Consolidated Audit Trail (CAT): SEC Rule 613 Requirements

Jan 16, 2026

·

18 min read

Contents

The Consolidated Audit Trail (CAT) is one of the most important reporting systems in US securities regulation. It often seems complex at first, but at its core, it’s simply about giving regulators a clearer view of trading activity across the markets.

In this article, we’ll walk through what the CAT is, why it was created, and how it affects different market participants. We’ll also highlight explanations of the rules, the organizations behind them, and the reporting requirements that apply.

At InnReg, we help broker-dealers and market participants manage their Consolidated Audit Trail (CAT) responsibilities with practical, hands-on compliance support. Our team assists with CAT reporting workflows, CAIS data readiness, error management, and alignment between internal records and CAT submissions.

What Is the Consolidated Audit Trail (CAT)?

The Consolidated Audit Trail (CAT) is a centralized system that collects data on orders, executions, and trades in US equity and options markets. It was created so regulators could track activity across all exchanges and broker-dealers in one place.

Before the CAT, trade data lived in separate systems. Each venue kept its own records, which made following an order challenging as it moved through the market. The Consolidated Audit Trail changes that by bringing everything together and giving regulators a clear, complete view of trading activity.

In a nutshell, firms covered by CAT rules have to send details about trade events and customer activity to one central database. The Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) then use that data to surveil markets, maintain transparency, and monitor for potential misconduct.

Why the SEC Created the Consolidated Audit Trail

The Consolidated Audit Trail (CAT) was developed after several market events exposed significant gaps in regulatory oversight. Before CAT, regulators relied on multiple reporting systems, each capturing only a piece of the trading process. When an order moved across venues, data often got fragmented, making it nearly impossible to see the full picture.

The problem came into sharp focus during the 2010 Flash Crash, when the market dropped and recovered within minutes. Regulators struggled to piece together what happened because the data was scattered and inconsistent. The event ultimately raised an important question: were existing tools keeping pace with the speed of modern trading?

At the same time, high-frequency trading, alternative trading systems, and cross-venue routing were adding new layers of complexity. Orders were moving faster and through more channels than ever before, while oversight tools lagged behind. Regulators started facing real challenges in tracking activity, protecting investors, and keeping markets fair.

The SEC responded with Rule 613, which laid the foundation for the CAT.

SEC Rule 613: The Regulation Behind the CAT

The Consolidated Audit Trail traces back to SEC Rule 613, adopted in 2012. The rule basically told all national securities exchanges and FINRA to team up and build one system to track order and trade data across all US equity and options markets.

Under Rule 613, the self-regulatory organizations (SROs) were tasked with creating a national market system (NMS) plan. The plan explained how the CAT would be built, who would manage it, and how firms would report their data. In short, Rule 613 turned the idea of a consolidated audit trail into a real, industry-wide requirement.

For firms, this regulation translates into clear responsibilities:

Report every order event from entry to execution or cancellation

Submit customer and account details through the Customer and Account Information System (CAIS)

Meet deadlines for data submissions and follow technical standards

Keep internal records consistent with what is sent to the CAT

Rule 613 also established a clear oversight structure. Each exchange and FINRA are responsible for verifying that their members follow CAT requirements, while the SEC oversees the system at the national level. This setup helps keep reporting accurate and timely across the board.

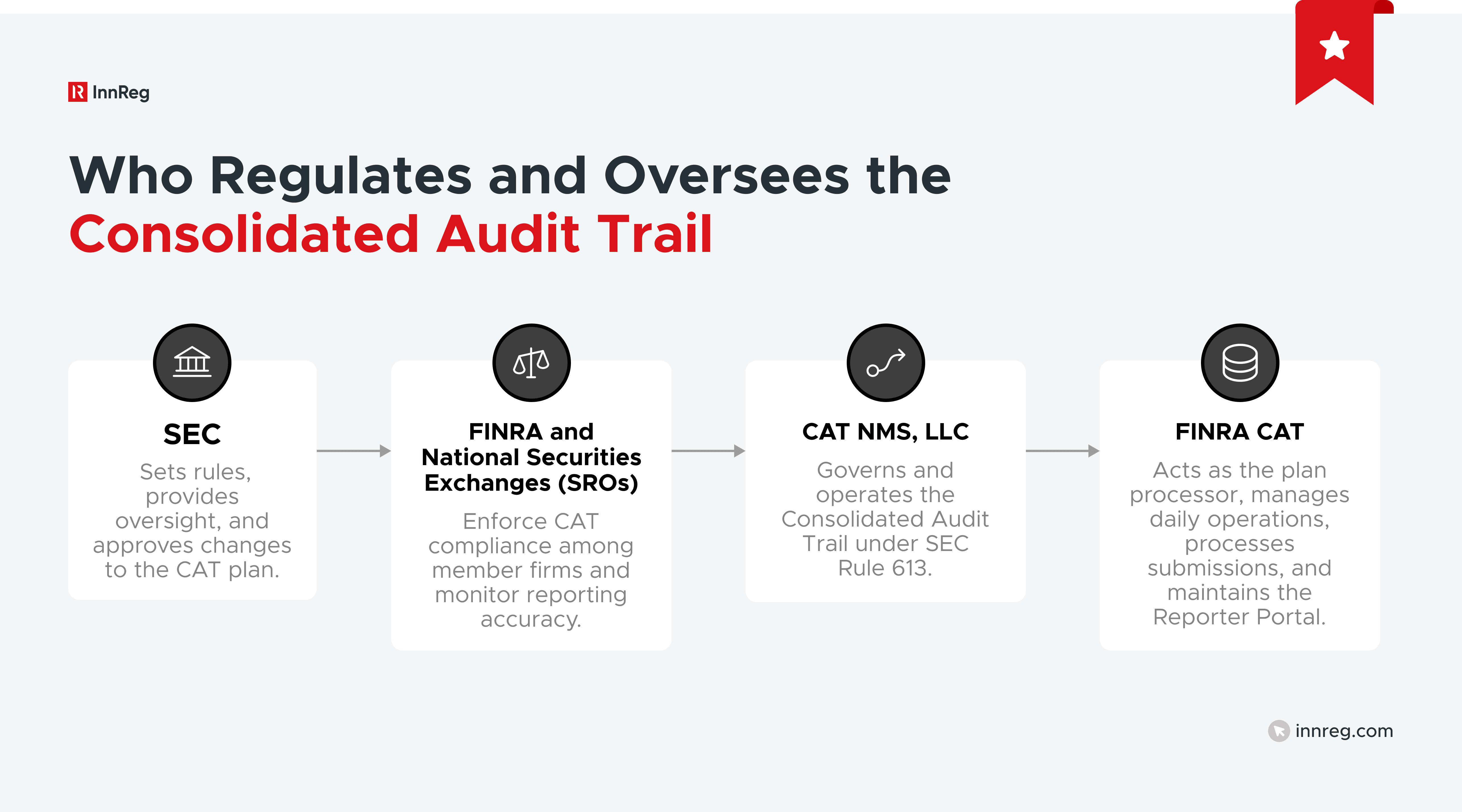

Who Regulates and Oversees the Consolidated Audit Trail

The CAT doesn’t run on its own. It’s managed through a coordinated effort between regulators and industry groups that each play a specific role.

Role of the SEC

The SEC is the architect behind the Consolidated Audit Trail. By adopting Rule 613, it required the creation of a single system that could capture equity and options activity across all US markets. Since then, the SEC has remained the top-level supervisor of how the CAT operates and evolves.

Its role covers several areas:

Rulemaking and policy direction: Setting the standards that define what must be reported, how data is structured, and how oversight works.

Oversight of self-regulatory organizations (SROs): Verifying that FINRA and the exchanges carry out their enforcement responsibilities fairly and consistently.

Plan approval and changes: Reviewing and approving any modifications to the CAT NMS Plan, including technical updates or cost allocations.

Market surveillance and investigations: Using CAT data to investigate unusual market activity, study systemic risks, and guide future policy decisions.

For firms, understanding the SEC’s role really matters. It defines what needs to be reported today and how those expectations might evolve.

Role of FINRA and the Exchanges

While the SEC sets the rules for the CAT, it’s FINRA and the national securities exchanges that handle day-to-day enforcement. These groups are known as self-regulatory organizations, which means they’re responsible for overseeing their members and confirming that CAT requirements are being met.

Their responsibilities include:

Monitoring submissions: Reviewing whether broker-dealers are reporting order events and customer information accurately and on time.

Identifying errors: Flagging reporting issues, inconsistencies, or missing data, and directing firms to make corrections.

Enforcement actions: Bringing cases when firms repeatedly fail to comply with CAT obligations, including fines or other disciplinary measures.

Industry guidance: Publishing notices, FAQs, and technical specifications to help firms interpret and meet reporting standards.

For compliance officers, this setup means your main point of contact for CAT compliance isn’t the SEC, but your firm’s primary SRO. These organizations are the ones that will send error feedback, request corrections, and review your reporting processes during regular exams.

CAT NMS, LLC and FINRA CAT as Plan Processor

The national securities exchanges and FINRA created CAT NMS, LLC to oversee and operate the Consolidated Audit Trail. It serves as the official body that manages the system under SEC Rule 613. All exchanges, along with FINRA, belong to this organization. This creates an interesting dynamic: the same entities that enforce CAT compliance also run the system itself.

To handle daily operations, CAT NMS, LLC appointed FINRA CAT as the plan processor. In this role, FINRA CAT handles the technical and administrative work that keeps the system running. It’s responsible for collecting order data, managing the CAIS, and processing submissions from broker-dealers and other reporting firms.

Key responsibilities of the plan processor include:

Operating the CAT Reporter Portal, where firms submit data

Managing data validation, error feedback, and corrections

Maintaining technical standards and documentation for the industry

Coordinating with SROs and the SEC on updates, enforcement, and governance

For compliance teams, FINRA CAT is the main point of contact. When firms submit reports, correct errors, or seek guidance, they work directly with the plan processor. CAT NMS, LLC sets the overall governance framework, but FINRA CAT handles the day-to-day operations that firms interact with most.

See also:

Scope of CAT Reporting Requirements

The Consolidated Audit Trail sets detailed obligations for broker-dealers and other market participants. These requirements define who must report, what information is covered, and how data must be submitted.

Covered Entities and Securities

The Consolidated Audit Trail covers nearly the entire securities industry. Every broker-dealer that’s a member of a national exchange or FINRA must report to the system. This includes large clearing firms and proprietary trading desks, as well as smaller brokers that handle everyday retail orders.

The scope of securities is just as broad. Reporting includes equities listed on US exchanges, listed options traded on options markets, and even over-the-counter (OTC) equity securities. By bringing together both exchange and off-exchange activity, the CAT gives regulators a unified view of almost all equity and options trading across the country.

Reportable Events in the Trade Lifecycle

The Consolidated Audit Trail is designed to capture every step of an order’s journey. That means firms must report not just executions, but the whole chain of events from the moment an order is created until it is either filled, modified, or canceled.

For compliance teams, this level of detail highlights why CAT data is so valuable to regulators. It allows them to see how orders move across firms and venues, how routing decisions are made, and where potential market manipulation could occur. For firms, it means that even small errors in reporting a single step can create inconsistencies once the lifecycle is pieced together.

Customer and Account Information (CAIS)

In addition to order events, the CAT requires firms to report customer and account data through CAIS. This part of the system links trades to the people or entities behind them, providing regulators with a complete view of market activity.

Firms have to submit details such as customer identifiers, account numbers, and key attributes, like whether an account is retail, institutional, or proprietary. This information helps regulators connect trading activity across different firms and venues, even when the same customer uses multiple brokers.

CAIS also requires updates when customer information changes. For example, if a firm opens a new account, modifies existing account data, or closes an account, that update must be reflected in CAT reporting. This adds an extra layer of operational responsibility since firms need internal processes to keep customer records consistent with their CAT submissions.

For compliance officers, CAIS is one of the more resource-intensive parts of CAT. It requires coordination between onboarding, account maintenance, and reporting teams. Getting this right is essential because gaps in customer data can undermine the value of the entire audit trail.

Linkages Across Venues and Firms

One of the defining features of the Consolidated Audit Trail is its ability to connect order events across different firms and trading venues. Orders often do not stay within a single broker or exchange. They are routed, modified, and sometimes executed in multiple places. Without linkages, regulators would see only fragments of activity.

The CAT solves this challenge by requiring firms to include identifiers that connect related events. This means an order that starts with a retail broker, moves through a routing firm, and ends up executed on an exchange can be tracked every step of the way.

From a compliance standpoint, these linkages are more than just a technical requirement. They’re what turn millions of individual reports into meaningful data for market surveillance. Regulators then rely on them to uncover patterns that might otherwise go unnoticed.

Submission Deadlines and Data Standards

The Consolidated Audit Trail follows strict reporting timelines. Firms need to submit their order events and customer information by 8:00 a.m. Eastern Time on the day after the activity happens. This rule covers every reportable event, and missing the deadline can lead to error reports and sometimes draw the attention of regulators.

Just as important are the data standards that define how submissions need to be formatted. Every record has to include key fields like timestamps, order identifiers, and customer information. These details have to be accurate and consistent. Even small mistakes, such as mismatched order IDs or incorrect timestamps, can break the reporting chain and lead to correction requests.

For chief compliance officers, the mix of tight deadlines and strict data standards means reporting processes have to be reliable and closely watched. Many firms use automated systems to manage submissions, but human oversight is still essential.

Need help with broker-dealer compliance?

Fill out the form below and our experts will get back to you.

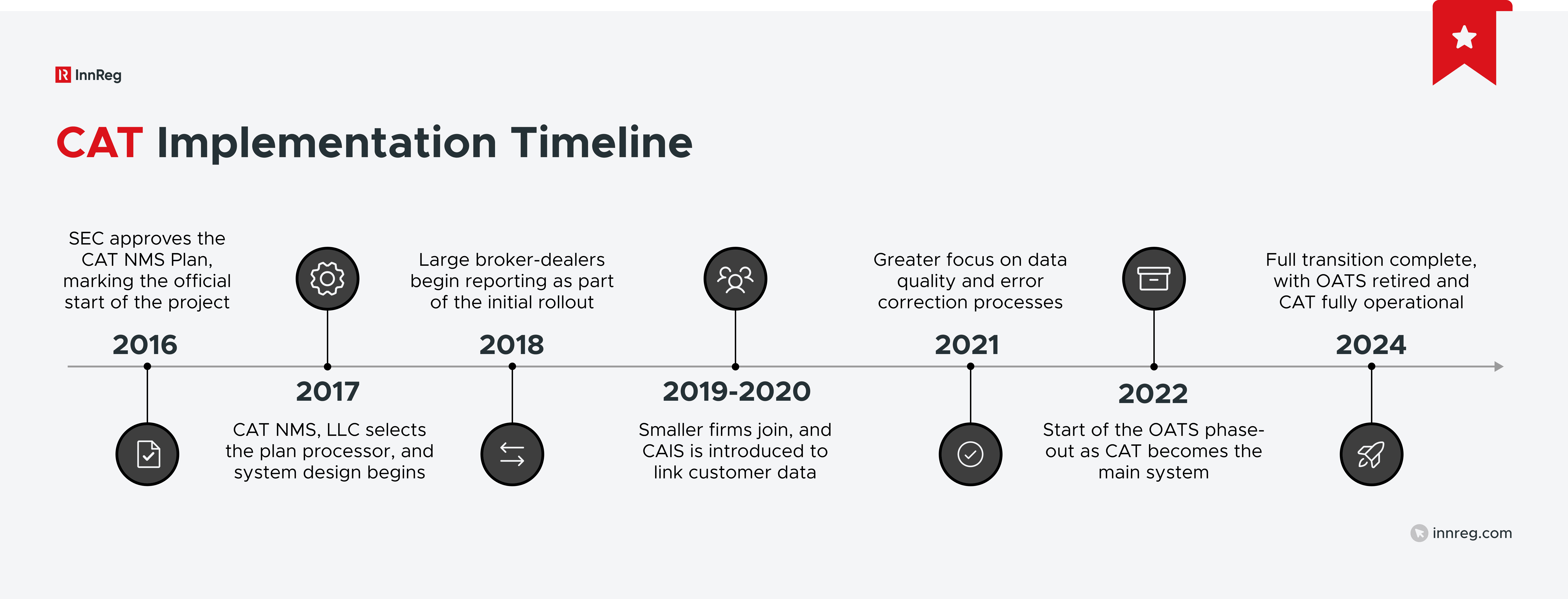

CAT Implementation Timeline

The Consolidated Audit Trail was not rolled out all at once. Regulators introduced it in stages, giving firms time to adapt to new reporting rules and technical requirements. Since the SEC approved Rule 613, the timeline has included years of planning, phased reporting milestones, and the eventual shift away from the older Order Audit Trail System (OATS).

Key Phases From 2016 to 2024

The rollout of CAT stretched across several years. Each phase expanded the scope of reporting and added technical requirements that firms had to meet.

2016: SEC approval of the CAT NMS Plan

The SEC gave formal approval to the CAT NMS Plan, requiring exchanges and FINRA to move forward with building a single system to track order and trade data. This decision set the entire project into motion.

2017: Plan processor selected

CAT NMS, LLC appointed a plan processor to design and operate the system. This marked the shift from concept to actual infrastructure development.

2018: Large broker-dealers begin reporting

The first wave of firms, primarily large broker-dealers, were required to start submitting order and trade data for equities and options. These firms served as the initial test group for the system.

2019-2020: Expansion and CAIS introduction

Reporting obligations extended to smaller firms, bringing nearly all broker-dealers into scope. During this period, CAIS was introduced, linking orders to customer data and adding significant complexity to reporting.

2021: Data validation and corrections

Regulators placed more focus on data quality. Firms had to manage error feedback and corrections through the CAT Reporter Portal, which increased operational demands on compliance and reporting teams.

2022: Start of OATS phase-out

With CAT established, regulators began winding down reliance on OATS. This signaled confidence that CAT could serve as the primary record of equity and options market activity.

2024: Full transition to CAT

OATS was officially retired, and CAT became the sole system for order and trade reporting. For firms, this marked the point where all compliance obligations related to order reporting now flow through a single framework.

For compliance professionals, this phased rollout shows why CAT requirements are so detailed today. Each stage added new layers of reporting to close gaps, strengthen data quality, and make the system capable of supporting full market surveillance.

Transition From OATS to CAT

Before the Consolidated Audit Trail, regulators relied on OATS to track equity orders. OATS was introduced in the late 1990s, providing FINRA with visibility into order handling, but it had significant limitations. It covered only equities, did not include options, and could not connect data across multiple venues. As trading became faster and more complex, these gaps became more obvious.

CAT was designed to replace OATS by capturing a complete view of equity and options markets in one system. The transition happened gradually. For several years, firms had to report into both systems, which added to their workload but gave regulators a chance to confirm that CAT data was reliable. In 2024, CAT became the sole source of order audit data.

Cost and Funding of the Consolidated Audit Trail

Building and maintaining the Consolidated Audit Trail is an expensive undertaking. The system handles billions of records every day, which takes advanced technology, strong security, and constant oversight. The costs are shared across the industry, but exactly how those costs should be divided has been a topic of debate since the project first started.

How Costs Are Shared Across Firms

The CAT runs on a shared funding model. Self-regulatory organizations cover the costs first, then pass them on to their member firms, which means both broker-dealers and exchanges share in these expenses.

Larger firms usually pay more because their higher trading volumes create more reporting work for the system. Smaller firms still contribute, but their costs are scaled to match their activity levels.

Current Debates on Funding Models

The way CAT is funded has sparked ongoing industry debate. Some firms argue that the current structure places too much weight on broker-dealers, especially smaller players that lack the resources of large institutions. Others contend that exchanges should cover a greater share since they benefit from having a consolidated system that strengthens market integrity.

Regulators and industry groups continue to review proposals for alternative funding models, including volume-based assessments, fixed fees, or hybrid approaches. While no single approach has satisfied all stakeholders, the debate reflects a broader tension: balancing the cost of regulation against the need for fair competition across firms of different sizes.

Practical CAT Compliance Workflow

Staying compliant with the Consolidated Audit Trail takes more than just sending in reports. It’s an ongoing process that involves coordination, accuracy, and teamwork across different parts of the firm.

Order Management Systems and Data Capture

The Consolidated Audit Trail starts with how firms manage orders in their own systems. Most of the required data comes from order management and execution management systems. These tools capture every step in the process, whether an order is entered, routed, changed, or canceled. Each event needs to be recorded with accurate timestamps and identifiers to keep the reporting complete and reliable.

For most firms, meeting CAT requirements means building them into existing technology workflows. Some rely on third-party vendors, while others use their own platforms. In either case, the goal is the same: to capture every required detail in the proper format. That includes order IDs, customer information, and timestamps accurate to the millisecond.

Compliance teams also play a critical role. They work closely with technology and operations teams to confirm that systems are capturing data correctly. Regular testing, ongoing reviews, and good coordination across departments help prevent gaps that could later turn into reporting errors.

See also:

Submitting Through the CAT Reporter Portal

Once order data is captured internally, firms must submit it to regulators through the CAT Reporter Portal. This portal, managed by FINRA CAT, is the official entry point for all submissions.

Submitting data to the Consolidated Audit Trail is more than just uploading files. Each file has to meet strict formatting and validation standards before it’s accepted. Most firms use automated systems to prepare and send their reports, but compliance and operations teams still need to keep an eye on the results.

The Reporter Portal is also where firms manage corrections, review data quality reports, and find guidance from FINRA CAT. In many ways, it serves as both a submission platform and a compliance hub, making it a central part of the overall reporting process.

Managing Error Feedback and Corrections

After firms file their reports, they receive feedback from the CAT Reporter Portal showing whether their submissions were accepted or flagged with errors. These errors can include missing fields, mismatched identifiers, or timing inconsistencies.

That feedback marks the start of the next step: managing and correcting the errors. Firms need to review the reports daily, identify what went wrong, and make updates quickly. Some issues can be fixed through resubmissions, while others may require coordination across teams to align customer data, timestamps, or order IDs. The goal is not just to correct mistakes but to prevent them from happening again.

Because this review process never really stops, error management has become one of the most demanding parts of CAT compliance. It takes strong collaboration between technology, operations, and compliance teams.

Internal Recordkeeping Obligations

In addition to reporting to the Consolidated Audit Trail, firms must keep internal records that match what they submit. These records act as the firm’s own audit trail, helping compliance teams confirm what was reported and respond if regulators ask for supporting information.

Recordkeeping includes order details, customer information, and any changes or corrections made after reports are filed. Firms are expected to store this information in a way that can be easily retrieved during an exam or inquiry. In practice, this often requires coordination between compliance, operations, and technology teams to maintain one consistent version of the data.

Firms also need a process for reconciling their internal records with what was reported to the CAT. If discrepancies go unresolved, they can raise red flags during regulatory reviews.

CAT vs. Other Reporting Systems (OATS, EBS)

Feature | OATS | EBS | CAT |

|---|---|---|---|

Scope | Equity orders only | Equity and options, but only on request | Equities and options across all venues |

Frequency | Daily reporting | Ad hoc, when regulators request data | Daily reporting by all broker-dealers |

Coverage | Broker-dealers reporting equities | Broker-dealers reporting equities Firms responding to investigations | All broker-dealers in equities and options |

Limitations | No options, no cross-venue linkages | Not continuous, depends on regulatory use | Comprehensive, linked, and ongoing reporting |

The two most relevant comparisons are with the Order Audit Trail System and the Electronic Blue Sheets (EBS) program.

CAT vs. OATS: OATS, launched in the late 1990s, required broker-dealers to report equity order data. It improved visibility but applied only to equities and lacked the ability to track orders across venues. CAT goes further by covering both equities and options, and it requires linkages that connect orders as they move between firms and markets.

CAT vs. EBS: EBS is a request-based system where firms provide customer and trade data when regulators ask for it. It is useful for investigations but does not provide ongoing surveillance. CAT changed that by collecting daily submissions from all reporting firms, giving regulators a consolidated and continuous view of market activity.

This shows that CAT is not just an update of past systems. It represents a shift to comprehensive, near real-time oversight that touches every broker-dealer active in the US equity and options markets.

Global Context and Comparisons

The Consolidated Audit Trail is not the only system of its kind. Other markets, especially in Europe, have their own frameworks for monitoring trading activity.

Similarities to MiFID II in Europe

The Consolidated Audit Trail and MiFID II in Europe share the same goal: giving regulators a clear, unified view of trading activity across complex and fragmented markets. Both frameworks are designed to strengthen market integrity, increase transparency, and help identify abusive practices like spoofing or insider trading.

Like the CAT, MiFID II also requires firms to record and report detailed order and transaction data. Both systems call for timestamps, customer identifiers, and linkages that let regulators trace the full lifecycle of a trade.

They also share a similar focus on cross-venue visibility. In Europe, MiFID II reporting covers trading venues, systematic internalizers, and over-the-counter activity, much like the CAT covers exchanges, alternative trading systems, and broker-dealer activity in the United States.

What Makes the US CAT Unique

While many markets around the world have their own transaction reporting frameworks, the Consolidated Audit Trail stands out for its scope and design. Unlike systems that focus only on completed trades, the CAT captures the entire order lifecycle. This creates a much richer dataset than models that record only trade-level details.

Another feature that makes the CAT unique is its integration of customer and account information. Through CAIS, regulators can directly link trading activity to the customers and accounts behind it. This gives the US approach a broader reach than many global systems, which often stop at trade data.

The sheer scale of the CAT also sets it apart. It processes billions of records every day across equities and options, making it one of the largest regulatory reporting systems in the world. Its design reflects the complexity of US markets, where orders can move quickly between exchanges, alternative trading systems, and broker-dealers.

See also:

Recent Updates and Enforcement Trends

The Consolidated Audit Trail is still evolving as regulators tighten standards and increase oversight. Recent updates and enforcement actions show how data quality and reporting accuracy are becoming bigger priorities for the SEC and FINRA.

FINRA’s First CAT Enforcement Actions

FINRA has already begun taking action against firms that fall short on Consolidated Audit Trail reporting obligations. These early enforcement cases signal that regulators are moving past the initial rollout phase and now expect firms to meet the rules with consistency.

The first actions focused on firms that submitted incomplete or inaccurate data, missed reporting deadlines, or failed to correct errors flagged through the CAT Reporter Portal. In some cases, the issues stretched over long periods, suggesting weaknesses in internal controls or oversight of reporting processes. FINRA responded with fines and public settlements, highlighting that CAT compliance is now a standing enforcement priority.

Examinations and Risk Monitoring Priorities

Regulators now treat Consolidated Audit Trail reporting as a standard part of examinations. During routine reviews, FINRA and the SEC evaluate not only whether firms submit data on time but also whether their internal controls support consistent reporting.

Risk monitoring has also become a priority. Regulators are using CAT data to identify patterns of potential misconduct such as layering, spoofing, or suspicious cross-venue trading. This means firms may face follow-up inquiries triggered by CAT data, even if their own submissions are technically correct.

Industry Debates on Funding and Scope

Since its launch, the Consolidated Audit Trail has faced ongoing debate within the industry about how it should be funded and how far its scope should reach. Smaller broker-dealers often argue that the current funding model puts a disproportionate burden on them, while larger firms contend that costs should be shared more evenly.

There are also questions about scope. Some firms and trade groups believe CAT collects more data than is necessary for effective surveillance, especially when it comes to sensitive customer information. Privacy, data security, and the potential for breaches are frequently raised in public comment letters and industry forums.

Regulators have acknowledged these concerns but maintain that CAT’s breadth is essential for monitoring today’s complex markets. While no final alternative has been adopted, it is clear that both cost allocation and data scope will remain central points of debate.

—

The Consolidated Audit Trail is now one of the cornerstones of US securities regulation. What began with SEC Rule 613 has grown into the most comprehensive reporting system ever applied to equity and options markets. It captures the full lifecycle of orders, links activity across venues, and connects trades to customer and account data in ways that older systems like OATS and EBS could not.

For firms, CAT compliance is both a technical and an operational responsibility. It touches order management, data quality, error correction, and recordkeeping, all under strict deadlines. Enforcement actions and examination priorities also make clear that regulators expect accuracy, timeliness, and strong internal processes.

How Can InnReg Help?

InnReg is a global regulatory compliance and operations consulting team serving financial services companies since 2013.

We are especially effective at launching and scaling fintechs with innovative compliance strategies and delivering cost-effective managed services, assisted by proprietary regtech solutions.

If you need help with broker-dealer compliance, reach out to our regulatory experts today:

Last updated on Jan 16, 2026