How the NASAA Model Rules Impact Fintech Compliance

Feb 5, 2026

·

11 min read

The NASAA Model Rules play a central role in shaping how state securities regulators oversee investment advisors, broker-dealers, and other financial firms.

For fintechs operating in regulated spaces, especially those straddling multiple business models, understanding these rules is not optional. They often serve as the legal backbone behind many state-level compliance requirements.

This article breaks down what the NASAA Model Rules are, why they matter, and which ones are most relevant to innovative financial firms. We will cover the key areas where NASAA rules are actively shaping state law: from written compliance procedures to cybersecurity, continuing education, broker conduct, and marketing.

At InnReg, we help fintechs understand where NASAA Model Rules apply and what they mean in practice at the state level. Our team supports licensing, compliance program build-outs, and ongoing workflows tied to policies, cybersecurity, and marketing oversight. Contact us to learn more.

What Are the NASAA Model Rules?

The NASAA Model Rules are standardized regulatory templates developed by the North American Securities Administrators Association (NASAA). They cover a wide range of topics, including investment advisor conduct, broker-dealer practices, cybersecurity, continuing education, and more.

These rules are not laws by themselves. Instead, they serve as a framework for state securities regulators. Individual states decide whether and how to adopt them into their own legal codes. Once adopted, they carry the full weight of law in that jurisdiction.

For fintech firms operating across multiple states, the NASAA Model Rules often define the minimum compliance expectations. Over time, they have become a critical reference point for how state-level regulation aligns with or diverges from federal rules.

Why the NASAA Model Rules Matter to Fintechs

For fintech companies offering investment, advisory, or money movement services, the NASAA Model Rules often shape the compliance landscape, even if the firm is not aware of it at first.

Operating across multiple states introduces a layer of regulatory complexity that cannot be ignored. When states adopt NASAA Model Rules, those rules become enforceable law, covering areas such as compliance documentation, cybersecurity standards, and how firms market themselves or describe their personnel.

Fintech platforms that blend traditional and innovative financial services are frequently impacted. A product that offers investment functionality may trigger advisor registration requirements. If broker-dealer activities are involved, best interest standards and title restrictions could apply.

In practice, these model rules act as a foundation for what many state regulators now expect from financial entities. Being aware of them early can reduce friction during licensing, examinations, and ongoing operations.

Key NASAA Model Rules Financial Firms Should Know

While NASAA publishes a broad range of model rules, several have become particularly important for fintechs and other financial firms operating in regulated verticals.

These rules shape how firms build, document, and maintain compliance programs. They also influence how products are delivered, how personnel are trained, and how marketing is conducted, especially in multi-state operations.

Written Policies and Procedures Rule

The Written Policies and Procedures Model Rule requires state-registered investment advisors to adopt formal, documented compliance programs. These programs must address areas such as supervision, code of ethics, safeguarding client information, proxy voting (if applicable), and business continuity planning.

This rule effectively sets a compliance floor for smaller advisory firms that are not regulated by the SEC. Many states have adopted it to align their expectations with federal standards.

For fintech firms launching advisory services, this means having a comprehensive manual from day one. State examiners frequently look for these documents during exams. Gaps, outdated references, or missing topics are common findings and can lead to deficiency letters or delays in registration.

Firms building novel products, such as embedded advice features or hybrid advisor models, should treat this rule as a foundational requirement. Whether a firm manages compliance internally or partners with an external provider, having structured, written procedures is a non-negotiable expectation in most jurisdictions.

Cybersecurity and Privacy Rule

The Cybersecurity and Privacy Model Rule requires state-registered investment advisors to implement written information security policies. These must cover how client data is stored, accessed, protected, and monitored, both physically and electronically.

States adopting this rule expect firms to tailor their cybersecurity programs to their size, structure, and operations. That includes defining access controls, incident response plans, encryption standards, and training protocols.

For fintechs that handle sensitive data through APIs, mobile apps, or cloud-based infrastructure, this rule is directly relevant to their daily operations. Advisors must also deliver annual privacy notices to clients and retain detailed documentation of their security practices.

Inadequate or poorly implemented cybersecurity policies are now considered a regulatory deficiency and, in some states, an unethical business practice. Regulators are increasingly expecting firms to treat cybersecurity as part of their core risk management, not just an IT function.

Investment Advisor Representative Continuing Education Rule

The IAR Continuing Education (CE) Model Rule requires investment advisor representatives to complete 12 hours of approved coursework annually. This includes six hours focused on product knowledge and industry practices, and six hours covering ethics and regulatory topics.

The rule applies only in states that have formally adopted it. However, that list is growing quickly, with more than 25 states enforcing CE requirements as of 2025. Advisors registered in multiple jurisdictions must stay compliant based on where they are registered, not just where they reside.

Some CE credits can be satisfied through existing FINRA programs, but firms still need a process to monitor completion, state adoption, and recordkeeping. This is especially relevant for fast-moving fintechs with distributed teams and hybrid licensing models.

For fintech platforms employing or contracting with IARs, tracking this requirement is now part of basic compliance hygiene. Failing to complete CE on time can trigger a “CE Inactive” status in FINRA’s IARD system, preventing renewals and disrupting advisor operations.

Learn more about NASAA Continuing Education →

Broker-Dealer Best Interest and Title Usage Amendments

NASAA’s updates to its Broker-Dealer Model Rule introduced two major changes: a best interest standard for recommendations, and new restrictions on how professionals may use the term “advisor” or similar titles.

The best interest provision aligns closely with the SEC’s Regulation Best Interest (Reg BI), but it gives states the ability to enforce this standard independently. Firms must now justify recommendations not just based on suitability, but on whether they truly serve the retail investor’s best interest.

The title usage amendment restricts broker-dealer agents from using terms like “financial advisor” unless they are properly licensed as investment advisors. This change targets marketing practices that may mislead clients about the nature of their relationship with a representative.

Best Interest Standard | Title Usage Restrictions |

|---|---|

Applies to all retail investment recommendations | Applies to anyone using the title “advisor” |

Mirrors SEC Reg BI, but enforceable at the state level | Limits the title use to those registered as IAs |

Requires documentation of recommendation rationale | Impacts marketing, job titles, and rep communication |

Requires training for compliance teams | Firms must audit digital and print materials |

For fintech broker-dealers, especially those combining automated investing with human support, these rules add extra scrutiny. Internal training, customer-facing language, and documentation workflows may all need revision, depending on the states where the firm is active.

See also:

Proposed Marketing and Advertising Rule Updates

NASAA’s 2025 proposal to modernize its Advertising and Marketing Model Rule reflects ongoing efforts to align state requirements with the SEC Marketing Rule. The proposed changes would allow certain practices that were previously prohibited, such as the use of testimonials and third-party ratings, under strict conditions.

If adopted, state-registered investment advisors would be permitted to reference client endorsements, display performance results, and use independent rankings, provided they follow clear disclosure, documentation, and review protocols.

For fintech advisors who rely heavily on digital marketing, this would mark a meaningful shift. Current state-level rules can conflict with SEC guidance, creating confusion and compliance risk. NASAA’s update aims to eliminate that gap.

The proposal also expands what counts as an “advertisement” and updates recordkeeping expectations. Firms would need to track the audience, context, and supporting documentation for each ad, including social media posts and influencer partnerships. For growth-focused fintechs, this raises the bar for how marketing compliance is built and maintained across channels.

Need help with broker-dealer compliance?

Fill out the form below and our experts will get back to you.

Regulatory Bodies Behind the NASAA Model Rules

The NASAA Model Rules framework is developed by the North American Securities Administrators Association (NASAA), an organization comprising securities regulators from all 50 states, Washington, D.C., Puerto Rico, and several Canadian provinces.

These rules do not originate from federal agencies, such as the SEC or FINRA. Instead, NASAA provides model templates that individual states can adopt and enforce through their own securities divisions or commissions. Once a model rule is adopted, it becomes part of that state's regulatory code.

Understanding NASAA’s role helps clarify why tracking state-by-state adoption matters. It also explains why compliance strategies need to be flexible enough to accommodate multiple regulatory frameworks.

Learn how InnReg helps fintechs develop regulatory and product strategy →

NASAA Model Rules: What’s Likely Coming Next

As the financial landscape shifts, NASAA continues to evaluate new areas of risk and innovation. The next wave of model rules is likely to reflect growing regulatory focus on several key domains:

Ongoing Adaptation to Market Risk and Innovation

While NASAA Model Rules aim to create regulatory alignment across states, they are not static.

New technologies, shifting investor behavior, and federal rulemaking all influence how NASAA updates its frameworks. These changes often originate in areas where innovation has outpaced regulation, which is common in the fintech space.

Fintech firms exploring emerging models should keep an eye on areas where NASAA has signaled future rulemaking or issued interpretive guidance. Several of these topics are already drawing attention from state regulators and industry groups.

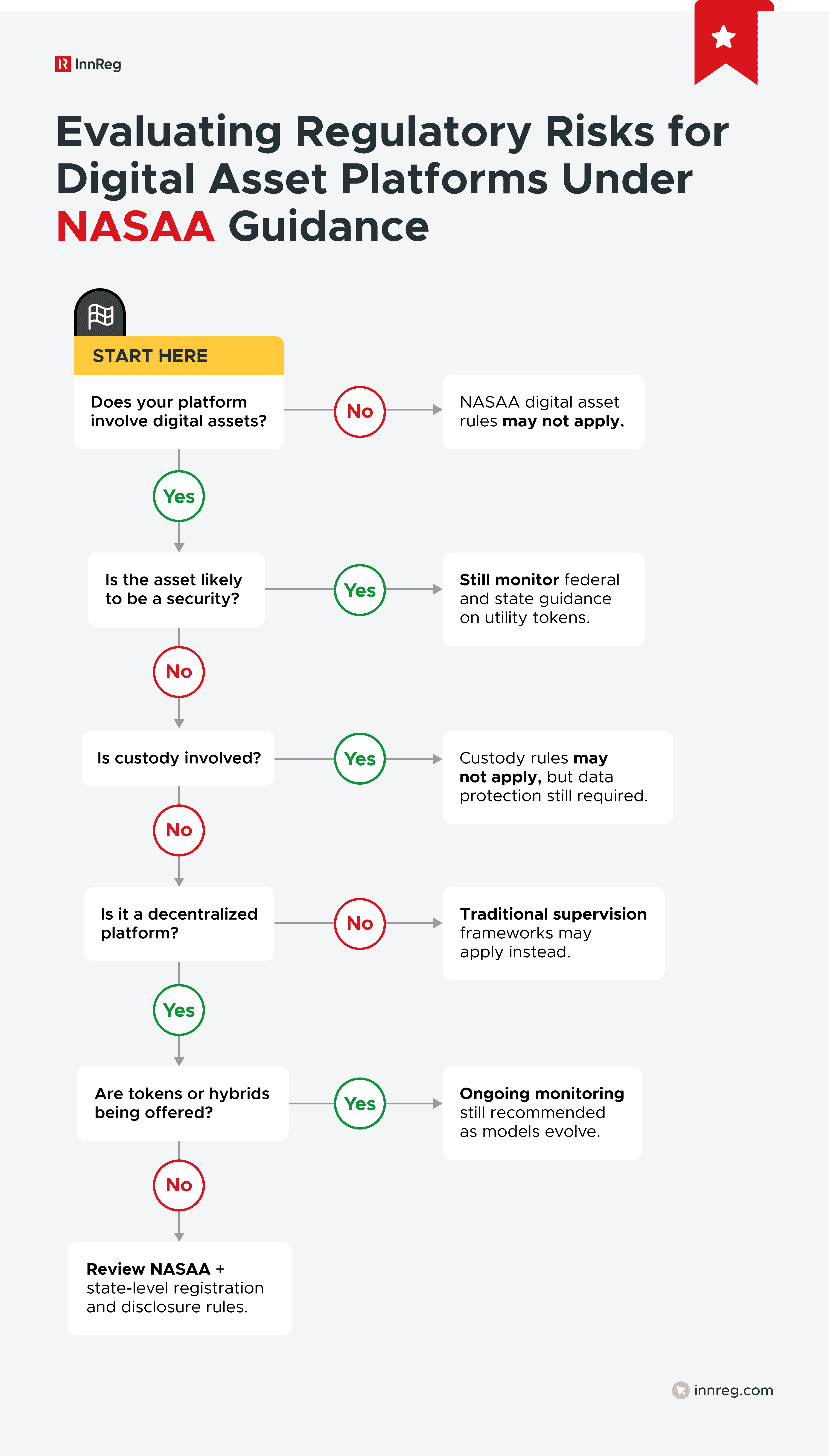

Digital Assets and Custody

Digital asset regulation is one of the most closely watched areas in NASAA’s policy discussions. While no comprehensive model rule exists yet, NASAA has released statements warning about the risks of crypto-related offerings, particularly those targeting retail investors.

Key focus areas include:

Classification of digital assets as securities

State custody requirements for crypto holdings

Compliance gaps in decentralized platforms

Registration issues for tokenized securities or hybrid offerings

As more states begin developing crypto frameworks, either through legislation or rulemaking, NASAA may offer a model rule to encourage consistency across jurisdictions. For fintechs dealing in custody, tokenized securities, or embedded crypto functionality, this could significantly affect product structure and compliance obligations.

AI, Automation, and Algorithmic Advice

NASAA is also monitoring how automation and artificial intelligence are used in financial services. The concern is less about the technology itself and more about how it affects traditional compliance pillars: suitability, supervision, transparency, and recordkeeping.

Future model guidance or rules may touch on:

Disclosures about how algorithms make recommendations

Documentation standards for automated decision-making

Supervisory obligations when humans oversee AI-driven tools

Limits on outsourcing judgment to unsupervised systems

This area is particularly relevant for fintechs offering robo-advice, algorithmic rebalancing, or predictive analytics. Even without a formal model rule yet, states are beginning to ask tougher questions during registration and exams.

Fintechs that rely heavily on automation should prepare internal documentation and workflows that mirror those of traditional advisors, just adapted for software-based processes.

Harmonizing with Federal Shifts

As the SEC and other federal regulators continue to evolve their own rules, like updates to custody, marketing, and cybersecurity, NASAA often responds with proposed adjustments to keep state rules in sync.

This synchronization is not automatic. It can result in:

Transitional periods where federal and state rules conflict

Compliance programs that require dual tracking of requirements

Additional complexity for firms with SEC registration in some lines of business and state registration in others

Firms should monitor both sides. NASAA model rules often lag slightly behind federal updates, but when they arrive, they carry enforceable consequences in adopting states. Maintaining forward-looking compliance policies can help reduce disruption when a rule does land.

Topic | SEC Rule | NASAA Status | Implication for Dual-Registered Firms |

|---|---|---|---|

Custody | Proposed amendment | Not yet aligned | Track both rule versions |

Marketing | SEC 2021 rule | NASAA proposed update | Watch state timelines |

Cybersecurity | SEC proposal in progress | Many NASAA states adopted | Check overlapping gaps |

See also:

Staying Ahead of NASAA Model Rules Changes

Fintech firms working in regulated verticals cannot afford to treat NASAA model rules as static reference material. Staying ahead means anticipating what’s coming, not reacting after it lands.

Below are four practical strategies firms can use to stay current with evolving model rules and state-level adoption:

Follow NASAA Updates: NASAA regularly publishes model rule proposals, adoption reports, and investor alerts on its website. Firms should monitor these updates and track which rules are gaining traction at the state level. Signing up for compliance-focused newsletters, alerts from legal counsel, or notifications from regulatory monitors can help teams catch early signals of upcoming changes.

Engage and Educate: When model rules are proposed, NASAA often opens a public comment period. Submitting feedback, directly or through an industry group, can shape how the final rule is written. This is especially useful when the rule affects emerging business models or technologies where existing definitions do not apply cleanly. Internally, educating staff early allows time to build understanding and align product, marketing, and compliance teams before new requirements go live.

Uniform Compliance Framework: State-by-state rules may differ, but compliance inefficiencies grow when each jurisdiction is treated as a one-off. Many experienced teams take a highest-common-denominator approach, aligning their operations to the most rigorous version of a rule, even if not yet required in all locations. This approach can reduce long-term technical debt and simplify training, supervision, and documentation, especially helpful for startups with lean teams and fast product cycles.

Leverage Technology and Expertise: Manual tracking of rule adoption, CE deadlines, marketing reviews, and document versioning is not sustainable at scale. Purpose-built tools like compliance task managers, CE tracking platforms, or marketing review archives can reduce risk and workload.

Many fintechs also turn to compliance outsourcing partners with direct experience navigating NASAA-driven state requirements. These teams can manage recurring workflows, provide strategic guidance, and adapt programs as rules evolve.

InnReg helps fintechs integrate the NASAA Model Rules requirements into their compliance strategy. Contact us to learn how our team of experts can help you.

—

The NASAA Model Rules framework continues to shape how state-level regulators approach compliance across the financial services ecosystem. For fintechs operating in or adjacent to regulated verticals, these rules are the starting point for what states expect.

Whether it is building written procedures, meeting cybersecurity requirements, tracking advisor education, or aligning marketing practices, model rules often signal where enforcement is heading. Staying informed and operationalizing these expectations early is key to reducing regulatory friction and building resilient infrastructure.

As new rules emerge around digital assets, AI-driven advice, and evolving federal coordination, a proactive compliance strategy becomes a competitive advantage. Firms that build flexibility into their compliance programs and understand where NASAA fits within the regulatory landscape will be better positioned to move quickly without incurring costly setbacks.

How Can InnReg Help?

InnReg is a global regulatory compliance and operations consulting team serving financial services companies since 2013.

We are especially effective at launching and scaling fintechs with innovative compliance strategies and delivering cost-effective managed services, assisted by proprietary regtech solutions.

If you need help with broker-dealer compliance, reach out to our regulatory experts today:

Last updated on Feb 5, 2026