What Is a BitLicense? Understanding NY's Crypto Regulation

Jan 13, 2026

·

17 min read

Contents

New York’s crypto industry is expected to reach new heights as the US crypto market hits US$16.1 billion in 2025. For regulators, this growth puts the state’s cryptocurrency framework in the spotlight. The BitLicense remains one of the most comprehensive and heavily scrutinized crypto licensing regimes in the United States.

Whether you’re a money transmitter, crypto exchange, stablecoin issuer, or fintech startup offering digital asset services, understanding what this license covers is essential before entering the New York market.

This article breaks down the BitLicense in plain terms: what it is, who needs it, and how it works in practice. It also explains how the BitLicense compares to other regulatory paths. You’ll find detailed sections on capital, AML, cybersecurity, recordkeeping, and more, as well as insight into how the New York Department of Financial Services (NYDFS or DFS) enforces compliance.

For fintechs building innovative crypto solutions, this guide aims to make New York’s requirements structured and practical. That said, let’s explore…

InnReg is a global regulatory compliance and operations consulting team serving financial services companies since 2013. If you need assistance with compliance or fintech regulations, click here.

What Is a BitLicense?

The BitLicense is a regulatory license issued by the NYDFS for businesses conducting virtual currency business activity with New York residents. It was introduced in 2015 under 23 NYCRR Part 200, following the early expansion of digital asset markets and the need for a clear state-level framework.

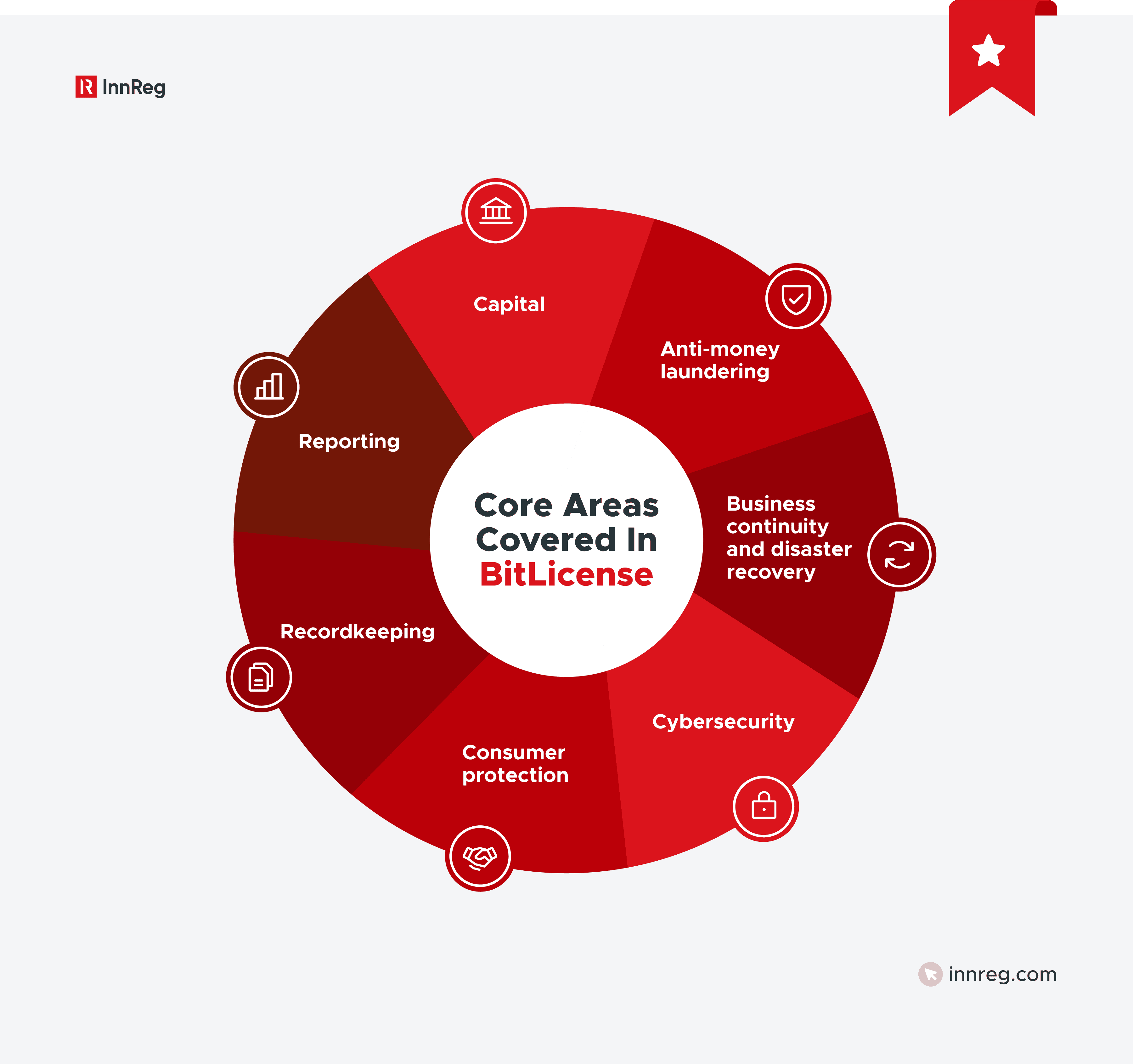

The framework is designed to bring digital asset activities under a compliance structure similar to traditional financial institutions, focusing on areas such as:

Capital adequacy

Anti-money laundering

Cybersecurity

Consumer protection

Recordkeeping

Each licensee is subject to regular examinations and ongoing supervision by the NYDFS.

Who Needs a BitLicense (and Who Doesn’t)?

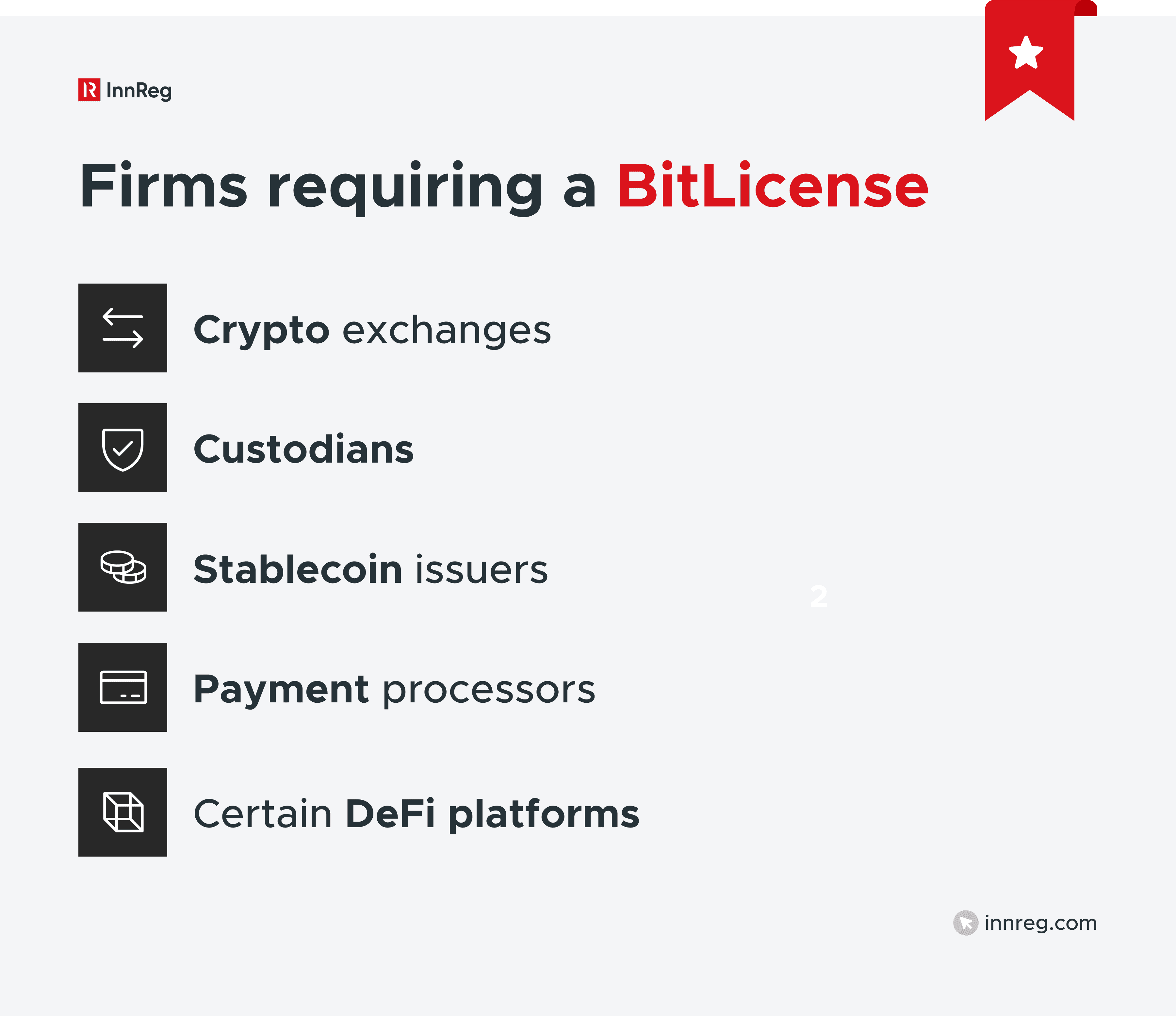

In practical terms, the BitLicense covers companies that store, transmit, buy, sell, or issue virtual currency as a business.

The BitLicense applies to companies engaged in “virtual currency business activity” with individuals or entities in New York or involving New York residents. This includes both firms headquartered in the state and those offering services remotely to New York customers.

Under 23 NYCRR Part 200.2(q), virtual currency business activity includes:

Receiving virtual currency for transmission or transmitting it

Buying and selling virtual currency as a customer business

Performing exchange services between virtual currency and fiat or other virtual currencies

Controlling, administering, or issuing a virtual currency

Storing, holding, or maintaining custody of customer assets in digital form

Companies that, under the conditions previously mentioned, perform any of these functions, even partially, typically need to obtain a BitLicense.

Exemptions

The NYDFS outlines specific activities that are exempt from BitLicense requirements:

Merchants and consumers who use virtual currency solely to buy or sell goods and services.

Software developers and technology providers who create tools without directly handling customer funds.

Chartered entities such as banks or trust companies already under DFS supervision may conduct virtual currency activities with DFS approval instead of holding a BitLicense.

These exemptions highlight the DFS’s intent: the BitLicense targets financial intermediaries, not technology creators or everyday users. Still, the boundaries can be nuanced. For example, a wallet provider that gains control over users’ private keys could fall back into licensing territory.

New York’s BitLicense vs. Limited-Purpose Trust Charter

New York offers two primary pathways for companies seeking to operate in the virtual currency space:

The NYDFS oversees both, but they differ in scope, supervision, and strategic fit, depending on a company’s business model.

The BitLicense is generally suited for fintech and crypto firms that facilitate virtual currency transactions without taking on traditional fiduciary duties. It allows companies to conduct virtual currency business activity under 23 NYCRR Part 200 while being subject to ongoing compliance, cybersecurity, and capital requirements.

Here’s how they compare at a glance:

Feature | BitLicense | Limited-Purpose Trust Charter |

|---|---|---|

Regulatory Basis | 23 NYCRR Part 200 | New York Banking Law |

Issued By | NYDFS Virtual Currency Unit | NYDFS Banking Division |

Best For | Exchanges, wallet providers, payment processors, stablecoin issuers (in limited cases; depends on structure and reserve model) | Custodians, institutional crypto firms, stablecoin issuers (common path; required for fiat-backed stablecoins due to fiduciary/custodial obligations), and entities needing fiduciary powers |

Fiduciary Authority | No | Yes |

Capital Requirements | Risk-based, per NYDFS determination | Higher, bank-like capital requirements |

Supervision | NYDFS ongoing exams and reporting | Banking Law examinations and governance oversight |

Complexity and Cost | Lower relative to a trust charter | Higher due to chartering and governance obligations |

Both paths require substantial compliance infrastructure. The difference lies in how much regulatory depth and operational flexibility a company needs. Firms handling institutional custody or offering complex asset services may prefer the trust charter, while others may opt for the BitLicense for faster market access with narrower obligations.

BitLicense Core Requirements

The BitLicense framework sets detailed compliance expectations across several operational areas. These requirements are designed to align crypto businesses with the same level of rigor expected of traditional financial institutions, with NYDFS oversight covering everything from capitalization to recordkeeping.

Each BitLicense holder must demonstrate that its operations are financially sound, transparent, and resilient to compliance and cybersecurity risks. The core areas include the following:

Capital

NYDFS requires each BitLicensee to maintain sufficient capital to support its ongoing operations, protect customer assets, and absorb potential losses. The agency does not prescribe a fixed amount.

Instead, it uses a risk-based approach, considering factors like transaction volume, asset custody, and operational complexity. Capital plans must be reviewed and updated regularly.

Note: NYDFS can require additional reserves if a firm’s activities or exposures change significantly.

AML

Under Section 200.15, BitLicensees must maintain a written anti-money laundering (AML) program that meets federal Bank Secrecy Act (BSA) standards as well as Section 200.15. Programs should include:

Customer identification and verification (KYC)

Risk-based due diligence

Transaction monitoring and suspicious activity reporting

OFAC sanctions screening at onboarding and throughout the customer lifecycle

Recordkeeping and independent testing

DFS examinations often focus on whether a firm’s AML program is appropriately scaled to its risk profile. Insufficient staffing or delayed alert reviews are among the most common findings in enforcement actions.

Cybersecurity

The cybersecurity component must comply with both Part 200.16 and Part 500 of the NYDFS Cybersecurity Regulation. Licensees must appoint a Chief Information Security Officer (CISO) responsible for implementing a policy that protects customer data, wallet systems, and internal infrastructure.

Effective programs include:

Role-based access controls and encryption protocols

Incident response and reporting procedures

Regular penetration testing and vulnerability management

Each firm must also maintain a BCDR plan, updated annually and tested to verify that critical operations can resume after a disruption. NYDFS often reviews test results during routine exams.

See also:

Business Continuity and Disaster Recovery

Per Section 200.17, licensees must develop and maintain a Business Continuity and Disaster Recovery (BCDR) plan that enables critical operations to resume quickly after disruptions. The plan should identify key personnel, recovery time objectives, and data backup procedures.

NYDFS expects firms to test and update BCDR plans annually and maintain records of testing outcomes. This requirement is closely tied to cybersecurity resilience and operational risk management.

Need help with money transmitter compliance?

Fill out the form below and our experts will get back to you.

Consumer Protections

Consumer protection standards under Sections 200.18–200.20 focus on transparency and customer fairness. Firms must provide clear disclosures covering transaction fees, exchange rates, and risks associated with virtual currencies.

They must also issue receipts for each transaction, maintain an accessible complaint-handling process, and retain communications related to customer service. Firms must also establish an accessible complaint-handling process with documented resolution steps.

Advertising and promotional materials are also within scope. NYDFS can review marketing to verify that claims about products, fees, or yields are accurate and not misleading.

Misleading marketing or a lack of disclosure documentation can trigger DFS scrutiny. DFS also pays close attention to how companies record and respond to customer issues, as these interactions often reveal the maturity of internal controls.

Recordkeeping

BitLicensees must keep detailed books and records for at least seven years. This includes transaction data, customer identification records, and audit trails for both fiat and digital asset flows.

Records should be stored in a readily retrievable, secure format, consistent with the SEC’s “reasonably usable” data principle for broker-dealers. NYDFS examiners review these records during routine inspections.

Reporting

Finally, BitLicensees are subject to ongoing reporting and examination obligations. BitLicensees must retain books and records for at least seven years, covering transactions, customer information, compliance activity, and financial statements. Records must be maintained in a secure, retrievable format and made available to DFS upon request.

Firms also face ongoing reporting obligations, including:

Quarterly financial statements

Annual reports

Annual compliance certifications

Prompt incident notifications

Any material change in ownership, key personnel, or business activity must be reported within a reasonable timeframe. Firms must also submit periodic risk assessments and make their compliance officers available for regulatory inquiries. NYDFS maintains active, continuous supervision, comparable to that applied to banks and trust companies operating under state law.

Collectively, these requirements define the foundation of BitLicense compliance. Maintaining these core elements helps firms remain regulator-ready between examinations. Many companies partner with specialists like InnReg, who build and operate compliance programs that align with NYDFS expectations while supporting agile fintech growth.

Costs, Application Process, and Timeline

Obtaining a BitLicense is a detailed and resource-intensive process. Applicants must demonstrate operational soundness, compliance readiness, and financial stability before approval. The NYDFS reviews each application closely, often engaging in multiple rounds of clarification.

The following areas outline the main cost and process components associated with applying for and maintaining a BitLicense.

Application Fees and Required Documentation

As of 2026, the application fee is $5,000, payable to NYDFS at the time of submission. This covers initial review but not ongoing supervision.

Applicants must provide extensive documentation, including:

Detailed business plan outlining products, services, and target markets.

Organizational chart and information on all directors, officers, and principal shareholders.

Background checks and fingerprints for key personnel.

Drafts of required compliance policies, including AML, cybersecurity, BCDR, and consumer protection programs.

Financial statements audited by an independent CPA.

Descriptions of systems and technology architecture supporting custody and transaction operations.

DFS uses this information to assess both financial strength and control environment quality before proceeding to review.

NYDFS Review and Approval Process

Once submitted, applications enter a multi-stage review. The NYDFS first checks for completeness and then assigns the application to the Virtual Currency Unit (VCU) for substantive evaluation.

The review typically involves:

Document validation and requests for clarification or additional materials.

Interviews or meetings with senior management and compliance officers.

Assessment of compliance programs for adequacy and practical implementation.

Evaluation of financial and operational risk management frameworks.

The process is iterative as the DFS may issue multiple rounds of questions before moving an application forward. Final approval comes only after DFS determines that the applicant’s controls, governance, and financial position meet its standards.

See also:

Ongoing Supervisory Assessments

In April 2023, NYDFS began charging ongoing supervisory assessments to BitLicensees, aligning their cost structure with that of other regulated financial entities.

These assessments cover DFS’s expenses for examinations, compliance reviews, and related oversight. They are generally billed through multiple estimated payments each fiscal year, with a later true-up, based on each licensee’s transaction volume and custody-based tiers.

In addition to financial assessments, licensees undergo regular DFS examinations, during which regulators test AML procedures, cybersecurity resilience, and internal controls.

BitLicense Approval Timeline

How long does it take for your BitLicense to be approved?

The BitLicense approval timeline varies depending on the completeness of the application and the complexity of the business model.

Simple models (e.g., exchange or wallet services): 12-18 months on average.

Complex or institutional operations (e.g., custody, stablecoins): Up to 24 months or longer.

Although there is no official timeframe, most applicants find that early preparation and clear documentation reduce the review cycle. Delays often occur when policies are generic, unsupported by procedures, or disconnected from actual business workflows.

Because NYDFS reviews each application on its own merits, firms often seek help from experienced compliance advisors familiar with DFS expectations. InnReg supports fintech and crypto companies by developing, managing, and operating regulatory-ready compliance programs tailored to NYDFS standards. Talk to an expert today and get started!

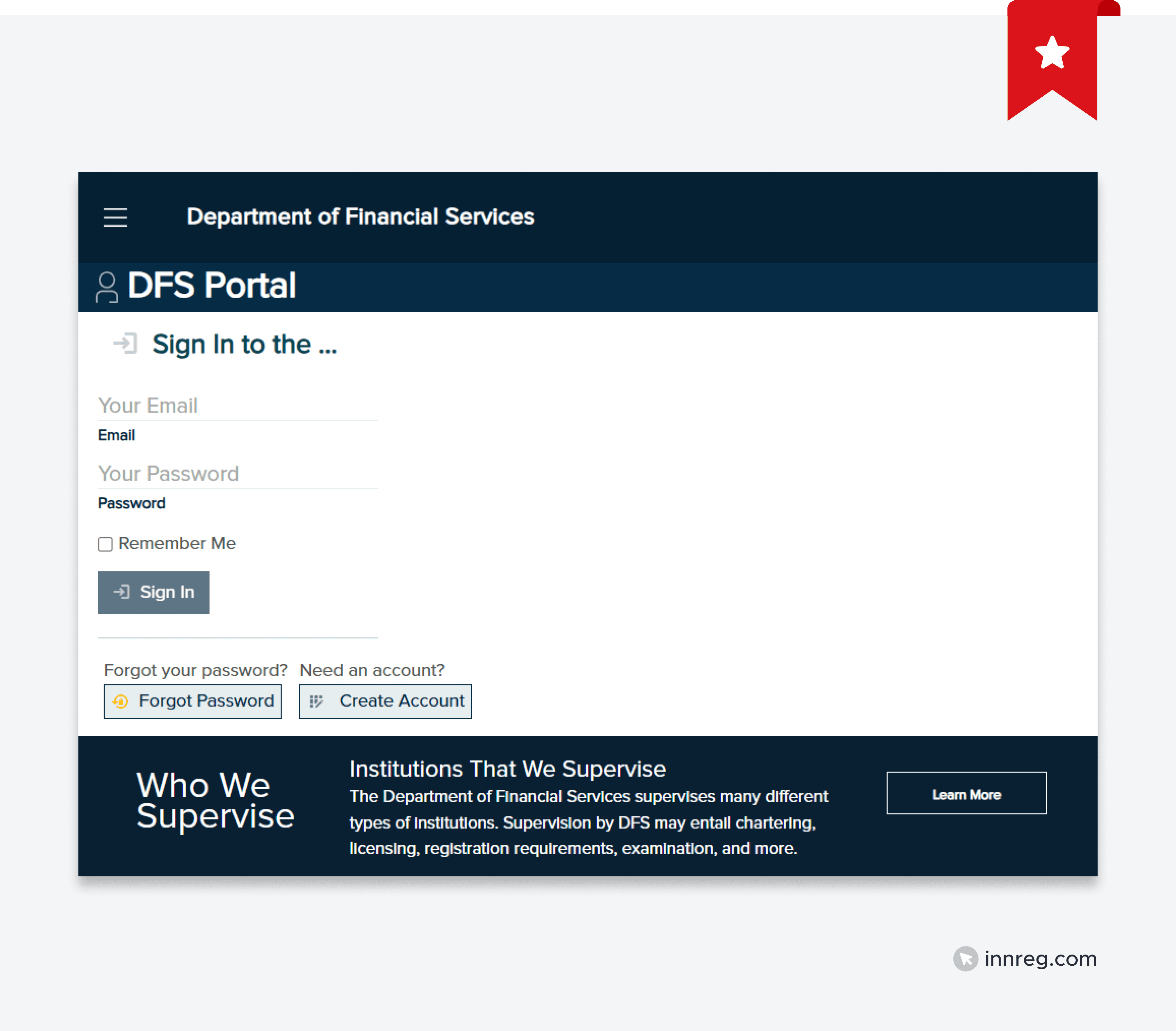

How to Register for a BitLicense

Registering for a BitLicense is a structured process that tests a firm’s operational, technical, and compliance maturity. NYDFS expects applicants to demonstrate readiness from day one, not develop programs after approval.

Below is a practical, step-by-step view of how to navigate the process from planning to supervision.

Step 1: Preparing Your Business Plan and Compliance Documentation

Before applying, companies should assemble a comprehensive business plan that explains their products, customer segments, technology model, and risk profile. This document forms the foundation of the DFS review.

In parallel, prepare draft compliance policies covering AML, cybersecurity, business continuity, consumer protection, and reporting. NYDFS favors operational clarity over generic templates. Hence, each policy should describe how procedures are implemented in practice, not just list high-level intentions.

Step 2: Submitting the Application to NYDFS

Applications are submitted electronically through the NYDFS online portal. All supporting documents must be included:

Financials

Compliance manuals

Organizational charts

Ownership details

At this stage, firms should confirm that all individuals with control or substantial interest in the company have undergone background and fingerprint checks. Incomplete or inconsistent filings are a leading cause of review delays.

Step 3: Background Checks and Review by the Virtual Currency Unit

Once accepted for review, the application is assigned to the VCU within NYDFS. This team conducts background checks on key personnel and evaluates management’s experience, governance structure, and financial integrity.

The VCU also performs initial risk assessments of the company’s operations, focusing on custody arrangements, customer fund segregation, and transaction monitoring capabilities. Applicants should expect questions that test the depth of their controls and reporting procedures.

Step 4: Responding to DFS Information Requests

After the preliminary review, DFS typically issues one or more Requests for Information (RFIs). These clarify aspects of the business model, compliance framework, or financial assumptions.

Timely, detailed responses are critical. Each RFI round adds time to the review, and incomplete answers can restart the process. Firms that maintain organized documentation and designated contacts for DFS inquiries tend to move more efficiently through this stage.

See also:

Step 5: Receiving Approval and Onboarding Into Supervision

Once the DFS is satisfied with the firm’s application, it issues a BitLicense approval letter. The company then moves into ongoing supervision, which includes regular reporting, periodic examinations, and communication with DFS examiners.

Approved firms must keep all compliance programs current, document changes in ownership or operations, and notify DFS promptly of material events. These expectations mirror those applied to other regulated financial institutions.

BitLicense vs. Other Crypto License Types

While the BitLicense is often viewed as the gold standard for state-level crypto regulation, it’s not the only framework governing digital asset businesses in the United States or abroad. Several states have introduced their own regimes, each reflecting different regulatory philosophies and levels of oversight.

Understanding how these frameworks compare helps fintech and crypto leaders plan multi-state or cross-border expansion strategies:

BitLicense vs. California DFAL

California’s Digital Financial Assets Law (DFAL), taking effect in 2026, closely mirrors the BitLicense structure. It requires licensure for businesses engaging in digital financial asset activities, including exchange and custody. DFAL also introduces strict disclosure and reporting requirements, although its consumer protection framework is expected to be lighter than New York’s.

Unlike the NYDFS, the California Department of Financial Protection and Innovation (DFPI) is still developing its supervisory framework and guidance. Firms planning early entry into California should anticipate future rulemaking and evolving expectations.

Learn more about California’s DFAL in our article →

BitLicense vs. Louisiana Virtual Currency Business Act

Louisiana’s Virtual Currency Business Act (VCBA) took effect in 2022, regulating companies that exchange, transfer, issue, or store virtual currencies.

The regime is narrower than the BitLicense, focusing primarily on transmission and custody, and includes compliance requirements such as minimum policies and surety-bond or net-worth obligations rather than the more expansive framework required in New York.

Supervision is managed by the Office of Financial Institutions (OFI), which applies money transmitter-style oversight. Compared to New York, the capital and cybersecurity obligations are less prescriptive, though licensees must still maintain anti-money laundering programs aligned with federal rules and meet tangible net-worth or surety-bond requirements.

BitLicense vs. Texas Virtual Currency Guidance

Texas does not issue a dedicated crypto license. Instead, the Texas Department of Banking regulates activities under its supervisory memoranda, clarifying when virtual currency transmission triggers licensing under existing money transmission laws.

This guidance-based system offers flexibility, but it comes with less regulatory certainty. Firms must interpret applicability on a case-by-case basis, often consulting legal advisors or regulators directly. In contrast, the BitLicense provides a structured path, albeit one with higher compliance costs.

BitLicense vs. Wyoming SPDI Charter

The Wyoming Special Purpose Depository Institution (SPDI) charter is a unique hybrid of banking and crypto regulation. It authorizes companies to offer custody and payment services for digital assets under bank-level standards.

SPDIs must hold 100% reserve backing and meet extensive capital, governance, and cybersecurity requirements. While they gain certain privileges, such as access to payment systems, they also face bank-style examinations and fiduciary duties. Compared to the BitLicense, the SPDI charter targets institutional-grade firms with higher operational capacity.

BitLicense vs. Florida Virtual Currency Law

Florida revised its money transmission laws in 2023 to include virtual currency transmission, eliminating most licensing ambiguity for crypto firms. The framework remains transaction-based rather than program-based, meaning it focuses on registration, bonding, and AML obligations rather than deep compliance governance.

This makes Florida more accessible to smaller operators, but also less prescriptive on cybersecurity or consumer protection controls compared to New York.

BitLicense vs. EU MiCA

The Markets in Crypto-Assets Regulation (MiCA), effective across the European Union in 2024-2025, establishes a single passportable regime for crypto-asset service providers (CASPs). It includes detailed rules for stablecoin issuers (EMTs and ARTs), custody, and market integrity.

While the BitLicense applies at the state level, MiCA offers cross-border authorization within the EU, creating operational efficiency for firms with European ambitions. However, MiCA’s requirements for governance, whitepapers, and reserve transparency are similarly rigorous to New York’s standards.

For fintech companies building long-term digital asset operations, understanding these regulatory differences is essential. The table below summarizes key differences between New York’s BitLicense and other major licensing models:

Framework | Administering Authority | Primary Scope | Supervision Level | Distinctive Feature |

|---|---|---|---|---|

New York BitLicense | NYDFS | Virtual currency business activity (custody, transmission, issuance) | High | Most comprehensive; includes AML, cybersecurity, and consumer protection mandates |

California DFAL | DFPI | Digital asset activities and stablecoin issuance | High | Takes effect in 2026; modeled partly on BitLicense, but adds a consumer protection focus |

Louisiana VCBA | OFI | Virtual currency transmission | Moderate | Simplified money transmitter approach for crypto firms |

Texas Guidance | TX Department of Banking | Exchange and custody activities | Moderate | Operates via guidance letters, not a formal licensing statute |

Wyoming SPDI Charter | Wyoming Division of Banking | Custody, fiduciary, and payment services | High | Allows limited banking powers for crypto firms; strong capital requirements |

Florida Virtual Currency Law | OFR | Virtual currency transmission | Moderate | Integrates crypto into money transmitter law; fewer bespoke requirements |

EU MiCA | National Competent Authorities (NCAs), European Securities and Markets Authority (ESMA), European Banking Authority (EBA) (for significant stablecoin issuers) | Crypto-asset service providers (CASPs) | High | Single-license passporting across the EU; extensive stablecoin and reserve rules |

DFS Guidance Shaping BitLicense Compliance

The NYDFS actively refines how BitLicensees operate through periodic guidance and industry letters. These documents interpret existing rules, respond to market changes, and clarify supervisory expectations.

For compliance leaders, staying aligned with DFS guidance is as important as meeting the core requirements. The following are the most consequential directives shaping BitLicense compliance today.

Stablecoin Reserve and Redemption Guidance

In June 2022, NYDFS issued formal guidance outlining requirements for USD-backed stablecoins issued by regulated entities. The policy mandates that reserves:

Be fully backed by high-quality, liquid assets such as US Treasury bills or reverse repurchase agreements fully collateralised by US Treasury bills

Be held with US-chartered banks and segregated from the issuer’s operational funds

Be audited monthly by an independent accounting firm, with attestations published publicly

The guidance also requires that redemption be honored 1:1 in US dollars and processed promptly upon request. This framework set a national precedent and continues to inform how DFS supervises stablecoin arrangements.

In 2025, DFS expanded this guidance to reinforce redemption timeframes and reporting obligations, signaling tighter scrutiny on reserve management and third-party custodial relationships.

Custody and Customer Asset Segregation Rules

In January 2023, DFS issued its Virtual Currency Custody Guidance, clarifying how BitLicensees and limited-purpose trust companies must safeguard customer assets.

Key expectations include:

Segregation of customer assets from corporate holdings at all times

Clear disclosures explaining that customers retain beneficial ownership of their digital assets

Oversight and documentation of sub-custodian relationships, including risk assessments and service-level agreements

In September 2025, DFS updated this guidance to emphasize sub-custody oversight and disclosure, requiring firms to identify where customer assets are held and under what legal arrangements. The update also introduced new documentation standards for third-party custody providers.

Coin-listing and Mandatory Delisting Frameworks

DFS significantly revised its coin-listing policy in November 2023, introducing new approval and delisting obligations. BitLicensees must now:

Maintain an internal coin-listing policy approved by DFS

Conduct and document risk assessments for each asset, covering market integrity, security, and legal exposure

Develop a delisting policy that defines procedures for removing assets that no longer meet compliance criteria

The framework also limits use of the DFS “Greenlist,” a set of pre-approved assets, to firms with an approved coin-listing policy in place. This means firms cannot rely solely on the Greenlist without maintaining governance and monitoring controls.

Customer Service and Complaint-Handling Standards

In May 2024, NYDFS released guidance requiring BitLicensees to formalize customer service standards. Firms must now:

Maintain documented policies and procedures for complaint intake, escalation, and resolution

Track and report quantitative metrics, such as response times and resolution rates

Provide DFS with periodic summaries to help monitor consumer outcomes

This directive elevates customer support to a compliance function, linking operational performance directly to regulatory oversight.

Together, these guidances show that NYDFS expects licensees to operate with institutional-level controls and transparency. They also illustrate how the agency’s expectations evolve as the digital asset market matures.

Common BitLicense Compliance Challenges

Even firms with mature compliance frameworks encounter challenges under the BitLicense regime. Understanding these common pitfalls helps compliance teams strengthen their programs before they become exam findings:

AML Alert Backlogs and Monitoring Capacity Gaps

Many enforcement actions against BitLicensees cite AML program deficiencies, especially around alert handling and transaction monitoring. As business volume increases, some firms struggle to scale their systems and staffing proportionately.

Typical DFS findings include:

Backlogs in alert reviews or delayed suspicious activity reports (SARs)

Under-calibrated monitoring systems that fail to capture riskier transaction types

Incomplete documentation of investigations and escalation decisions

DFS expects firms to maintain AML programs that match the complexity of their operations. Compliance staffing, data tools, and quality assurance processes must evolve as transaction volumes rise.

Weak Coin-listing and Delisting Governance

The 2023 DFS guidance on coin-listing introduced governance standards that many firms are still adapting to. DFS often identifies policies that exist on paper but lack detailed risk scoring, decision logs, or delisting protocols.

To mitigate regulatory risk, companies should consider:

Keep detailed documentation of coin evaluation processes

Maintain periodic reviews of each asset’s risk rating

Clearly define who approves listings and who oversees removals

A weak or undocumented governance trail can raise supervisory red flags, even if the technical process is sound.

Sub-custodian Oversight and Beneficial Ownership Clarity

Custody arrangements are a core area of DFS scrutiny. Common findings involve unclear asset ownership disclosures or insufficient oversight of sub-custodians.

Licensees must be able to demonstrate:

Written agreements specifying how and where assets are held

Controls verifying that customers retain beneficial ownership at all times

Regular due diligence and performance reviews for third-party custodians

DFS views sub-custody as an extension of a firm’s operational risk. Weak monitoring in this area can lead to findings during examinations or enforcement inquiries.

Meeting DFS Expectations for Customer Service Metrics

Since the 2024 guidance on customer service standards, firms must collect and report measurable data on complaint-handling and responsiveness.

DFS examiners now look for:

Response time benchmarks built into service-level policies

Complaint tracking systems with clear escalation records

Periodic internal reviews of performance metrics reported to DFS

For some firms, this has required building new data collection and analytics processes within compliance operations. Those that already maintain structured workflows, often with outsourced compliance support or integrated task systems, are better positioned to demonstrate oversight.

Key Takeaways

New York’s BitLicense has become a defining model for crypto regulation, setting the standard for transparency, governance, and consumer protection in digital asset operations. It is rigorous by design, requiring firms to demonstrate mature compliance, cybersecurity, and capital frameworks before and after licensing.

Staying aligned with DFS guidance, especially around money transmitter, stablecoins, and custody, has become essential to operating successfully in this market. For digital asset firms expanding into New York, success under the BitLicense framework depends on preparation, structure, and a disciplined approach to compliance execution.

How Can InnReg Help?

InnReg is a global regulatory compliance and operations consulting team serving financial services companies since 2013.

We are especially effective at launching and scaling fintechs with innovative compliance strategies and delivering cost-effective managed services, assisted by proprietary regtech solutions.

If you need help with money transmitter compliance, reach out to our regulatory experts today:

Last updated on Jan 13, 2026