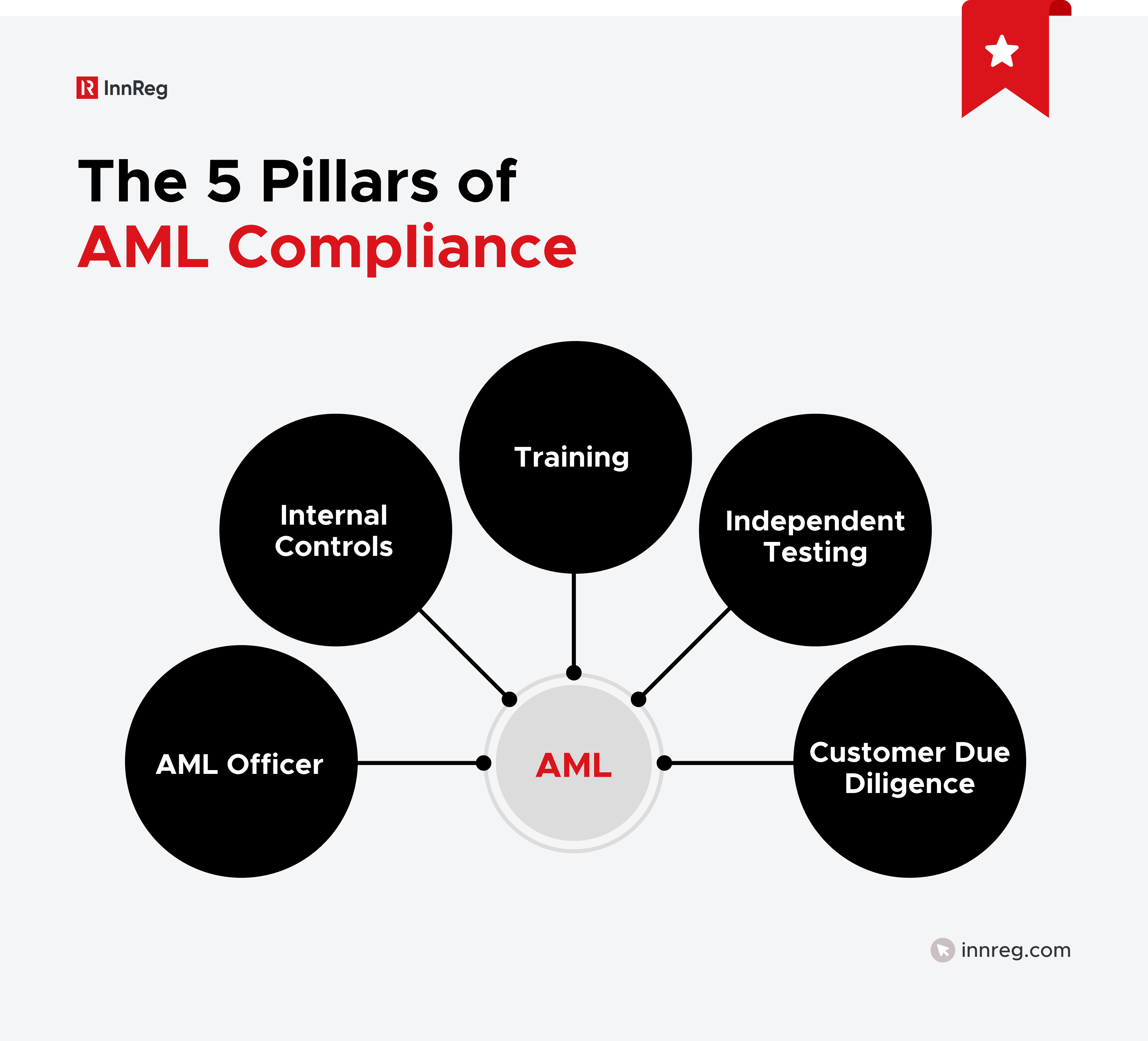

The Five Mandatory Pillars of AML Compliance

Federal rules require all financial institutions to build their AML framework around five core pillars. These pillars lay the foundation for your AML/CFT policy and guide how your compliance program operates.

The required pillars are:

A designated AML compliance officer who is responsible for oversight and ongoing program management.

Internal policies and controls that outline how your company detects and responds to suspicious activity.

Ongoing employee training for teams involved in customer onboarding, monitoring, and investigations.

Independent testing to confirm the program is working as intended.

Customer due diligence, including identifying customers and assessing their risk.

These pillars form the minimum standard regulators look for in exams. A policy that does not clearly address each pillar raises concerns, especially for fintechs operating at scale or in higher-risk models.

Key Internal Controls and Procedures to Document

Beyond the pillars, regulators and banking partners expect your policy to include detailed controls that show how your team applies those principles in practice. These controls help keep decisions consistent as the business grows.

Key areas to document include:

Customer identification and verification procedures at onboarding

Your customer risk-scoring model and how enhanced due diligence is triggered

Transaction monitoring rules and alert investigation steps

Escalation paths for unusual or suspicious activity

SAR and CTR filing workflows

OFAC screening and handling of potential matches

Recordkeeping requirements and retention periods

These controls enable auditors, investors, and partner banks to understand how your AML program operates in real-world scenarios. They also help your compliance team mitigate regulatory risks, especially as new products emerge.

Learn more about how to file a SAR →

How to Tailor Your AML/CFT Policy to Your Risk Profile

An effective AML/CFT policy reflects your company’s specific risks rather than a generic industry template. Fintechs operate in different models, serve different customer groups, and move funds in different ways.

Regulators look for a policy that matches those realities, not one that lists controls without context.

Start by mapping the risks tied to your core products and user journeys. A payments app serving gig workers, a crypto exchange onboarding global users, and an investing platform offering fractional shares each face different exposure points. Your policy should acknowledge those differences and explain the controls you apply.

Key factors to assess when tailoring your policy include:

Customer types and expected behavior across retail, business, or higher-risk categories

Transaction patterns, including speed, volume, and the types of transfers you allow

Geographies involved, whether in onboarding, fund flow, or counterparties

Delivery channels, such as mobile apps, APIs, or marketplace integrations

Product-specific risks, especially for crypto, cross-border payments, or investment services

Once these risks are defined, your AML/CFT policy should link them to the controls your team uses. For example, enhanced due diligence may apply only to certain business customers, while sanctions screening may need stricter rules for users transacting internationally.

This connection between risks and controls is what reviewers expect to see, especially during exams or banking partner diligence.

Model | Key Risks | Required Controls |

|---|---|---|

Payments app | High velocity transactions | KYC + Transaction monitoring |

Crypto exchange | Sanctions exposure + global users | KYC/EDD + sanctions screening + blockchain monitoring |

Investing platform | Securities risks | SEC/FINRA-aligned AML program (CIP + monitoring + SARs) |

Note: Risk profiles change as fintechs scale or add new features, so your policy should be revisited regularly.

Learn how to manage AI risk management in financial services →

See also:

Who Oversees AML/CFT Policies in the US?

Fintech companies fall under several layers of AML oversight. Each regulator focuses on different activities, and many fintechs interact with multiple regulators. Understanding who reviews your AML/CFT policy helps you anticipate expectations and prepare for onboarding, exams, or external audits.

Below are the primary regulators involved, along with how each one approaches fintech AML requirements.

Need help with fintech compliance?

Fill out the form below and our experts will get back to you.

FinCEN’s Role Under the Bank Secrecy Act

FinCEN sets the baseline Anti-Money Laundering requirements that apply across the financial industry. It defines which companies qualify as financial institutions, what an AML program must include, and how SARs and CTRs must be filed. Fintechs that register as Money Services Businesses operate under FinCEN’s rules, making accurate reporting and documentation essential.

FinCEN also issues advisories, guidance, and enforcement actions that influence how fintechs design their AML frameworks. Even if your company operates through a partner bank, you are still expected to understand and operate in alignment with FinCEN’s standards.

Other Federal Regulators: SEC, CFTC, and OFAC

Some fintech models fall under additional federal oversight:

SEC: Applies AML expectations to broker-dealers and investment platforms when securities are involved.

CFTC: Oversees derivatives activity, including certain digital asset services, and expects AML programs similar to those required for futures intermediaries.

OFAC: Enforces sanctions rules that apply to all US businesses. Your AML/CFT policy should outline how your company screens users and transactions for sanctions exposure.

Fintechs offering trading, digital asset services, or embedded investing may be subject to more than one of these regulators. That overlap is why your AML/CFT policy should reflect the full scope of your activities.

State Regulators and NYDFS Oversight

State agencies oversee many fintechs through licensing frameworks such as money transmitter licenses. During licensing reviews and exams, states expect to see complete AML documentation, including monitoring rules, escalation processes, and sanctions controls.

The New York Department of Financial Services (NYDFS) is especially relevant for companies that offer payments or virtual currency services. NYDFS often requires more detailed documentation than other states, and it reviews AML/CFT policies closely during both licensing and supervision.

Fintechs operating in multiple states should prepare for varying expectations. A policy that meets federal standards may still fall short at the state level, especially in states with more prescriptive requirements.

Developing and Implementing an AML/CFT Policy

Developing an AML/CFT policy requires more than documenting controls. It’s a structured process that connects your risk profile, regulatory obligations, and operational workflows. A well-built policy becomes the foundation your compliance team relies on as your fintech grows.

Here are the key steps involved in building, documenting, and operationalizing your AML framework:

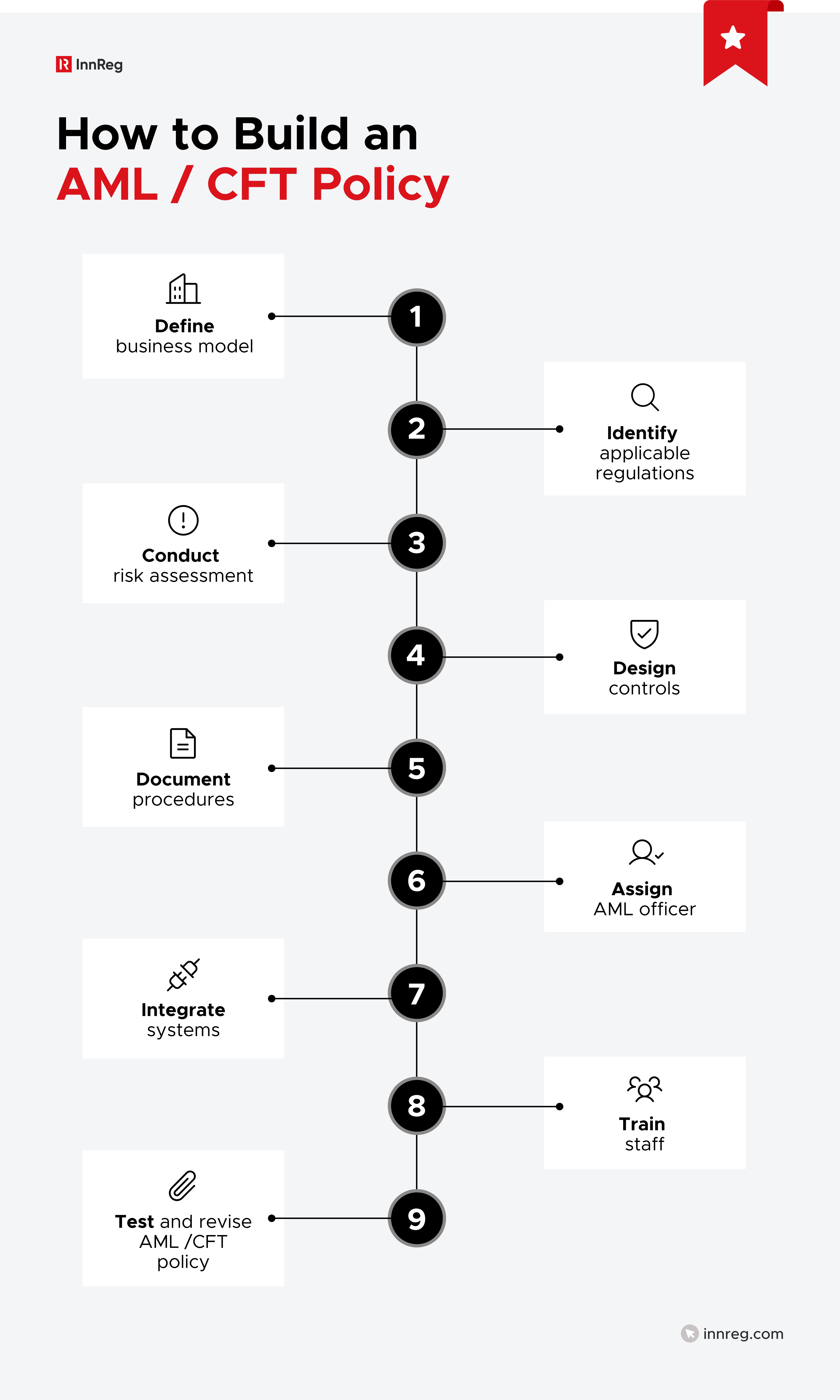

Step-by-Step Process to Build an AML/CFT Policy

A clear, organized process keeps policy development efficient and mitigates the risk of gaps later. While each fintech may follow a slightly different path, most effective Anti-Money Laundering programs begin with these steps:

Define your business model and financial services. Document what you offer, how money moves, and who you serve.

Identify applicable regulations, including federal, state, and any activity-specific rules.

Conduct a formal risk assessment to understand exposure across products, customers, and geographies.

Design internal controls based on those risks.

Document procedures in detail so teams can apply them consistently.

Assign ownership, including designating an AML compliance officer.

Integrate technology and workflows that support onboarding, monitoring, reporting, and record-keeping.

Train staff and confirm they understand how to follow the policy.

Test and revise the policy to validate that it works in practice.

This structure helps teams align policy language with real operations. A documented process also helps regulators and banking partners understand your approach, which is essential during onboarding or exams.

Conducting and Documenting a Risk Assessment

A risk assessment is the starting point for designing an AML/CFT policy. It identifies where financial crime risks exist in your business and how those risks vary across customers, products, and channels. Regulators rely on this assessment to evaluate whether your controls make sense, so it must be specific and accurate.

Your assessment should cover:

Customer types and expected behavior

Product risks, including how funds move

Geographic exposure

Transaction patterns and velocity

Delivery channels and onboarding methods

Document how each risk category was evaluated and why certain risks are rated higher or lower. This documentation supports decisions later in the policy, such as when enhanced due diligence applies or how transaction monitoring rules are calibrated. An updated assessment keeps the entire policy relevant as your company evolves.

See also:

Setting Up KYC, CDD, and EDD Procedures

Your AML/CFT policy should explain how you verify customer identities and determine their risk level. These procedures support early detection of unusual activity and help structure ongoing monitoring.

At a minimum, include clear guidance on:

KYC requirements, including identity verification steps and acceptable documents

CDD processes, such as customer risk scoring and expected activity profiles

EDD triggers, especially for higher-risk customers, businesses, or geographies

Explain how your team reviews and approves higher-risk customers, as well as how updates to customer information are handled. These procedures are central to initial onboarding decisions, and banking partners often review them before approving or renewing relationships.

Integrating OFAC Sanctions Screening

OFAC screening is a required part of financial crime compliance. Your AML/CFT policy should outline how you screen customers and transactions against OFAC lists and how potential matches are reviewed.

Strong sanctions procedures address:

When screening occurs (onboarding, ongoing, or both)

What systems are used to identify potential matches

How your team investigates, escalates, and documents those matches

How you handle blocked or rejected transactions

Sanctions screening is relevant even for companies that operate only in the US. Regulators expect fintechs to identify and prevent prohibited activity, and banking partners often evaluate sanctions controls as closely as broader AML processes.

Maintaining and Testing Your AML/CFT Program

Once your AML/CFT policy is in place, the focus shifts to maintaining it. Fintechs operate in fast-moving environments, and regulators expect your AML framework to keep pace. A well-maintained program shows that your controls work in practice, not only on paper:

Independent Testing and Program Reviews

Independent testing gives regulators and partners confidence that your program operates as intended. It highlights gaps, validates controls, and supports continuous improvement. Testing is a required part of any AML program, and it must be performed by someone who is not responsible for day-to-day compliance work.

Key elements of an effective review include:

Testing alert generation, escalation, and case documentation

Reviewing SAR and CTR filings for completeness and timeliness

Assessing whether monitoring rules reflect current risks

Verifying staff training records and role-specific requirements

Evaluating system configurations, especially when technology changes

Most fintechs conduct testing annually, but high-growth companies or those offering higher-risk products may need more frequent reviews. Banking partners also look for clear evidence that issues identified during testing are tracked and resolved.

Recordkeeping and Reporting Obligations

Recordkeeping and reporting are central parts of an AML/CFT program. Regulators expect detailed, organized records that show how decisions were made and why certain actions were taken. A strong recordkeeping process supports credible reporting and mitigates risk during audits or exams.

Your policy should clarify:

What records must be stored, including KYC data, monitoring alerts, SARs, CTRs, and investigation notes

How long records must be retained under federal and state rules

Where records are stored and who has access

How reporting workflows are managed

How documentation is reviewed for accuracy

Fintechs working with external compliance teams, such as InnReg, often benefit from process-driven systems that keep these records structured and accessible across teams.

Staff Training Requirements and Frequency

Training helps staff understand how financial crime risk appears in your environment and what actions they must take. It keeps your team aligned with regulatory expectations and internal procedures.

Your AML/CFT policy should outline:

Who receives training

How often training occurs

What topics are covered for specific roles

How completion is tracked

Training is not one-size-fits-all. Investigators, developers, product teams, and customer support staff each encounter different risks. Tailored training helps those teams recognize issues and escalate them appropriately.

Using RegTech to Monitor AML Effectiveness

RegTech tools help fintechs manage high alert volumes, complex onboarding flows, and evolving risk patterns. They support transaction monitoring, sanctions screening, case management, and data analysis.

When integrating RegTech, your policy should address:

What systems are used

How rules or models are calibrated

How alerts are reviewed and documented

How system changes are tested before rollout

How data is validated for accuracy

Technology does not replace human judgment, but it helps teams manage scale and reduce manual workload. Fintechs with rapid growth or high transaction volume often rely on a mix of automation and trained reviewers to monitor effectively and consistently.

See also:

Common Compliance Challenges for Fintechs

Fintech companies often face unique operational and regulatory pressures that make AML work more complex than it appears on paper. Understanding these challenges helps teams design programs that hold up under real-world conditions, especially as the business scales.

Balancing Speed and Compliance in Fast Growth

Fintechs grow quickly, often faster than their compliance infrastructure. Onboarding expands, transaction volume increases, and new products launch. If compliance processes don’t keep pace, backlogs and oversight gaps develop.

Common pressure points include:

High onboarding volume without adequate review capacity

Monitoring rules that don’t reflect new product features

Delays in SAR filings due to insufficient staffing

Misalignment between product teams and compliance

To stay ahead, fintechs revisit controls during growth milestones and adjust staffing, systems, or escalation paths before strain appears.

Managing False Positives and Data Quality Issues

Transaction monitoring systems generate large numbers of alerts. Many are false positives triggered by limited data, broad rules, or unusual but legitimate customer behavior. High false-positive rates slow down investigations and increase operational strain.

Common causes include:

Incomplete or inaccurate customer information

Basic monitoring rules that trigger too frequently

Lack of historical data to calibrate alerts

Poor integration between the product and compliance systems

Improving data quality, refining rules, and introducing automation can help reduce the burden while keeping risk signals visible.

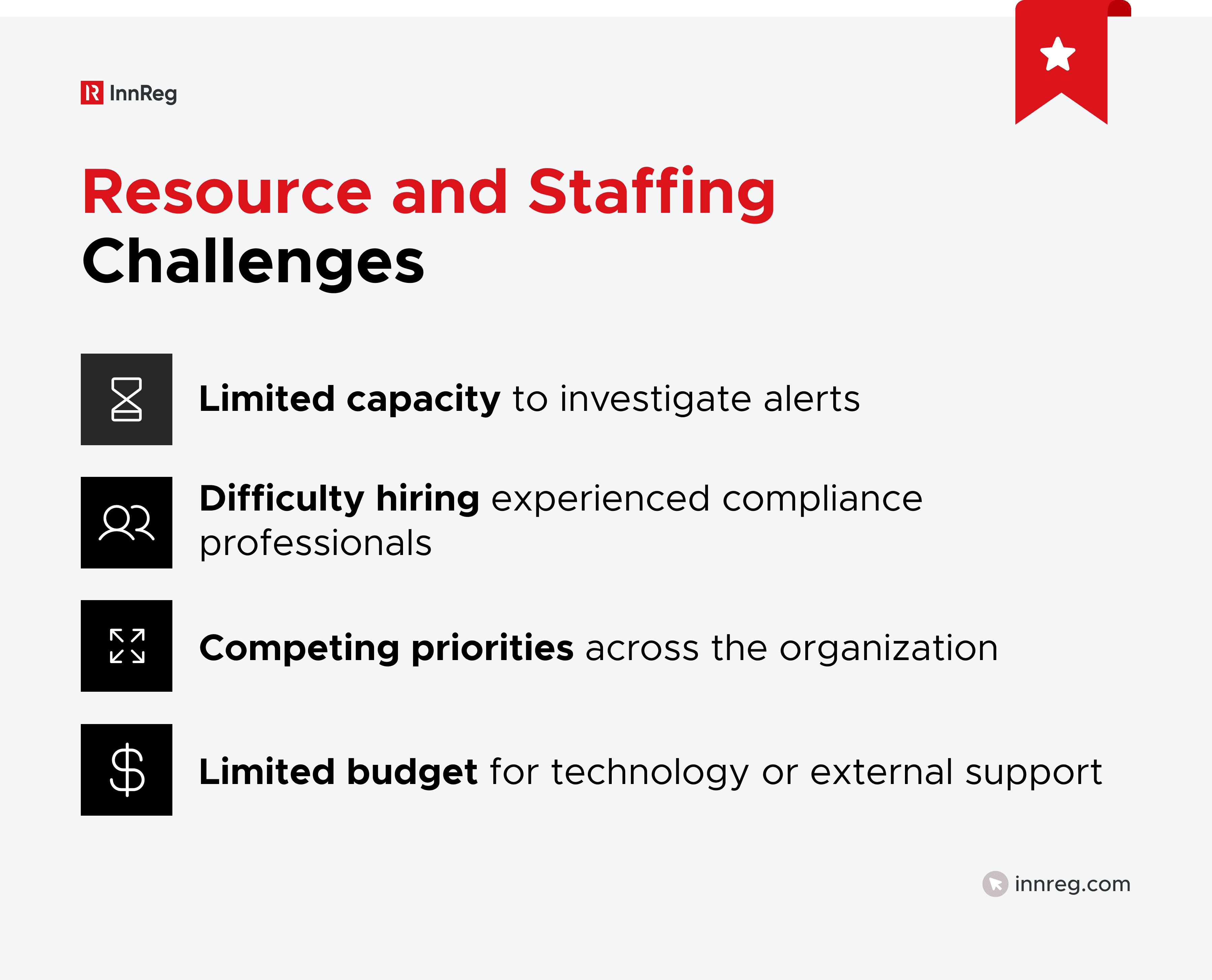

Resource and Staffing Limitations

Early-stage fintechs often operate with lean teams. Compliance roles may be split across multiple responsibilities, leaving little time for investigation work or policy updates. This affects monitoring, reporting, and documentation quality.

Some companies address this by partnering with outsourced compliance teams like InnReg, which provides specialized staffing and structured processes often at a lower cost than a full in-house department.

Multi-State and Cross-Border Complexity

Fintechs operating across multiple states or jurisdictions face different regulatory requirements. Each state may have its own expectations for money transmitter licensing, recordkeeping, or oversight. Cross-border activity introduces additional complexity, particularly around sanctions exposure.

This creates challenges such as:

Varying definitions of regulated activity across states

Different document requirements during state exams

Added risk controls for international transfers

Conflicting expectations across jurisdictions

A single AML framework must account for these variations, so fintechs often create jurisdiction-specific addenda or procedures to stay aligned with all applicable rules.

Case Studies on AML/CFT Policy Failures

Real-world enforcement actions show how gaps in AML programs materialize. They also highlight how a strong AML/CFT policy could have reduced operational strain, avoided regulatory findings, or prevented misuse.

These cases offer practical lessons for fintech compliance teams, especially those building programs in fast-growth environments:

Coinbase: Compliance Backlogs and Oversight Risks

Coinbase Europe Limited was subject to enforcement action by the Central Bank of Ireland after significant deficiencies were identified in its transaction monitoring framework. System configuration issues resulted in the failure to monitor over 30 million transactions in real time, leading to delays in the identification and reporting of suspicious activity.

The Central Bank concluded that these weaknesses constituted breaches of AML/CFT requirements, resulting in a substantial monetary penalty and increased supervisory scrutiny. The case highlights the importance of maintaining transaction monitoring systems and controls that remain effective as transaction activity and operational complexity increase.

BitMEX: Ignoring AML Requirements from Day One

BitMEX operated for several years without establishing and maintaining an adequate AML and KYC program, despite offering cryptocurrency derivatives trading services to U.S. customers. The company’s failure to implement required Bank Secrecy Act controls formed the basis of criminal enforcement action by U.S. authorities.

As a result, BitMEX was fined $100 million, and senior company executives previously pleaded guilty to related violations. The case underscores the regulatory consequences of operating crypto trading platforms without foundational AML governance and oversight.

Robinhood: Underestimating Resource Needs

Robinhood Securities and Robinhood Financial were subject to regulatory action after deficiencies were identified in their AML programs, including significant delays in reviewing potentially suspicious activity and filing SARs, which created a backlog.

Regulators found the firms’ AML processes and staffing did not keep pace with rapid customer growth, contributing to broader compliance failures and resulting in a $45 million civil penalty.

The enforcement action highlights the risks that arise when AML processes and resourcing do not keep pace with business growth, leading to operational gaps and regulatory breaches.

Key Takeaways for Fintech Founders and Compliance Teams

A well-structured AML/CFT policy is more than a regulatory requirement. It’s a practical tool that helps fintech teams manage risk, support growth, and maintain strong relationships with banking partners and regulators. The companies that stay ahead are the ones that treat AML as a core operational function rather than an afterthought.

Strong policies are tailored, documented, and updated as the business evolves. They reflect real product behavior, real customer patterns, and real operational realities. They also create clarity for investigators, managers, and external reviewers, which reduces friction when questions arise.

If your team needs support building or operating an AML program, InnReg offers hands-on experience in fintech compliance.

We help companies draft AML policies, manage day-to-day monitoring, and provide outsourced professionals, including CCO-level support when internal resources are limited. Talk to an expert at InnReg today and get started!

How Can InnReg Help?

InnReg is a global regulatory compliance and operations consulting team serving financial services companies since 2013.

We are especially effective at launching and scaling fintechs with innovative compliance strategies and delivering cost-effective managed services, assisted by proprietary regtech solutions.

If you need help with compliance, reach out to our regulatory experts today:

Last updated on Feb 12, 2026