RIA State vs. SEC Registration: What Fintechs Need to Know

Dec 23, 2025

·

9 min read

Contents

Choosing between RIA state and SEC registration is not just a compliance formality. It’s a choice that shapes how a firm grows, serves clients, and interacts with regulators.

For fintech founders and compliance officers, the decision can feel like a maze of overlapping rules, exceptions, and thresholds.

This article breaks down the key differences between SEC and state registration for Registered Investment Advisors (RIAs). We explain when each applies, what compliance responsibilities accompany them, and how recent rule changes, such as updates to the internet-only advisor exemption, could impact your approach.

InnReg is a global regulatory compliance and operations consulting team serving financial services companies since 2013. If you need assistance with compliance or fintech regulations, click here.

Who Regulates RIAs: SEC vs. State Overview

Registered Investment Advisors (RIAs) in the United States are regulated at either the federal or state level, but not both. The distinction depends primarily on how much regulatory assets under management (RAUM) the firm holds, among other factors.

The Securities and Exchange Commission (SEC) oversees larger advisors with a national or complex footprint. State securities divisions regulate smaller firms that operate or serve clients within their jurisdiction. Each regulator enforces its own set of rules, filing obligations, and examination priorities.

Understanding this split matters because compliance obligations vary significantly depending on which regulator has jurisdiction.

When RIAs Register with the SEC

Firms generally register with the SEC when they manage $100 million or more in regulatory assets under management. This threshold is a dividing line established by federal law.

SEC registration becomes mandatory once a firm crosses $110 million in RAUM. Firms can opt in early, starting at $100 million. Below $100 million, they are usually required to register at the state level, unless a specific exemption applies.

SEC registration may also apply to:

Advisors serving registered investment companies, regardless of size

Firms required to register in 15 or more states, to avoid multiple state registrations

Qualifying internet-only advisors

Firms based in New York, once they pass $25 million RAUM

These carve-outs let some sub-$100 million firms fall under SEC oversight. But they come with specific conditions and shouldn’t be relied on without a close legal or compliance review.

For fintechs, the SEC path is often more attractive when scaling nationally or building a digital platform. It consolidates oversight under a single regulator, which can reduce friction across state lines.

When RIAs Register with US States

RIAs that do not qualify for SEC registration, typically due to managing under $100 million in RAUM, must register with one or more state regulators. Firms that fail to meet a federal exemption or threshold must register with the state.

State-registered advisors are subject to each state’s specific rules, filings, and exam processes. In most cases, firms must register in their home state and in any additional states where they have more than five clients. There are exceptions to this standard threshold, where some states require registration with just one.

Examples of varying state registration requirements:

Texas and Louisiana require registration even with one client.

New York has no registration pathway for mid-sized advisors ($25-100 million RAUM); those firms must register with the SEC.

States may have unique rules around custody, bonding, and fee arrangements.

For fintechs operating across multiple states, this patchwork can become operationally burdensome. Tracking client counts, registration triggers, and state-specific requirements adds complexity.

Firms with national ambitions often outgrow state registration quickly and should consider whether the multi-state exemption or a planned move to SEC status makes sense.

RIA State vs. SEC Registration: Key Thresholds and Exceptions

The core difference between RIA state and SEC registration starts with the firm’s RAUM. But some exceptions allow or require certain firms to register federally even if they don’t meet the standard thresholds.

Below is a breakdown of the most common triggers and exemptions fintech firms should be aware of:

AUM Thresholds

The default rule is simple:

Under $100 million RAUM: Register with one or more states

$100 million to $110 million RAUM: May register with the SEC

Above $110 million RAUM: Must register with the SEC

This is the primary dividing line. If your firm is approaching or crossing $100 million, SEC registration should be on your radar. Some firms choose to register slightly early to avoid managing a transition during peak growth.

Multi-State Exemption

A firm operating in and required to register in 15 or more states may elect SEC registration even if it does not meet the $100 million RAUM threshold. This exemption exists to reduce the complexity of maintaining registrations across multiple jurisdictions.

For fintech platforms serving clients nationally, this exemption is frequently used. It avoids overlapping filings, duplicative exams, and conflicting state rules.

Internet-Only Advisors

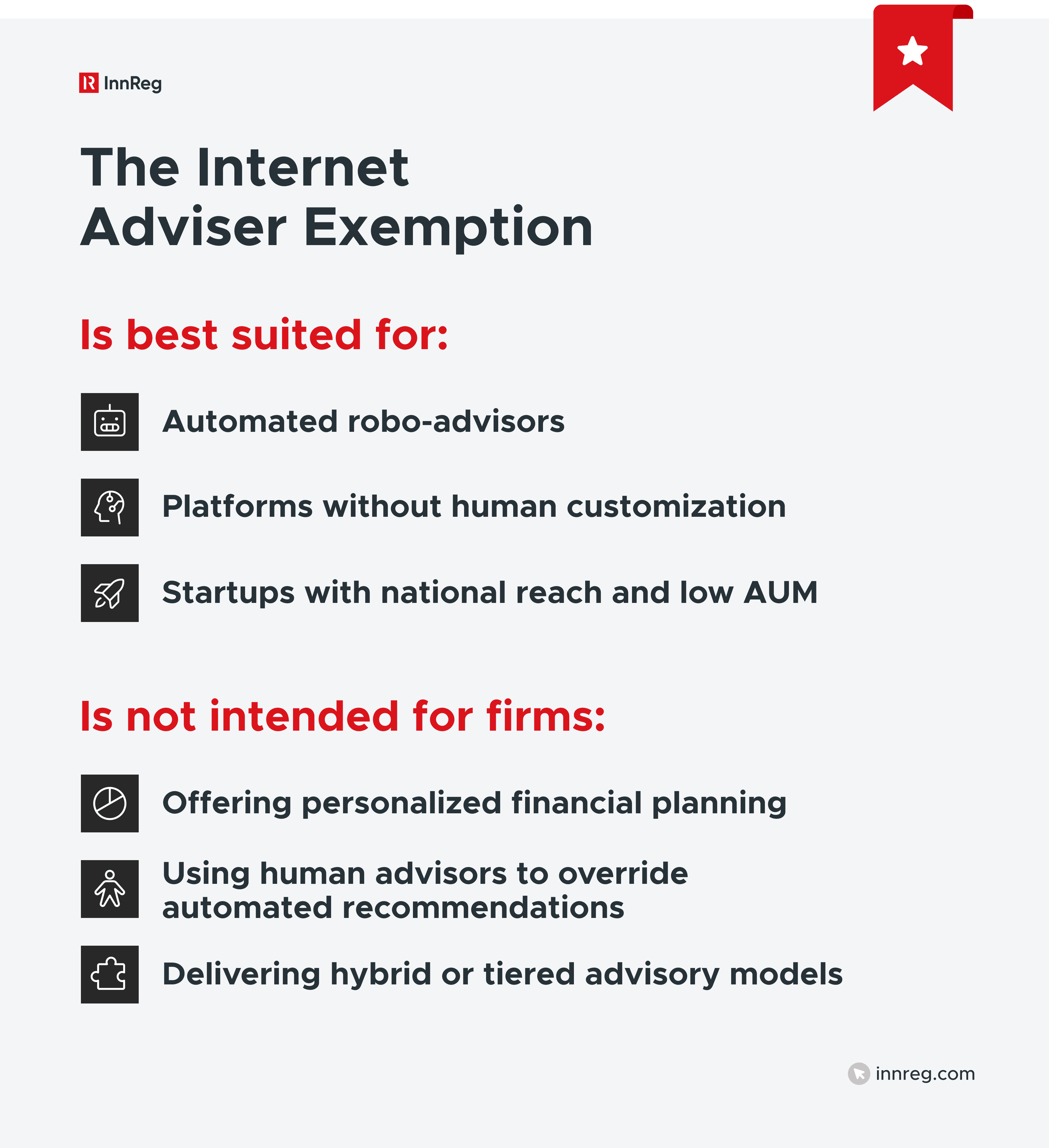

The SEC rules allow firms that provide investment advice exclusively through an online interactive website to register federally, regardless of AUM. This is known as the Internet Adviser Exemption.

In 2024, the SEC narrowed this exemption to prevent misuse. Firms combining digital advice with human interaction no longer qualify. It is a narrow path, but useful for firms building true robo models.

Learn more about Internet Adviser Exemption →

See also:

New York-Specific Rules

New York stands apart. Once a firm based in NY crosses $25 million RAUM, it must register with the SEC. New York does not offer a registration framework for mid-sized RIAs.

This rule often surprises early-stage founders. If your principal office is in New York, and you’re growing past $25 million, federal registration isn’t optional.

Need help with RIA compliance?

Fill out the form below and our experts will get back to you.

Advisors to Investment Companies

If a firm provides advice to a registered investment company, like a mutual fund or ETF, it must register with the SEC, regardless of its size or number of clients.

This applies even if it manages very little RAUM. The relationship with the fund is the determining factor, not the firm’s overall asset base. This rule is non-negotiable and strictly enforced.

Compliance Requirements: SEC vs. State RIAs

The day-to-day obligations of an RIA depend not just on the firm’s registration status, but also on who regulates it. SEC-registered and state-registered firms follow different rulebooks in several areas, even if the core fiduciary duties are similar.

Compliance Area | SEC-Registered RIA | State-Registered RIA |

|---|---|---|

Primary Rulebook | Varies by state (modeled loosely on NASAA guidance) | |

Advertising Rules | Follows the SEC Marketing Rule (testimonials allowed) | May follow older rules; some ban testimonials |

Custody Requirements | Surprise audit if custody applies | May define custody differently or impose extra steps |

Net Worth / Bonding | No net capital or bonding requirement | Many states impose bonding or net worth minimums |

Form CRS Requirement | Required if retail clients are served | Typically not required |

IAR Licensing | Home state + states with office presence | States where clients are located, often beyond the de minimis |

Fee Model Restrictions | Flexible, with proper disclosure | Some states restrict subscription or flat fees |

Advertising and Marketing

SEC-registered advisors follow the 2021 Marketing Rule, which permits client testimonials, social media endorsements, and performance marketing if properly disclosed and documented.

State regulators have not all adopted the same flexibility. Some still ban testimonials outright or limit what can be shown. For fintechs with digital campaigns, this creates a compliance split that’s easy to miss.

Custody Rules

Both regulators impose safeguards when firms hold or access client funds, but the frameworks differ.

Under SEC rules, custody typically requires an annual surprise exam. States may define custody more broadly and impose financial audits or bonding if a firm has discretion or standing instructions.

Firms need to understand their regulator’s stance to avoid custody violations, especially those integrating with fintech infrastructure providers or custodians.

Financial Requirements

SEC-registered firms do not have a net capital requirement. But many states do.

For example:

California may require up to $35,000 in net worth

Oregon mandates a $10,000 surety bond if custody exists

Some states impose minimums for discretionary authority

These rules can impact budgeting decisions early on, particularly for bootstrapped fintechs.

Fee Model Flexibility

The SEC allows a broad range of fee models, from AUM-based to flat-fee and subscription pricing, provided they are disclosed in Form ADV and not misleading.

States vary. Some, like Washington, have flagged recurring flat fees as potentially “unreasonable” for certain client profiles.

If you are experimenting with nontraditional pricing, like flat monthly fees or bundled services, reviewing the rules in every applicable state is critical.

Struggling with setting the right fees? Use our free RIA Financial Planning Calculator to determine the right price →

See also:

Form ADV and Form CRS

All RIAs, regardless of registration level, are required to file Form ADV Parts 1 and 2. Part 1 is filed through the IARD system and contains structured data for regulators. Part 2 is a narrative brochure that describes the firm’s services, fees, conflicts, and business practices in plain English, delivered to clients during onboarding and upon updates.

Only SEC-registered advisors serving retail clients must prepare and deliver Form CRS (Client Relationship Summary). This is a separate document introduced by the SEC in 2020 as part of Regulation Best Interest.

State-registered firms are typically not required to produce a Form CRS unless they are also registered as broker-dealers or dual registrants. However, they still must maintain a current Form ADV and ensure clients receive the appropriate disclosures at the right time.

IAR licensing

For state-registered RIAs, individual Investment Adviser Representatives (IARs) must register in each state where they have clients, often beyond five clients.

For SEC firms, IARs only need to register in states where they maintain a physical office or place of business. This makes licensing and renewals simpler at the federal level, especially for remote or national teams.

Compliance Considerations for Fintech Firms

Fintech firms bring unique business models to the advisory space. That’s where many run into regulatory friction. While the SEC and states apply the same foundational standards, fiduciary duty, disclosure, and supervision, fintechs typically face different requirements based on their operational structure.

Startup-Stage Decisions

Early-stage fintechs often begin under the state framework because they do not meet SEC thresholds. But registering in even one state requires full compliance from day one, including written policies, disclosures, and IAR licensing.

While early-stage firms may find the obligations demanding, states do not waive compliance requirements based on operational maturity or capitalization.

Some firms solve for this by outsourcing compliance, especially if they do not have in-house expertise. InnReg helps RIAs develop policies and disclosures and obtain the required licenses.

Digital-First or Hybrid Models

Firms offering algorithm-driven advice or automated portfolios might assume the Internet Adviser Exemption is a fit. In practice, it’s narrower than many expect.

To qualify:

All advice must be delivered via an online interactive website

No human interaction, personalized or offline interaction

The firm must actively use its platform, not just maintain a passive site

If you combine digital onboarding with behind-the-scenes human advisor input, you may fall outside the exemption and into state registration territory.

Review your client journey step-by-step. Even light human interaction can disqualify you from federal registration under this rule.

Multi-State Client Base

One early success metric for many fintechs is client distribution. But national traction can be a compliance liability under state registration rules.

Why? Because most states require registration once you exceed five clients. Some have lower thresholds. Each state has its own filing fees, IAR registration processes, and exam schedules.

If you’re approaching 10 or more states with clients, the 15-state exemption becomes relevant. This can justify moving to SEC oversight earlier than expected and reduce long-term operational complexity.

Transition Planning

Switching between regulators is not automatic. The SEC requires firms crossing $110 million in RAUM to file for federal registration within 90 days of the fiscal year-end. At the same time, they must withdraw from all state registrations.

The transition requires updated filings, new disclosures, and procedural changes, including adopting policies aligned with the Advisers Act and, in some cases, preparing Form CRS (required for SEC registration).

The reverse can also happen. A firm that falls below $90 million in RAUM may need to exit SEC registration and re-register in one or more states.

See also:

RIA State vs. SEC Registration: Choosing the Right Path for Your Firm

Choosing between SEC and state registration involves more than meeting an AUM threshold. It shapes how your firm allocates resources, manages compliance, and plans for growth.

The table below outlines how each option compares across cost, complexity, and strategic fit:

Evaluation Area | State Registration | SEC Registration |

|---|---|---|

Cost and Resource Implications | Lower initial cost if operating in one state only Cost increases with multi-state filings and IAR registrations Varies by state (some require bonding or minimum net worth) | Higher barrier to entry (e.g., ≥$100M RAUM) Centralized oversight and filings reduce long-term complexity, Generally more cost-efficient at scale |

Regulatory Complexity | Multiple regulators Varying rules on custody, advertising, and fees Complex when serving clients in multiple states | One rulebook: Advisers Act Uniform requirements across jurisdictions Better suited to digital-first or national models |

Strategic Fit for Fintechs | Practical for local or early-stage firms May restrict scalability or innovation, depending on state interpretations | Aligns with firms planning to scale nationally or offer automated/digital advice Reduces friction for rapid growth or multi-product strategy |

—

The choice between RIA state and SEC registration is a foundational decision that shapes how your firm grows, operates, and manages compliance risk.

State registration may be suitable for early-stage firms or those with a limited geographic footprint, but complexity increases quickly with growth.

On the other hand, SEC registration offers centralized oversight and regulatory consistency, which can support national expansion, automated platforms, and integrated financial products.

Fintech firms should factor in cost, operational burden, and long-term strategy, not just assets under management.

How Can InnReg Help?

InnReg is a global regulatory compliance and operations consulting team serving financial services companies since 2013.

We are especially effective at launching and scaling fintechs with innovative compliance strategies and delivering cost-effective managed services, assisted by proprietary regtech solutions.

If you need help with RIA compliance, reach out to our regulatory experts today:

Last updated on Dec 23, 2025