What Is Fintech Lending? A Complete Guide for Lenders

Jan 18, 2026

·

20 min read

Contents

Fintech lending is changing the way people and businesses borrow money. Instead of relying only on traditional banks, technology-driven lenders are offering faster applications, new ways to assess credit, and flexible loan options. For fintech founders, lawyers, and compliance officers, this space brings both exciting opportunities and serious regulatory responsibilities.

In this guide, we’ll break down what fintech lending actually means, how it works step by step, and the main models you’ll see in the market. We’ll also look at the benefits for borrowers and lenders, and outline the rules and regulators that matter most.

At InnReg, we help fintech lenders design and operate lending programs within complex US and global regulatory frameworks. Our team supports licensing, bank partnership structures, product design reviews, and end-to-end compliance across TILA, ECOA, UDAAP, state usury laws, and AML.

What Is Fintech Lending?

Fintech lending refers to the use of digital platforms and technology to provide credit outside of traditional banking channels. Instead of walking into a branch and filling out paperwork, borrowers apply online or through an app, and lenders use data-driven tools to review and fund loans.

At its core, fintech lending is still about connecting people who need capital with those who can provide it. What sets it apart is how the process works. With automated onboarding, smarter credit scoring, and faster decisions, fintech lenders can reach more types of borrowers and create space for new, innovative business models.

How Does Fintech Lending Work?

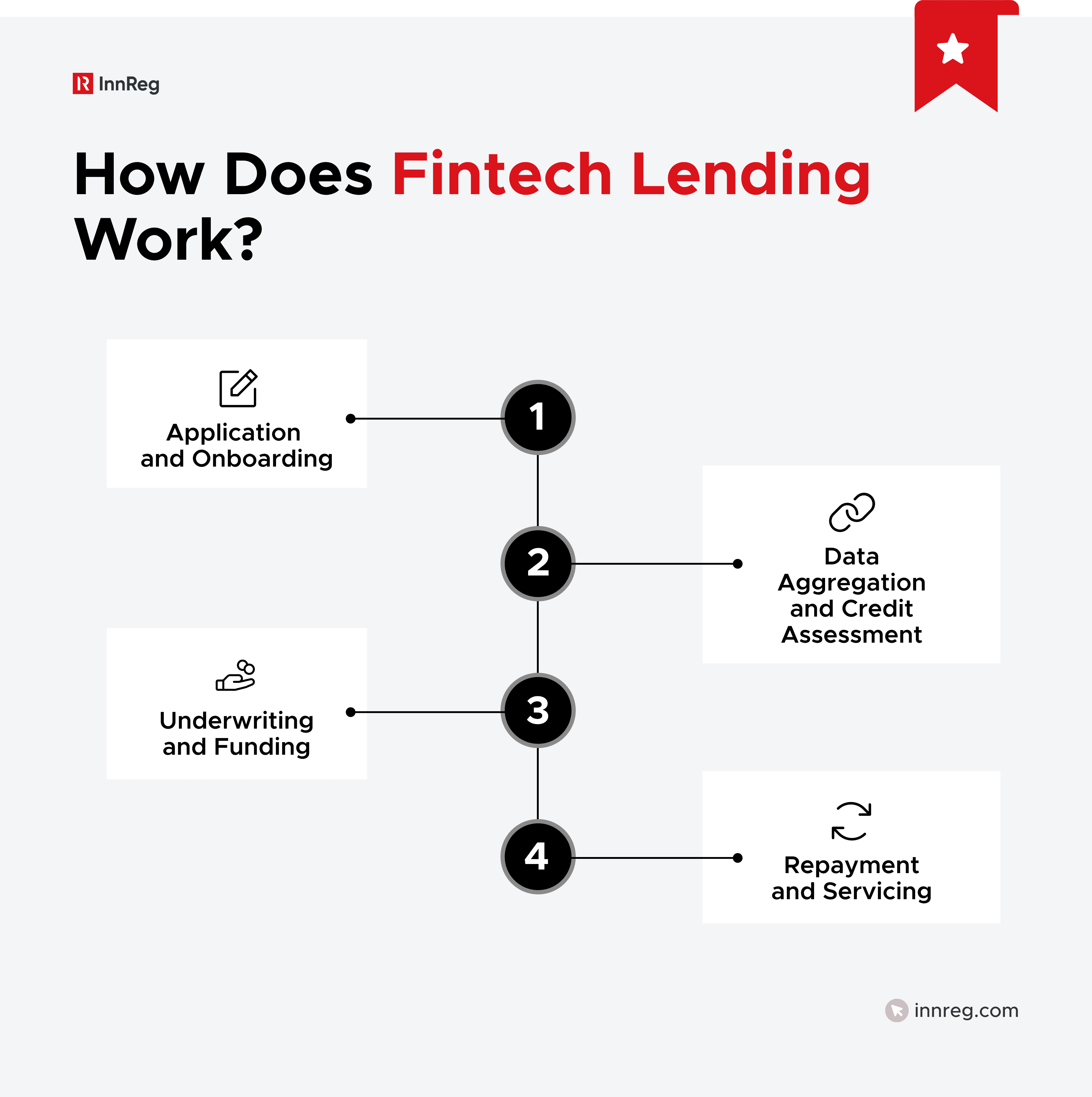

Fintech lending follows a clear process that mirrors traditional lending but relies on digital tools at every stage.

1. Application and Onboarding

The first step in fintech lending is the borrower’s application. Instead of paper forms, the process happens online or through a mobile app. Borrowers typically provide basic personal details, financial information, and the purpose of the loan. In most instances, platforms keep the initial application short to reduce friction, then collect more details once interest is confirmed.

Onboarding also includes verifying identity, checking for fraud, and meeting regulatory requirements such as Know Your Customer (KYC) and Anti-Money Laundering (AML) rules. Some lenders integrate document upload features, while others connect directly with third-party verification services.

For fintech operators, this stage sets the tone. A smooth application builds trust, while strong onboarding controls protect the platform from compliance risks.

2. Data Aggregation and Credit Assessment

Once the application is submitted, the platform gathers data to evaluate the borrower’s ability to repay.

Traditional lenders often rely heavily on credit bureau scores, but fintech lenders usually look beyond that. They pull in bank transaction data, payroll information, utility payment history, and in some cases, even alternative data such as cash flow from digital wallets. This broader set of inputs allows fintech lenders to build a more complete picture of a borrower.

The assessment process is typically automated, with algorithms reviewing large volumes of data quickly. Still, every lender must apply sound risk models and stay aligned with consumer protection laws.

3. Underwriting and Funding

After data is collected and analyzed, the next step is underwriting. In fintech lending, underwriting often blends automated decision-making with human review. Algorithms help flag risks, determine loan amounts, and suggest interest rates. For higher-value or more complex loans, compliance teams or credit specialists may step in to review the decision before final approval.

Funding follows once the loan is approved. Unlike traditional lenders, which may take days to release funds, fintech platforms can often transfer money within hours or the next business day.

This speed is a major advantage for borrowers but also requires lenders to maintain strong operational controls. That includes keeping documentation in order, following disclosure rules under the Truth in Lending Act (TILA), and communicating clearly with borrowers every step of the way.

4. Repayment and Servicing

Once the loan is funded, the focus shifts to repayment and ongoing account management. Fintech lenders typically offer digital repayment options like ACH transfers, debit card payments, or links to digital wallets. Many also let borrowers set up automatic payments, making it easier to stay on schedule and avoid missed deadlines.

But servicing a loan is about more than just collecting payments. It also means sending helpful reminders, providing clear statements, and offering support when borrowers have questions or run into financial challenges. Many lenders now use online dashboards or mobile apps so borrowers can track balances, upcoming payments, and interest charges all in one place.

Types of Fintech Lending Models

Fintech lending takes several forms, each with unique structures and compliance considerations. The most common models include peer-to-peer, marketplace, balance sheet, and embedded lending, such as buy now, pay later.

See also:

Peer-to-Peer (P2P) Lending

Peer-to-peer lending, often called P2P, is one of the earliest fintech lending models. It works by connecting people who want to borrow money with individuals who are willing to invest. Borrowers post their loan requests on a platform, and investors can decide which ones to fund. In return, investors earn interest as borrowers make repayments.

For borrowers, P2P lending can be attractive because the process is often faster and more flexible than going through a traditional bank. For investors, it offers a way to diversify portfolios and potentially access higher returns, though it also comes with more risk.

The platform sits in the middle, handling credit checks, loan servicing, and repayment tracking. This makes it easier for both sides to participate, but it also places responsibility on the operator. Securities laws may apply to investor notes, and regulators like the SEC can become involved. On top of that, consumer protection rules, state licensing requirements, and data security standards need to be managed carefully.

Need help with lender compliance?

Fill out the form below and our experts will get back to you.

Marketplace Lending

Marketplace lending is similar to peer-to-peer lending but with one key difference: most of the funding comes from institutions rather than individual investors. Instead of dozens of small lenders backing a loan, banks, hedge funds, and other financial firms provide the capital through the platform.

This model gives borrowers access to larger loan amounts and often more competitive rates. For institutional investors, it creates an efficient way to deploy capital into consumer or business loans without having to build their own lending infrastructure. The platform handles borrower acquisition, credit evaluation, servicing, and compliance tasks.

From a regulatory standpoint, marketplace lenders face many of the same considerations as P2P platforms. They must navigate state lending licenses, consumer protection laws, and data privacy requirements. In some cases, securities regulations also come into play. The difference is that the larger scale and institutional involvement can draw more attention from regulators, making clear policies and procedures even more important.

Balance Sheet Lending

In balance sheet lending, the fintech company uses its own capital to fund loans and keeps those loans on its books. Unlike peer-to-peer or marketplace models, there are no outside investors providing the money directly. The lender takes on both the risk and the reward.

This model gives the company more control. Decisions about credit policies, pricing, and repayment terms are entirely in the hands of the platform. It also means the lender earns the full return on each loan, but also carries the full risk if borrowers fail to repay. For this reason, balance sheet lenders often place strong emphasis on credit assessment and portfolio management.

Running this model requires a larger capital base and careful attention to regulations. Consumer lending laws, state licensing requirements, and reporting obligations all apply. Since the loans stay on the company’s balance sheet, financial reporting standards and risk management expectations can also be more demanding.

Embedded Lending and Buy Now, Pay Later (BNPL)

Embedded lending weaves credit directly into the customer experience. Instead of sending someone to a separate lender, the loan is offered at the point of need. A common example is buy now, pay later, where shoppers split purchases into installments right at checkout.

For borrowers, this approach feels quick and effortless, making it easier to access credit right when they need it. For merchants, it can drive more sales by giving customers flexible ways to pay. Behind the scenes, fintech lenders work with their bank partners to provide the credit and handle the servicing that keeps everything running smoothly.

However, buy now, pay later and other embedded lending models are drawing close attention from regulators. Rules around consumer protection, fair lending, and data privacy all apply, and questions about disclosures, fees, and borrower affordability are top priorities for agencies like the CFPB. Platforms must also stay on top of licensing requirements, especially when offering loans in multiple states.

Fintech Lending vs. Traditional Lending: Key Differences

Fintech lending takes the familiar idea of borrowing and reshapes it with digital tools. The result is a process that feels faster, more flexible, and often more accessible than a visit to a traditional bank. At the same time, these differences bring new questions about costs, risks, and regulation that every lender should consider.

Key Difference | Fintech Lending | Traditional Lending |

|---|---|---|

Speed and Convenience | Applications are completed online in minutes, with faster approvals and digital servicing. | Paper-heavy processes, branch visits, and longer approval times (days or weeks). |

Data and Underwriting | Uses alternative data like cash flow, payroll, and utility payments alongside credit scores. | Relies mainly on credit bureau scores, tax returns, and financial statements. |

Accessibility and Inclusion | Opens credit to underserved borrowers, thin-file consumers, and small businesses. | Limited flexibility often excludes those without established credit or collateral. |

Costs and Pricing | Lower overhead, transparent fee structures, and flexible pricing models. | Higher operating costs, fees can be less transparent, and pricing can be more rigid. |

Regulatory Environment | A patchwork of state licenses, federal consumer protection laws, and bank partnerships. | Governed by established federal charters, deposit insurance, and direct oversight. |

Speed and Convenience

Fintech lending platforms are built to reduce the time and effort it takes to access credit. Borrowers can complete applications online within minutes, often with pre-filled data from connected accounts. Automated systems then process the information, cutting down the wait for an approval decision from days or weeks to sometimes hours.

Convenience also extends beyond the application. Borrowers can upload supporting documents, verify income, and even sign agreements electronically. Customer support is often available through chat or in-app messaging, which removes the need to schedule bank visits or navigate long phone queues. The entire process feels more user-friendly compared to traditional lending, where multiple branch visits and physical paperwork are common.

For lenders and compliance teams, this speed must be carefully balanced with regulatory expectations. Fast processing still requires strong controls for identity verification, anti-money laundering checks, and proper disclosures.

Data and Underwriting Differences

Traditional lenders have long based their decisions on credit bureau scores, tax returns, and financial statements. Fintech lenders take it a step further by using alternative data like bank transactions, payroll records, utility payments, and even real-time cash flow.

For consumers with thin credit files or younger borrowers just starting out, this approach can open the door to financing opportunities that a bank might decline. For small businesses, real-time revenue data can provide a more accurate snapshot of financial health than outdated reports. This use of broader data sets allows lenders to create risk models that are more responsive to today’s digital economy.

When it comes to fintech founders and lenders, the opportunity lies in combining innovative data-driven underwriting with clear and transparent practices. This not only builds trust with borrowers but also positions the business to grow within regulatory expectations.

Accessibility and Inclusion

One of the strongest appeals of fintech lending is its ability to reach people who are often underserved by traditional banks. Many borrowers struggle with limited credit history, lack of collateral, or difficulty meeting a bank’s strict requirements. Digital lenders can fill that gap by using flexible models to assess risk.

For consumers, this can mean access to credit that supports everyday needs, education, or unexpected expenses. For small businesses, it can open funding options to grow operations, hire staff, or invest in new technology. By lowering barriers, fintech lending helps bring more people into the financial system.

Accessibility, however, comes with responsibility. Offering credit to underserved groups requires clear communication, fair lending practices, and strong compliance oversight. Regulators pay close attention to whether products are marketed transparently and whether repayment terms are sustainable for the borrower.

Costs and Pricing

Digital platforms typically operate with fewer overhead expenses since they do not maintain large branch networks or legacy systems. This allows them to price loans differently, sometimes offering competitive rates or more flexible fee structures.

For borrowers, the appeal often lies in transparency. Many fintech platforms display interest rates, fees, and repayment schedules upfront, which helps people compare options more easily. Some products may carry higher rates to reflect risk, especially for borrowers with limited credit history, but the ability to see terms clearly can make decision-making simpler.

Even with these advantages, pricing must be managed carefully. State usury laws, federal consumer protection rules, and fair lending standards all influence how loans can be structured.

Regulatory Environment

Banks operate under well-established frameworks with federal charters, deposit insurance, and clear oversight from regulators like the OCC, FDIC, and Federal Reserve. Fintech lenders, on the other hand, often piece together state licenses, bank partnerships, and federal compliance requirements to operate legally.

This patchwork can be complex. A fintech lender offering loans in multiple states may need to navigate different licensing rules, interest rate limits, and disclosure requirements. Consumer protection laws also apply no matter the platform. In addition, regulators like the CFPB and FTC closely monitor marketing practices, servicing standards, and borrower treatment.

For operators, the challenge is not just meeting today’s requirements but also staying ahead of regulatory expectations as the industry evolves.

Benefits of Fintech Lending

Fintech lending creates value for both borrowers and those providing capital. The benefits differ, but each side gains from the use of technology and innovative models.

For Borrowers

Fintech lending reshapes the borrowing experience by making access to credit quicker and more approachable. For someone facing an urgent expense or a business needing short-term funding, this speed can make a meaningful difference.

Another advantage is expanded access. Traditional lenders often rely heavily on credit scores and collateral, leaving many people without options. Fintech lenders widen the lens by looking at alternative data. This approach gives students, freelancers, and small business owners a better chance at qualifying for credit.

Transparency also matters. Many fintech platforms present repayment terms, interest rates, and fees upfront in a clear format. Borrowers can compare offers easily and understand what repayment will look like before they commit. Features like online dashboards or mobile apps add another layer of convenience, letting borrowers track balances, make payments, and receive reminders in real time.

For borrowers, the combination of speed, accessibility, and clarity creates a practical alternative to traditional banking. While the products vary, the common thread is a borrowing process designed to fit into modern financial lives.

See also:

For Lenders and Investors

Fintech lending opens new opportunities for those providing capital. Traditional banks often focus on established customer bases, but fintech platforms can reach markets that were previously underserved. This creates a wider pool of borrowers and, in turn, more ways for lenders and investors to diversify their portfolios.

Technology also improves efficiency. Automated underwriting, digital servicing, and real-time data reduce the cost of originating and managing loans. Instead of manual reviews and paper-heavy processes, lenders can rely on systems that speed up decision-making and provide clearer insights into portfolio performance.

For investors, fintech lending offers an asset class that sits between traditional bonds and equities. Consumer and business loans can provide steady returns, especially when platforms offer options to spread investments across multiple borrowers. Institutional investors, from hedge funds to pension plans, have taken a strong interest in marketplace and balance sheet lending models for this reason.

These benefits come with the need for solid compliance structures. Lenders must meet state licensing rules, federal consumer protection laws, and, in some cases, securities regulations. Platforms that integrate compliance into their operations gain more credibility with both investors and regulators.

Key Regulatory Considerations in Fintech Lending

Fintech lending operates within a complex web of federal, state, and industry rules. These laws shape how loans are issued, marketed, and serviced, making compliance a central part of every model.

Federal Laws

Fintech lenders operate in a space where consumer protection is front and center. A handful of federal laws set the tone for how lending should be offered, explained, and managed. Understanding these laws is key not just for compliance, but for building trust with borrowers.

Truth in Lending Act (TILA): TILA makes sure borrowers know the true cost of their loan. Lenders must clearly disclose the annual percentage rate (APR), repayment schedule, fees, and total amount owed. The goal is to prevent surprises and give borrowers a fair chance to compare different credit products.

Equal Credit Opportunity Act (ECOA): ECOA verifies that lending decisions are based on financial criteria, not personal traits. A borrower cannot be denied credit because of race, gender, religion, national origin, marital status, or age. If an application is denied, the lender must provide a clear explanation of why.

Fair Credit Reporting Act (FCRA): This law governs how consumer credit information is collected and shared. Borrowers have the right to know what information was used in making a lending decision and to challenge errors in their credit reports. For fintech lenders using alternative data, this means being careful about accuracy and transparency.

Fair Debt Collection Practices Act (FDCPA): The FDCPA protects borrowers during collections. Lenders and collectors must communicate respectfully, without threats, harassment, or misleading claims. Timing of contact, language used, and honesty about the debt all fall under this law.

Unfair, Deceptive, or Abusive Acts or Practices (UDAAP): UDAAP is a broad standard that covers harmful practices not always addressed by other laws. If a lending product confuses, misleads, or takes advantage of borrowers, regulators can act under UDAAP authority. This makes clarity in marketing, disclosures, and servicing essential.

For fintech companies, these laws provide a framework for responsible lending. Meeting these standards protects the business legally, but it also helps build long-term credibility with borrowers and regulators.

State Licensing and Usury Laws

While federal laws set broad rules, lending is also heavily shaped by state requirements. Every state has its own licensing framework that determines who can offer loans and under what conditions. A fintech lender operating nationwide may need to secure multiple state licenses, each with unique application processes, fees, and ongoing reporting duties.

Usury laws add another layer. These laws place limits on the maximum interest rates that can be charged to borrowers. The caps vary widely by state and often depend on the type of loan. What may be permitted in one state could be restricted in another, making it essential for lenders to carefully map out where and how they operate.

For fintech lenders, state licensing and usury laws often represent the most time-consuming part of compliance. They also highlight the value of a strong regulatory strategy. Without proper licensing and rate structures, platforms risk penalties, lawsuits, or being forced to stop lending in certain states.

Bank Partnerships and the “True Lender” Issue

Many fintech lenders work with banks to reach more borrowers and simplify licensing. In these partnerships, the bank issues the loan while the fintech handles marketing, technology, and servicing. This structure enables fintech companies to operate nationwide without needing to apply for dozens of state licenses.

The challenge comes with the “true lender” question. Regulators and courts closely examine who actually controls the lending process. If the fintech, rather than the bank, is seen as the true lender, then state licensing rules and usury laws may apply directly to the fintech. This can affect interest rates, disclosures, and even the legality of certain products.

This issue has drawn significant attention because it shapes how bank-fintech partnerships are structured. Clear agreements, transparent practices, and strong compliance programs are key to making these partnerships work. Lenders must be ready to show regulators that their arrangements are legitimate and not designed to sidestep state laws.

If handled carefully, bank partnerships can be a powerful way to expand lending models and reach more customers. They also show how closely innovation and regulation are tied together in the fintech lending space.

Securities Law Considerations

In peer-to-peer lending, loans are often broken into small pieces and sold as notes to investors. These notes may be treated as securities, which brings them under the SEC’s oversight. That means platforms need to consider registration requirements, disclosure obligations, and investor protections that mirror those in the broader securities market.

For fintech lenders, this adds complexity. It is not enough to connect borrowers and investors; the platform must also provide transparent information about risks, expected returns, and how defaults are handled. If investors are misled or not given adequate information, regulators can intervene.

Securities law also influences how platforms attract investors. Marketing materials, risk disclosures, and investment terms all fall under scrutiny. Some platforms address this by working with institutional investors rather than retail ones, while others build compliance programs robust enough to support both groups.

Data Privacy and Cybersecurity Requirements

Fintech lending relies on collecting and analyzing sensitive data, which makes privacy and security central concerns.

Borrowers share personal details, bank account information, income records, and sometimes alternative data such as utility or rental payments. Protecting this information is not just good practice but also a legal requirement under laws like the Gramm-Leach-Bliley Act (GLBA) and state privacy rules such as the California Consumer Privacy Act (CCPA).

Cybersecurity is equally important. Lenders face constant risks of data breaches, fraud attempts, and cyberattacks. Regulators expect strong safeguards such as encryption, access controls, regular audits, and incident response plans. For fintech lenders, weak security can undermine trust with borrowers and attract regulatory penalties.

Transparency matters as well. Borrowers want to know how their information is collected, stored, and shared. Clear privacy policies, easy-to-understand disclosures, and straightforward opt-out options go a long way toward building confidence.

In practice, data privacy and cybersecurity requirements push fintech lenders to invest in secure systems, reliable vendors, and staff training. Those who approach this area thoughtfully not only stay compliant but also strengthen their reputation in a market where trust is everything.

AML and KYC Obligations

Every fintech lender must take steps to prevent money laundering and financial crime. AML and KYC requirements are at the heart of this responsibility. They are designed to make sure lenders know who their borrowers are and to detect suspicious activity before it becomes a problem.

KYC begins at onboarding. Borrowers are asked to provide identifying information such as government-issued IDs, proof of address, and sometimes additional documents, depending on the size or type of loan.

AML obligations continue throughout the life of the loan. Lenders must monitor transactions, flag unusual patterns, and report suspicious activity to regulators when required. For example, a sudden change in repayment behavior or transfers linked to high-risk jurisdictions might trigger additional review.

For fintech lenders, strong AML and KYC processes not only meet legal requirements but also build credibility with partners, investors, and regulators. They signal that the business is committed to operating responsibly in a highly regulated space.

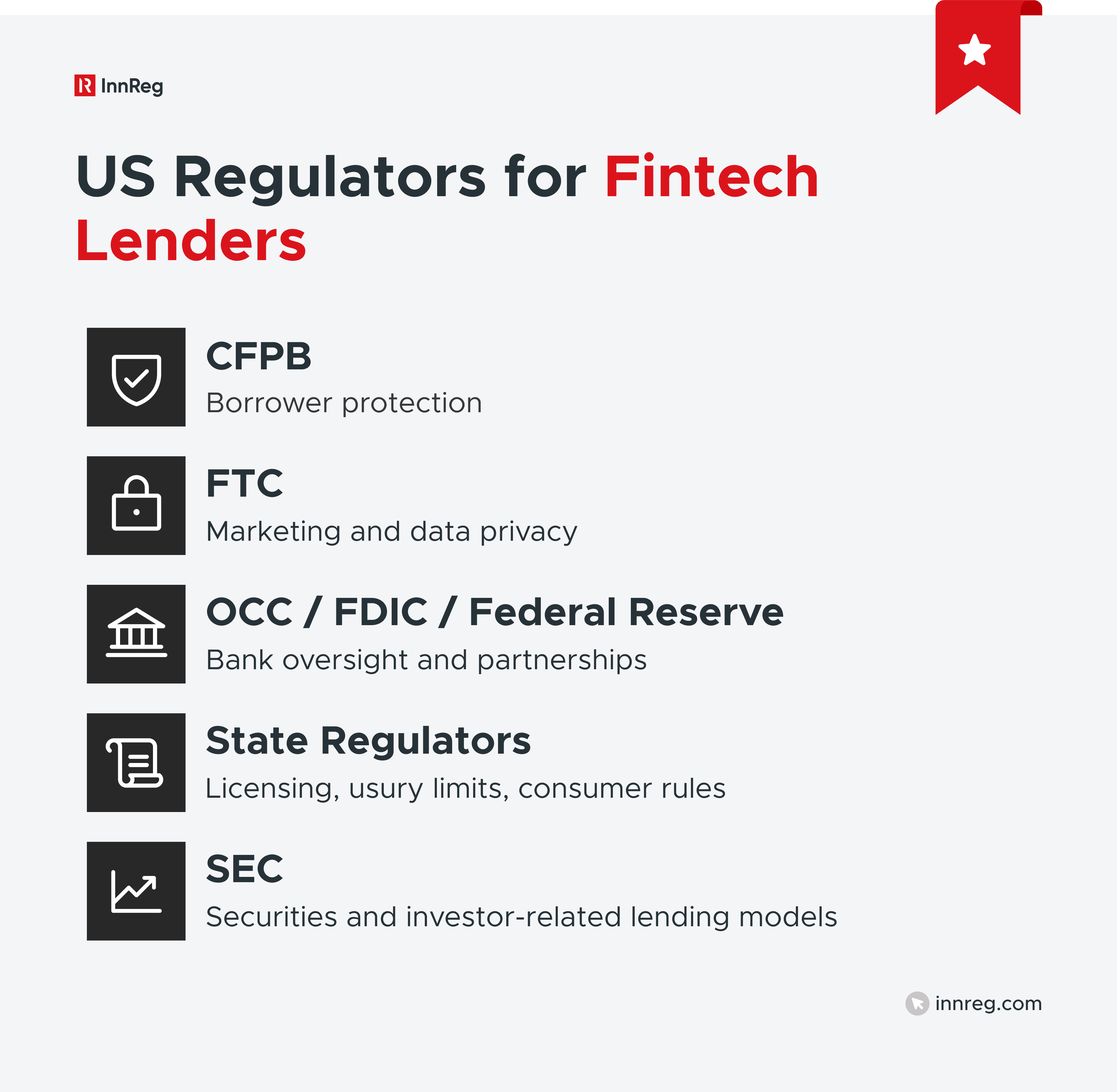

Relevant US Regulators for Fintech Lenders

Fintech lenders answer to several regulators, each shaping different parts of the lending process. The mix depends on the business model, but certain agencies consistently play a central role.

CFPB

The Consumer Financial Protection Bureau (CFPB) is the primary federal regulator focused on protecting borrowers. It oversees how loans are marketed, how disclosures are presented, and how servicing and collections are handled. The CFPB has broad authority to investigate practices it views as unfair, deceptive, or abusive.

For fintech lenders, this means loan terms must be communicated clearly, customer complaints need to be taken seriously, and repayment practices must be fair. The CFPB also publishes guidance and brings enforcement actions, which shape the standards the industry follows.

Because the bureau looks closely at both consumer experience and compliance, fintech lenders that prioritize transparency and responsible practices are better positioned to avoid regulatory challenges and build long-term trust.

FTC

The Federal Trade Commission (FTC) plays a major role in regulating advertising and business practices in fintech lending. Its focus is on making sure that marketing is accurate, transparent, and not misleading. If a lender promotes low interest rates, simple approvals, or quick funding, the FTC expects those claims to be backed up with clear evidence.

The FTC also monitors data privacy and security practices. Since fintech lenders handle sensitive borrower information, the commission can step in if data is misused, shared improperly, or left vulnerable to breaches.

For fintech lenders, compliance with the FTC’s standards means paying close attention to how products are marketed and how customer information is managed. A strong approach in these areas helps lenders avoid enforcement actions and strengthens credibility with borrowers who value honesty and privacy.

OCC, FDIC, Federal Reserve

When a fintech works with a chartered bank to issue loans, that bank must comply with rules from its primary regulator, which could be the Office of the Comptroller of the Currency (OCC), the Federal Deposit Insurance Corporation (FDIC), or the Federal Reserve.

The OCC supervises national banks, the FDIC insures deposits and monitors the safety of member institutions, and the Federal Reserve sets broader policy for the banking system. Each of these bodies expects bank partners to manage risks carefully, including those that arise in fintech collaborations.

For fintech lenders, this means that working with a bank also means meeting the expectations of the bank’s regulator. Loan terms, disclosures, and servicing practices must align with standards set for traditional financial institutions. These partnerships can open doors to nationwide lending, but they also bring heightened oversight and the need for strong compliance coordination.

State Regulators

State regulators play one of the most direct roles in fintech lending. Each state has its own licensing system, usury limits, and disclosure requirements, and these can vary widely across the country. A lender that wants to operate nationally often needs to obtain multiple state licenses, maintain reporting obligations, and adapt loan terms to meet local laws.

State agencies also enforce consumer protection rules. They monitor how loans are marketed, how collections are carried out, and whether interest rates stay within legal limits. In some states, regulators are especially active in examining fintech lending practices, particularly when products reach vulnerable borrowers.

For fintech lenders, this patchwork of state oversight can be challenging but also manageable with the right strategy. Staying engaged with state regulators and building compliance programs that can flex to local rules makes it possible to operate at scale while protecting the business from penalties or restrictions.

See also:

SEC (Where Applicable)

The SEC becomes relevant when fintech lending models involve investment products. This is most common in peer-to-peer platforms where loans are bundled into notes and sold to investors. In these cases, the SEC may treat those notes as securities, which brings registration, disclosure, and reporting requirements.

For platforms, this means investors must receive clear information about risks, expected returns, and how defaults are managed. Marketing materials also need to avoid overpromising and must present a balanced view of potential outcomes. The SEC has taken enforcement actions in the past when platforms failed to meet these standards.

Even if a fintech lender does not think of itself as operating in the securities space, the structure of its investor offerings can change that reality. Careful planning and legal review are essential when raising capital from investors through lending products. Building transparency into the process not only keeps regulators satisfied but also helps attract investors who value clarity and trust.

—

Fintech lending has reshaped the credit landscape by making borrowing faster, more accessible, and more data-driven. From peer-to-peer platforms to embedded lending at checkout, these models show how technology can create new opportunities for borrowers and investors alike. At the same time, the regulatory environment is complex, with layers of federal laws, state licensing requirements, and oversight from multiple agencies.

For founders, lawyers, and compliance officers, success in this space depends on more than product innovation. Building a lending business that lasts requires clear policies, responsible practices, and a regulatory strategy that can stand up to scrutiny.

How Can InnReg Help?

InnReg is a global regulatory compliance and operations consulting team serving financial services companies since 2013.

We are especially effective at launching and scaling fintechs with innovative compliance strategies and delivering cost-effective managed services, assisted by proprietary regtech solutions.

If you need help with lender compliance, reach out to our regulatory experts today:

Last updated on Jan 18, 2026