Understanding NASAA Continuing Education

Dec 17, 2025

·

19 min read

Contents

The NASAA Continuing Education (CE) requirement has become a key compliance topic for investment advisor representatives (IARs) across the United States. Designed by the North American Securities Administrators Association (NASAA), this rule establishes annual education standards to keep financial professionals informed on evolving regulations, ethics, and industry practices.

For fintech, understanding the NASAA CE model is essential for maintaining good standing in multiple states, preventing registration lapses, and keeping advisors sharp in a fast-changing regulatory landscape. As states continue adopting the model rule, it’s quickly becoming a nationwide baseline for advisory professionalism.

This article breaks down what NASAA Continuing Education is, who it applies to, how it works, and what non-compliance means in practice. It also highlights practical strategies for integrating CE requirements into firm operations, from tracking and reporting to managing costs and avoiding last-minute issues.

InnReg helps fintechs and advisory firms track CE obligations, monitor advisor status, and prevent registration lapses before they happen. From multi-state expansion to ongoing oversight, our team acts as an extension of your compliance function.

What NASAA Continuing Education Is and Why It Matters

The NASAA Continuing Education (CE) requirement has become a central topic for investment advisor representatives across the United States.

It sets annual education standards that keep financial professionals current on regulatory expectations, ethical responsibilities, and practical industry developments. The rule is now a routine part of maintaining an active IAR registration in many states.

Advisors working across multiple jurisdictions face different regulatory triggers, and CE is one of the easiest areas for a lapse to occur. Missing a deadline or misinterpreting a state’s requirement can disrupt operations. Consistent education also helps advisors stay aligned with changes in products and technology, which is especially relevant for fast-moving fintech models.

Who Must Comply with NASAA Continuing Education Requirements

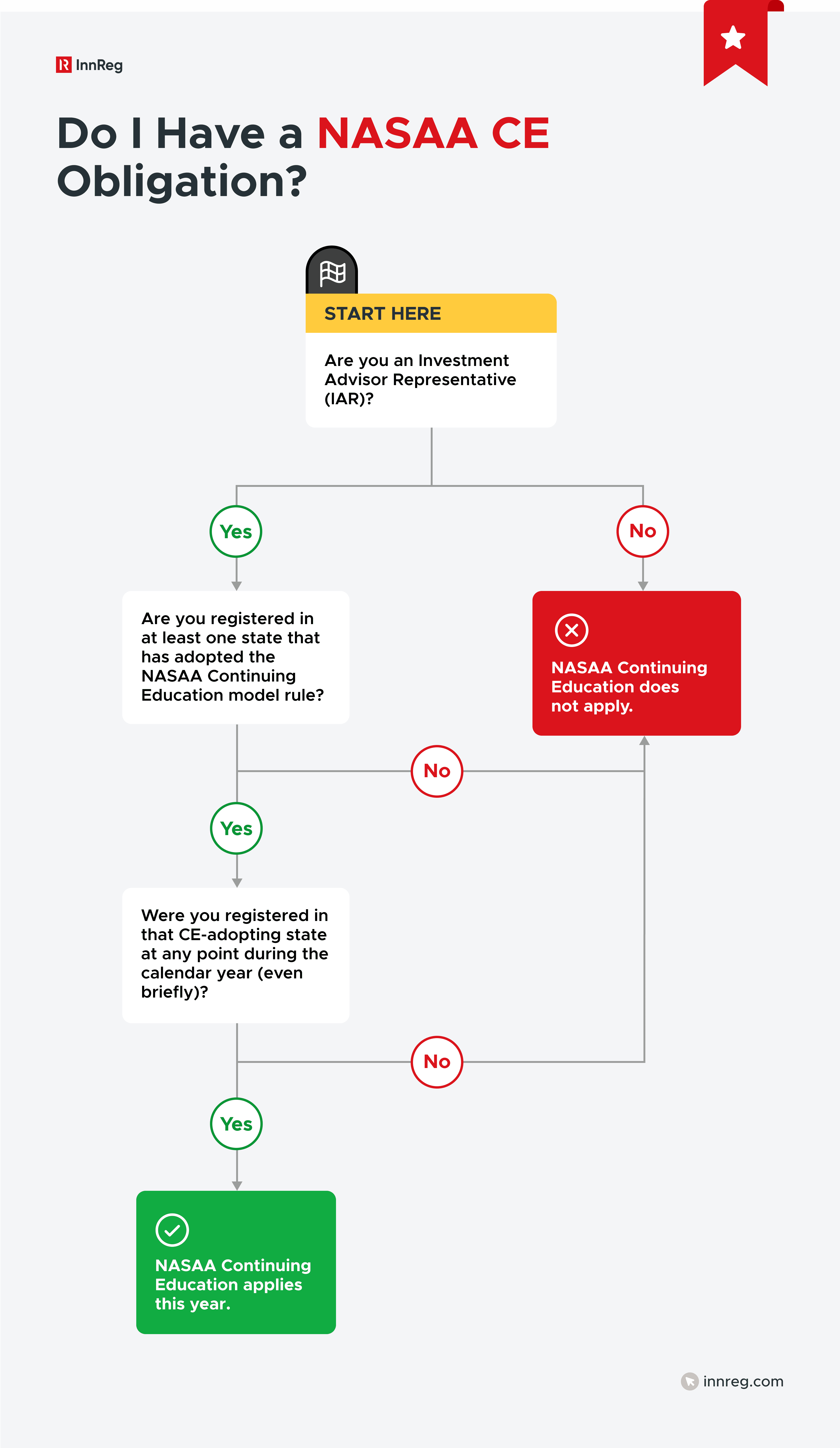

Understanding who must comply with NASAA Continuing Education is important because the rule applies to individual investment advisor representatives, not firms. An advisor becomes subject to CE as soon as they are registered in a state that has adopted the model rule.

State vs. Federal Registration Explained

Investment advisor registrations operate on two levels in the United States: state registration and federal registration. The distinction affects how NASAA Continuing Education requirements apply to individual representatives.

State-registered firms have their IARs licensed directly with each state where they conduct business. SEC-registered firms follow a federal framework, but their representatives still register at the state level. This is where many teams get tripped up. Even if the advisory firm is federally registered, the individual advisor must follow the CE rules of each state where they hold an active registration.

For fintech companies expanding quickly across multiple jurisdictions, this creates a patchwork of obligations. A single new client in a CE-adopting state can immediately place an IAR under NASAA’s CE requirements. Tracking these triggers becomes part of ordinary compliance work, especially for firms with distributed teams or remote advisors.

Common Misconceptions About Applicability

Misunderstandings about who must comply with NASAA Continuing Education are common, especially for firms moving quickly across multiple states. These misconceptions often lead to missed deadlines or unexpected registration issues.

One frequent assumption is that SEC-registered firms do not fall under state CE rules. In practice, state CE obligations follow the advisor, not the firm.

Another misconception is that residency determines whether CE applies. What matters is where the advisor holds an active registration, not where they live or work.

Some advisors also believe they can avoid CE by withdrawing from a state mid-year. Once an advisor is registered in a CE-adopting state at any point during the year, the requirement applies for that full year.

Fintech teams navigating rapid growth should keep these points in view as they assess regulatory exposure across jurisdictions.

Key Components of NASAA Continuing Education

The core structure of NASAA Continuing Education centers on a predictable annual cycle. Every advisor registered in a CE-adopting state must complete a set number of credits, divided across specific subject areas.

These components create a consistent standard that applies across jurisdictions, even as states adopt the rule on different timelines:

The 12-Credit Annual Requirement

Each year, investment advisor representatives must complete 12 credits of NASAA Continuing Education. This requirement applies to every advisor registered in a state that has adopted the model rule, regardless of whether they work for a state-registered or SEC-registered firm.

The rule follows a yearly cycle. Credits must be completed within the calendar year, and they must be taken through NASAA-approved providers. Advisors who work across multiple CE-adopting states only complete the 12 credits once per year, as states accept the same set of completed credits.

For fintech teams operating in several jurisdictions, this fixed annual requirement becomes part of routine planning. It is predictable, structured, and essential to track early in the year to avoid last-minute pressure in December.

6 Ethics Credits and 6 Products and Practices Credits

NASAA Continuing Education divides the annual requirement into two core categories. Advisors must complete six credits in Ethics and six credits in Products and Practices each year. States do not allow credits from one category to substitute for the other, which means both areas must be completed to meet the annual requirement.

Ethics courses focus on professional conduct, conflicts of interest, fiduciary standards, and communication practices. These topics are meant to help advisors stay current with evolving expectations around transparency and client protection, while Products and Practices courses cover investment strategies, market developments, and operational topics.

This structure offers a balanced approach. Advisors refresh their understanding of ethical principles while also keeping pace with new products, technologies, and regulatory developments. Fintech firms often find the Products and Practices category particularly useful, as it connects directly to innovations like digital assets, automated advice, and new trading models.

What Counts as a “Credit” and How Courses Are Structured

A NASAA Continuing Education credit represents roughly 50 minutes of approved instructional time. NASAA and Prometric assign each course a specific credit value during the approval process, and only those approved credits count toward the annual requirement.

The majority of courses follow this structure: advisors complete the instructional material, take a short assessment, and receive credit only after passing the final test. Courses can range from quick one-credit modules to multi-credit sessions that cover broader topics like digital assets or regulatory updates.

Because credits are tied to course approval, firms cannot rely on internal meetings or generic training sessions unless those materials have been formally reviewed and approved. This requirement gives advisors a predictable format and helps compliance teams track progress across multiple providers.

Approved Course Providers and Delivery Formats

NASAA Continuing Education courses can only be taken through approved providers.

These organizations go through a formal review process to offer content that meets NASAA’s standards for accuracy, relevance, and instructional quality:

How Courses Are Approved by NASAA and Prometric

NASAA works with Prometric to review and approve all NASAA Continuing Education courses. Providers must submit detailed course outlines, learning objectives, instructor credentials, and assessment plans before a course is accepted.

This process keeps the content aligned with regulatory expectations and industry needs.

Once approved, each course receives a credit value and a category designation. Providers must also follow ongoing standards, including regular updates and accurate reporting of completed credits.

For firms comparing vendors, knowing a course is formally approved through NASAA and Prometric instills confidence that the credits will count toward an advisor’s annual requirement.

Online vs. In-Person Options

Advisors can complete NASAA Continuing Education through online or in-person courses, as long as the provider is approved. Most firms prefer online formats because they offer flexibility, shorter modules, and easier scheduling across dispersed teams.

In-person sessions are available through certain training vendors and industry conferences. These formats can be useful for teams that want live instruction or group participation. Regardless of the format, advisors must complete the required assessment to receive credit.

For fintechs with distributed or remote advisors, online courses tend to be the most practical choice. They allow teams to work around product launches, client demands, and other operational priorities.

Exams, Passing Scores, and Reporting to FINRA

Every NASAA Continuing Education course includes an assessment that advisors must pass to receive credit. Providers set the format, but the exam typically appears as a short quiz at the end of the course. A passing score is required for credit to be reported and applied toward the annual requirement.

Most approved providers allow multiple attempts. The goal is to confirm the advisor has understood the material, not to create a barrier to completion. Once the advisor passes, the provider reports the credit to FINRA’s systems, where state regulators can view completion status.

Because reporting flows through FINRA, firms benefit from working with providers that submit credits promptly and accurately. This helps avoid year-end discrepancies, especially for teams with advisors registered across several CE-adopting states.

Compliance Deadlines and Timing Rules

Timing plays a central role in NASAA Continuing Education.

The CE cycle follows a strict calendar-year schedule, and missing key dates can create registration issues for advisors:

See also:

Annual Calendar and Functional Deadlines (December 26 Cutoff)

The CE cycle runs from January 1 through December 31. Advisors must complete all NASAA Continuing Education credits within the same calendar year for them to count. There is no carryover into future years.

A practical detail often missed is the December 26 functional deadline. FINRA’s systems pause for year-end processing in the final days of December, which means providers cannot report completions during that period. Advisors who finish courses after December 26 risk having their credits posted late, creating administrative problems at renewal time.

For firms with advisors registered in multiple states, setting internal deadlines earlier in December helps reduce year-end congestion and avoids last-minute course issues.

Need help with fintech compliance?

Fill out the form below and our experts will get back to you.

First-Year Exemptions for New Registrants

Newly registered advisors receive a first-year exemption from NASAA Continuing Education. The requirement does not apply during the partial calendar year in which an advisor first becomes registered in a CE-adopting state.

The obligation begins on January 1 of the following year. This timing gives new registrants space to onboard, complete firm training, and settle into their role before taking on annual CE requirements.

For fintech firms hiring rapidly or expanding into new states, tracking when each advisor’s first CE year begins helps avoid confusion and prevents unnecessary last-minute course assignments.

How Course Completion Is Reported and Tracked

After an advisor completes a NASAA Continuing Education course, the provider reports the credit directly to FINRA’s tracking systems. Advisors do not upload certificates themselves. The approved provider handles the entire reporting process.

State regulators review CE completion through these systems, which means accurate reporting is essential. Advisors can also view their own CE status through their FINRA system access, making it easier to confirm whether all credits have posted.

Consequences of Non-Compliance

Missing NASAA Continuing Education requirements trigger specific status changes for advisors. These changes directly affect an individual’s ability to stay registered in CE-adopting states:

CE Inactive Status

Advisors who do not complete their NASAA Continuing Education credits by year-end move into CE Inactive status on January 1. This status signals that the advisor is behind on required coursework but remains registered for the time being.

Some CE-adopting states allow advisors to continue advisory activities during the first year of CE Inactive status, while others restrict activity until missing credits are completed. Because this authority rests with each state, firms should confirm the rules in every jurisdiction where an advisor is registered.

The outstanding credits are added to the new year’s requirement, which increases the overall workload and creates more pressure as deadlines approach.

For firms, identifying CE Inactive status early helps prevent further complications. Advisors who stay inactive in a second year face a more serious consequence that affects their ability to remain registered.

Two-Year Failure and Registration Termination

If an advisor remains CE Inactive for a second consecutive year, their registration in CE-adopting states is terminated. At that point, the advisor is no longer permitted to conduct advisory activities in those jurisdictions.

Termination is administrative, but the impact is significant. The advisor must complete all missing credits before submitting a new registration request. This creates operational friction for firms, especially those relying on a small number of registered individuals to support advisory functions.

For fintech teams working across multiple states, monitoring CE status throughout the year reduces the risk of reaching this stage. Once a termination occurs, returning to active registration requires both coursework and a new filing process.

Reinstatement After CE Lapse

Advisors who lose their registration because of a CE lapse must complete all outstanding NASAA Continuing Education credits before reapplying. This includes the credits missed in previous years as well as the current year’s requirement.

Once the coursework is finished and reported, the advisor can submit a new registration filing. Firms should be prepared for processing time, as reinstatement is not immediate and depends on state review.

For fintech companies with lean compliance teams, planning for potential reinstatement delays is important. A lapse can slow client onboarding or limit the firm’s ability to operate in certain states until the advisor’s registration is active again.

See also:

Integrating NASAA Continuing Education Into Compliance Programs

Building NASAA Continuing Education into daily compliance operations helps firms avoid last-minute issues and maintain consistent oversight.

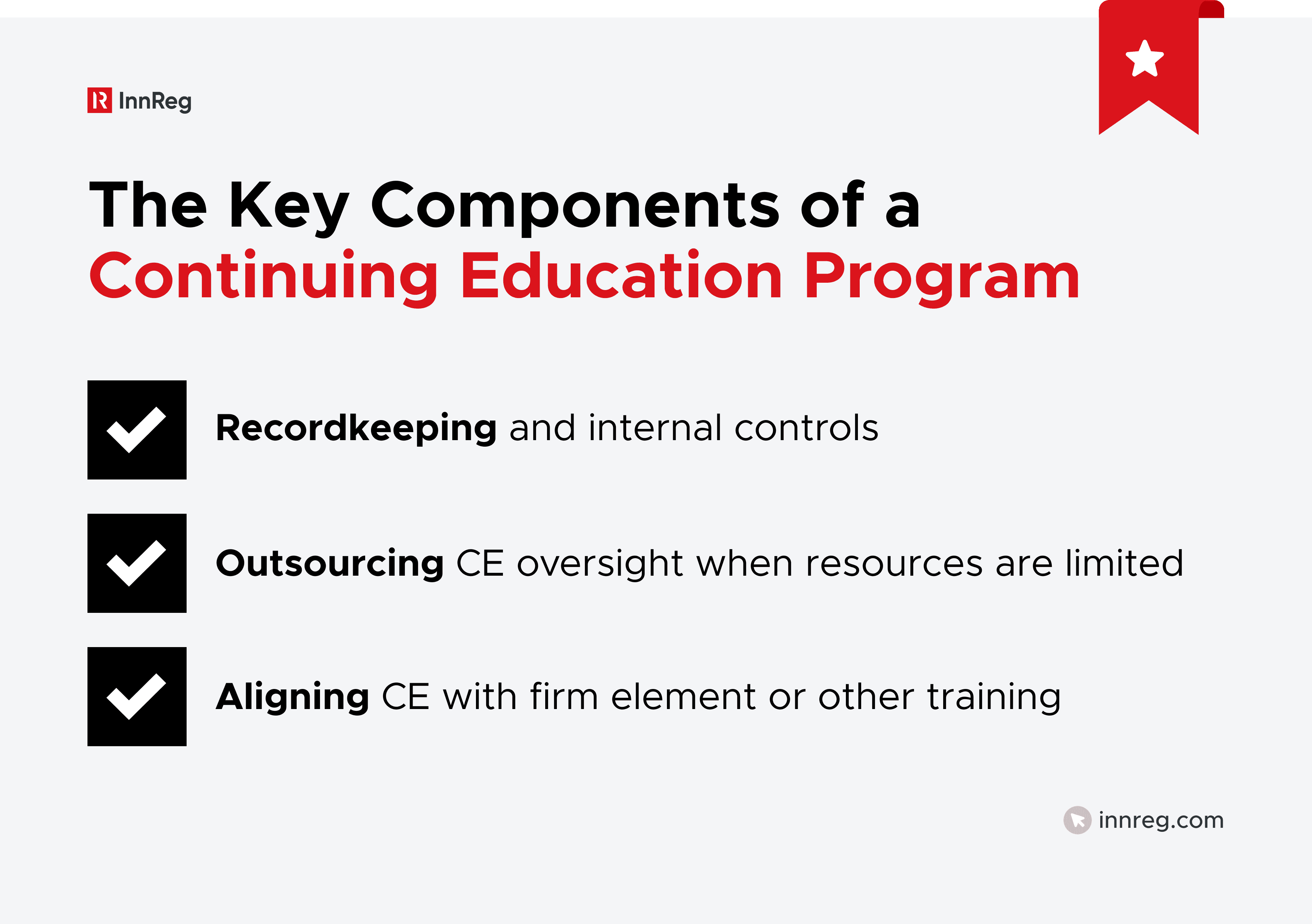

Recordkeeping and Internal Controls

Strong recordkeeping practices support accurate CE tracking and help firms respond quickly during audits or regulatory reviews. Firms should maintain internal logs of completed courses, credit values, and reporting dates, even though official reporting flows through FINRA.

Internal controls play an important role. Compliance teams can set periodic check-ins, assign CE monitoring tasks, and document any exceptions or delays. These steps create a consistent process that reduces the risk of missed credits or reporting discrepancies.

For fintech firms that operate at a fast pace, structured recordkeeping provides stability. It also supports better coordination between compliance, operations, and hiring teams as advisors join or change roles throughout the year.

Outsourcing CE Oversight and Tracking

Some firms choose to outsource CE oversight to compliance partners, especially when internal resources are limited. An external team can manage annual CE tracking, monitor advisor status, and follow up on outstanding credits throughout the year.

For fintech companies, outsourcing can be helpful when expanding into new states or managing distributed teams. It brings structured processes, reduces internal workload, and creates a central point of accountability for NASAA Continuing Education requirements.

InnReg supports this model through practical, process-driven oversight. Our team integrates into a firm’s existing tools and workflows, which helps maintain consistent tracking without adding friction to daily operations.

Aligning CE with Firm Element or Other Training

Firms often run multiple training programs throughout the year, including Firm Element training for broker-dealer activities or internal compliance refreshers. Coordinating these programs with NASAA Continuing Education requirements can reduce duplicate work and create a smoother training schedule.

Some CE courses also qualify for other credentials or internal programs, which helps advisors meet several obligations at once. The key is confirming that the provider and course are approved for NASAA credit before relying on them for CE.

For fintech firms balancing complex product lines or hybrid registrations, aligning CE with existing training supports efficiency. It also simplifies communication, since advisors receive a single, coordinated training plan rather than scattered requirements.

Cost, Fees, and Budgeting for CE Programs

Budgeting for NASAA Continuing Education helps firms plan training activities without last-minute surprises. Costs vary by provider, course format, and the number of advisors completing credits each year.

Typical Course Pricing and FINRA Reporting Fees

Most NASAA Continuing Education courses fall in the range of $25 to $60 per credit. Pricing varies based on the provider, course length, and whether the content is part of a package or purchased individually. Multi-course bundles often lower the per-credit cost, which can be helpful for firms with several advisors.

In addition to course fees, providers pay FINRA reporting fees to submit completed credits to FINRA’s tracking systems. These costs are generally built into the course price, so firms do not pay FINRA directly. Still, it is helpful to confirm how each provider structures its pricing to avoid unexpected add-on charges.

For fintech firms with growing teams, creating an annual CE budget supports more predictable spending. It also helps compare vendors based on total cost rather than course pricing alone.

Time Management and Productivity Considerations

Advisors often complete NASAA Continuing Education while balancing client activity, product work, and internal deadlines. Planning CE early in the year mitigates the risk of last-minute bottlenecks and keeps workloads more manageable.

Breaking courses into smaller sessions helps advisors fit training into busy schedules. Many providers offer one-credit modules that can be completed in short blocks of time, which is useful for teams working across trading cycles, development sprints, or regulatory filings.

For fintech firms, building CE milestones into quarterly planning keeps progress visible. It also helps compliance teams identify advisors who may need reminders or alternative course options before year-end pressures arrive.

Common Misunderstandings About NASAA Continuing Education

Several misunderstandings continue to circulate about NASAA Continuing Education. These misconceptions often cause advisors to miss deadlines or overlook obligations tied to their state registrations:

SEC Registration vs. State CE Rules

A common misconception is that SEC-registered firms are exempt from NASAA Continuing Education. In reality, CE obligations apply at the individual level and follow each advisor’s active state registrations. SEC registration covers the firm, not the advisor.

Advisors working for SEC-registered firms must complete CE if they are registered in any state that has adopted the model rule. This means a single state registration is enough to trigger the annual requirement.

For fintech companies that rely on a federal registration but operate across multiple states, this distinction is important. CE obligations may apply even when the firm’s main regulatory oversight comes from the SEC.

Residency vs. Registration Jurisdictions

Another frequent misunderstanding is that NASAA Continuing Education depends on where an advisor lives. As previously mentioned, residency has no impact on CE obligations. What matters is where the advisor is registered to conduct advisory activities.

If an advisor holds an active registration in a CE-adopting state, the annual requirement applies even if the advisor lives elsewhere. This is common in fintech firms with remote employees who support clients across multiple jurisdictions.

Firms should track registrations closely, especially when advisors onboard new clients or expand into additional states. A change in business activity can trigger CE requirements even when the advisor’s physical location stays the same.

Dropping Registration Mid-Year

Some advisors believe they can avoid NASAA Continuing Education by withdrawing from a CE-adopting state before year-end. The rule does not work this way. CE obligations apply for the full calendar year if the advisor was registered in that state at any point during the year.

Even a short registration period triggers the requirement. Advisors who withdraw mid-year must still complete the full 12 credits if they want to remain eligible for future registration in that state. Regulators track this through FINRA’s systems, so incomplete CE follows the advisor until it is resolved.

For fintech firms that frequently adjust state registrations based on growth or market tests, this point is critical. Dropping a registration does not remove CE obligations already in place, and ignoring them can complicate future filings.

Professional Designations and Double Counting

Another misconception is that completing coursework for a professional designation automatically satisfies NASAA Continuing Education requirements. Most designation programs, such as CFP, CFA, or CIMA, do not count toward NASAA CE unless the specific course has been approved by NASAA and Prometric.

Even if the content overlaps with CE topics, it will not apply unless listed as an approved NASAA course. Advisors must verify that a course is approved before relying on it to meet the 12-credit requirement.

For firms that encourage ongoing education or sponsor designation programs, this distinction is important. Professional credentials offer value, but they do not replace NASAA CE obligations unless the provider has gone through the formal approval process.

Recent Developments and Future Outlook

NASAA Continuing Education continues to evolve as more states adopt the model rule and regulators expand the scope of approved content. Understanding recent developments helps firms plan ahead and anticipate how CE requirements may shift in the coming years.

Growing State Adoption Momentum

More states continue to adopt the NASAA Continuing Education model rule, expanding the number of advisors who must complete annual CE. Early adopters helped establish the framework, and each year, more jurisdictions formalize their requirements.

This momentum means firms operating across multiple states may see new CE obligations appear with little lead time. Fintech companies, in particular, should track adoption trends closely because a single new state registration can bring CE requirements into scope.

As adoption spreads, the model rule is moving toward a nationwide baseline. Firms that build CE into long-term compliance planning will be better positioned to adapt as additional states join the program.

NASAA’s Exam Validity Extension Program (EVEP)

NASAA introduced the Exam Validity Extension Program (EVEP) to help advisors maintain the validity of specific qualification exams when they step away from active registration. EVEP allows eligible individuals to keep their exam results active for a defined period, provided they complete specific annual CE requirements.

This program is separate from the core NASAA Continuing Education rule, but the two often intersect. Advisors participating in EVEP must complete designated CE content each year to keep their exam validity intact.

For fintech firms, EVEP can be useful when advisors shift roles, pause client-facing work, or take time away from the industry. It helps preserve exam standing without requiring full registration during those periods.

FINRA CE Alignment and Dual Registrant Implications

FINRA has updated its own continuing education framework in recent years, and these changes overlap with NASAA Continuing Education for advisors who hold dual registrations. Dual registrants must complete both NASAA CE and FINRA’s Regulatory Element, since the two programs serve different regulatory purposes.

FINRA and NASAA do not merge credits across their systems. A course approved for NASAA CE will not satisfy FINRA CE unless it is separately approved under FINRA’s rules. This distinction matters for advisors who switch between advisory and broker-dealer responsibilities throughout the year.

For fintech firms with hybrid models or associated broker-dealers, tracking both CE programs is important. Dual-registered advisors may face a heavier training load, and misalignment can result in gaps that affect either registration. Integrating both CE calendars into compliance planning helps avoid these issues.

Emerging CE Topics: AI, Digital Assets, and Cybersecurity

As the financial industry evolves, NASAA Continuing Education content is expanding to cover new and complex subjects. Courses related to AI in financial services, digital asset strategies, and cybersecurity practices are becoming more common across approved providers.

These topics reflect the risks and opportunities shaping modern advisory work and offer fintech firms practical value by addressing areas where technology, regulation, and compliance intersect. Advisors gain exposure to emerging issues while staying aligned with regulatory expectations.

As NASAA updates its content framework, more courses in these areas are expected to appear. Firms that operate in fast-moving sectors may want to prioritize these topics to support both compliance needs and business strategy.

Best Practices for Compliance Teams and Fintech Firms

Managing NASAA Continuing Education becomes easier when firms take a structured, proactive approach. Clear processes, early planning, and coordinated communication help advisors stay on track throughout the year.

The following practices support a smoother CE cycle for fast-growing fintech teams.

Coordinating CE with Firm-Wide Training and Policies: Align CE timelines with existing compliance training to reduce overlap and create a more organized annual schedule. This helps advisors manage all required learning without juggling conflicting deadlines.

Communicating CE Expectations to IARs Early: Set expectations at the start of the year. Early communication gives advisors time to plan, select courses, and raise questions before demands increase later in the cycle.

Preventing Last-Minute Rush and Missed Deadlines: Create internal checkpoints throughout the year to track progress. Regular reminders reduce the risk of advisors scrambling in December or missing the December 26 functional cutoff.

Documenting and Auditing CE Completion: Maintain internal records of completed courses, reporting dates, and provider confirmations. Strong documentation supports quick responses during regulatory reviews or internal audits.

Leveraging Dual Credit Opportunities: Some courses qualify both for NASAA Continuing Education and internal training programs or professional designations. When applicable, these options help advisors meet multiple obligations with a single effort.

Assigning CE Oversight Roles: Designate responsibility for monitoring CE status, whether through the compliance team or an outsourced partner. A clear owner helps prevent gaps and keeps the process organized.

Reviewing CE Providers Annually: Evaluate CE providers each year to confirm course quality, reporting accuracy, and pricing. This review helps firms identify better options as new providers enter the market or existing offerings evolve.

See also:

—

NASAA Continuing Education is now a central part of maintaining investment advisor registrations, particularly for firms working across multiple states. As more jurisdictions adopt the model rule, CE has shifted from an occasional requirement to a year-round operational priority.

For fintech teams, building CE into broader compliance planning mitigates unnecessary risk. Early communication, structured oversight, and clear internal processes help prevent registration lapses and keep advisors on track even during busy periods.

Emerging CE topics, including digital assets, AI, and cybersecurity, add practical value by addressing the technologies and risks shaping modern advisory work. Firms that integrate CE into long-term compliance strategy gain more stability, stronger advisor readiness, and better alignment with evolving regulatory expectations.

How Can InnReg Help?

InnReg is a global regulatory compliance and operations consulting team serving financial services companies since 2013.

We are especially effective at launching and scaling fintechs with innovative compliance strategies and delivering cost-effective managed services, assisted by proprietary regtech solutions.

If you need help with compliance, reach out to our regulatory experts today:

Last updated on Dec 17, 2025