What Is the GLBA Privacy Notice: Requirements for Compliance

Feb 9, 2026

·

13 min read

Consumers’ financial data brings one of the most significant elements into play for every fintech: data privacy. The US has established and enforced several privacy regulations, one of the most foundational being the GLBA privacy notice.

If your fintech handles consumer data, you should likely comply with this framework. But what is the GLBA privacy notice? How does it impact your fintech?

This article breaks down exactly what the GLBA privacy notice is, who needs to provide it, and how to comply without overcomplicating the process. We’ll also cover opt-out requirements, common mistakes, and how the GLBA’s Safeguards Rule ties into your overall compliance program.

InnReg is a global regulatory compliance and operations consulting team serving financial services companies since 2013. If you need assistance with compliance or fintech regulations, click here.

Understanding the GLBA Privacy Notice

The GLBA privacy notice is a disclosure that financial institutions must provide to consumers explaining how their personal financial data is collected, used, and shared. It's a core requirement under the Gramm-Leach-Bliley Act (GLBA), which governs data privacy practices across a wide range of financial entities in the US.

At its core, the notice is about transparency. It tells consumers what nonpublic personal information (NPI) you collect, whether you share it with affiliates or third parties, and what choices, if any, they have to limit that sharing.

The GLBA privacy notice is required at two points:

At the start of a customer relationship

Annually for the entirety of the relationship

It must be written in a clear, accessible format. Many companies rely on the government-issued model privacy form to meet this requirement, but customization is allowed if all necessary content is present.

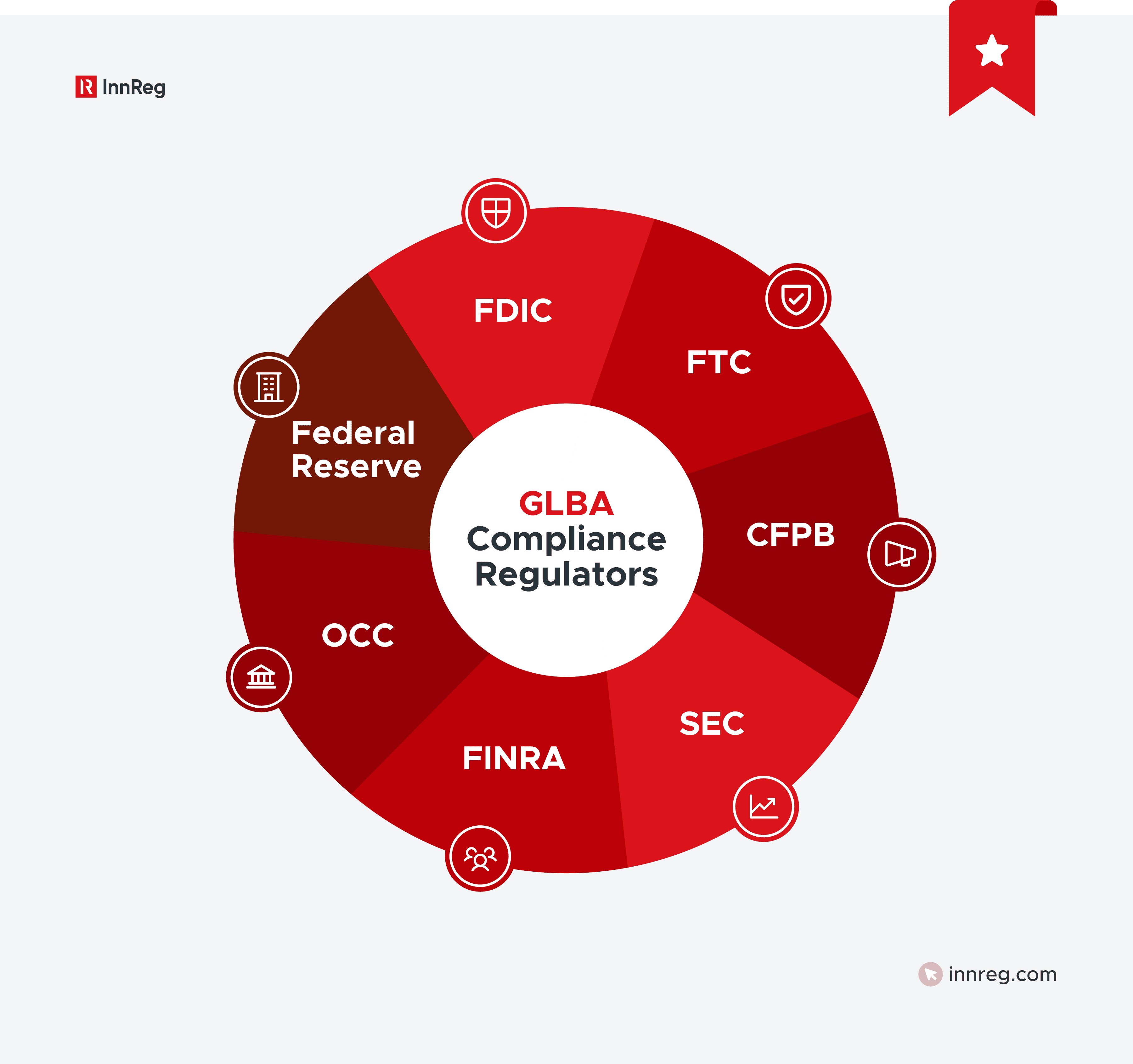

Who Regulates and Enforces GLBA Compliance?

Several federal regulators oversee compliance with the GLBA, depending on the type of financial institution involved. For fintech companies, understanding which agency has jurisdiction is critical because each has its own supervision practices, expectations, and enforcement track record.

FTC

The Federal Trade Commission (FTC) is the primary GLBA regulator for non-bank financial institutions. That includes many fintechs, particularly those offering lending, payments, investment tools, or account aggregation outside of a traditional bank charter.

The FTC enforces both the GLBA Privacy Rule and the Safeguards Rule, and has a history of taking action against companies that mishandle financial data. If another federal financial agency doesn’t directly regulate your fintech, assume the FTC is your primary GLBA regulator.

CFPB

The Consumer Financial Protection Bureau (CFPB) enforces the GLBA Privacy Rule, which is also known as Regulation P. This rule applies to financial institutions within CFPB’s jurisdiction, such as non-bank lenders, mortgage providers, and certain Money Services Businesses (MSBs).

The CFPB also examines how GLBA compliance overlaps with broader consumer protection obligations. If your fintech offers personal financial products or services, the CFPB’s supervisory and enforcement authority likely applies.

SEC

If your company operates as a broker-dealer, investment advisor, or investment company, you fall under the Securities and Exchange Commission (SEC) for GLBA compliance.

These entities enforce GLBA through Regulation S-P, which mirrors the privacy notice and security requirements for financial firms in the securities space. This is especially relevant for fintechs offering investing, trading, or wealth management services.

Banking Regulators

For fintechs operating under or in close partnership with federally chartered banks, enforcement may come from the OCC, Federal Reserve, or FDIC.

These agencies apply GLBA rules as part of routine safety and soundness examinations. If your product is bank-sponsored or integrated into a bank’s infrastructure, these regulators will expect your privacy notices and safeguards to hold up under scrutiny.

Who Must Provide a GLBA Privacy Notice?

Under the GLBA, any company “significantly engaged in financial activities” must provide a privacy notice to applicable consumers. That includes a wide range of businesses beyond traditional banks.

If your company offers financial products or services to individuals for personal, family, or household purposes, you're likely subject to the Privacy Rule. These are some examples:

Personal finance management tools

Crypto exchanges with fiat on-ramps

Account aggregators or financial data connectors

Under the GLBA, there’s a distinction between a consumer and a customer:

Term | Definition | GLBA Notice Requirement |

|---|---|---|

Consumer | An individual who obtains a financial product or service for personal use | Only required if data will be shared outside of exceptions |

Customer | A consumer with a continuing relationship with the company | Always required at the start and then annually |

Fintech teams often underestimate their exposure here. Even if your business isn’t a direct lender or custodian, if you collect or use consumer financial data in the delivery of a product, GLBA privacy obligations may apply.

Note: Many fintechs must provide a GLBA privacy notice, even if they don’t carry a charter or banking license.

See also:

What Information Must Be Disclosed?

The GLBA privacy notice must include specific details about how your company handles nonpublic personal information (NPI). This step isn't optional or vague since regulators expect disclosures to follow a clear structure and use accessible language.

Need help with fintech compliance?

Fill out the form below and our experts will get back to you.

Categories of Personal Data Collected

You must disclose what types of NPI you collect from consumers. This typically includes:

Identifying data (name, address, Social Security number)

Account details (balances, payment history, transaction history)

Information from applications or forms

Information from credit reports or other third-party sources

The notice must describe these categories clearly, not generically. Avoid language like “we collect your information” without context.

How Data Is Used and Shared

Your notice must explain how and why you share data, and with whom. That includes:

Affiliates (companies related by common ownership)

Non-affiliates (marketing firms, data processors, business partners)

Joint marketing partners (co-marketing partners in financial services)

You must list each type of recipient and the purpose of sharing. For example, if you share data for everyday business operations, marketing, or data analytics, that should be spelled out.

Consumer Opt-out Rights

If you share NPI with non-affiliated third parties for non-exempt purposes, your notice must describe the consumer’s right to opt out. This includes:

What types of sharing trigger opt-out rights

How consumers can exercise those rights

A reasonable way to opt out (e.g., online, phone, form)

Opt-out disclosures must be clear, not buried. If you don’t share in a way that triggers opt-outs, the notice should still explain that.

Security Practices and Contact Info

You’re required to include a brief description of how you protect consumer data. This doesn’t mean revealing your full security stack. It means referencing internal safeguards and practices to limit access and protect confidentiality.

You must also provide a way for consumers to contact your company with questions about the policy. That often includes an email, phone number, or a designated privacy contact.

When and How to Deliver a GLBA Privacy Notice

Timing and delivery matter just as much as content. A complete GLBA privacy notice that the consumer has never actually seen is still a compliance failure. Regulators expect notices to be both timely and accessible.

Initial vs. Annual Notice Requirements

A GLBA privacy notice must be provided at the start of a customer relationship, not after the fact. This typically means at onboarding, during account opening, or before a transaction is processed. If someone becomes a “customer” by creating an ongoing financial relationship, you owe them a full privacy notice upfront.

You must also send an annual privacy notice every year for the duration of that relationship, unless you meet a specific exemption (more on that later). The notice should reflect your current data practices, not a boilerplate from three years ago.

See also:

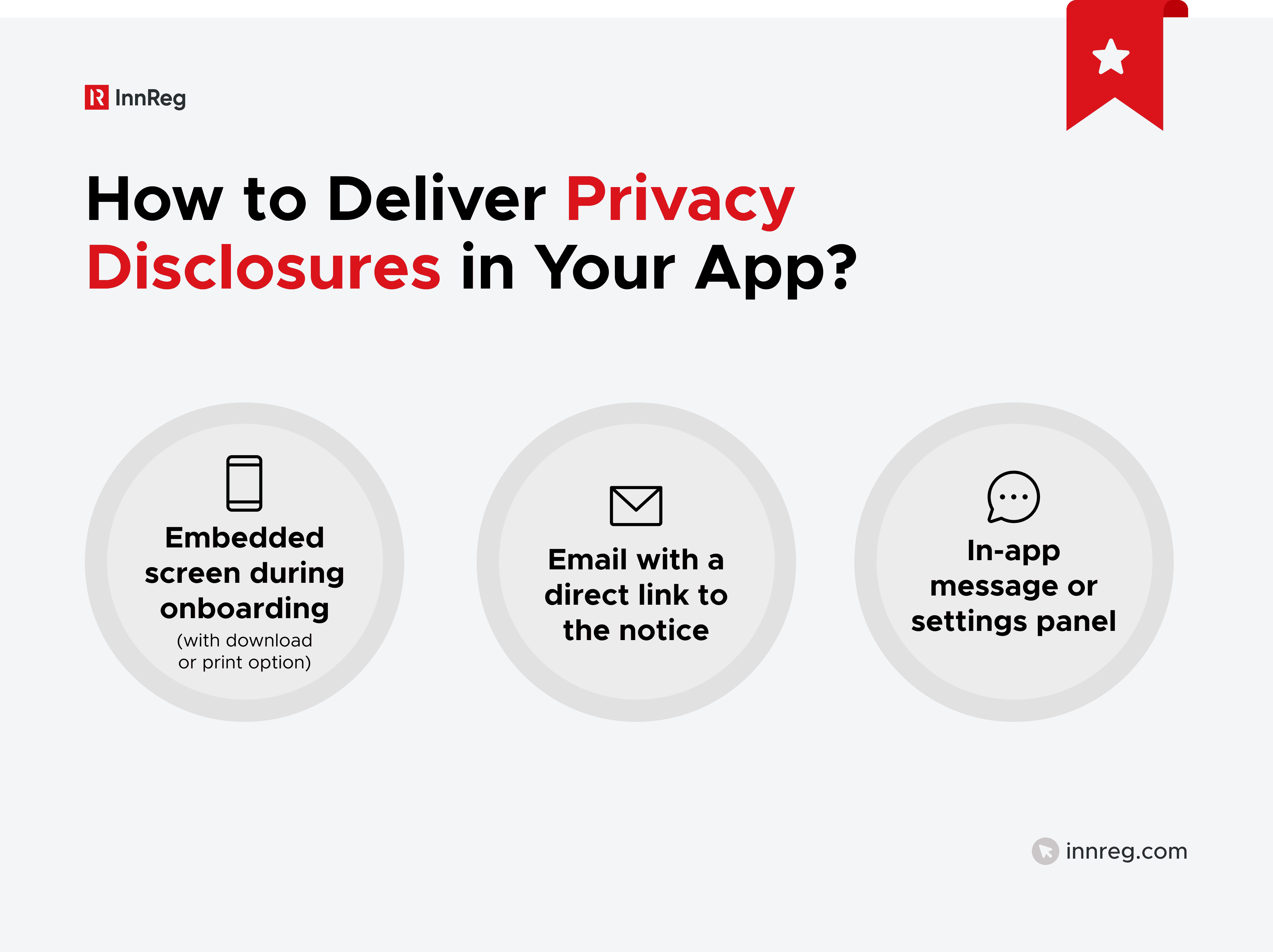

Electronic Delivery and In-App Disclosures

Digital-first fintechs can deliver GLBA privacy notices electronically, but only if the consumer agrees to electronic delivery. Posting a link on your website isn’t enough unless it’s paired with affirmative consent or clear visibility during account creation.

Tip: Make it hard to miss. If you’re relying on digital methods, the notice should be prominent and accessible, not buried behind multiple clicks.

Recordkeeping Expectations

GLBA doesn't specify exact recordkeeping rules, but regulators expect proof that privacy notices were sent. That includes:

Timestamps of when and how the notice was delivered

Logs of annual notice distribution

Handling of undeliverable notices (bounced emails, returned mail)

If a regulator asks when a user received their last privacy notice, you should be able to answer without guesswork. For fintechs operating at scale, automating this tracking is often necessary.

Opt-Out Requirements Under the GLBA Privacy Rule

The GLBA requires disclosure and also gives consumers the right to limit certain types of data sharing. Whether your fintech triggers these opt-out obligations depends on how you use and share personal information.

When Opt-outs Are Required

If you share nonpublic personal information (NPI) with non-affiliated third parties for purposes outside of specific legal exceptions, you must offer consumers the right to opt out.

There are a few common scenarios that trigger opt-out requirements, including:

Sharing with non-affiliated marketing firms

Selling or licensing user data to external platforms

Disclosing consumer data to business partners for cross-promotions

If the data sharing falls outside permitted exceptions, the opt-out must be clear, timely, and actionable.

Exceptions to the Opt-out Rule

Certain types of data sharing are allowed without offering opt-out rights, including:

Sharing with service providers under strict confidentiality contracts

Joint marketing agreements with other financial institutions

Disclosures necessary for processing transactions, fraud prevention, or legal obligations

These exceptions are narrow and conditional. If you rely on them, your notice must still describe the sharing, and your agreements must meet specific criteria.

Acceptable Opt-out Methods

You’re required to offer a “reasonable means” to opt out. That typically includes:

Toll-free phone number

Online form or account setting toggle

Printable mail-in form (if notices are mailed)

The method should be straightforward and not require login hurdles or multiple steps. Make it easy, and document every opt-out received.

Fintechs often centralize opt-outs in account dashboards, which can be efficient as long as it’s visible and functional.

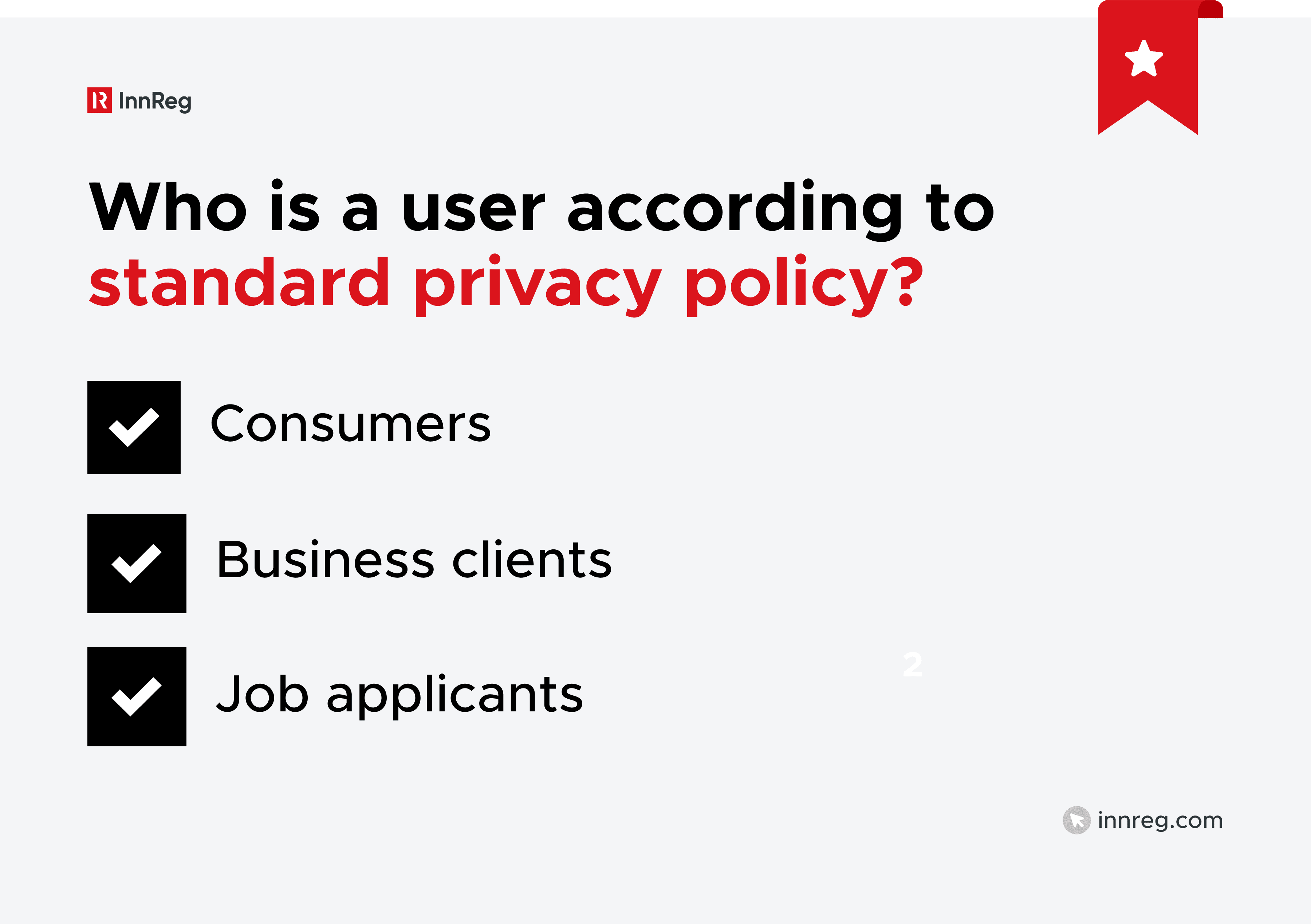

GLBA Privacy Notice vs. Standard Privacy Policy

A common mistake in fintech is assuming a general privacy policy on your website covers GLBA requirements. It doesn’t. While both documents deal with data practices, they serve different legal and functional purposes.

A GLBA privacy notice is a regulatory document required by law. It must follow specific content and timing rules under the Privacy Rule. Its audience is clearly defined, and it must explain NPI collection, use, sharing, and opt-out rights in plain terms.

A standard privacy policy, on the other hand, typically covers broader data practices under laws like the California Consumer Privacy Act (CCPA) or GDPR. It may apply to all users and often includes cookies, device tracking, and analytics disclosures.

Here’s how they compare:

GLBA Privacy Notice | Standard Privacy Policy |

|---|---|

Legally required under the GLBA | May be required under state or international laws |

Focuses on financial products/services | Covers broader website and user data collection |

Structured format (often model form) | Flexible format, company-defined |

Delivered to consumers and customers directly | Often posted publicly on a website |

Includes opt-out disclosures for data sharing | May include broader consumer rights and requests |

If your fintech is subject to GLBA, you need both: a public-facing privacy policy and a separate or clearly structured GLBA privacy notice. One cannot substitute for the other.

How GLBA Safeguards Rule Complements the Privacy Notice

While the GLBA privacy notice focuses on what data is collected and shared, the Safeguards Rule addresses how that data is protected. Together, they form the two pillars of GLBA compliance: disclosure and security.

Key Requirements Under the Safeguards Rule

The Safeguards Rule requires covered financial institutions to implement a written information security program that protects customer data. The program must be tailored to the company’s size, complexity, and data risk exposure.

Core requirements under the Safeguards Rule include:

Designating a qualified individual to oversee the program

Conducting regular risk assessments

Limiting and monitoring access to customer data

Encrypting data in transit and at rest (where feasible)

Monitoring systems and testing safeguards

Maintaining an incident response plan

Reporting to the board annually on program effectiveness

In 2023, these requirements were updated to be more specific and now apply to a broader range of nonbank financial institutions as well as fintechs.

Security Program Essentials for Fintech Compliance

Startups and growth-stage fintechs often collect large volumes of consumer data without a dedicated security team in place. Under the Safeguards Rule, that’s no longer defensible.

To comply, fintechs typically need to:

Identify where customer data lives (infrastructure, tools, vendors)

Implement MFA, access controls, and audit logging

Vet and contractually bind service providers handling sensitive data

Train staff on handling and protecting customer information

Build repeatable processes for incident response and security testing

GLBA doesn’t give credit for good intentions, only for documented controls. While a privacy notice explains what you do with data, the Safeguards Rule requires you to prove how you’re protecting it.

See also:

Misconceptions About the GLBA Privacy Notice

Fintech teams often misjudge how and when GLBA applies. These misunderstandings can lead to overlooked requirements or incomplete compliance programs.

Here are some of the most common misconceptions:

GLBA applies to banks only: GLBA covers any business “significantly engaged” in financial activities. That includes many fintechs, even those without a charter, if they handle consumer financial data.

Having a privacy policy on your website is enough: A general privacy policy doesn’t satisfy GLBA. The GLBA privacy notice has specific content and delivery rules, and it's targeted at customers of financial products or services.

You don’t need to give a notice unless you share data: Not quite. If you have a customer relationship, a privacy notice is required, even if you don't share NPI beyond exceptions. Sharing simply changes how detailed that notice needs to be.

“Consumers never read the notice: That may be true, but regulators do. GLBA compliance is measured by your actions, not your assumptions about user behavior.

GLBA language should only be added to onboarding terms: GLBA requires a standalone, clearly presented privacy notice. Tucking it into legalese doesn't meet the “clear and conspicuous” standard expected by regulators.

Correcting these assumptions early can prevent avoidable compliance gaps and the regulatory scrutiny that can follow.

Recent Rule Changes and Enforcement Trends

Over the past few years, GLBA enforcement has evolved. Regulators have tightened expectations and clarified requirements, particularly around security and notice delivery. Therefore, fintechs operating in regulated spaces need to keep pace. To keep you informed, here are some recent trends:

Revised Safeguards Rule

The FTC updated the Safeguards Rule in 2021, with compliance deadlines phasing in through 2023. The revised rule introduced specific, prescriptive requirements for data security programs.

Notable changes include:

Mandatory encryption of customer data (at rest and in transit, where feasible)

Multi-factor authentication (MFA) for access to customer information

Written incident response plans

Regular risk assessments and monitoring

Annual board reporting on the program’s effectiveness

These updates apply to most nonbank financial institutions, expanding the rule’s reach to include more fintech service providers and data platforms.

Annual Notice Exemption Updates

Since 2015, companies that meet two conditions can skip the annual GLBA privacy notice. The first condition is that they don’t share NPI outside of permitted exceptions, while the second condition is that their privacy practices haven’t changed since the last notice.

If either condition changes, the annual notice becomes mandatory again. This exemption can reduce operational overhead, but only if you’re tracking sharing practices closely.

Penalties and Enforcement Priorities

GLBA violations can trigger enforcement actions from the FTC, CFPB, or SEC. While fines vary by agency, they’re often paired with long-term reporting obligations and audits.

Recent enforcement actions have focused on:

Inadequate or missing privacy notices

Failure to offer opt-outs where required

Weak or undocumented security practices under the Safeguards Rule

Regulators have signaled an increased focus on data privacy and security in financial services. Fintechs that wait to address GLBA compliance until a product is live or until an issue arises usually risk higher exposure.

Best Practices for GLBA Compliance in Fintech

Meeting GLBA requirements is about building operational habits that hold up under regulatory scrutiny. For fintech teams, the challenge is staying compliant without slowing product velocity. These practices can help:

Aligning Compliance With Product UX

GLBA privacy notices must be clear and accessible. That means working with product and design teams to make disclosures visible during onboarding, not hidden in footer links or dense legal text.

Some fintechs embed notices in:

Signup flows, with a required acknowledgment

In-app “Privacy & Terms” hubs

Email confirmations sent post-registration

Using the Model Privacy Form Effectively

Regulators have published a model privacy form as a safe harbor. It’s a short-form, tabular format that covers required disclosures clearly and concisely.

You can customize the model form to fit your business practices, but straying too far from its structure adds risk. If you’re drafting your first GLBA privacy notice, this is the most efficient place to start.

Integrating Privacy Terms Into Vendor Contracts

If third-party vendors handle your customer data, GLBA still holds you responsible. That means your vendor contracts should:

Define the vendor’s access and data-handling responsibilities

Require confidentiality and compliance with safeguards

Include breach notification terms

Your privacy obligations extend beyond your own infrastructure. Vendor due diligence and contract hygiene are critical components of a defensible compliance posture.

Coordinating GLBA With State and Federal Privacy Laws

GLBA may exempt certain data from state laws like the CCPA, but only if it’s handled strictly within the GLBA framework. Many fintechs fall into dual-compliance zones, especially if they handle both financial and non-financial user data.

Compliance teams should coordinate GLBA notices with:

Public privacy policies

CCPA/CPRA disclosures

Any other sector-specific requirements (e.g., FCRA, HIPAA if applicable)

Tip: Avoid duplication and contradictions by creating a centralized privacy governance workflow. This reduces legal exposure and simplifies ongoing updates.

—

GLBA compliance is a critical part of operating responsibly in the financial space. From drafting clear privacy notices to managing opt-outs and building a defensible security program, the requirements are specific and often easy to overlook.

Fintech teams don’t always have the time or in-house resources to manage these obligations consistently. That’s where InnReg can help. We work as an extension of your team, bringing deep fintech compliance expertise and a practical, process-driven approach.

Whether you're setting up your first privacy framework or need ongoing support, we help you mitigate regulatory risks without compromising product delivery. Talk to our experts today.

How Can InnReg Help?

InnReg is a global regulatory compliance and operations consulting team serving financial services companies since 2013.

We are especially effective at launching and scaling fintechs with innovative compliance strategies and delivering cost-effective managed services, assisted by proprietary regtech solutions.

If you need help with compliance, reach out to our regulatory experts today:

Last updated on Feb 9, 2026