SEC Rule 204-2: What Fintech Advisors Need to Know

Dec 29, 2025

·

8 min read

SEC Rule 204-2 is one of the most foundational regulations for registered investment advisors. It governs what books and records must be kept, how long they must be retained, and how they must be stored.

For fintech companies operating as RIAs or in adjacent spaces, this rule directly impacts their day-to-day operations and long-term compliance strategy.

This article breaks down what SEC Rule 204-2 requires, how it applies to fintech platforms, and where firms typically run into trouble. We will cover regulatory expectations, retention periods, digital recordkeeping standards, recent enforcement trends, and common misconceptions.

At InnReg, we help RIAs interpret and implement the recordkeeping requirements of SEC Rule 204-2 through practical documentation workflows, supervisory processes, and ongoing operational support. Contact us to learn more about InnReg’s RIA compliance services.

What Is SEC Rule 204-2 and Who Does It Apply To

SEC Rule 204-2 outlines the recordkeeping obligations for SEC-registered investment advisors. It is part of the Investment Advisers Act of 1940 and applies to any firm registered with the SEC as an investment advisor, regardless of size or structure.

That includes traditional RIAs, but also fintech companies offering digital investment services, robo-advisors, or hybrid models that combine securities with other assets. If a business provides investment advice for compensation and falls under SEC jurisdiction, it is subject to Rule 204-2, even if its model is entirely app-based or uses automated algorithms.

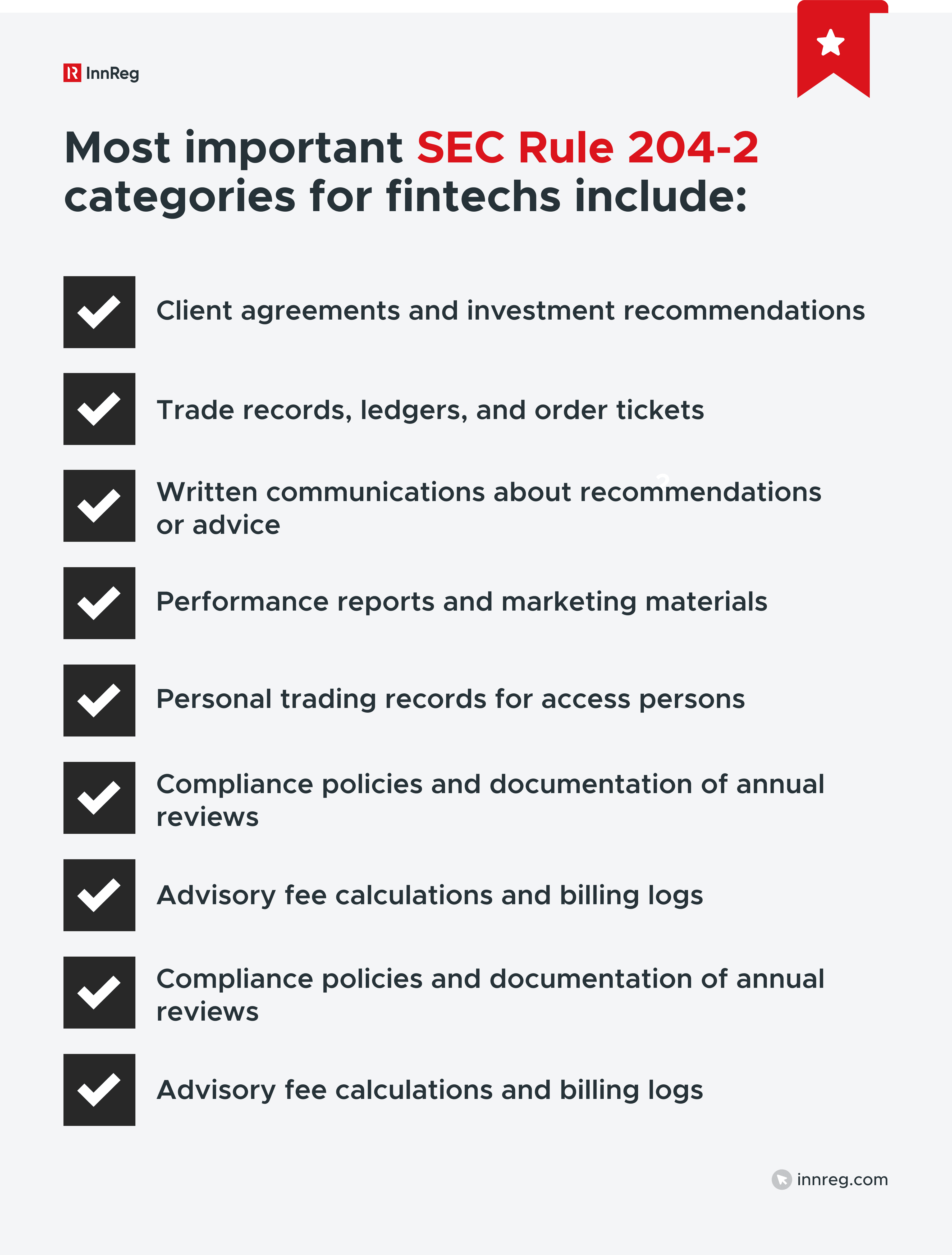

The rule requires advisors to create and retain specific categories of records tied to their business activities. This includes

Communications

Transactions

Agreements

Marketing materials

Compliance documents

Importantly, it also defines how long those records must be kept and how quickly they must be accessible in the event of an exam or inquiry.

For fintechs, the scope of this rule often extends beyond expected areas like trade confirmations or client contracts. Records of social media content, in-app messages, internal chats about investment strategies, and even product update notes may fall under its scope.

Core Recordkeeping Requirements Under SEC Rule 204-2

SEC Rule 204-2 specifies what investment advisors must record and retain, and for how long. These requirements apply regardless of a firm’s size, business model, or tech stack.

Required Books and Records

SEC Rule 204-2 requires advisors to retain a wide range of documents that reflect how they operate, communicate, and make decisions. These are not limited to formal contracts or trade confirmations. Day-to-day operational records count, too.

Anything that reflects how advice is delivered, fees are calculated, or compliance is maintained may fall under recordkeeping. Even screenshots of social media posts or backend logs of algorithm changes can be considered records depending on the context.

Many fintech platforms do not fit neatly into traditional document categories. That makes interpretation more nuanced.

If your model combines advisory and transactional functions, or uses APIs to drive client engagement, you will need to map technical artifacts (like data logs or chatbot interactions) back to regulatory categories.

InnReg helps fintechs implement SEC Rule 204-2 into their daily operations. Contact us to learn more.

Retention Periods and Storage Expectations

Under SEC Rule 204-2, most records must be kept for five years in an easily accessible location, with the first two years in an appropriate office of the investment adviser. This is not just about archiving: it is about being able to produce key documents quickly during an exam or regulatory inquiry.

SEC Rule 204-2 Record Retention Timelines: | |

|---|---|

Record Type | Minimum Retention Period |

General books and records | 5 years, easily accessible |

Corporate documents (e.g., articles) | Lifetime of the firm + 3 years post-close |

Code of ethics reports | 5 years from creation |

Communications with regulators | 5 years from the date sent/received |

Records related to performance claims | 5 years from last use |

Accessibility is just as important as retention. Advisors must be able to retrieve records promptly, not just “store them somewhere.” That applies whether you’re using a cloud platform, a local server, or a third-party archiving vendor.

This is where fintech firms often run into operational friction. Startups may lack centralized storage systems or rely on tools that were not built with compliance in mind. Shared drives, disorganized email chains, or uncaptured Slack messages become liabilities.

Format, Access, and Location Rules

SEC Rule 204-2 gives advisors flexibility on format, but not on control or accessibility. Records can be kept on paper or electronically, as long as they are legible, complete, and reproducible.

Advisors must be able to deliver records promptly in a form the SEC can review. That means files should be indexed, timestamped, and stored in a system that prevents tampering.

The first two years of records must be kept in an “appropriate office,” meaning either onsite or readily retrievable from a designated system. For many fintechs, this means cloud-based archives or outsourced compliance platforms.

To help fintechs with their compliance obligations, InnReg provides compliance services, including outsourced Chief Compliance Officers →

Some firms mistakenly assume that basic backups or Google Drive folders are sufficient. They are not. Regulators expect organized, immutable records, not a scavenger hunt through shared drives.

How SEC Rule 204-2 Applies to Fintech RIAs

While SEC Rule 204-2 applies to all registered investment advisors, fintech RIAs face added complexity due to digital delivery models, automated workflows, and product architecture that crosses traditional regulatory lines:

Robo-Advisors, Digital Platforms, and Hybrid Models

Fintech RIAs often deliver advice through automated engines, APIs, or digital experiences rather than one-on-one interactions. That creates recordkeeping obligations that look different from traditional advisory setups.

For example:

If your platform dynamically generates investment recommendations, you must retain the inputs, logic, and outputs of that process, even if no human advisor was involved.

Chat-based onboarding flows or in-app financial guidance may count as written communications subject to Rule 204-2.

Algorithm updates, A/B-tested disclosures, and product-level changes tied to user experience can also become part of the compliance record if they affect how advice is delivered.

Hybrid models (those combining brokerage, advisory, and possibly crypto or payments functionality) carry even more overlap. These firms may be subject to multiple books-and-records rules, including SEC Rule 17a-4 (for broker-dealers) or state-specific retention requirements.

What matters is not just the content, but the intent. If a feature guides investment behavior or supports a regulated activity, its data trail may fall under Rule 204-2, even if it is not labeled that way internally.

See also:

Overlap with Broker-Dealer and FINRA Requirements

Many fintech firms operate across multiple regulatory frameworks. If a business is dual-registered as an RIA and a broker-dealer, or relies on a broker-dealer affiliate for execution, it is likely subject to both SEC Rule 204-2 and SEC Rule 17a-4.

Rule | Applies To | Focus |

|---|---|---|

SEC Rule 204-2 | Registered Investment Advisors | Books and records tied to advisory services |

SEC Rule 17a-4 | Broker-Dealers | Broker-dealer records and communications |

FINRA Rule 4511 | FINRA Members | Reinforces SEC record retention and format |

FINRA rules often mirror SEC requirements but go further on format. Broker-dealer records must be stored in a non-rewritable, non-erasable format (WORM) or an approved alternative with tamper-evident features and an audit trail.

Fintech firms frequently run into issues here. A shared data environment between RIA and broker-dealer operations does not mean the records are compliant under both regimes. Each entity must meet its own retention and access standards, even if teams or tools overlap.

Learn more about SEC Rule 17a-4 →

Need help with RIA compliance?

Fill out the form below and our experts will get back to you.

State vs. SEC Jurisdiction Considerations

RIAs with under $100 million in AUM are typically registered at the state level, unless a federal exemption applies. While most states follow the structure of SEC Rule 204-2, recordkeeping rules can differ in retention periods, definitions, and enforcement expectations.

Some states require six or more years of retention. Others may define advertising or client communications more narrowly, or more broadly, than the SEC. Compliance teams that overlook these distinctions risk misalignment, especially when operating across multiple states.

For fintech RIAs, the challenge is operational. A system built for SEC requirements may not cover state-specific obligations out of the box. Mapping records to both regimes often requires tailored workflows and policy nuance.

Common Compliance Challenges with SEC Rule 204-2

Fast-growing fintech firms often run into problems with SEC Rule 204-2 because compliance infrastructure lags behind product development.

Below are four common failure points firms should monitor closely:

Messaging Apps, Emails, and Communication Gaps: Business conversations happening over text, Slack, or WhatsApp often go uncaptured. If those messages include investment guidance or client interactions, they fall under SEC recordkeeping requirements.

Disorganized or Incomplete Archives: Having the right records is not enough. If files are scattered across inboxes, folders, or team silos, retrieval during an exam becomes a liability, especially if you can not track who stored what, where, and when.

Rapid Scaling and Recordkeeping Gaps: As user volume and internal systems grow, firms often expand without updating compliance workflows. New product features, client channels, or integrations may not be covered under existing policies.

Underestimating Third-Party Vendor Risk: Many fintech platforms rely on cloud vendors or CRM tools to handle client data. If those vendors do not provide compliant storage or access logs, you are still accountable for the missing records.

InnReg works with RIAs to help them tackle these challenges. Learn more about the services we provide to registered investment advisors →

Recent Enforcement Trends Related to SEC Rule 204-2

The SEC has made recordkeeping violations a major enforcement priority. Since 2022, dozens of firms, including RIAs, broker-dealers, and dual registrants, have been fined for failing to capture off-channel communications like texts and WhatsApp messages.

These cases typically involve business-related messages sent on personal devices, outside firm-approved systems. In some instances, firms had policies in place but failed to enforce them. In others, the firms didn’t monitor messaging behavior at all.

Notably, the SEC has not limited these actions to large institutions. Fines have reached hundreds of millions of dollars, and recent cases show that mid-sized RIAs and fintechs are also under scrutiny.

The message is clear: if a firm is discussing client business, investment advice, or operational decisions, it must be captured and archived. That includes informal channels, hybrid tools, and internal messaging systems.

What Fintechs Should Prioritize

For fintech companies subject to SEC Rule 204-2, compliance is an operational discipline that must evolve with the business. As platforms grow more complex, so do their recordkeeping obligations.

The focus areas fintech teams should actively manage include:

Internal Policies, Training, and Technology: Compliance policies should clearly define what constitutes a “record” across all communication channels and workflows, including apps, chat tools, and algorithm-driven content. Teams also need regular training on what must be retained and where. Technology should support this process by automating capture, archiving, and auditability within daily tools.

Building a Scalable Recordkeeping Framework: Early-stage setups often rely on ad hoc storage: shared drives, scattered email folders, or vendor-controlled logs. That breaks down quickly. As the product scales, firms should shift to a structured system that tags and indexes records by type, ties them to regulatory categories, and allows fast retrieval. This framework should support both daily compliance tasks and long-term audit readiness.

Knowing When and Why to Outsource Recordkeeping Compliance: Managing books and records internally can strain bandwidth, especially at growth-stage companies with lean teams. Outsourcing can be a cost-effective way to bring in expertise, offload complexity, and apply a proven compliance process without building everything from scratch. It’s particularly useful for firms operating in hybrid or cross-jurisdictional models where regulatory overlap adds extra risk.

InnReg supports growing fintechs by providing outsourced compliance. Contact us to learn how we can help you.

—

SEC Rule 204-2 is a living part of a fintech firm’s regulatory posture. As product lines evolve and communication channels expand, recordkeeping must keep up. That means documenting not only what is required today, but also building systems that can adapt to future scrutiny.

Firms that treat Rule 204-2 as core infrastructure are better positioned for audits, growth, and long-term trust.

Whether you manage compliance in-house or outsource support, the priority is the same: keep accurate, accessible, and defensible records of what you do and how you do it.

How Can InnReg Help?

InnReg is a global regulatory compliance and operations consulting team serving financial services companies since 2013.

We are especially effective at launching and scaling fintechs with innovative compliance strategies and delivering cost-effective managed services, assisted by proprietary regtech solutions.

If you need help with RIA compliance, reach out to our regulatory experts today:

Last updated on Dec 29, 2025