SEC Rule 15c3-3: Customer Protection Rule Explained

Jan 30, 2026

·

19 min read

Contents

SEC Rule 15c3-3 plays a major role in how broker-dealers protect customer money and securities. Even if you only work near custody issues, this rule shapes more of your daily operations than you might expect.

Many people first come across it during licensing, early filings, or a conversation with a clearing partner. The Rule can feel technical at first, but its core purpose is simple: to keep customer assets protected and prevent firms from mixing those assets with their own business funds.

For fintech teams, having a clear grasp of Rule 15c3-3 helps build stronger products and compliance operations. Whether you work in legal, operations, or growth, this rule influences how your business handles customer assets behind the scenes.

At InnReg, we help broker-dealers interpret and implement SEC Rule 15c3-3 customer protection requirements. Our team supports reserve formula calculations, possession or control procedures, clearing relationships, and customer asset segregation workflows tied directly to Rule 15c3-3. Contact us to learn more about InnReg’s broker-dealer services.

What Is the SEC Rule 15c3-3 (Customer Protection Rule)?

SEC Rule 15c3-3, known as the Customer Protection Rule, sets the standards for how broker-dealers handle and safeguard customer assets. If your business deals with customer cash or securities in any way, this rule sits at the center of your operational responsibilities.

The idea behind it is straightforward. Customer assets must be protected, and they must stay separate from the broker-dealer’s own funds or activities. Everything in the rule is built around maintaining that separation clearly and consistently.

How Rule 15c3-3 Safeguards Customer Assets

Rule 15c3-3 protects customers through two core requirements:

Possession or control of their securities

Dedicated reserve account for their cash

Both work together to keep customer property separate from the firm’s own activity.

The first piece focuses on securities. Customer securities must be held in locations that the broker-dealer can access and verify at all times, and they cannot be used to support the firm’s own trading or financing needs. This keeps customers from being exposed to risks created by the broker-dealer’s business operations.

The second piece focuses on cash. Broker-dealers that hold customer funds must place an amount of cash or qualified securities into a special reserve bank account. This account is set aside for the exclusive benefit of customers. Firms must calculate how much belongs there on a regular schedule.

Together, these safeguards create a structure that protects customer property even when markets shift or the firm faces financial pressure.

The History of Rule 15c3-3 and the Securities Exchange Act

Rule 15c3-3 grew out of lessons learned during periods of market stress and broker-dealer failures in the 1960s and early 1970s. At the time, several firms collapsed and left customers unable to access their own securities. Regulators saw the need for a clearer framework that protected customer property, even when a firm ran into serious trouble.

The Securities Exchange Act of 1934 already gave the SEC broad authority over broker-dealer practices, but it did not provide specific standards for asset custody and segregation. Rule 15c3-3 filled that gap and introduced a detailed system for how customer cash and securities must be handled.

When the rule took effect in 1972, it became one of the cornerstones of modern customer protection. Over time, updates have refined the calculations, clarified what counts as a good control location, and strengthened the reserve formula. The purpose has, however, stayed the same. Customers should not lose access to their assets because a broker-dealer mismanaged or improperly used them.

What Is the Core Objective of the Customer Protection Rule?

The core objective of Rule 15c3-3 is to protect customer assets by keeping them separate from the broker-dealer’s own accounts and activities.

At its heart, this rule aims to reduce the risk that customer money or securities could be used to support the firm’s business. Customer property must remain available for customers, and it should not be diverted for trading, financing, or other internal needs. This creates a strong layer of protection during both normal operations and periods of financial stress.

For firms operating in fast-moving fintech environments, this objective becomes even more important. Clear separation of assets safeguards client assets, builds trust, supports operational stability, and helps reduce exposure during regulatory exams or unexpected market events.

How Does Rule 15c3-3 Differ From Banking Deposit Protections?

Rule 15c3-3 often gets compared to banking protections, but the two frameworks work very differently. Broker-dealers do not operate like banks, and customer assets are not treated the same way.

Banks pool deposits and use them for lending and other core activities. Deposits are protected through FDIC insurance, which steps in if a bank fails. Broker-dealers cannot treat customer assets this way. Customer securities must remain separate, and customer cash should be segregated in a dedicated reserve account that the firm cannot use for its own business.

The result is a different kind of protection. Instead of an insurance model, Rule 15c3-3 focuses on segregation and access. Customers should be able to receive their assets quickly, without depending on an insurance payout or waiting through a long resolution process.

Aspect | Broker-Dealers (Rule 15c3-3) | Banks (FDIC Deposit Model) |

|---|---|---|

Core Protection Method | Segregation of customer assets from firm assets | Insurance coverage for customer deposits |

Use of Customer Funds | Cannot use customer cash or securities for business activities | Banks use deposits for lending and operations |

Customer Access to Assets | Assets are returned promptly because they remain separate | Access depends on the FDIC resolution process after a failure |

Protection Trigger | Ongoing, through mandatory custody and reserve requirements | Activates only when a bank fails |

Applies To | Broker-dealers holding customer funds or securities | Banks holding customer deposits |

Primary Regulator | FINRA & SEC | FDIC |

This distinction matters for fintech teams that operate across both banking and securities environments. Each framework has its own logic, and Rule 15c3-3 builds protection through separation, not pooled insurance.

How Does Rule 15c3-3 Impact Fintech Broker-Dealers?

Rule 15c3-3 influences several core areas of a fintech broker-dealer’s operations. Here are the most common ways it shows up:

Custody model decisions: Teams must choose structures that protect customer assets and keep them separate from firm accounts. This affects how clearing, custody, and settlement partners are selected.

System design and data flow: Accurate data is essential for reserve calculations, reconciliations, and tracking customer balances. Any gaps in automation can create compliance risks.

Vendor and integration choices: Third-party tools that touch customer cash or securities must support Rule 15c3-3 requirements. Poor integrations can lead to delays or errors.

Daily operational workflows: Tasks like reconciling activity, reviewing exception reports, or processing deposits and withdrawals tie directly into possession or control requirements.

Cross-team coordination: Product, operations, and compliance teams need to stay aligned. Clear communication helps avoid missed steps that could affect customer asset protection.

This list reflects how deeply the rule connects to the day-to-day work of fintech broker-dealers, especially those operating on fast product cycles or automated workflows.

SEC Rule 15c3-3 Explained in Practice

Rule 15c3-3 can feel abstract until you look at how it works day to day. Here are the core mechanics that drive customer protection inside a broker-dealer.

Safeguard | What It Covers | Key Requirement |

|---|---|---|

Possession or Control | Customer securities | Securities must be held at approved good control locations and remain available for prompt delivery |

Customer Reserve Bank Account | Customer cash | Cash or qualified securities must be set aside in a dedicated reserve account for the exclusive benefit of customers |

Possession or Control of Customer Securities

Possession or control requires broker-dealers to keep customer securities in locations where they can be accessed, verified, and delivered without delay.

In practice, this means the firm must either hold the securities directly or keep them at approved third-party locations known as “good control locations.”

Customer securities must always be available for prompt delivery, and they cannot be borrowed, rehypothecated, or used to support the firm’s own activity unless specific exceptions apply.

Daily monitoring is key. Firms must review settlement activity, pending trades, and stock loan transactions to confirm that customer positions remain fully protected. If a deficit is discovered, the broker-dealer has a strict timeline to correct it.

Maintaining the Customer Reserve Bank Account

The customer reserve bank account is a dedicated account at a bank that holds cash or qualified securities for the exclusive benefit of customers.

Each week, and in some cases each day, the firm must calculate how much customer cash should be placed in this account. The goal is to set aside enough funds to cover customer credit balances and prevent the firm from relying on those funds for its own operations.

Example of Asset Segregation in a Broker-Dealer Environment

Asset segregation becomes easier to understand when you look at a simple scenario.

Imagine a customer opens an account, deposits cash, and buys securities through a fintech broker-dealer.

The customer’s cash is placed into the reserve formula calculation. Any amount owed to customers must be backed by funds in the reserve bank account, so the firm sets aside the required balance. The customer’s securities, once purchased, are held at a good control location such as a clearing firm or a depository.

Throughout the day, deposits, withdrawals, and trade settlements affect the firm’s calculations. Operations teams review these changes to confirm that both cash and securities remain properly segregated. This then protects customers by keeping their assets separate from the broker-dealer’s business activity.

See also:

Who Must Comply With Rule 15c3-3?

Understanding your firm’s custody profile is the first step. Once that is clear, it becomes easier to see whether you are fully subject to the rule or operating within an exemption designed for firms with minimal custody responsibilities.

Need help with broker-dealer compliance?

Fill out the form below and our experts will get back to you.

Which Broker-Dealers Are Covered by the Rule

Broker-dealers that carry customer accounts or hold customer assets are fully subject to Rule 15c3-3. This includes clearing firms, self-clearing broker-dealers, and any firm that maintains custody of customer cash or securities as part of its business.

Introducing broker-dealers that route all customer activity to a clearing firm may also fall under parts of the rule, depending on how their agreements are structured. If a firm ever takes possession of customer assets, even briefly, it must comply with the associated requirements.

The rule casts a wide net because customer protection is a core part of securities regulation. Any firm with custody responsibilities needs to follow the safeguards designed to keep customer property separate and protected.

Looking to register a broker-dealer? Start with our practical FINRA NMA guide →

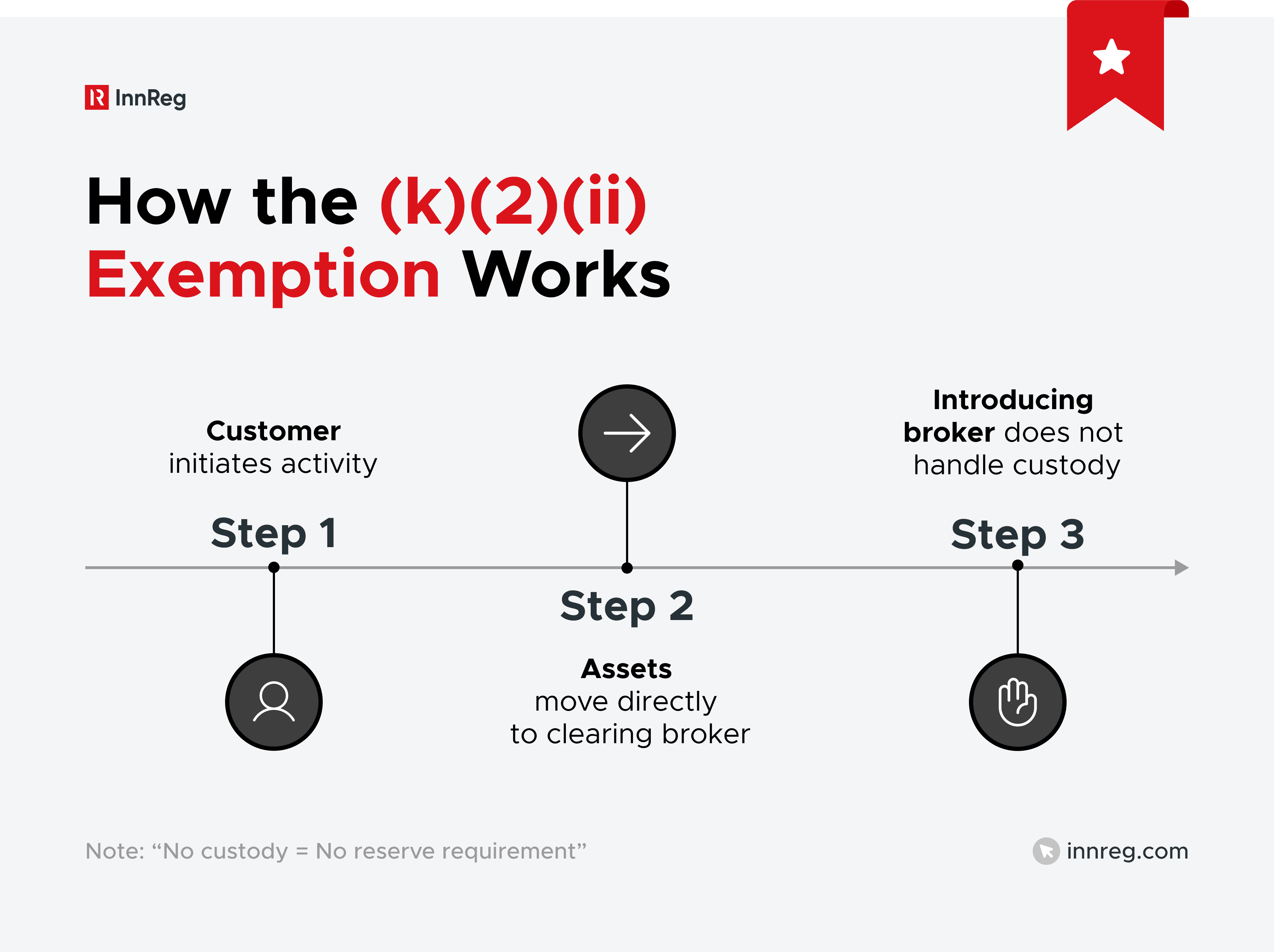

Understanding the (k)(2)(ii) Exemption for Introducing Brokers

The(k)(2)(ii) exemption is one of the most common exemptions for introducing broker-dealers that do not want to handle customer assets directly. Under this exemption, the firm routes all customer transactions to a clearing broker and does not carry accounts or hold customer funds or securities.

To maintain this status, the introducing broker must structure its operations carefully. Customer assets must move directly between the customer and the clearing firm, and the introducing broker cannot hold or control those assets at any point. This applies to deposits, withdrawals, settlements, and transfers.

Firms operating under (k)(2)(ii) still have regulatory responsibilities, but they avoid the full custody and reserve requirements of Rule 15c3-3. Staying within the exemption depends on strict language in the agreements with the clearing broker and strict internal controls that prevent accidental custody.

How Fintechs Partner With Clearing Brokers Meet Custody Obligations

Many fintech broker-dealers rely on clearing brokers to handle the custody functions required under Rule 15c3-3. This partnership lets fintechs focus on product, customer experience, and front-end operations while the clearing firm manages settlement, custody, and reserve responsibilities.

A strong clearing relationship hinges on clear contracts and well-defined workflows. Customer funds and securities must move directly between the customer and the clearing broker, and all custody-related tasks must follow the clearing agreement. Any deviation can create accidental custody exposure for the fintech firm.

Fintech teams also need tight integration between their platform and the clearing broker’s systems. Accurate data flow supports account setup, trading activity, and reconciliation. A well-built integration enables both sides to meet their regulatory responsibilities without gaps or delays.

Key Compliance Requirements Under SEC Rule 15c3-3

Rule 15c3-3 comes to life through a series of recurring operational requirements. These are the day-to-day activities that keep customer assets protected and your firm in compliance.

1. Weekly and Daily Reserve Formula Computations

The reserve formula is a core part of Rule 15c3-3. It determines how much money a firm should set aside in its customer reserve bank account. Most firms calculate this amount weekly, though some run the calculation daily if they meet certain activity thresholds.

The formula compares customer credits and debits to determine the net amount that must be placed in the reserve account. If the calculation shows that customer funds are owed, the firm must make a timely deposit. If the firm has excess funds in the account, it may withdraw the difference, but only after confirming that the updated calculation supports it.

Accurate data is essential. Even small errors in trade activity, settlement timing, or customer balances can affect the reserve requirement. Many firms automate the process, but still need strong oversight to confirm that the numbers feeding the calculation are complete and correct.

2. Maintaining Good Control Locations for Securities

Good control locations often include clearing brokers, depositories, and certain banks that meet regulatory standards. The goal is to keep customer securities in locations the broker-dealer can access and verify without delay.

To stay compliant, firms must confirm that every customer security position is held at an approved location. Securities must remain available for prompt delivery, and the firm must avoid placing them anywhere that limits access or creates unnecessary risk.

Operations teams review settlement activity, stock loans, fails to deliver, and other movements each day. This ongoing review helps confirm that customer securities are always kept within approved good control locations and handled according to regulatory expectations.

See also:

3. Reporting and Recordkeeping Obligations

Rule 15c3-3 comes with detailed reporting and recordkeeping expectations. These requirements help regulators confirm that the firm is handling customer assets properly and following custody rules throughout its operations.

Broker-dealers must maintain accurate records of customer account balances, securities locations, reserve computations, and any adjustments made to the reserve account. These records must be complete and easy to retrieve, and they must reflect the firm’s actual custody activity without gaps or inconsistencies.

Firms also submit periodic filings that document their custody practices and financial condition. These reports give regulators visibility into how customer assets are managed and help identify issues before they become larger problems. Strong documentation supports smoother exams and helps the firm respond effectively to regulatory inquiries.

4. Written Supervisory Procedures for Customer Protection

Every broker-dealer needs clear written supervisory procedures (WSPs) that explain how the firm meets its obligations under Rule 15c3-3. These procedures outline the controls, workflows, and responsibilities that support customer asset protection.

WSPs should cover key processes, including how the firm monitors possession or control, completes reserve formula calculations, reviews reconciliations, and works with its clearing partners. Clear, well-written procedures help staff understand their responsibilities, and give regulators a transparent view of how the firm protects customer assets.

Strong WSPs are reviewed and updated regularly. As products change or systems evolve, the procedures should reflect the way the firm actually operates. This keeps controls aligned with daily workflows and supports a healthier, more reliable compliance program.

Looking for a deeper breakdown of what your WSPs should include? Read our full guide →

5. Notifications and Audit Requirements

Rule 15c3-3 also sets out specific notification and audit requirements that help regulators keep track of how firms manage customer assets. These obligations apply year-round and matter even more when custody issues come up.

Broker-dealers must notify regulators right away if they find problems that could affect customer asset protection. Issues like reserve computation errors or possession or control deficits need prompt attention, and firms must report them within the required timelines.

Annual audits add another level of oversight. Independent auditors review financial statements, custody practices, and internal controls. Their reports give regulators an independent perspective on how the firm handles customer assets and highlight areas that may need attention.

6. Handling Fully Paid and Excess-Margin Securities

Rule 15c3-3 sets specific requirements for fully paid and excess-margin securities because these assets belong entirely to the customer. The firm cannot use them for lending, financing, or any other business activity.

Fully paid securities are owned outright by the customer, with no balance owed. Excess-margin securities are the portion of a customer’s holdings that sit above what is needed to support a margin loan. Both must be stored in good control locations and must be ready for prompt delivery whenever the customer requests them.

Broker-dealers review these positions every day to confirm they remain separate from firm activity. Any movement, settlement, or adjustment must be captured accurately and timely in the books and records. This daily oversight keeps these assets protected and helps the firm stay aligned with Rule 15c3-3 requirements.

7. Relationship Between Rule 15c3-3 and the Net Capital Rule

Rule 15c3-3 works closely with the Net Capital Rule because both aim to protect customers and maintain stability in the broker-dealer system. While Rule 15c3-3 focuses on keeping customer assets separate, the Net Capital Rule focuses on keeping the firm financially sound enough to meet its obligations.

The two rules interact through daily and weekly processes. Reserve calculations can affect the firm’s capital position, and capital levels can influence how the firm handles its custody responsibilities. A gap in either area can quickly create pressure on the other.

For fintech broker-dealers, understanding this relationship helps teams anticipate how operational choices might affect regulatory thresholds. When custody controls and capital management stay aligned, the firm is better positioned to protect customer assets and navigate exams with fewer surprises.

What Are the Common Compliance Challenges Under Rule 15c3-3?

Rule 15c3-3 is detailed and operational, which means even small gaps in data or workflow design can create compliance issues. Fintech broker-dealers often face these challenges as they scale or introduce new features.

Errors in Reserve Formula Calculations and Data Accuracy

Reserve calculations depend on clean, complete data. When trade activity, customer balances, or settlement details are inaccurate or delayed, the reserve formula can produce the wrong result.

This often happens when firms rely on multiple systems that do not sync perfectly or when new features affect how balances are tracked. Even minor data mismatches can create reserve account deficits, and those deficits require quick action to stay compliant.

Strong reconciliation processes and regular data checks help firms catch issues early. Many fintechs also build alerts or reviews into their workflows so teams can respond before a routine calculation turns into a larger problem.

Difficulties Maintaining Possession or Control of Customer Securities

Maintaining possession or control can be difficult when settlements, transfers, and stock loan activity move at a fast pace. If any part of the process slows down or fails, customer securities can slip out of good control locations.

This often happens due to late settlements, mismatched instructions, or delays in receiving securities from counterparties. Even a small lapse can create a possession or control deficit, and firms must address these issues within strict regulatory timelines.

Fintech broker-dealers that rely on automation need strong monitoring to stay ahead of these risks. Daily reviews, exception reports, and close coordination with clearing partners help keep customer securities in approved locations throughout the day.

Supervisory and Oversight Gaps in Compliance Programs

Fast-growing fintech firms often move quickly, which can leave supervisory processes lagging behind product updates or operational changes. When procedures do not match real workflows, gaps begin to form.

These gaps can show up in incomplete reviews, missed reconciliations, or unclear ownership of key tasks. Minor oversights create room for custody issues, and regulators expect supervisory systems to keep pace with the firm’s actual activity.

Regular reviews of workflows, responsibilities, and controls help keep the compliance program aligned with day-to-day operations. As products evolve, the supervisory structure needs to evolve with them.

System Integration and Operational Breakdowns

Fintech broker-dealers rely heavily on automation, integrations, and real-time data flow. When those systems do not sync smoothly, custody processes can break down.

Common trouble spots include delayed API updates, missing data fields, failed batch transfers, or changes in one system that are not reflected in another. Any interruption in data flow can affect reserve calculations, and breakdowns during settlement may disrupt possession or control.

Strong integration testing and ongoing monitoring help reduce these risks. Firms that review system connections regularly can catch issues early and keep custody operations running smoothly.

Challenges for Fintech Broker-Dealers Managing Rapid Growth

Rapid growth can strain a broker-dealer’s custody processes, especially when new users, assets, and features all scale at the same time. Operational steps that worked at a smaller volume may start to break under heavier activity.

Growth can also create pressure on data accuracy, reconciliations, and exception handling. Higher volumes introduce more opportunities for minor errors, and fast product changes can leave compliance teams catching up.

Fintech firms that plan ahead for scale tend to manage this more effectively. Building flexible systems, strengthening cross-team communication, and reviewing custody workflows regularly help keep customer asset protection stable as the business expands.

How Does Rule 15c3-3 Apply to Digital Assets and Crypto?

Digital assets introduce new questions for broker-dealers operating under Rule 15c3-3. The framework was built for traditional securities, so applying it to blockchain-based assets requires careful interpretation and strong operational controls.

See also:

Custody Requirements for Digital Securities and Crypto Assets

When digital assets fall under the definition of a security, broker-dealers must apply Rule 15c3-3 to those assets just as they would with traditional securities. The challenge is that blockchain-based assets do not fit neatly into legacy custody models.

Firms need a way to safeguard private keys, maintain accurate books and records, and keep customer assets separate from their own holdings. The core principle stays the same across all asset types, and customer property must remain protected and accessible.

This often requires specialized custodians, multi-signature arrangements, or technology solutions designed for digital asset storage. Broker-dealers must confirm that these solutions meet regulatory expectations and support the same level of control required for traditional securities.

SEC and FINRA Guidance on Digital Asset Custody Compliance

Both the SEC and FINRA have issued guidance to help firms understand how traditional custody rules apply to digital assets. While the guidance is still evolving, regulators have made it clear that customer protection standards do not change simply because the asset lives on a blockchain.

Broker-dealers must demonstrate that they can safeguard digital assets with the same level of control expected for traditional securities. This includes proving that they can access and transfer customer assets when needed, and showing that their custody solution prevents unauthorized use or loss.

Regulators also expect clear documentation. Firms should be able to explain their technology setup, key management processes, and operational checks. This transparency helps regulators evaluate whether the firm’s approach meets Rule 15c3-3 expectations in a digital environment.

Challenges of Applying Rule 15c3-3 to Blockchain-Based Assets

Applying Rule 15c3-3 to blockchain assets creates operational and technical challenges that traditional custody models never had to address. The decentralized nature of blockchain means there is no central depository, and transfers cannot be reversed once executed.

Private key management becomes a critical point of risk. Losing access to a private key means losing access to customer assets, and improper storage can expose keys to theft or unauthorized use. These risks make custody controls far more complex than simply holding securities at a good control location.

Settlement timing also poses challenges. Many digital assets settle instantly or within minutes, which can create reconciliation gaps if systems are not built to capture every movement. Broker-dealers must design workflows that keep pace with blockchain activity while still meeting the recordkeeping and control expectations of Rule 15c3-3.

Examples of Compliant Digital Asset Custody Models

Firms exploring digital asset custody have begun adopting models that align more closely with Rule 15c3-3 expectations. These setups focus on control, access, and clear separation of customer property from firm assets.

One approach uses a qualified custodian that specializes in digital securities. These custodians provide secure key management and give broker-dealers a structure that mirrors traditional good control locations. This helps firms maintain access to customer assets while relying on a partner with strong technical safeguards.

Another model involves multi-signature wallets that separate control between the broker-dealer and its custodian. This structure limits the risk tied to any single key and supports stronger operational oversight. Some firms also build hybrid models that combine hardware security modules, offline storage, and tightly controlled access procedures.

Each of these approaches aims to bring digital asset custody closer to the standards required for traditional securities, while acknowledging the unique characteristics of blockchain-based assets.

SEC Rule 15c3-3 Enforcement Cases

Enforcement cases show how Rule 15c3-3 works in real situations. They highlight the types of custody and reserve failures that regulators pay attention to and the lessons broker-dealers can apply to their own operations.

Merrill Lynch’s $415 Million Settlement

One of the most well-known Rule 15c3-3 cases involved Merrill Lynch. Regulators found that the firm had used customer cash to finance its own trading activities, which violated the core principle of keeping customer assets separate from firm operations.

The investigation showed gaps in how reserve computations were handled and how customer funds were allocated across internal accounts. These issues created periods where required reserve amounts were not fully maintained, and customer cash was exposed to risks tied to the firm’s business.

The case resulted in a $415 million settlement and became a key example of how seriously regulators take customer protection. It also showed the industry that even large, sophisticated firms can face significant consequences when custody and reserve processes break down.

Interactive Brokers’ Segregation Deficit Findings

Interactive Brokers faced regulatory action after examiners identified segregation deficits tied to customer securities. The firm experienced periods where customer assets were not fully protected, primarily due to operational and reconciliation issues.

Regulators found that certain control checks were not functioning as expected, which led to gaps in how customer securities were tracked and maintained. These breakdowns created moments when the firm did not have full possession or control, and customer positions were exposed to avoidable risk.

The case highlighted the importance of strong daily monitoring, reliable system integrations, and accurate books and records. It also showed how quickly small operational issues can grow into custody problems when workflows move at a high volume.

—

Rule 15c3-3 remains one of the most important safeguards in the broker-dealer regulatory framework. It protects customer assets by keeping cash and securities separate from firm activity, and it shapes the operational backbone of any firm that handles custody.

For fintech broker-dealers, the rule becomes even more meaningful. Rapid growth, automation, and new asset types introduce risks that require strong controls and clear oversight. Understanding the rule’s mechanics helps teams build safer products and supports healthier operations as the business scales.

How Can InnReg Help?

InnReg is a global regulatory compliance and operations consulting team serving financial services companies since 2013.

We are especially effective at launching and scaling fintechs with innovative compliance strategies and delivering cost-effective managed services, assisted by proprietary regtech solutions.

If you need help with broker-dealer compliance, reach out to our regulatory experts today:

Last updated on Jan 30, 2026