Beneficial Ownership Reporting for Investors Under Rule 13D-G

Jan 5, 2026

·

22 min read

When an investor starts to gain real influence over a company, regulators need visibility. Rule 13D-G outlines how those ownership stakes should be reported to keep things transparent and fair.

For fintech founders and compliance leaders, this rule shapes how investors are viewed by regulators, the market, and even potential partners. Understanding when and how to file helps keep operations running smoothly and prevents unwanted scrutiny.

In this guide, we’ll walk you through how beneficial ownership reporting works, why it matters, and what investors need to keep in mind as they grow, trade, or expand into new opportunities.

At InnReg, we help institutional investors, funds, and fintechs manage beneficial ownership obligations under Rule 13D-G. Our team supports you with ownership monitoring workflows, Schedule 13D/13G filings, and governance processes. Contact us to learn more.

Understanding Beneficial Ownership

Beneficial ownership goes beyond whose name is on the stock certificate. It’s about uncovering who actually controls or benefits from those shares, giving regulators and the market a clearer picture of real influence within a company.

Here are the main elements that determine beneficial ownership and how they affect reporting under Rule 13D-G.

Direct and Indirect Ownership

Direct Ownership | Indirect Ownership |

|---|---|

|

|

Direct ownership refers to when an investor holds shares in their own name, giving them both control and economic interest. Indirect ownership, on the other hand, refers to situations where control or benefit flows through another entity or arrangement, such as holding shares through a trust, partnership, or subsidiary.

Understanding this distinction matters because indirect holdings often reveal where real influence lies. For example, a founder might technically own no shares personally but still control voting decisions through a fund or holding company.

Ultimately, identifying beneficial ownership requires looking beyond formal titles or account names. Investors and compliance teams must assess the complete picture of how shares are held, who controls them, and who benefits from them financially or strategically.

Group Ownership and Aggregation Rules

Beneficial ownership can extend beyond individual investors. When people or entities act together with a shared purpose, like influencing management, voting outcomes, or strategic decisions, they may be treated as a group under Rule 13D-G.

Groups can form in different ways. Sometimes it’s through formal agreements, like joint investment plans or proxy arrangements. Other times, it develops more organically, like when investors coordinate their actions or share confidential information to influence how a company is run.

This matters because group members must aggregate their ownership when calculating total holdings. Even if each person owns less than 5% individually, their combined interest could trigger a reporting obligation.

Derivative Holdings and Voting Power

Beneficial ownership isn’t just about holding shares the traditional way. Investors can also gain influence through derivatives that give them rights to acquire, sell, or vote on securities. While instruments like options or swaps don’t transfer direct ownership, they can still provide meaningful control or influence over a company’s stock.

Regulators focus mainly on voting power. If a derivative allows an investor to influence how shares are voted, or functions like actual ownership, it may be considered beneficial ownership under Rule 13D-G.

For instance, an investor might hold cash-settled swaps tied to a company’s shares. They don’t technically own the stock, but regulators could still see that position as a form of influence. That’s why compliance teams need to understand these nuances when monitoring complex portfolios.

What Rule 13D-G Means for Investors

Here’s an overview of Rule 13D-G, including who it covers and the main terms it uses to help investors stay transparent and compliant when reporting their ownership.

Overview of Rule 13D-G and Its Purpose

Rule 13D-G is designed to bring transparency to who really holds power in public companies. It requires investors who take prominent positions to disclose their holdings and intentions so the market can see who might be influencing corporate decisions.

The goal is openness. When control or voting power shifts, investors, regulators, and companies all get the same clear picture. These disclosures prevent major transactions from happening behind closed doors and help keep the market fair and balanced.

For compliance teams and investors, Rule 13D-G promotes a foundation of trust. It discourages hidden control battles, supports honest trading, and helps companies understand who truly holds influence over their stock.

Who Must File Under Rule 13D-G

Rule 13D-G comes into play only when an investor or a group working together acquires more than 5% of a public company’s registered equity securities. Once that level of ownership is reached, the investor must file a disclosure that details their stake and explains their intentions.

Rule 13D-G can apply to a wide range of investors. This includes:

Individual investors who build a sizable position in a company’s stock.

Institutional investors, such as funds, banks, or asset managers, that hold large portfolios.

Groups of investors who work together or share similar goals around control or influence.

For fintech firms, these thresholds are critical. When you manage several investment vehicles or affiliated entities, small positions can add up fast. Compliance teams should, therefore, keep an eye on total ownership, since even indirect stakes or shared control can trigger a filing.

See also:

Key Terms and Definitions

Understanding the key terms in Rule 13D-G makes it much easier for investors and compliance teams to understand what triggers a filing. Here are several terms that come up frequently under the rule.

Beneficial Owner: A beneficial owner is anyone who directly or indirectly has the power to vote, dispose of, or gain from a security’s value. This definition captures both individual investors and entities acting through subsidiaries, trusts, or other arrangements. Even if the name on the certificate is different, the person or entity benefiting from the shares is the beneficial owner.

5% Threshold: Once an investor’s holdings reach more than 5% of a registered equity security, they must file a Schedule 13D or 13G. This threshold includes both direct and indirect ownership, and in some cases, derivative instruments that provide similar control or economic benefit.

Schedule 13D and 13G: These are the two primary disclosure forms. Schedule 13D applies to active investors who may influence or change control of the company, while Schedule 13G is for passive investors, such as institutional holders without control intentions. Each form has its own timing, content, and amendment rules.

Group: When investors coordinate or share a common purpose regarding a company’s management or policies, regulators may view them as a group. Their combined holdings are aggregated for determining whether the 5% threshold has been crossed.

Control Intent: This term refers to whether an investor’s purpose in acquiring shares is to influence or direct company operations. Identifying intent correctly helps determine which filing type applies and whether future updates are required.

Need help with fintech compliance?

Fill out the form below and our experts will get back to you.

Why Beneficial Ownership Reporting Matters

Beneficial ownership reporting plays a significant role in keeping markets honest. It protects investors, strengthens oversight, and builds trust between companies and the public. Here’s why it matters.

Market Transparency and Fair Trading

Beneficial ownership reporting gives everyone a clearer view of who actually holds power in public companies. By disclosing significant shareholdings, investors help create a more open market where information is available to all participants, not just insiders.

This transparency supports fair trading by reducing the chance that large investors can quietly build control positions without public awareness. It also helps prevent market manipulation and promotes informed decision-making among shareholders, analysts, and regulators.

Investor Protection and Market Integrity

Through beneficial ownership reporting, investors know who has real influence over a company’s decisions. When control and intent are visible, markets operate on more accurate information instead of speculation.

This helps keep markets honest by discouraging hidden partnerships or quiet attempts to gain control. Clear and transparent reporting also builds trust in how companies are run and how major investors help shape their direction.

Visibility Into Control Changes

Beneficial ownership reports give the market early insight into who may be gaining or losing influence over a public company. These filings act as an early signal of potential control shifts, helping investors, analysts, and regulators understand how ownership dynamics are evolving.

When major shareholders buy or sell significant stakes, that information can impact both the market and a company’s strategy. Having clear visibility into these changes helps avoid surprises, keeps leadership accountable, and supports better decisions across the market.

Regulatory Oversight and Accountability

Beneficial ownership reporting helps regulators keep a close eye on market activity and spot potential red flags. By tracking major shareholdings and shifts in control, agencies like the SEC can detect unusual trading patterns, coordinated actions, or signs of insider activity early on.

These reports also promote accountability among large investors and company insiders. When ownership information is out in the open, it’s much harder to hide influence or delay disclosures. This level of transparency builds trust and reinforces confidence in the rules that keep public markets fair and well-governed.

Governance and Public Confidence

Transparent ownership reporting helps strengthen corporate governance by showing who really holds influence over company decisions. When major shareholders share their positions and intentions, boards and management get a clearer picture of the interests driving their investor base.

This kind of visibility builds trust in how companies are run. Investors and analysts can spot potential conflicts, changes in control, or new alliances more easily. With that clarity, markets can react to facts instead of speculation, which helps maintain confidence between companies and their stakeholders.

Strategic Insight for Fintech and Institutional Investors

Beneficial ownership reporting also offers valuable strategic insight for investors and companies in fast-moving markets. Knowing who holds major stakes helps firms understand their competitive landscape, anticipate new partnerships, and spot changes in investor sentiment early on.

For fintechs and institutional investors, this information can inform key decisions around partnerships, fundraising, or entering new markets. Tracking ownership trends among peers and competitors can also reveal where influence is growing and where fresh opportunities might emerge.

Learn more about reporting beneficial ownership information

When Rule 13D-G Applies: The 5% Ownership Threshold

Here’s how the 5% ownership threshold works, when filings are triggered, and what real-world situations can lead to reporting requirements.

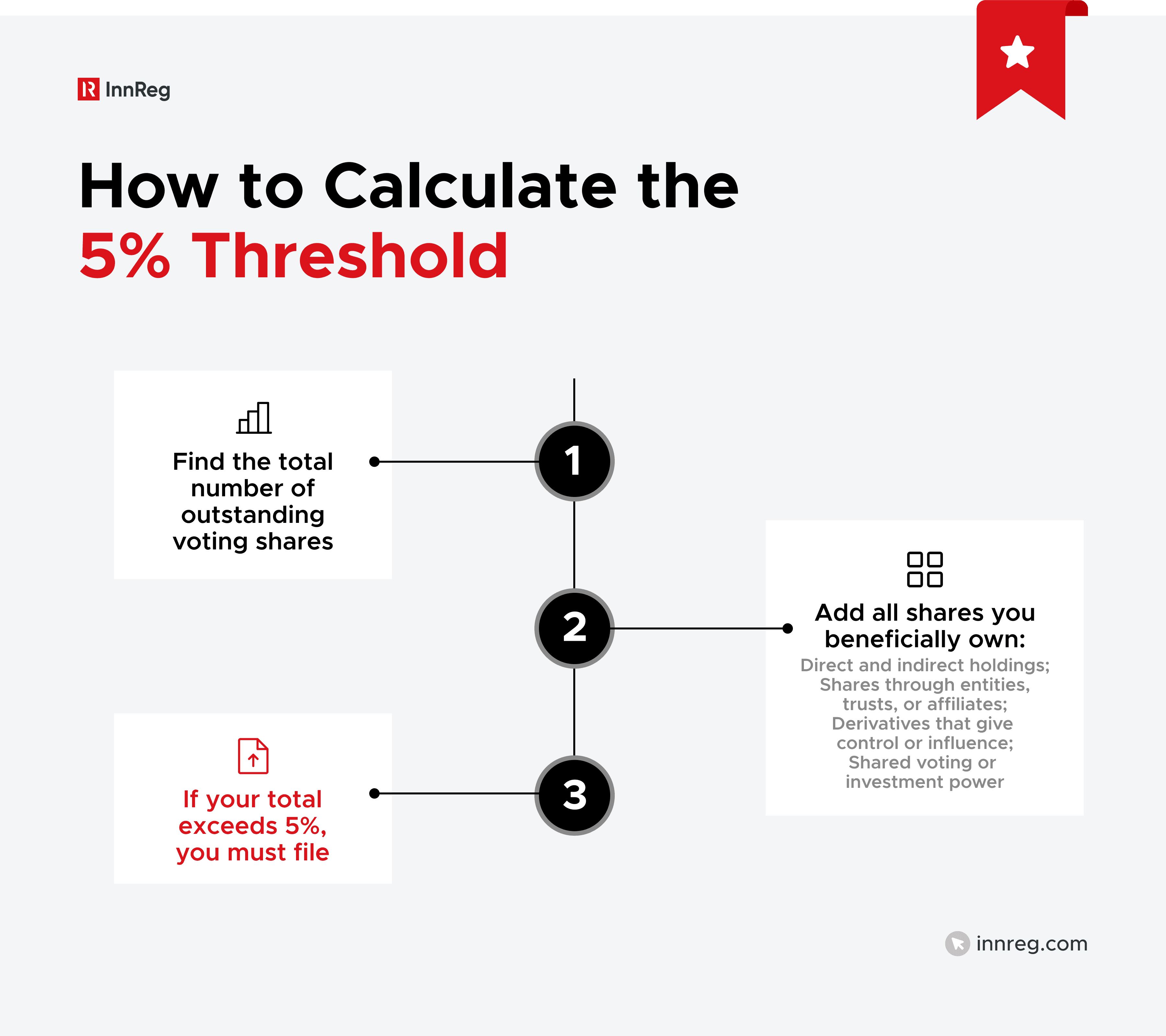

How the 5% Threshold Is Calculated

Once an investor holds more than 5% of a company’s voting shares, that position becomes significant enough to report publicly.

To calculate this, start with the total number of outstanding shares of the class you’re investing in. You can usually find this in the company’s most recent Form 10-K, 10-Q, or other filings. Then add up all shares you beneficially own, whether directly or indirectly. This includes:

Shares held personally or through another entity you control

Holdings through partnerships, trusts, or affiliates

Derivatives that give you the right to acquire or influence shares

Shared voting or investment power with other investors

Example:

Let’s say a fintech investment firm holds 3.2 million shares of a company with 60 million total shares outstanding. That equals 5.33% ownership, crossing the 5% line and triggering a Rule 13D-G filing requirement. Even if some shares are held through an affiliated fund or a swap agreement, they still count toward the total.

Because ownership structures can get complicated, especially across multiple entities, many compliance teams use ongoing monitoring systems to track positions and flag when filings might be needed. This approach keeps investors ahead of reporting deadlines and maintains transparency with regulators and markets.

Triggering Events and Timing Considerations

Rule 13D-G also applies when certain actions or changes occur afterward. These triggering events determine when new filings or amendments are required to keep disclosures accurate and up to date.

Here are some common triggering situations:

Initial acquisition: When your beneficial ownership first exceeds 5% of a registered equity security.

Material change in holdings: When your ownership percentage rises or falls by more than 1% after your initial filing.

Change in purpose or control: When your intent shifts from passive investment to active influence over management or strategy.

Group formation or dissolution: When investors start or stop coordinating their ownership activities.

Timing also matters. Rule 13D-G filings must be made within strict deadlines, which vary depending on the type of filer (active, passive, or institutional). Missing a filing window can draw regulator attention or trigger penalties.

Examples of Ownership Scenarios

Beneficial ownership can appear in different forms, depending on how an investor holds or controls shares. The following examples show how Rule 13D-G applies across common situations, helping investors and compliance teams recognize when a filing may be required.

Example 1: Direct Ownership

Imagine a fintech founder buys 3 million shares in a public company with 50 million shares outstanding. That works out to a 6% stake, which is enough to cross the 5% reporting threshold. Because the founder plans to influence the company's strategy and may pursue a board seat, a Schedule 13D filing is required. This filing not only discloses the size of the stake but also explains the purpose of the investment, including any plans related to governance or management changes.

Example 2: Indirect Ownership

Let’s say a venture capital firm owns 4% of a company’s stock through its main fund, and an affiliated fund under the same management holds another 2%. On their own, neither fund crosses the 5% threshold, but together they have 6%, which triggers a reporting requirement. Even if the funds manage their investments separately, regulators may treat them as a single group because they share management and strategy. In this case, the firm would need to file a joint Schedule 13D or 13G, depending on its investment intent.

Example 3: Derivative Holdings

Let’s say an institutional investor uses total return swaps to gain the same economic exposure as holding 5.5% of a company’s shares. Even though the investor doesn’t actually hold the shares, the swaps provide similar influence over those securities. Under Rule 13D-G, these kinds of arrangements can still count as beneficial ownership if they include voting power, control, or a right to acquire the shares. In that case, the investor may still need to file a Schedule 13D or 13G.

Schedule 13D vs. Schedule 13G: Which One Applies to You?

Both Schedule 13D and Schedule 13G are used to report beneficial ownership, but they apply to different types of investors and situations. The next sections explain how they differ and how to choose the right one for your filing.

See also:

Main Differences Between Schedule 13D and 13G

While both forms disclose beneficial ownership, they serve different purposes and audiences. Schedule 13D is designed for investors who may influence or change control of a company, while Schedule 13G is for those holding shares passively.

Here’s a quick comparison to help clarify how they differ:

Feature | Schedule 13D | Schedule 13G |

|---|---|---|

Filing Purpose | Filed by investors seeking to influence or change control of a company. | Filed by investors with a passive or institutional interest. |

Filing Deadline | Within five business days of crossing 5% ownership. | Varies by filer type; generally within 45 days after the quarter-end for most passive or institutional investors. |

Disclosure Detail | Requires detailed information on the purpose of the acquisition, funding source, and future plans for control or management. | Requires basic ownership information without detailed intent disclosures. |

Updates | Amend within two business days after any material changes. | Within 45 days after quarter-end, when ownership changes materially. |

Filer Categories and Eligibility

Different filer categories have different disclosure rules, depending on how the investor interacts with the company and what their goals are.

The main filer types include:

Active investors: Those who buy shares with the intention of influencing company management or strategy. These investors must file Schedule 13D, which requires more detailed disclosure about their purpose and potential plans.

Passive investors: Investors who own more than 5% but have no intention to control or direct the company. They can use Schedule 13G, which involves a shorter form and fewer disclosure requirements.

Qualified institutional investors (QIIs): Organizations such as banks, insurance companies, or registered investment advisors that buy shares during normal business activities. They may also file Schedule 13G, often with different timing requirements from individual investors.

Choosing the Correct Form

Knowing whether to file a Schedule 13D or 13G comes down to two main factors: intent and investor type. The form you choose signals to regulators and the market what kind of investor you are and how you approach your holdings.

Here’s a simple way to think about it:

If you plan to influence or change how a company is run, Schedule 13D applies. It requires more detail about your purpose, funding, and future plans.

If you hold the shares purely for investment, with no control intent, you can usually file Schedule 13G. The disclosure is shorter and the deadlines are less strict.

Some investors may need to switch forms if their intent changes. For example, a passive investor who later seeks a board seat or joins an activist campaign must move from Schedule 13G to Schedule 13D.

Rule 13D-G Filing Deadlines

Timely filings are central to compliance with Rule 13D-G. The rule lays out clear timeframes for when investors must disclose their beneficial ownership and when updates are required.

Initial Filing Deadlines by Filer Type

Once an investor crosses the 5% mark, the countdown begins. The timelines below reflect the SEC’s 2024 updates, which shortened several of the previous deadlines.

Schedule 13D filers: Investors with control intent must file within five business days after acquiring more than 5% of a company’s voting shares.

Passive Schedule 13G filers: Investors with no intent to influence control have 45 days after the end of the calendar quarter in which they cross the threshold.

Qualified institutional investors (QIIs): Entities like banks, insurance companies, and registered investment advisors must file within 45 days after the end of the quarter in which they crossed the 5% threshold, or within five business days after the end of any month in which their holdings exceed 10%.

Exempt investors: Those who acquired shares before registration or through passive means must file within 45 days after the quarter-end when their holdings exceed 5%.

These deadlines reflect the SEC’s push for faster, more transparent ownership reporting, helping investors and companies track control changes more efficiently.

Amendment and Update Requirements

Ownership isn’t static, so Rule 13D-G requires updates whenever holdings or intent change significantly.

Schedule 13D: Filers must amend their report within two business days of a material change. This can include buying or selling a large block of shares, changing control intent, or entering into new agreements that affect voting power.

Schedule 13G: Filers must amend their report within 45 days after quarter-end when there are material changes during the quarter, unless their ownership exceeds 10%or changes by 5% or more, in which case earlier amendments are required.

Summary of 2024 SEC Deadline Changes

In 2024, the SEC finalized amendments to modernize the 13D-G filing process and speed up market disclosure. The most notable changes include:

Shorter initial Schedule 13D deadline: Reduced from 10 calendar days to five business days.

Amendments to Schedule 13D: Must now be filed within two business days of any material change.

Revised Schedule 13G deadlines: Align timing between passive and institutional filers, promoting more consistent reporting.

Electronic filing requirements: All forms must now be submitted through EDGAR in a structured, machine-readable format.

See also:

Common Compliance Challenges Under Rule 13D-G

Complying with Rule 13D-G often involves more than just tracking share counts. Complex ownership structures, shifting investment intent, and tight filing windows can make reporting difficult. The following sections break down the most common challenges investors and compliance teams face and how to manage them effectively.

Monitoring Ownership Across Multiple Entities

For investors operating through several funds or subsidiaries, tracking beneficial ownership across multiple entities can quickly become complicated. Shares held through affiliates, trusts, or partnerships often add up faster than expected, creating filing obligations that aren’t immediately obvious.

Imagine a fintech investment group where one fund holds 3 percent of a company and an affiliated fund holds another 3 percent. Individually, neither crosses the threshold, but together they exceed 5% and trigger a Rule 13D-G filing. Situations like this happen often, especially when teams work independently without centralized oversight.

To manage this effectively, compliance teams need a clear and connected process. Bringing data together, using shared dashboards, and keeping legal, trading, and compliance teams in sync helps avoid last-minute filings and keeps reporting accurate, even when ownership structures get complex.

Determining Passive vs. Active Investor Intent

One of the biggest challenges under Rule 13D-G is deciding whether an investor is passive or active. The distinction matters because it determines which form to file and how much detail must be disclosed.

The tricky part is that intent isn’t always black and white. A fund might start out as passive but later join discussions with management or coordinate with other shareholders. At that point, the investor must switch from Schedule 13G to Schedule 13D and update disclosures accordingly.

Being clear about purpose from the start helps avoid confusion and late amendments. Regular conversations between investment and compliance teams also make it easier to spot when intent begins to shift toward control or influence.

Identifying and Managing Group Status

Determining when investors are considered a group under Rule 13D-G can be one of the most confusing parts of compliance.

Sometimes this coordination is formal, such as when investors sign an agreement or share voting rights. Other times, it’s informal, like when investors share information or align on how to vote. Even casual cooperation can be viewed by regulators as group activity.

The challenge for compliance teams is recognizing when collaboration crosses that line. Keeping clear communication between legal, trading, and investor relations teams helps avoid surprises. When in doubt, documenting discussions and reviewing joint actions can also help determine whether a group filing might be required.

Tracking and Disclosing Derivative Positions

Derivatives can make beneficial ownership reporting more complicated. These instruments don’t always involve direct ownership, but they can still give an investor economic or voting influence over a company’s shares.

For example, a total return swap might mirror the performance of a company’s stock without transferring actual ownership. Even though no shares change hands, regulators may still consider the position part of beneficial ownership if it gives the investor meaningful control or insight.

The challenge lies in keeping track of these indirect exposures across different portfolios and counterparties. Compliance teams need a clear view of how each derivative affects control or voting power. With organized data and close coordination between legal and trading teams, investors can report these positions accurately and avoid surprises when ownership limits are reached.

Meeting Tight Filing and Amendment Deadlines

Rule 13D-G filings come with short timelines, and keeping up with them can be stressful in fast-moving markets. Once an investor crosses the 5% threshold, the clock starts ticking.

The real challenge is staying current after the first filing. Ownership levels can shift daily, and any material change requires a prompt amendment. Missing those updates can draw unwanted regulator attention.

Most firms handle this by keeping ownership data current and creating alerts for threshold changes.

Coordinating Across Legal, Trading, and Compliance Teams

Filing under Rule 13D-G is a team effort that depends on strong communication between legal, trading, and compliance departments. Each group sees a different part of the picture, and bringing that information together is key to accurate reporting.

Traders monitor positions in real time, compliance teams track ownership thresholds, and legal handles disclosure details. When those efforts don’t stay aligned, filings can slip or go out incomplete. Regular coordination and transparent ownership tracking help keep everyone moving together.

Many firms use shared dashboards or simple workflows to stay organized. With teams connected, they can spot filing triggers early and submit reports on time, even in fast-moving trading environments.

Maintaining Accurate and Up-to-Date Beneficial Ownership Data

Maintaining accurate and current beneficial ownership data is one of the biggest ongoing challenges under Rule 13D-G. As portfolios shift, new investors join, and positions move between accounts, even small data gaps can lead to missed filings or outdated disclosures.

The problem often starts with fragmented systems. Different teams or affiliates may track holdings separately, using their own tools or formats. Without a single source of truth, it’s easy to lose sight of the full ownership picture.

To stay organized, firms benefit from having a centralized process for collecting, reviewing, and updating ownership data. Regular reconciliations, clear reporting responsibilities, and periodic audits all help keep records reliable.

Practical Steps to Strengthen Your Compliance Program

Managing filings under Rule 13D-G can feel complex, but a structured compliance approach makes it manageable. Here’s how investors, fintech firms, and compliance teams can build stronger processes that keep ownership reporting accurate, timely, and well-documented.

Implement Strong Ownership Monitoring Systems

When holdings are spread across different accounts, funds, or affiliates, even small position changes can tip you over the 5% line without anyone noticing. That’s why a reliable ownership monitoring system is such a game-changer.

Think of it as your early warning system. Automated tools that pull data from trading and custody platforms into one dashboard can help your team see the full picture in real time. But technology isn’t the only answer. Regular check-ins, consistent recordkeeping, and open communication between trading, legal, and compliance teams make a big difference, too.

The goal is to stay aware of your total ownership at all times. When your data is accurate and easy to access, filings stop feeling like a scramble and start feeling like part of a smooth, ongoing process.

Establish Clear Pre-Filing Procedures and Internal Coordination

Filing under Rule 13D-G often comes down to timing and teamwork. When ownership starts approaching that 5% mark, everyone involved needs to know what happens next. Clear pre-filing procedures help your team move quickly and confidently when it’s time to disclose.

Start by defining who does what. Trading teams track positions, compliance monitors thresholds, and legal prepares filings. When these roles are clear, information flows faster and decisions get made without confusion. It also helps to have a simple checklist or shared workspace so everyone can follow the same process.

Prepare Draft Disclosures Before Crossing Thresholds

Getting close to the 5% mark is the right time to get ahead of your filing. Preparing draft disclosures early saves time later and helps your team avoid rushing once a trigger event happens.

Think of it as building a head start. Gather key details like investor information, ownership structure, and intent while things are still calm. Having a draft ready means you can review it carefully, catch any inconsistencies, and make quick adjustments when your position changes.

Verify Beneficial Ownership Calculations Regularly

Ownership percentages can change quickly, especially when trading activity, derivatives, or affiliate holdings are involved. Regularly verifying beneficial ownership calculations helps keep filings accurate and avoids surprises that might trigger late updates.

Set a routine for reviewing both direct and indirect holdings. Double-check positions held through subsidiaries, funds, or trusts, and make sure all data reflects the latest outstanding share count from the company’s filings. Even small changes in share totals can shift your ownership percentage more than you think.

File and Amend Within Required Deadlines

It’s easy for deadlines to slip when markets move fast or multiple people are involved. Setting up reminders, ownership alerts, or an internal filing calendar helps everyone stay on track. Quick coordination between trading, compliance, and legal teams also keeps the process running smoothly.

Timely filings show regulators and market participants that your reporting is accurate and up to date. When filing becomes a regular, organized routine, your team can focus more on strategy and less on scrambling to meet a deadline.

Maintain Centralized Records of All Filings

Keeping all Rule 13D-G filings and related documents in one central place helps your team stay organized and ready for audits, internal reviews, or regulator questions.

A well-structured archive should include filings, ownership data, correspondence, and any calculations used to support disclosures. When everything lives in one accessible system, it’s easier to trace decisions, confirm past filings, and spot patterns over time.

Centralized records also help new team members get up to speed quickly. Instead of digging through emails or spreadsheets, they can see the full filing history at a glance and understand how ownership positions have evolved. It’s a small habit that saves a lot of time and keeps your compliance process consistent.

Review Compliance Policies After Regulatory Updates

The SEC periodically updates Rule 13D-G, often tightening deadlines or refining definitions of beneficial ownership.

Set aside time each year to review your internal policies and procedures. Look at how new rules or enforcement trends might affect your filing workflows. Small adjustments like updating checklists, training materials, or internal review timelines can make a big difference. It also helps to keep your team in the loop.

Sharing updates during compliance meetings or quick training sessions keeps everyone aware of what’s changed and how it affects their work. Staying current builds confidence that your program reflects the most recent expectations and keeps your reporting consistent over time.

Lessons From SEC Enforcement Actions

SEC enforcement cases offer valuable insight into how regulators view Rule 13D-G compliance in practice. By studying past actions, investors and compliance teams can better understand where mistakes happen and how to avoid them.

Case Examples

These SEC cases show how even well-known investors can run into trouble when filings don’t match their actions.

HG Vora Capital Management: HG Vora filed a Schedule 13G as a passive investor but later started talks with management about influencing the company’s direction. The SEC determined that the firm should have switched to a Schedule 13D and shared its true intent. This case showed that filings must reflect real behavior, and even early conversations about strategy can signal a shift from passive to active.

Elon Musk and Twitter (now X): Elon Musk crossed the 5% mark in Twitter stock but submitted his Schedule 13 after the deadline. The SEC determined that the delay gave him an unfair advantage and left other investors without key information. The case made one thing clear: timely disclosure protects both investors and market integrity.

Across these cases, a few themes stand out. Timeliness, accuracy, and transparency are the foundation of proper beneficial ownership reporting. Many violations happened not because of deliberate misconduct but because of poor coordination, delayed internal communication, or a misunderstanding of when intent shifts from passive to active.

The key takeaway for investors and compliance teams is to build habits that make reporting part of daily operations.

—

Rule 13D-G might look like just another filing rule, but it’s really about transparency and accountability. It gives everyone in the market a clearer view of who holds real influence in public companies and why.

For investors and compliance professionals, staying ahead means keeping ownership data accurate, filings timely, and intent consistent. When your team has the right systems and habits in place, beneficial ownership reporting becomes part of everyday operations instead of a last-minute rush.

How Can InnReg Help?

InnReg is a global regulatory compliance and operations consulting team serving financial services companies since 2013.

We are especially effective at launching and scaling fintechs with innovative compliance strategies and delivering cost-effective managed services, assisted by proprietary regtech solutions.

If you need help with compliance, reach out to our regulatory experts today:

Last updated on Jan 5, 2026