Form BR: FINRA Branch Office Registration for Broker-Dealers

Nov 19, 2025

·

12 min read

Contents

Filing Form BR is one of the first administrative steps broker-dealers face when expanding beyond a single office or operating with distributed teams. It is the required form for registering branch offices with FINRA, state regulators, and other participating authorities.

For fintech broker-dealers that may have offices ranging from traditional hubs to remote supervisory setups, getting Form BR right is crucial.

This article explains what Form BR is, when it needs to be filed, and how the process works, while also covering how FINRA defines a branch office, applicable exclusions, and how recent rule changes, such as Residential Supervisory Locations (RSLs), affect compliance.

At InnReg, we help broker-dealers plan and manage Form BR branch office registrations, including remote work structures, RSL use, OSJ designations, and state-level requirements. Contact us to learn more.

What Is Form BR?

Form BR (Branch Office Registration) is the standard filing broker-dealers use to register branch office locations with FINRA and other regulators. The form is submitted electronically through FINRA’s Central Registration Depository (CRD) system and is required whenever a firm establishes a new branch, modifies existing branch information, or closes a location.

The form collects key information about the branch, including address, designated supervisor, business activities, and any office-sharing arrangements. It links directly to other filings, such as Form U4, which associates registered individuals with the branch. This alignment is important for compliance, as regulators expect branch and personnel records to be consistent across forms.

As many fintechs operate in hybrid or distributed environments, decisions about whether a home office, shared workspace, or remote supervisory site qualifies as a “branch office” have direct implications for filing. Missteps, like failing to register a location that regulators consider a branch, can lead to findings during exams or enforcement actions.

Learn how Form BR fits into a broader broker-dealer registration process →

When and Why It Must Be Filed

Broker-dealers must file Form BR whenever they establish a new branch, make material changes to an existing branch, or close a location. The form establishes the regulatory record that enables FINRA, and in many cases, state regulators, to track where securities business is being conducted.

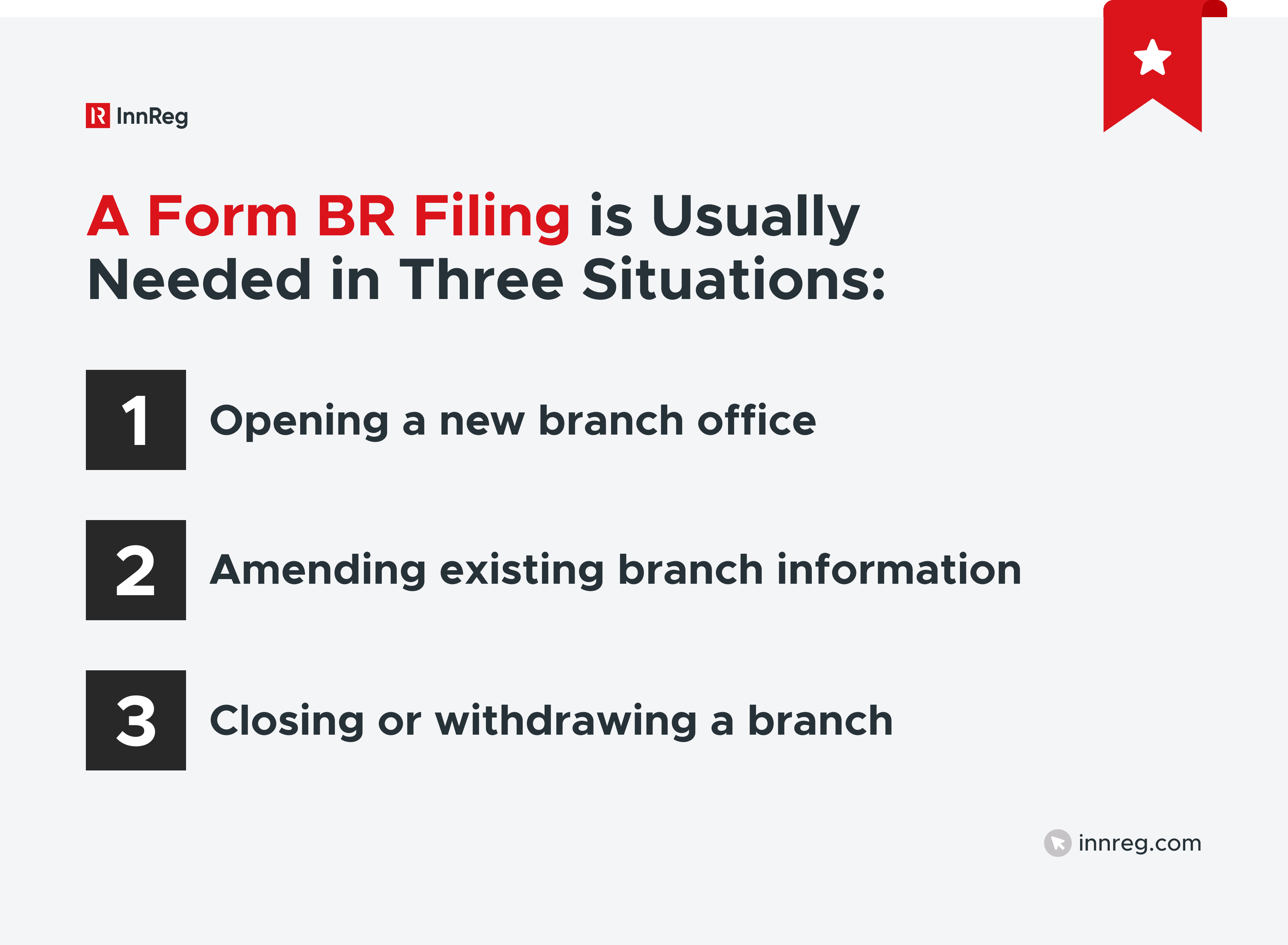

A Form BR filing is typically required in three situations:

Opening a new branch office: registering the address, designating a supervisor, and describing the activities.

Amending existing branch information: for example, if the branch moves to a new suite, changes its supervisor, or modifies the scope of activities.

Closing or withdrawing a branch, documenting when the branch stopped operations.

Regulators generally expect filings and amendments to be submitted within 30 days of a change. Missing this window can result in exam comments or, in repeated cases, fines. For firms scaling quickly, especially fintechs with hybrid or remote setups, tracking these deadlines should be part of the compliance workflow.

Form BR filings also interact with other membership rules. For example, a single branch opening typically falls under the “safe harbor” for business expansion, but a series of openings may require a Continuing Membership Application (CMA) with FINRA. This adds another layer of planning for startups transitioning from a single office to multiple offices.

Regulators Involved

Form BR filings reach more than just FINRA. The form is processed through the CRD, which simultaneously coordinates updates across multiple regulators.

The key regulators are:

FINRA: As the primary self-regulatory organization (SRO) for broker-dealers, FINRA requires branch office registration and review filings as part of its rules.

SEC: While the SEC does not directly receive Form BR filings, it oversees FINRA and expects firms to maintain accurate records of their branch offices as part of broader compliance under the Securities Exchange Act of 1934.

State Regulators: Many states require broker-dealers to register or file notice of their branches. Through CRD, Form BR also satisfies these state-level obligations, though requirements and fees vary by jurisdiction.

For firms operating across multiple states, Form BR provides a single point of filing. However, it does not eliminate the complexity of differing state rules. Some states treat the filing as a notice that becomes effective upon submission, while others require explicit approval before business can begin at a branch. As such, tracking the requirements that apply to each jurisdiction is an essential part of regulatory planning.

See how InnReg helps fintechs with regulatory strategy →

What Counts as a Branch Office in Form BR?

FINRA defines a branch office as any location where one or more associated persons of a broker-dealer regularly conduct securities business or where the location is held out as such. This definition is intentionally broad. It encompasses traditional offices, regional branches, and occasionally less obvious setups, like a small sales office or a single representative’s workspace.

Offices of Supervisory Jurisdiction (OSJs) vs. Non-OSJ Branches

A branch can either be classified as an Office of Supervisory Jurisdiction (OSJ) or a registered or non-registered location. OSJs are locations where key supervisory functions take place (approving new accounts, reviewing trades, or supervising other branches).

Learn more about Offices of Supervisory Jurisdiction (OSJs) →

Each OSJ must have a designated principal with the proper licenses, often a Series 24. Non-OSJ branches are locations without those supervisory responsibilities, but they still require a designated person-in-charge.

Learn more about all 32 FINRA licences →

Common Exclusions

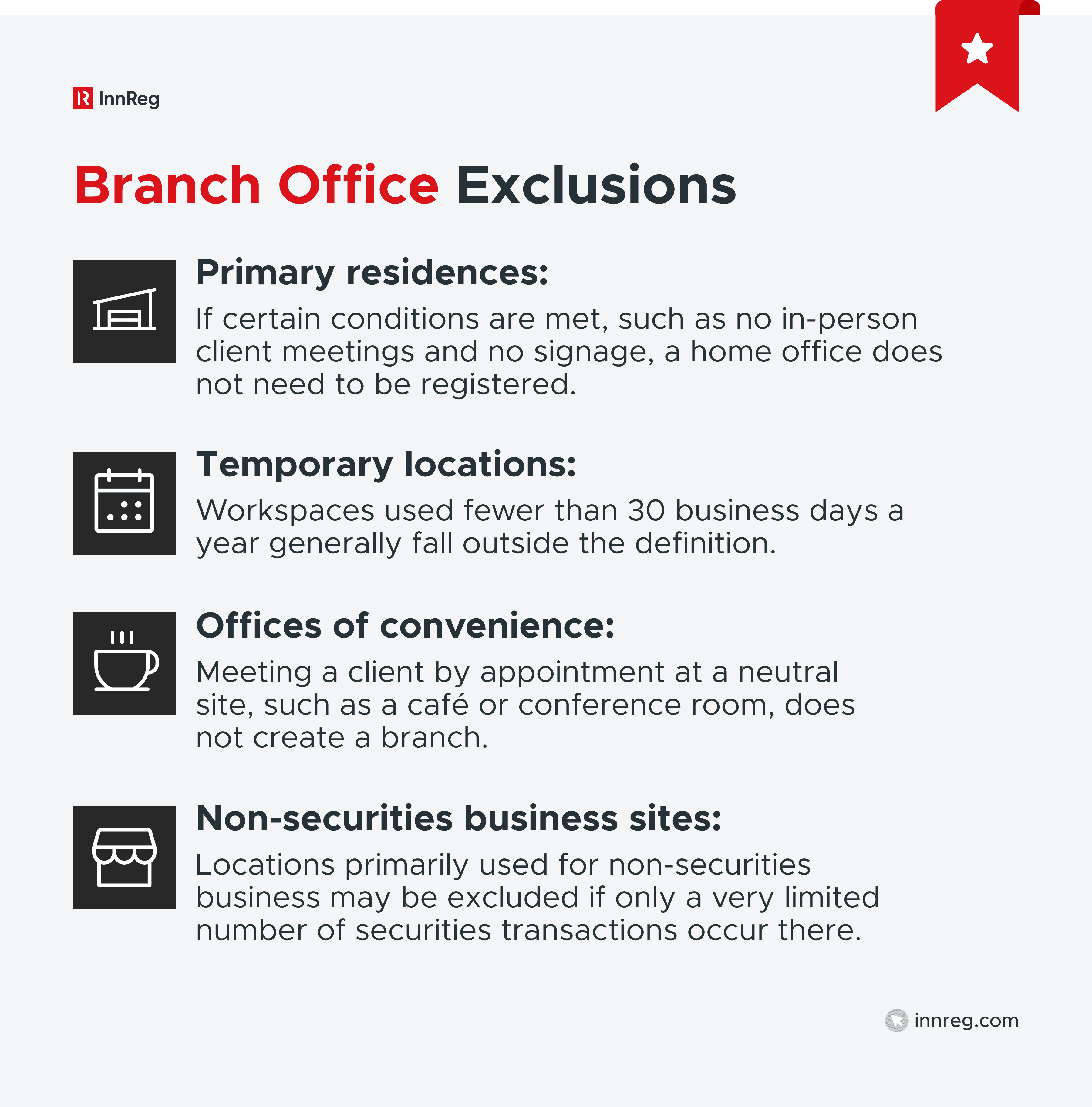

Not every location qualifies as a branch. FINRA and NASAA recognize several exclusions that fintech firms often rely on:

These exclusions are helpful, but they come with strict conditions. If a home office or shared workspace is ever used in a way that contradicts the exclusion, like meeting clients face-to-face, it would become a branch that requires Form BR registration.

Recent Developments: Remote Work and RSLs

Remote work arrangements became widespread in the fintech industry during the pandemic, and FINRA has formalized a framework to address this trend. On June 1, 2024, FINRA adopted rules allowing certain home offices to qualify as Residential Supervisory Locations (RSLs).

This change means that a principal working from home and performing supervisory duties no longer automatically triggers branch registration, provided the RSL requirements are met.

See also:

How RSLs Differ From Traditional Branch Offices

Unlike traditional branch offices or OSJs, RSLs are not registered through Form BR. Instead, they are flagged on Form U4, creating a distinction in regulatory filings. An RSL remains subject to supervision, but it is treated as a non-branch location for registration purposes. This classification reduces the administrative burden for firms with supervisors working remotely, while still keeping oversight intact.

Learn more about Form U4 in our guide →

Need help with broker-dealer compliance?

Fill out the form below and our experts will get back to you.

Eligibility Criteria and Limitations

Not every home office can be an RSL. To qualify:

Only one associated person (or immediate family member) may work at the residence

The location cannot be advertised or used for in-person client meetings

Customer funds and securities are not handled at the location

The supervisor must be assigned to a registered branch office for recordkeeping

All communications and approvals must go through the firm's systems

The firm must conduct a risk assessment and keep RSL documentation available for FINRA

Some firms (including newly registered broker-dealers and those with recent disciplinary issues) are not eligible to use RSLs. Supervisors with limited experience or a history of prior supervisory failures may also be disqualified.

—

RSLs can be a practical way to support distributed leadership teams without expanding formal branch registrations.

However, RSLs must still undergo inspections every three years, and firms must maintain detailed supervisory procedures outlining how remote oversight is handled. Treating an RSL as “just a home office” is a common mistake, as it requires structured controls and proper documentation.

Prepare by using our FINRA Branch Office Inspection template and checklist →

Filing Form BR: Process and Key Details

Once a firm determines a branch needs to be registered, the next step is completing the filing through FINRA’s Central Registration Depository.

How and Where Form BR Is Filed

Form BR is filed electronically through FINRA’s CRD, accessed via the FINRA Gateway.

Once submitted, the filing updates FINRA and participating state regulators. This centralized process means that firms do not need to send separate filings to each regulator, although state-specific approvals or fees may still apply.

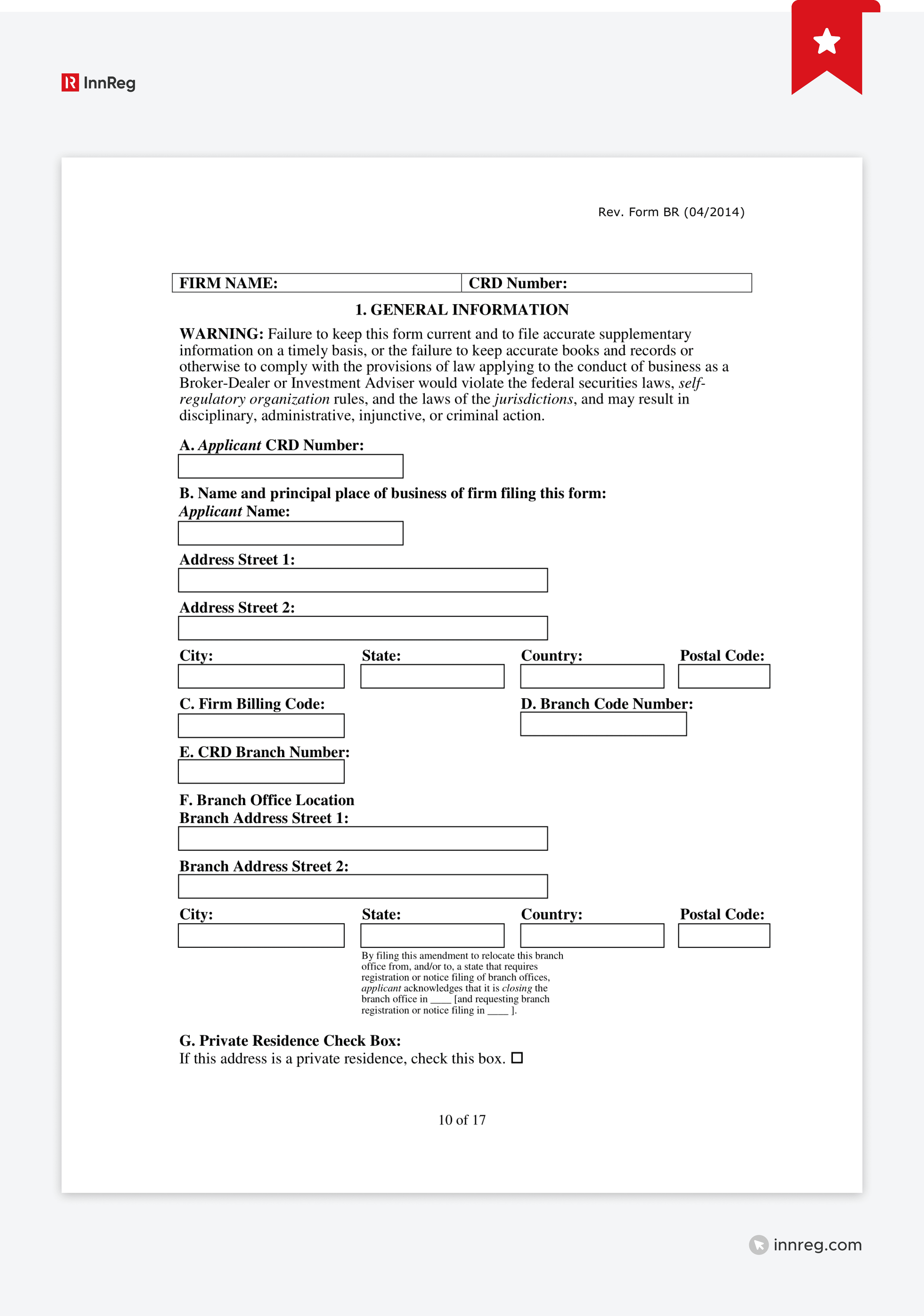

Required Information and Sections of the Form

Form BR requests a detailed profile of the branch, including:

General details: Address, phone, branch number, and whether it’s residential or commercial.

Office type: OSJ or non-OSJ branch

Activities conducted: Retail, institutional, trading, investment banking, or other business.

Supervisor designation: Each OSJ must have a registered principal supervising the location, and each non-OSJ branch must identify a Person-in-Charge.

Office sharing: Disclosure of other financial businesses operating at the same location.

This information is linked directly to the filings of registered individuals, particularly Form U4, which connects personnel to their respective branches.

Initial Registration, Amendments, and Closing a Branch

Firms use Form BR not only for initial branch registrations but also for:

Amendments to update address changes, supervisors, or activities.

Closures to record when a branch ceases operations.

FINRA expects updates within 30 days of a change. This expectation applies equally to new fintechs and large broker-dealers, and missed deadlines can raise issues during exams.

Fees and Funding Requirements

Branch office registration fees are charged by FINRA and, in many cases, by states. These fees are automatically deducted from a firm’s FINRA Flex-Funding Account.

Firms should maintain sufficient balances in advance of filings to avoid delays. The cost varies depending on the number of branches and jurisdictions, making budgeting crucial for fintechs with distributed or fast-scaling teams.

See also:

Supervisory Roles and Responsibilities

Supervision is central to branch office compliance. FINRA requires every registered location to have an individual accountable for day-to-day oversight, whether it is a supervisory hub or a smaller branch.

The key responsibilities include:

Designating a Supervisor or Person-in-Charge

Every registered non-OSJ branch must designate a Supervisor or Person-in-Charge. The role involves supervising branch operations and carrying out the supervisory procedures required under FINRA’s rules. On Form BR, the firm must list this person and link them to the branch.

Principal Requirements for OSJs

If the branch is classified as an OSJ, the supervisor must have an appropriate license, usually a Series 24. This principal must be located at the OSJ and have the authority to review and approve activities such as new accounts, advertising, and trade reviews.

For non-OSJ branches, a Person-in-Charge is still required, but the qualifications may differ. These individuals often serve as local managers, coordinating with principals in an OSJ or the main office.

Inspection Cycles for Branches vs. OSJs

FINRA sets inspection requirements based on how a branch is classified. OSJs and supervisory branches must be reviewed annually, while non-supervisory branch offices are required to be inspected on a three-year review cycle.

With the introduction of Residential Supervisory Locations (RSLs) in 2024, certain home offices now fall under the non-branch cycle but still need documented inspections.

Form BR and State Regulators

While FINRA serves as the central point for broker-dealer branch registration, states retain their own authority. Form BR is designed to connect these layers, streamlining how firms report branch information.

NASAA’s Branch Office Registration Program

Form BR does more than update FINRA. It also connects to the state level through the North American Securities Administrators Association (NASAA).

Many state securities regulators participate in NASAA’s Branch Office Registration Program, which allows firms to satisfy state branch filing requirements through the same CRD submission.

This integration simplifies multi-state operations, but it does not remove the need to understand each state’s rules.

Notice Filing vs. Registration States

States fall into two general categories:

Notice filing states automatically accept Form BR. Once submitted, the branch is effective immediately, and the firm can begin operating there.

Registration states require the filing to be reviewed and approved before the branch can conduct business. The timing varies; some states act within days, while others may take longer.

Firms expanding across state lines must know which category applies to each jurisdiction and plan operations accordingly. Establishing a branch in a registration state is permitted once Form BR is submitted, but conducting securities business from that branch before approval is received can create regulatory issues.

Examples of State-Specific Requirements

Even within the uniform program, details differ. For example:

Florida charges a state branch office fee and requires managers to be listed with the state.

Illinois requires amendments within ten days of opening or closing a branch in that state.

Most states impose annual branch renewal fees in addition to FINRA’s renewal cycle.

Form BR Compliance Challenges and Misconceptions

The most common compliance challenges and misconceptions about Form BR include:

Misunderstanding Remote Work and Home Offices

One of the most common pitfalls is assuming that a home office never qualifies as a branch. While certain exclusions apply, if a representative or supervisor meets clients in their home or advertises the location, regulators will likely consider it a branch office requiring registration through Form BR.

Risks of Unregistered Branch Offices

Operating from an unregistered location exposes firms to regulatory risk. FINRA examinations frequently verify that all active branches are on record, and discrepancies can lead to fines or other regulatory actions.

For fast-moving fintechs, where teams expand quickly and often work remotely, the risk of leaving a location unregistered is higher.

Common Mistakes in Updates and Amendments

Another frequent challenge is failing to keep Form BR current.

Changes such as moving to a new suite, appointing a new supervisor, or adjusting business activities must be filed within 30 days.

Overlooking small details creates mismatches between firm operations and regulatory filings, which examiners often flag.

Issues with Office-Sharing and Disclosures

Many fintechs use co-working spaces or share offices with related businesses. They must disclose these arrangements on Form BR, including details of any financial firms at the same location.

Failure to disclose can create transparency issues and complicate branch inspections.

Practical Tips for Fintech Broker-Dealers

Expanding or managing branch offices requires building compliance into day-to-day operations.

For fintech broker-dealers, the following practices can help reduce regulatory risk and keep filings aligned with business growth:

Planning Office Structures With Compliance in Mind: Before opening new offices or assigning supervisors, consider how the structure will be recorded in Form BR. Determine which branches qualify as OSJs, and verify that principals hold the required licenses. A compliance review before expansion helps avoid costly amendments later.

Managing Remote Teams Under Form BR Requirements: Hybrid and remote setups make it harder to track when a home office or shared workspace becomes a branch. Establish internal policies for classifying work locations and apply them consistently. Document decisions so you can explain them during FINRA exams.

Building Form BR Updates Into Compliance Workflows: Changes in addresses, supervisors, or business activities must be filed within 30 days. Treat Form BR updates as a standing compliance task, not an afterthought. Using compliance management tools or assigning responsibility to a compliance partner can help prevent missed deadlines.

Leveraging Outsourced Compliance Expertise: For startups and fast-scaling fintechs, maintaining an internal compliance team large enough to handle filings, inspections, and supervisory oversight can be costly. Many firms use outsourced compliance support to manage Form BR obligations. This model provides access to experienced professionals without the overhead of hiring full-time staff in every location.

Learn how InnRegs helps broker-dealers manage their obligations →

—

Form BR is a central piece of broker-dealer compliance, which establishes where business is conducted, who is responsible for supervision, and how state regulators view each branch.

For fintech broker-dealers, the challenges often lie in adapting these requirements to modern operating models: remote teams, shared workspaces, and rapid scaling. Missteps in filings or overlooked amendments can create unnecessary regulatory risk.

That’s why fintechs should treat Form BR as part of a broader compliance framework. That means aligning it with Form U4 data, incorporating updates into daily workflows, and planning ahead for state-specific requirements.

How Can InnReg Help?

InnReg is a global regulatory compliance and operations consulting team serving financial services companies since 2013.

We are especially effective at launching and scaling fintechs with innovative compliance strategies and delivering cost-effective managed services, assisted by proprietary regtech solutions.

If you need help with broker-dealer compliance, reach out to our regulatory experts today:

Last updated on Nov 19, 2025