What Is FinCEN Regulation? A Fintech Guide

Jan 15, 2026

·

18 min read

If you’re building or scaling a fintech company in the US, FinCEN regulation is something you can’t afford to ignore. It shapes how financial innovation happens, setting the rules that protect the system from money laundering and other financial crimes.

But FinCEN’s world can feel complicated. Between registration requirements, reporting rules, and the many agencies that overlap with its work, it’s easy to get lost in the details. This guide walks you through what FinCEN is, what it regulates, and how fintechs, from payment startups to crypto platforms, can stay compliant without slowing down growth.

At InnReg, we help fintech companies and MSBs navigate FinCEN requirements with practical, risk-based compliance support. Our team assists with MSB registration, AML program development, KYC and monitoring workflows, and ongoing compliance operations tailored to fast-moving business models. Contact us to learn more.

What Is FinCEN?

The Financial Crimes Enforcement Network (FinCEN) is a bureau of the US Department of the Treasury. Its main job is to protect the financial system from money laundering, terrorist financing, and other illegal activities that move through financial channels.

When people talk about FinCEN regulation, they’re referring to the set of rules and responsibilities FinCEN enforces. These regulations affect banks, money transmitters, broker-dealers, crypto companies, and many other financial institutions.

For fintechs, FinCEN is both a regulator and a resource. It sets expectations around knowing your customers, monitoring transactions, and reporting suspicious activity. At the same time, it recognizes that innovation in finance is changing fast and aims to keep the system safe while supporting responsible growth.

Mission and Authority Explained

FinCEN’s mission is to safeguard the financial system and make it harder for bad actors to move or hide money. It collects and analyzes financial data to spot suspicious activity, shares insights with law enforcement, and helps shape national and global strategies against financial crime.

This body operates under the US Department of the Treasury, giving it the authority to issue regulations, collect reports, and coordinate investigations. It enforces parts of the Bank Secrecy Act (BSA) and works closely with other agencies to fight money laundering and terrorist financing.

Beyond enforcement, FinCEN also plays an educational role. It releases guidance, advisory notices, and best practices to help financial institutions understand their obligations. For fintechs, this information can be especially valuable, as it helps clarify how traditional banking rules apply to newer business models like crypto exchanges or online payment platforms.

How FinCEN Coordinates With Other Regulators

FinCEN doesn’t work alone. It’s part of a larger network of US and international regulators that share a common goal: keeping the financial system clean and transparent.

Within the US, FinCEN works closely with agencies like the Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), and FINRA, especially when financial institutions fall under multiple regulatory frameworks. For example, a broker-dealer or crypto firm might need to meet both SEC rules and FinCEN’s anti-money laundering requirements.

FinCEN also partners with international organizations and foreign regulators to track money that flows across borders. Its work supports global standards set by the Financial Action Task Force (FATF) and helps the US stay aligned with international efforts to combat financial crime.

This level of coordination matters for fintechs that operate across markets. It helps reduce conflicting requirements and gives companies a clearer picture of what compliance looks like in different jurisdictions.

The Role of FinCEN in US Financial Regulation

FinCEN plays a central role in how financial regulation works in the US. Here’s what it actually does in practice:

Sets and enforces anti-money laundering (AML) rules: FinCEN creates the regulations that financial institutions must follow under the BSA. These rules cover areas like Customer Due Diligence (CDD), suspicious activity reporting, and recordkeeping.

Collects and analyzes financial data: FinCEN receives millions of reports each year, including Suspicious Activity Reports (SARs) and Currency Transaction Reports (CTRs). Its analysts use this information to identify trends and patterns that may indicate illegal activity.

Supports law enforcement investigations: The data FinCEN collects is shared with agencies such as the FBI, the IRS, and Homeland Security Investigations. This helps uncover networks of financial crime and supports criminal cases.

Collaborates with other regulators: FinCEN works with agencies like the SEC, CFTC, OCC, and FINRA to align AML expectations across different sectors. This coordination helps financial institutions understand overlapping requirements.

Guides financial institutions and fintechs: FinCEN publishes advisories, guidance, and FAQs to help companies interpret its regulations and apply them to emerging technologies like crypto, digital banking, and online payments.

Represents the US in global financial efforts: FinCEN participates in international partnerships, including the FATF, to strengthen global AML standards and promote cooperation across borders.

For fintechs, understanding these roles is essential to building a compliance framework that supports innovation while keeping the business aligned with regulatory expectations.

Who Falls Under FinCEN Regulation?

FinCEN oversees a wide range of financial businesses in the US, from traditional banks to fast-moving fintech startups. If your company moves money, stores value, or facilitates financial transactions in any form, there’s a good chance you fall under FinCEN’s regulatory scope.

The following categories highlight the main types of institutions and businesses that FinCEN regulates and what their obligations typically look like.

Type of Business | Common Examples in Fintech | Main Compliance Responsibilities |

|---|---|---|

Financial Institutions | Banks, broker-dealers, trust companies | Maintain AML programs, file SARs and CTRs, verify customer identity, and keep detailed transaction records. |

Money Services Businesses (MSBs) | Payment apps, digital wallets, money transmitters | Register with FinCEN, create written AML policies, monitor transactions, and report suspicious activity. |

Crypto Exchanges and Digital Asset Platforms | Virtual asset service providers, crypto trading, or custody platforms | Register as MSBs, apply AML and KYC rules, monitor blockchain transactions, and file SARs and CTRs. |

Bank–Fintech Partnerships | Banks offering embedded or white-label services to fintechs | Share AML oversight with partners, define who performs onboarding and monitoring, and maintain transparent reporting. |

1. Financial Institutions

Traditional financial institutions were the first to come under FinCEN’s supervision, and they remain central to how the agency protects the financial system today. This group includes banks, credit unions, broker-dealers, mutual funds, and trust companies. These organizations handle large volumes of money and customer data daily, making them key players in preventing financial crime.

Under FinCEN regulation, financial institutions must develop and maintain strong anti-money laundering programs that help detect and report suspicious activity. This means they need to verify who their customers are, monitor transactions for unusual behavior, and submit reports when something looks off.

Recordkeeping is another essential part of compliance. Institutions must keep detailed records of their customers and transactions so regulators and law enforcement can access that information if needed. FinCEN encourages a risk-based approach, which means compliance programs should be designed around the institution’s size, services, and risk profile rather than a one-size-fits-all model.

2. Money Services Businesses in Fintech

Many fintech companies fall into a category that FinCEN calls Money Services Businesses (MSBs). This group covers a wide range of non-bank financial companies that move, store, or convert money on behalf of customers. Examples include payment processors, money transmitters, digital wallet providers, and foreign exchange platforms.

Under FinCEN regulation, an MSB must register with FinCEN and follow the anti-money laundering requirements outlined in the BSA. This recordkeeping helps FinCEN track who is operating in the financial space and gives regulators a clear view of the entities that handle funds outside of the traditional banking system.

Once registered, MSBs must create and maintain a written AML program that fits the nature and risks of their business. These steps are not just formalities; they are what keep companies in good standing and help maintain access to banking and payment networks.

See also:

3. Crypto Exchanges and Digital Asset Platforms

FinCEN was one of the first US regulators to recognize that cryptocurrencies and other digital assets could be used in the same ways as traditional money. As a result, many crypto exchanges and digital asset platforms fall under FinCEN’s definition of an MSB. This means they must register with FinCEN and follow the same anti-money laundering rules that apply to other financial companies.

In practice, crypto businesses must identify their users, monitor transactions for suspicious activity, and report any signs of money laundering or terrorist financing. Even though crypto transactions happen on decentralized networks, FinCEN views the exchange or platform operator as the responsible party.

FinCEN has also made it clear that compliance in the crypto world is not optional. It expects platforms dealing in digital assets to apply the same level of diligence as banks and payment companies. This applies whether a business offers crypto-to-fiat exchanges, peer-to-peer transfers, or stablecoin-related services.

For fintechs working with blockchain technology, this presents both a challenge and an opportunity to build trust in a growing market. Transparent compliance practices can help attract partners, maintain banking relationships, and demonstrate legitimacy to both regulators and users.

FinCEN continues to update its guidance as the digital asset space evolves, often working with the SEC, CFTC, and other agencies to define where different types of tokens and transactions fit into existing laws. Staying informed and adaptable is key for any fintech operating in or near the crypto ecosystem.

Need help with money transmitter compliance?

Fill out the form below and our experts will get back to you.

4. Bank-Fintech Partnerships

Bank-fintech partnerships have become one of the most common models in modern financial services. These collaborations allow fintechs to offer products like checking accounts, debit cards, or lending services while using a partner bank’s regulatory infrastructure and licenses. FinCEN plays a key role in how these partnerships operate by setting clear expectations around anti-money laundering compliance and oversight.

In a typical arrangement, the bank remains the regulated financial institution, but both parties share responsibility for meeting FinCEN’s requirements. The bank is expected to maintain a strong AML program that covers all of its activities, including those performed by fintech partners. At the same time, fintechs are expected to understand their compliance obligations and follow the same standards for customer onboarding, transaction monitoring, and reporting.

This shared responsibility means fintechs need clear agreements with their partner banks. These agreements should define who handles customer due diligence, who monitors transactions, and who files required reports like Suspicious Activity Reports. Having this clarity not only helps with regulatory compliance but also builds trust and operational efficiency between partners.

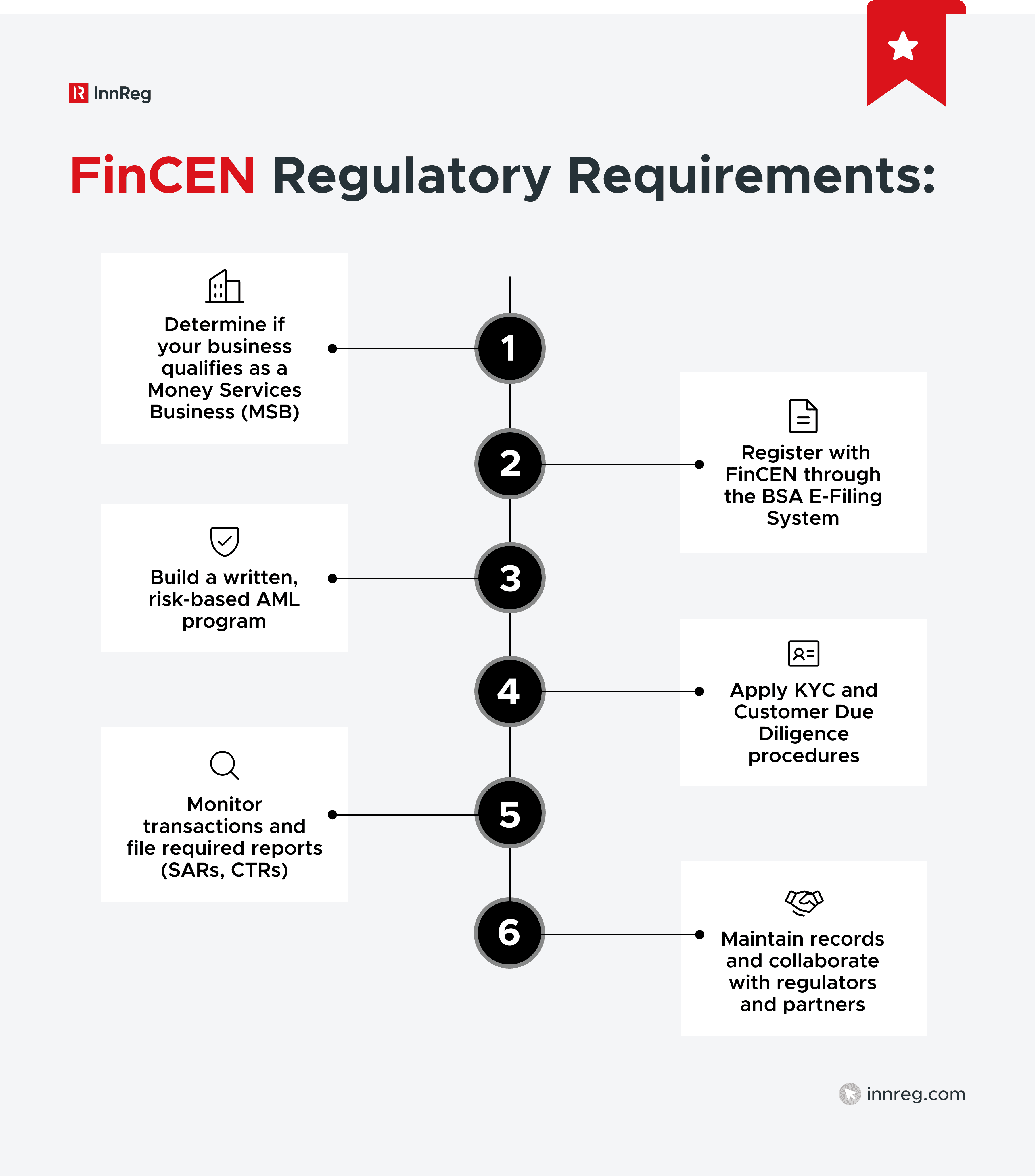

Key FinCEN Regulatory Requirements

The sections below walk through the main FinCEN obligations that apply to financial institutions and fintech businesses, explaining what each one means in practice and how to approach it effectively.

Registering as a Money Services Business

Registration is the first major step toward compliance, and it helps regulators understand who is operating in the financial ecosystem. It must be completed within 180 days of starting business operations, and it applies to all companies that fall within the MSB definition.

The process is done electronically through FinCEN’s BSA E-Filing System, where companies submit identifying details such as their business name, ownership structure, and types of financial activities.

Once registered, the MSB must renew its information every two years or whenever there are significant changes in ownership or operations. Failing to register, or registering incorrectly, can lead to severe penalties and limit access to critical banking relationships.

Registration signals that a company recognizes its responsibilities under the BSA and is committed to maintaining transparency. It also makes it easier to build trust with banks, investors, and regulators, who often view registered MSBs as more credible and lower risk.

Building a Risk-Based AML Program

Once a fintech company registers with FinCEN, the next essential step is developing a strong AML program. This program forms the backbone of compliance and helps the business identify, manage, and report potential financial crime risks. FinCEN requires every covered institution to design its AML program around its specific operations, which is what makes it a risk-based approach.

Creating this program starts with understanding how your business operates and where potential risks may appear. For example, a company offering international money transfers faces different risks than one providing peer-to-peer payment services or digital asset trading. By identifying these differences, you can tailor your controls to the level of risk your business actually faces instead of applying generic policies that may not fit.

A complete AML program typically includes written policies and procedures, a designated compliance officer, regular employee training, and independent testing. The written program should explain how your company verifies customer identities, monitors transactions, and reports suspicious activity. The compliance officer then oversees the program, monitors regulatory developments to maintain its relevance, and serves as the primary liaison with regulators.

Training is another critical piece. Every employee who interacts with customers or financial data should understand what money laundering looks like and how to report concerns. Regular refreshers keep the entire team aware of red flags and evolving risks.

Independent testing, often done by an outside expert like InnReg or an internal audit team, helps confirm that your AML program is working effectively. It can highlight gaps, uncover outdated procedures, and support continuous improvement.

Know Your Customer (KYC) and Customer Due Diligence (CDD) Essentials

Strong KYC and CDD processes are at the heart of any fintech compliance program. These practices help companies confirm who their customers are, understand how they plan to use financial services, and spot any activity that might raise red flags.

KYC starts with collecting and verifying basic information about each customer. This usually includes a full name, date of birth, address, and a government-issued identification document. For business clients, fintechs also gather details about ownership and control to identify who ultimately has authorization for the account or transactions.

CDD goes one step further by assessing the customer’s risk profile. It involves understanding the nature and purpose of the customer’s relationship with your company. For example, a customer who frequently sends funds abroad may present different risks than one who uses a domestic payment app for small transactions. Fintechs use this information to decide how closely to monitor customer activity and when to conduct enhanced due diligence (EDD) for higher-risk cases.

Ongoing monitoring is another vital part of both KYC and CDD. It means keeping an eye on customer behavior and updating information when something changes, such as a new address, ownership change, or a shift in transaction patterns. This helps fintechs stay alert to potential risks as the business grows and customer activity evolves.

Beneficial Ownership Reporting Under the Corporate Transparency Act

The Corporate Transparency Act (CTA) introduced a significant shift in how companies report and share ownership information in the US. Its goal is to make it harder for criminals to hide behind shell companies or complex ownership structures. FinCEN is responsible for collecting and maintaining this information through a secure database that law enforcement and certain regulators can access when investigating financial crime.

Under the CTA, most corporations, limited liability companies, and similar entities created or registered to do business in the US must report their beneficial owners to FinCEN. A beneficial owner is any individual who directly or indirectly owns or controls at least 25% of the company or exercises substantial control over it. This includes founders, executives, or anyone who has significant decision-making authority.

For fintechs, this requirement connects directly to broader compliance efforts under FinCEN’s oversight, especially customer due diligence. When fintechs understand who truly controls the companies they serve, they can better assess risk, detect suspicious activity, and maintain stronger relationships with their banking partners.

See also:

Monitoring Transactions and Filing Suspicious Activity Reports

One of FinCEN’s core requirements for financial institutions and fintech companies is to monitor transactions and report suspicious activity.

Monitoring begins with understanding what “normal” looks like for your customers. Every fintech has its own transaction patterns based on the services it offers. A peer-to-peer payment app might see small, frequent transfers, while a digital asset platform may handle larger, cross-border transactions. By establishing a baseline, fintechs can spot unusual behavior more easily.

When something looks suspicious, companies are required to file a Suspicious Activity Report (SAR) with FinCEN. The report must be submitted within 30 days of detecting the suspicious activity and should include details such as the parties involved, the nature of the transactions, and why the activity raised concerns. These reports are confidential, meaning customers are not notified when one is filed.

To make monitoring effective, fintechs often combine technology with human oversight. Automated transaction monitoring systems can flag potential issues in real time, while compliance teams review alerts and decide whether a SAR should be filed.

Currency Transaction Reports and Thresholds You Should Know

In addition to monitoring and reporting suspicious activity, FinCEN also requires financial institutions and fintechs to file Currency Transaction Reports (CTRs) for certain cash-related activities. These reports help regulators keep track of large movements of cash that might otherwise go unnoticed and are an essential part of maintaining transparency in the financial system.

A CTR must be filed whenever a business conducts a cash transaction of more than $10,000 in a single day, either as a single transaction or through multiple related transactions. This applies to both deposits and withdrawals, as well as currency exchanges. For example, a customer making two separate $6,000 cash deposits on the same day would trigger a CTR filing because the combined total exceeds the threshold.

CTRs include information about the customer, the nature of the transaction, and the total amount involved. The goal is not to accuse anyone of wrongdoing but to create a record that helps FinCEN and law enforcement detect patterns that could indicate money laundering or other illegal activity.

FinCEN also requires institutions to report any attempts to avoid CTR filing, a practice known as “structuring.” Structuring happens when someone intentionally breaks large transactions into smaller ones to stay under the $10,000 limit. Identifying and reporting these behaviors is just as important as filing the CTR itself.

Recordkeeping and Travel Rule Compliance for Traditional and Crypto Transfers

FinCEN’s recordkeeping rules help create transparency in the movement of money across the financial system. A critical part of these rules is the Travel Rule, which requires certain information about transactions to “travel” with the funds as they move between financial institutions.

Under the Travel Rule, financial institutions must collect and share specific details whenever they send or receive a transfer of $3,000 or more. This information includes the name, address, and account number of both the sender and the recipient, as well as the amount and date of the transfer. For most traditional banks and money transmitters, this process is built into existing systems for wire transfers and electronic fund movements.

Recordkeeping extends beyond the Travel Rule as well. Financial institutions must maintain detailed records of customer transactions, account histories, and due diligence documentation. These records must generally be kept for at least five years and be available to FinCEN or other regulators upon request.

Sanctions Compliance and Overlap With OFAC

Sanctions compliance is another key part of FinCEN’s broader approach to financial integrity. While FinCEN focuses mainly on anti-money laundering and transparency, the Office of Foreign Assets Control (OFAC) manages the US sanctions programs that restrict financial dealings with certain individuals, companies, and countries. Together, FinCEN and OFAC form a robust line of defense against the movement of illicit funds through the financial system.

OFAC’s role is to enforce economic and trade sanctions based on US foreign policy and national security goals. This means financial institutions and fintechs must avoid doing business with anyone listed on OFAC’s Specially Designated Nationals (SDN) list or entities owned or controlled by them.

FinCEN and OFAC often overlap in their expectations. Both agencies require strong customer identification, transaction monitoring, and recordkeeping programs. For example, a fintech company screening for money laundering risks under FinCEN rules should also be screening customer names and transactions against OFAC lists. These processes usually happen at the same time during onboarding and throughout ongoing customer monitoring.

Compliance Challenges Fintech Companies Face Under FinCEN

Here are the most common challenges fintechs face under FinCEN’s oversight, along with practical ways to address them.

Determining If Your Business Qualifies as an MSB

Many fintech startups don’t begin by thinking of themselves as financial institutions. They often see themselves as technology providers or payment facilitators. Yet, depending on how money moves through their platforms, FinCEN may classify them as MSBs.

FinCEN looks closely at the flow of funds. If your company receives money from one person and transmits it to another, or if it offers a platform where users can exchange value, it likely falls under MSB regulation. Even companies that never physically handle funds but control how they are transferred through APIs or digital wallets may qualify.

Failing to register when required can result in civil penalties and reputational harm. It can also make it harder to form partnerships with banks and payment processors, who view FinCEN registration as proof of compliance.

Solution: Fintechs should conduct a clear operational review early in their business planning. This means mapping how money flows through the platform, who owns or controls funds at each step, and how value is transmitted. Working with experienced compliance professionals like InnReg can make this process much easier and help clarify whether the business meets FinCEN’s MSB definition. If registration is required, we can also guide you through the filing process and help you build a compliance framework that supports long-term growth.

Designing an AML Program From the Ground Up

The first step in creating an AML program is understanding your business model and spotting potential risks. FinCEN expects every program to be risk-based, meaning it should reflect how your company operates, who your customers are, and how money moves through your platform. For example, a global payment processor faces very different risks than a peer-to-peer lending app.

Next, put your policies and procedures in writing. These outline how you verify customer identities, monitor transactions, file reports, and keep records. Having them written down keeps your team aligned and shows regulators that compliance is built into your operations.

Appointing an AML Compliance Officer is also key. This person manages the AML program, tracks regulatory developments, and promotes awareness of compliance responsibilities across the organization. Finally, plan for regular reviews and independent testing to keep your program current. As your business grows or enters new markets, your risks will evolve, and your AML program should evolve, too.

Solution: Start small but stay organized. Create a clear roadmap that sets your compliance goals, assigns responsibilities, and identifies the tools you’ll need. Regularly review and refine your approach to keep it effective as your company grows.

Overcoming Technology and Data Hurdles

A common issue fintechs face is data fragmentation. Customer and transaction data often live in separate systems like payment processors, onboarding tools, or accounting software. When data isn’t connected, detecting unusual activity or keeping accurate records becomes more challenging. Bringing this information together in one place gives a clearer view of your company’s risk landscape.

Scalability is another concern. As a fintech grows, manual compliance processes that worked early on may not keep up. Automating key tasks such as identity checks, transaction monitoring, and reporting allows compliance teams to focus on analysis and decision-making.

Data privacy also plays a significant role. Fintechs must meet regulatory requirements for collecting and storing information while respecting privacy laws such as the Gramm-Leach-Bliley Act and, in some cases, the General Data Protection Regulation (GDPR). Systems that protect sensitive data while supporting regulatory needs help maintain customer trust.

Finally, collaboration between compliance and technology teams is essential. When compliance officers, engineers, and product managers work together, they can build controls directly into systems and workflows. This reduces errors and helps make compliance a natural part of company operations.

Solution: Treat compliance technology as part of your core infrastructure, not a separate add-on. Use tools that scale with your business and give your compliance team reliable, real-time data. Strong collaboration and well-designed systems will keep your processes efficient as your company grows.

Navigating Multi-Jurisdictional and State-Level Requirements

One of the biggest challenges for fintechs under FinCEN regulation is managing compliance across multiple jurisdictions. While FinCEN sets federal standards, state regulators also play a major role. A company operating in several states or offering cross-border services must follow a mix of federal, state, and sometimes international rules.

At the federal level, FinCEN enforces the BSA, which forms the foundation for anti-money laundering compliance. States, however, often add their own licensing and reporting rules, especially for money transmitters and lenders. For example, a fintech offering digital wallets or remittance services may need separate licenses in each state where it operates.

Fintechs that operate internationally face another layer of complexity. Serving users outside the United States may bring them under rules from organizations like the FATF or regulators such as the FCA in the United Kingdom or FINTRAC in Canada. These often align with FinCEN’s expectations but differ in the details of reporting and verification processes across jurisdictions, reducing confusion for compliance teams.

Solution: Create a clear compliance map that lists all regulatory obligations by location, including registration needs, reporting timelines, and regulator contacts. A structured, proactive approach helps your company expand confidently while keeping compliance under control.

Balancing User Experience With Regulatory Demands

Fintechs thrive when they make finance simple and fast, but they also work in one of the most regulated industries. Meeting FinCEN rules while keeping the user experience smooth can be challenging, but smart design makes it possible.

A big pressure point is onboarding. KYC and CDD requirements mean fintechs must collect and verify user details before offering services. This helps prevent fraud and money laundering, but can slow sign-ups. Integrating identity checks directly into the app keeps the process quick and user-friendly.

Transaction monitoring can also create friction. Automated tools sometimes flag normal activity as suspicious. To solve this, fine-tune rules, use analytics to understand behavior, and communicate clearly when extra checks happen.

Solution: Design compliance with the user in mind. Test onboarding flows, track where people drop off, and keep improving. When compliance feels easy, users stay longer, and your business stays protected under FinCEN rules.

Enforcement and Penalties Under FinCEN Regulation

FinCEN takes compliance seriously, and its enforcement actions show that failure to follow the rules can have real consequences. When fintechs neglect their regulatory duties, the result can be costly fines, damaged reputations, and even criminal liability for individuals involved.

Civil Monetary Penalties for Non-Compliance

FinCEN can issue civil monetary penalties when companies fall short of their compliance duties. These penalties encourage accountability and help keep the financial system fair. For fintechs, understanding how and why penalties happen is key to avoiding them.

Violations can include failing to register as an MSB, not maintaining a proper AML program, or missing required filings like SARs and CTRs. Even small gaps in recordkeeping or monitoring can lead to serious issues.

The size of a penalty depends on how severe and long-lasting the violation is. Some fines can reach hundreds of thousands of dollars, especially when multiple violations occur. FinCEN also looks at whether a company cooperated with regulators and took steps to fix the problem.

The impact goes beyond money. Penalties can harm a fintech’s reputation, strain banking relationships, and make it harder to get licensed or attract investors. Repeated problems may also draw attention from other regulators such as the SEC, CFPB, or state agencies.

See also:

Criminal Liability and High-Profile Cases

While many FinCEN cases result in civil penalties, some can lead to criminal charges. This happens when a company or individual willfully ignores the rules or helps conceal illegal transactions. Criminal penalties are far more serious and can include prosecution, prison time, and lasting damage to a company’s reputation.

FinCEN often works with the DOJ and other law enforcement agencies to investigate criminal cases. These usually involve deliberate actions, like falsifying customer data, failing to file reports, or helping move funds tied to illegal activity. In such cases, both companies and individuals can face liability.

Criminal penalties can mean hefty fines and up to five years in prison. If other crimes like fraud or conspiracy are involved, the punishment can be even harsher. The reputational fallout is often just as damaging, affecting partnerships and customer trust.

Reputational and Business Consequences

For fintechs, reputation drives everything from customer trust to regulatory relationships. Customers expect their money and data to be safe. A publicized compliance issue can quickly damage that trust and send users to competitors. Negative news and social media can further complicate recovery.

Banking and payment partners are just as cautious. Many fintechs rely on these relationships to move money and hold funds. If a partner bank thinks a fintech is falling short of FinCEN expectations, it might pause or end the relationship to protect itself, disrupting operations and growth.

Investors also pay attention. Enforcement actions raise questions about leadership and long-term stability. Even minor penalties can hurt valuation and make fundraising more difficult. Finally, non-compliance drains internal resources. Time spent fixing issues, managing audits, or rebuilding trust takes away from product and customer focus.

—

FinCEN rules can seem complex at first, but understanding them is essential for any fintech operating in the United States. These regulations protect the financial system, promote transparency, and support responsible innovation.

For fintechs, compliance is more than following the law. It’s about building trust with customers, partners, and regulators. Companies that understand and meet FinCEN requirements often grow faster, form stronger partnerships, and handle regulatory challenges with confidence.

How Can InnReg Help?

InnReg is a global regulatory compliance and operations consulting team serving financial services companies since 2013.

We are especially effective at launching and scaling fintechs with innovative compliance strategies and delivering cost-effective managed services, assisted by proprietary regtech solutions.

If you need help with money transmitter compliance, reach out to our regulatory experts today:

Last updated on Jan 15, 2026

Related Articles

Feb 25, 2026

·

22 min read

Feb 19, 2026

·

12 min read