Broker-Dealer Regulation Guide 2026

Jan 27, 2026

·

10 min read

Contents

Broker-dealer regulation remains one of the most critical areas for fintechs entering the US financial markets in 2026.

Whether a firm is building a trading platform, integrating alternative assets, or experimenting with new digital products, its model may trigger regulatory obligations that are both complex and business-critical.

Understanding where broker-dealer rules apply, and how to address them early, can make the difference between a smooth launch and costly delays.

This guide offers a practical overview of broker-dealer regulation for fintech companies, outlining the roles of key regulators, breaking down core compliance requirements, highlighting recent developments, and addressing common challenges fintechs face when entering this space.

At InnReg, we help broker-dealers and fintech innovators navigate complex regulatory obligations with practical, experience-driven compliance support. Contact us to learn more.

What Broker-Dealer Regulation Means in 2026

A broker-dealer is a firm or individual engaged in the business of buying and selling securities for clients, for its own account, or both. In practice, this covers a wide range of activities, from executing stock trades on behalf of retail investors to structuring private placements.

US law defines broker-dealer activity broadly, and the SEC focuses on what the business does rather than how it describes itself.

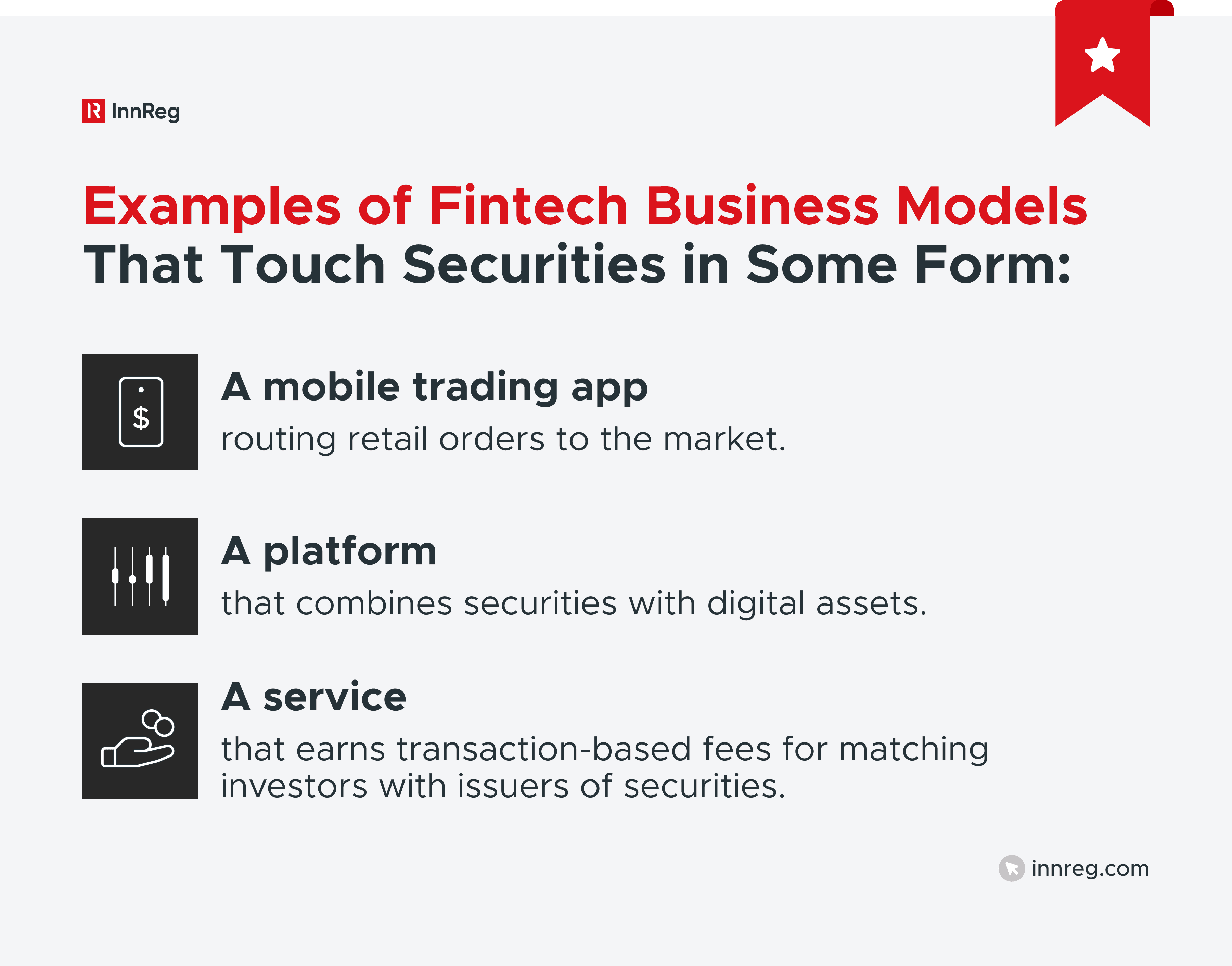

For fintechs, this means that offering products and services like fractional share trading, tokenized assets, or alternative investment marketplaces may qualify as broker-dealer activity. Once a company falls under that definition, broker-dealer regulation applies in full.

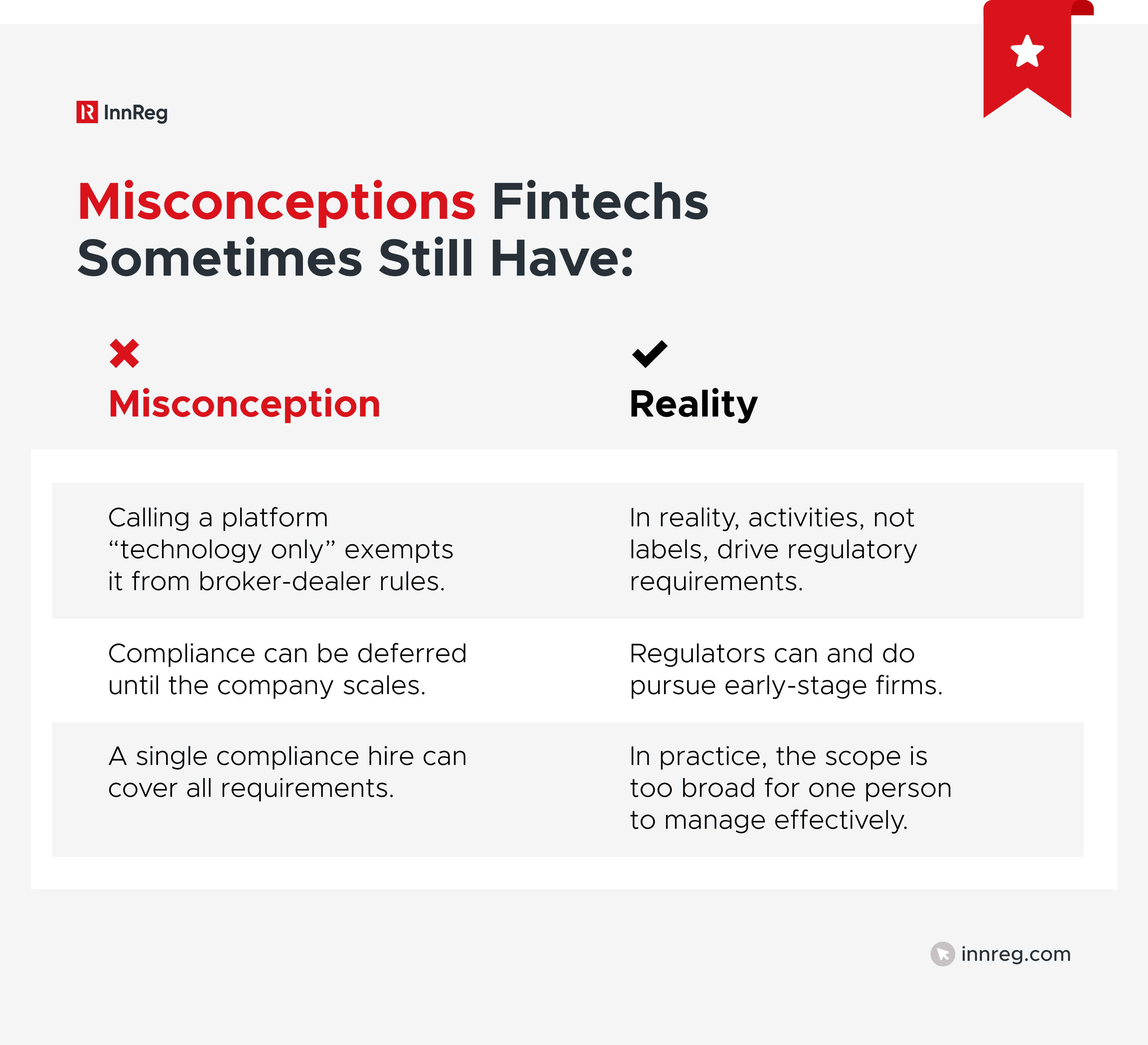

Startups sometimes underestimate how quickly innovation overlaps with regulated activity. The label “technology platform” does not exempt a business if it performs functions that regulators associate with securities brokerage.

Learn about broker-dealer registration →

Key Regulators Overseeing Broker-Dealer Regulation

Broker-dealer regulation in the United States is primarily enforced at the federal level, but oversight involves multiple bodies. Each plays a distinct role in protecting investors and supervising firms.

The key regulators are:

Securities and Exchange Commission (SEC): The SEC is the federal authority that oversees the registration and conduct of broker-dealers. Any firm “engaged in the business of effecting transactions in securities” must register with the SEC unless a narrow exemption applies. The SEC’s focus is on investor protection and market integrity. It requires firms to disclose their business practices, maintain financial stability, and comply with anti-fraud laws.

Financial Industry Regulatory Authority (FINRA): FINRA is a self-regulatory organization that operates under SEC oversight. All broker-dealers that interact with the public must become FINRA members. Once admitted, firms are subject to FINRA’s detailed rulebook, covering supervision, sales practices, recordkeeping, and licensing of individual representatives. FINRA also examines broker-dealers regularly and has disciplinary authority when rules are violated.

State Regulators and “Blue Sky” Laws: Although SEC and FINRA registration covers most obligations, broker-dealers must also comply with state-level requirements. State securities regulators can impose additional registration, reporting, and fee obligations. These are known as “blue sky” laws, and while they vary across jurisdictions, they can add operational complexity for firms doing business nationwide.

SIPC and Customer Protection: SIPC provides limited protection to customers, currently up to $500,000 per account, in the event a brokerage fails. This membership does not protect against investment losses but adds a layer of security for client funds and securities.

Core Broker-Dealer Compliance Requirements

Broker-dealer regulation extends beyond registration. Once approved, firms must maintain compliance across several areas that regulators monitor closely.

For fintech companies, these requirements often shape both the business model and the operational setup:

Registration and Licensing Process

Registering as a broker-dealer requires filing Form BD and applying for FINRA membership. Firms must disclose ownership, business activities, supervisory procedures, and financial details. Principals and representatives also need to pass qualification exams.

The process is detailed and can take several months, making it a critical planning point for any fintech considering this path.

Additional resources: | |

|---|---|

| |

Net Capital and Financial Responsibility Rules

The SEC’s Net Capital Rule (Rule 15c3-1) requires broker-dealers to maintain minimum net capital based on their activities.

Clearing firms must hold higher amounts than introducing firms. Regulators also expect firms to manage liquidity daily to meet obligations.

Failing to meet capital requirements can result in immediate restrictions, which is why financial and operational planning are closely tied to compliance.

Customer Protection

The Customer Protection Rule (Rule 15c3-3) requires broker-dealers holding customer funds or securities to segregate assets and maintain a reserve account.

Amendments adopted in 2024 will require some firms to perform these reserve calculations daily, with compliance deadlines extending into 2026.

For fintechs, this often means building systems capable of handling more frequent reconciliations.

Books, Records, and Reporting

Broker-dealers must maintain accurate records of transactions, communications, and customer information. Rules specify retention periods, formats, and tamper-proof requirements for electronic records.

Firms are also required to submit periodic financial and operational reports. For fintechs, building compliant data systems early is far more efficient than retrofitting them later.

See also:

Written Supervisory Procedures (WSPs) and Governance

Every broker-dealer must adopt written supervisory procedures (WSPs) tailored to its business model. These procedures outline how the firm monitors trades, reviews communications, approves accounts, and handles customer issues.

A Chief Compliance Officer (CCO) and qualified principals must be designated, with their responsibilities clearly defined and assigned. Regulators expect WSPs to evolve in tandem with the firm’s products, technologies, and associated risks.

See how InnReg helps broker-dealers create compliance programs →

Need help with broker-dealer compliance?

Fill out the form below and our experts will get back to you.

Standards of Conduct and Customer Protections

Broker-dealer regulation is not only about capital and reporting obligations, but also about governing how firms interact with clients. These standards are central to investor protection and are regularly reviewed by both the SEC and FINRA.

Regulation Best Interest (Reg BI)

Since 2020, broker-dealers recommending securities to retail investors must follow Regulation Best Interest.

This rule requires that recommendations put the client’s interests ahead of the firm’s.

It also expands on the older suitability standard by demanding that conflicts be identified, disclosed, and mitigated. For fintech platforms, this applies whether recommendations come from human representatives or automated tools.

CTA: Learn more about Reg BI and the fiduciary standard →

Suitability and KYC

Broker-dealers must also meet suitability obligations by collecting and updating customer information as part of their Know Your Customer (KYC) process.

This includes details such as financial status, investment experience, objectives, and risk tolerance.

Suitability reviews are essential for determining whether recommendations are appropriate.

Advertising and Communication Rules

FINRA Rule 2210 requires broker-dealers to keep all communications fair, balanced, and not misleading.

This includes content on websites, mobile apps, emails, and social media.

For fintechs, where much of the client experience is digital, this requirement often extends to interface design, marketing copy, and even push notifications. All materials must be approved, archived, and supervised.

Anti-Money Laundering and KYC Obligations

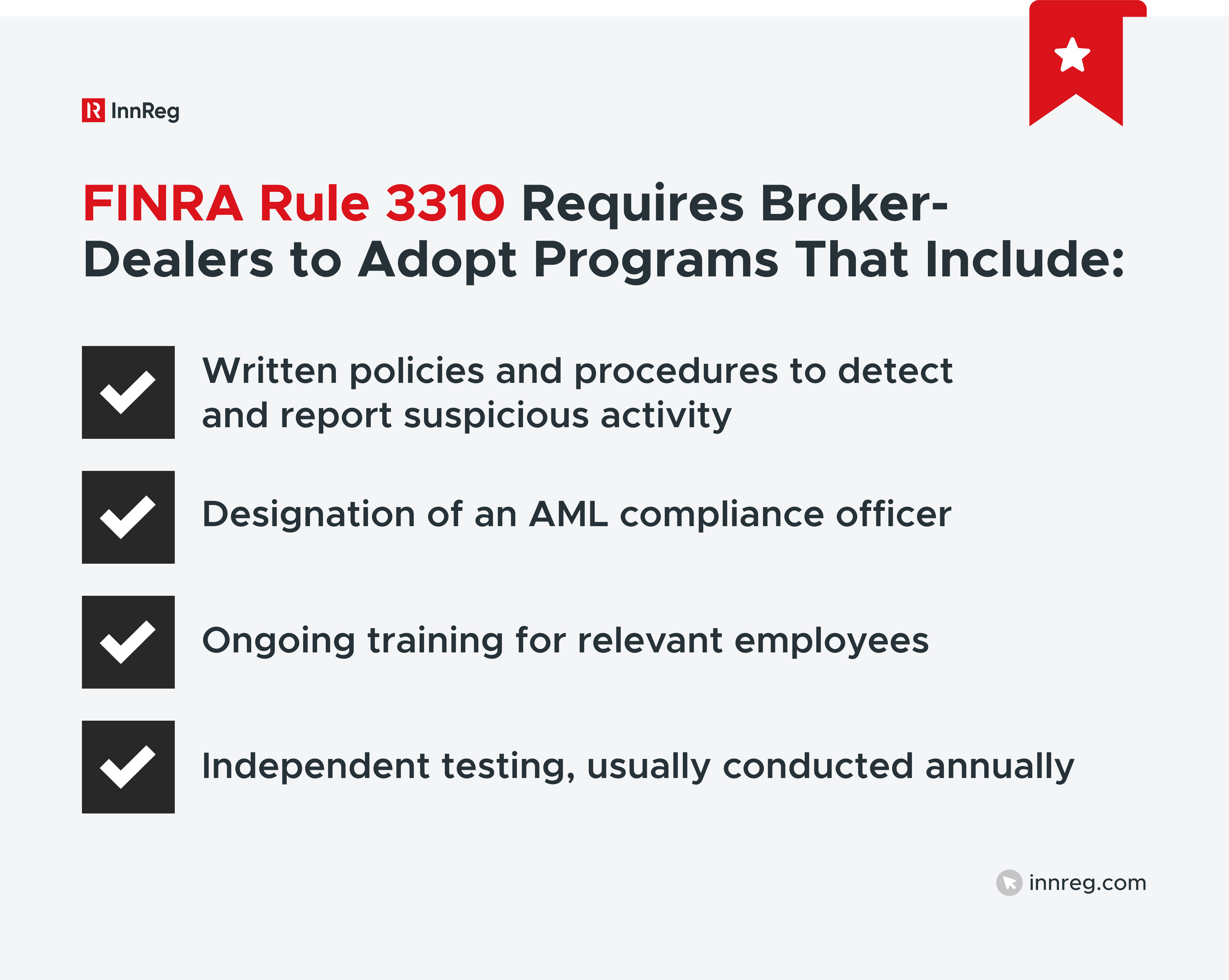

Broker-dealer regulation also covers obligations under the Bank Secrecy Act and related anti-money laundering (AML) laws. Every broker-dealer must have a written AML program that fits its business model and is tested annually.

AML Program Components

Learn how to create an effective AML compliance program →

Customer Identification Program (CIP)

Broker-dealers must verify customer identities at account opening.

This involves collecting basic information, such as name, date of birth, address, and identification number, and validating it against reliable sources.

CIP rules also require screening against government watchlists. In practice, fintech firms often integrate digital KYC tools to meet this obligation.

Learn more about KYC compliance best practices →

Suspicious Activity Monitoring and Reporting

Beyond onboarding, broker-dealers must monitor transactions for red flags of money laundering or fraud (AML transaction monitoring).

If and when suspicious activity is detected, a Suspicious Activity Report (SAR) must be filed with FinCEN. Firms are also required to submit Currency Transaction Reports (CTRs) for cash transactions over $10,000. For fintechs, automated transaction monitoring systems can help flag unusual activity, but human review remains necessary.

See how InnReg helps fintechs build and refine their suspicious activity monitoring programs →

Technology, Cybersecurity, and Third-Party Risks

Technology is at the core of most fintech broker-dealer models. Regulators expect firms to maintain robust systems for data protection, cybersecurity, and oversight of third-party vendors. Weak controls in any of these areas can quickly become compliance failures.

Data Security Expectations

Broker-dealers are required to protect customer data under SEC Regulation S-P and related FINRA guidance.

Expectations include encryption, strong access controls, multi-factor authentication, and documented incident response plans.

For fintechs, this means designing platforms with compliance in mind from the earliest development stages.

Learn about the FINRA cybersecurity checklist →

AI, Algorithms, and Automated Trading Oversight

Firms using algorithms or AI in trading, risk assessment, or customer recommendations are expected to supervise those tools just as they would human staff.

This involves testing models for errors, monitoring outcomes, and preventing market manipulation.

Regulators have emphasized that “black box” models without oversight are unacceptable.

Vendor and Cloud Service Oversight

Most fintech broker-dealers rely on third parties for functions such as cloud hosting, KYC solutions, or order management systems. Regulators hold firms responsible for the risks those vendors introduce.

Effective oversight means:

Performing due diligence before onboarding a vendor

Reviewing service-level agreements for compliance obligations

Vendor management and documenting oversight activities

Startups often underestimate this requirement. Yet vendor risk management is now a recurring theme in FINRA’s annual priorities, making it an area fintechs cannot afford to ignore.

Emerging Areas in Broker-Dealer Regulation

Broker-dealer regulation continues to evolve as financial products and technologies change.

Several areas are drawing heightened attention from regulators in 2026:

Extended-Hours and Overnight Trading Risks: Offering trading outside regular market hours is increasingly common among fintech apps. However, it carries risks such as lower liquidity, wider spreads, and increased volatility. FINRA requires broker-dealers to disclose these risks clearly and to maintain supervisory procedures tailored to extended-hours trading.

Crypto and Digital Asset Securities: Digital assets remain a gray zone, but the SEC has consistently taken the position that many tokens qualify as securities. Broker-dealers engaging with tokenized securities must comply with the same rules as for traditional securities, including custody and reporting requirements. FINRA also expects firms to notify it of any crypto-related business activities.

Crowdfunding and “Finders:” If you're building a platform that brings together issuers and investors, you need to figure out whether you're operating as a broker-dealer. It's not always obvious. Regulation Crowdfunding gives you a clear path if you want to be a funding portal, but plenty of business models don't fit neatly into that box.

The SEC has been cracking down on unregistered "finders," people who connect companies with investors without proper registration. They've brought several enforcement actions, and it's become a real minefield for startups. You might think you're just making introductions, but the SEC could see it differently. Getting this wrong early on can derail your entire business.

Broker-Dealer vs. Investment Adviser Distinctions: Fintech firms often blur the line between brokerage and advice. Broker-dealers execute transactions and are generally paid per trade, while Registered Investment Advisers (RIAs) provide advice and are compensated through fees. Some business models may require dual registration.

Common Compliance Challenges for Fintech Broker-Dealers

Even with strong planning, fintech broker-dealers often face recurring challenges once operations begin.

These issues reflect the tension between fast-moving product development and the slower pace of regulatory requirements:

Registration Timelines and Costs

The broker-dealer registration process can take several months to complete. Preparing the application, responding to regulator questions, and meeting financial requirements all demand resources.

For early-stage fintechs, underestimating these timelines often results in delayed product launches and investor commitments.

Building a Compliance Program from Scratch

Once approved, firms must maintain ongoing compliance across capital, supervision, and reporting requirements.

Designing a program from the ground up takes both expertise and infrastructure.

Broker-dealers who wait until after approval to focus on operations often find themselves scrambling to meet regulatory obligations and establish proper controls after the fact.

InnReg helps broker-dealers in building compliance programs →

Managing Vendor and Partner Risk

Most fintechs depend on third-party vendors for technology, custody, or client onboarding. Regulators expect broker-dealers to monitor those vendors as if they were part of the firm.

Weak oversight can create gaps that draw regulatory scrutiny. Where Vendor management may have seemed optional in the past, it is now part of standard compliance examinations.

Misconceptions Fintech Often Have

These misconceptions add risk if left unaddressed. For fintechs, clarity around obligations and realistic planning are key to avoiding costly course corrections.

Broker-Dealer Regulation: Turning Requirements into Action

Understanding broker-dealer regulation is one step. Deciding how to act on it is the next. Fintechs must evaluate whether their business model requires licensing, explore alternative options, and integrate compliance into their operations from the outset.

1. Deciding Whether You Need a Broker-Dealer License

The decision depends on activities and the revenue model. If the company executes trades, routes orders, or receives transaction-based compensation, registration as a broker-dealer is usually required.

Many companies also consider buying a broker-dealer. However, acquiring an existing broker-dealer is not necessarily faster than registering a new one and may introduce additional risks.

Read our article if you are thinking about buying a broker-dealer →

2. Considering Alternatives: Partnerships or Outsourcing

Not every fintech needs to operate its own broker-dealer. Partnering with an established firm or outsourcing compliance functions can be more cost-effective, particularly in the early stages.

This approach provides startups with access to regulatory infrastructure without requiring them to immediately assume the full burden of operating as a licensed broker-dealer.

InnReg helps broker-dealers by providing outsourced compliance support that functions as an extension of their teams. Contact us to learn more.

3. Building Compliance Into Product Design and Operations

Whether licensing directly or working through a partner, compliance must be integrated into daily operations. That means embedding controls into technology, aligning onboarding with KYC requirements, and setting up workflows for recordkeeping and supervision.

Firms that plan for compliance early avoid costly redesigns later.

Learn how InnReg helps broker-dealers develop regulatory and product strategy →

See also:

—

In 2026, broker-dealer regulation plays a decisive role in determining how fintech firms can operate in US markets.

The rules are broad and constantly evolving, but they exist to protect investors and maintain market integrity.

For fintechs, the key is understanding how these regulations apply to specific business models and planning for compliance from the outset.

How Can InnReg Help?

InnReg is a global regulatory compliance and operations consulting team serving financial services companies since 2013.

We are especially effective at launching and scaling fintechs with innovative compliance strategies and delivering cost-effective managed services, assisted by proprietary regtech solutions.

If you need help with broker-dealer compliance, reach out to our regulatory experts today:

Last updated on Jan 27, 2026