A Guide to SEC's RIA Compliance Rule 206(4)-7

Dec 5, 2025

·

13 min read

Contents

Registered investment advisors (RIAs) operate under one of the most closely monitored regulatory frameworks in the financial industry. The cornerstone of that framework is SEC Rule 206(4)-7, often referred to as the RIA Compliance Rule. This rule defines what an advisor must do to build and maintain a compliant program.

For fintechs entering the advisory space, understanding this rule is especially critical. Innovative business models must still fit within the same compliance expectations as traditional firms. And Rule 206(4)-7 is where that alignment begins.

This guide breaks down what SEC Rule 206(4)-7 requires, how it applies to RIA compliance, and what fintechs and advisors can do to implement it effectively. You’ll learn what regulators expect in written policies, how to approach annual reviews, and the most common pitfalls that draw scrutiny.

At InnReg, we help RIAs interpret and operationalize SEC requirements, including obligations under Rule 206(4)-7. Our team supports firms with registration, compliance program development, and ongoing oversight activities. Contact us to learn more about InnReg’s RIA compliance services.

What is the SEC Rule 206(4)-7?

SEC Rule 206(4)-7, commonly known as the RIA Compliance Rule, is the foundation of compliance for registered investment advisors. Adopted under the Investment Advisers Act of 1940, it requires firms to build compliance programs that detect, prevent, and correct regulatory violations.

The rule applies equally to traditional advisory firms and fintech advisors offering digital or algorithmic investment services. The rule sets three obligations:

Maintaining written policies and procedures

Conducting annual reviews of those policies

Designating a qualified chief compliance officer.

Together, these form the framework regulators use to evaluate whether a firm operates responsibly and transparently.

Understanding its requirements is the first step in developing a compliance program for fintechs that supports growth without exposing the business or its clients to unnecessary risk.

Importance of SEC Rule 206(4)-7 for RIAs and Fintechs

SEC Rule 206(4)-7 is more than a procedural requirement. It’s the benchmark regulators use to assess how effectively a registered investment advisor manages compliance risk. It turns compliance from a one-time setup into an ongoing system of oversight and accountability.

For both traditional and fintech advisors, the rule matters because it:

Defines the SEC’s baseline for RIA compliance. Every firm must have a structured, proactive program tailored to its operations, risks, and clients.

Establishes equal standards for all business models. Whether managing individual portfolios or offering digital advice through automated tools, advisors are held to the same expectations for governance and control.

Forces compliance alignment with innovation. Fintech advisors introducing new products, APIs, or algorithmic models must ensure their compliance framework evolves alongside their technology.

Drives operational discipline. Rule 206(4)-7 ties compliance quality directly to how a firm monitors risks, documents processes, and addresses regulatory changes in real time.

In practice, the rule is where regulatory accountability meets innovation, a balance every growth-minded fintech must master early.

Key Requirements Under Rule 206(4)-7

Rule 206(4)-7 sets out three core requirements that form the foundation of RIA compliance. These requirements apply to all registered investment advisors, regardless of size, structure, or technology use. Each is designed to make compliance a measurable and ongoing process rather than a static policy.

Written Policies and Procedures

Every advisor must maintain written policies and procedures that are “reasonably designed” to prevent violations of the Investment Advisers Act and related rules.

These policies should not be a slightly tweaked generic template, but must reflect how the firm actually operates. Regulators expect procedures to address trading, client communications, cybersecurity, valuation, and other areas where compliance risk exists.

Annual Review of the Compliance Program

Firms must perform an annual review to test whether their policies and procedures remain effective and relevant. The SEC’s 2023 amendment now requires firms to document this review in writing, giving regulators direct visibility into how they evaluate and update their programs.

Chief Compliance Officer Designation

Each firm must appoint a chief compliance officer (CCO) with the authority and expertise to oversee the compliance program. The CCO should have access to management, understand the firm’s operations, and be empowered to act on compliance findings.

For many fintechs, outsourcing this role to a specialist team can provide cost-effective access to regulatory expertise while maintaining operational focus.

State-Registered Advisors and RIA Compliance

While SEC Rule 206(4)-7 applies to federally registered investment advisors, state-registered advisors operate under similar frameworks. States often mirror SEC requirements to promote consistency in compliance expectations, but the level of scrutiny and local interpretation can vary:

See also:

NASAA’s Model Rule on Compliance Programs

The North American Securities Administrators Association (NASAA) introduced a model rule that parallels SEC Rule 206(4)-7. It sets similar expectations for state-registered advisors, requiring them to:

Adopt written compliance and supervisory procedures that reflect the firm’s business model and risk areas.

Conduct an annual review of those procedures to confirm they remain effective and up to date.

Designate a compliance officer with the authority and knowledge to oversee daily compliance operations.

The model rule helps smaller or emerging firms that are below the SEC’s registration threshold maintain structured, investor-focused compliance programs that promote accountability and transparency.

Need help with RIA compliance?

Fill out the form below and our experts will get back to you.

How State Expectations Compare to SEC Oversight

State regulators often take a more hands-on approach during exams, focusing on recordkeeping, client disclosures, and supervision. While the SEC emphasizes risk-based reviews, state examinations can be broader and more procedural.

For fintech advisors operating across jurisdictions, this creates an additional layer of complexity. Maintaining compliance programs that satisfy both SEC and state standards helps firms streamline operations and avoid conflicting requirements as they grow.

InnReg frequently works with hybrid and state-registered firms navigating this overlap. A process-driven approach helps these firms stay aligned with both state and federal expectations without duplicating effort.

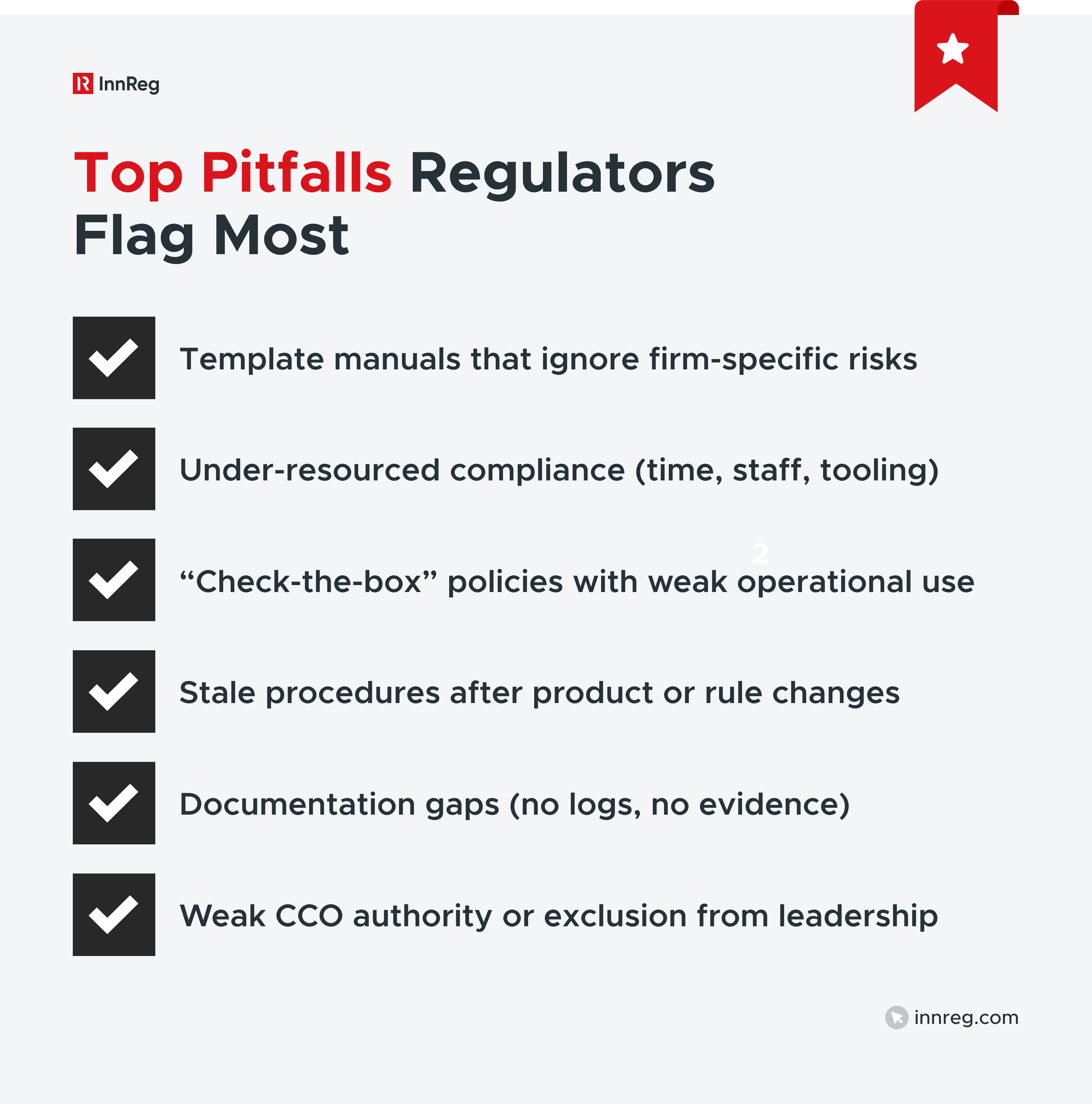

Common RIA Compliance Challenges

Even well-structured compliance programs can face weaknesses over time. For RIA compliance, the most frequent problems arise when firms focus on documentation over application, or when growth outpaces the systems meant to support it.

Overreliance on Templates

Many firms start with off-the-shelf compliance manuals. Generic templates often overlook firm-specific risks, including emerging fintech products, digital onboarding, and algorithmic trading. Regulators expect policies that match a firm’s actual operations, not recycled language from another business model.

Underestimating Resource Needs

Compliance programs require consistent attention and resources. Assigning compliance oversight to a single person who also manages operations or client services often leads to missed reviews or gaps in documentation. Fast-growing fintech firms can benefit from outsourced support that scales as their compliance needs expand.

Treating Compliance as a Box-Check

Compliance isn’t a one-time formality. When firms treat policies as paperwork rather than operational tools, issues remain undetected until regulators intervene. Regular testing, cross-department reviews, and ongoing updates turn a static policy into an active safeguard.

Firms that embed compliance in daily decision-making, rather than isolating it to one department, tend to identify risks earlier and resolve them before they escalate.

Not Updating Policies for Business or Regulatory Changes

A compliance manual written once and left untouched becomes a liability. Any shift in the firm’s services, client base, or technology requires updates. For fintechs, that includes changes to API integrations, digital asset custody, or vendor management practices.

Staying current means regularly assessing how new laws, rule amendments, or product features impact compliance procedures, not just waiting for the next annual review.

See also:

Documentation Gaps and “If It’s Not Written, It Didn’t Happen”

Verbal procedures hold little weight in an SEC or state examination. Examiners expect documented evidence to demonstrate ongoing compliance activity, such as:

Training logs

Testing records

Version-controlled policies

Without consistent documentation, even well-established compliance practices can appear nonexistent, exposing the firm to avoidable regulatory findings or penalties.

Misunderstanding CCO Liability

The chief compliance officer oversees the program, but ultimate responsibility rests with the firm. Still, a CCO who lacks authority, access, or support can face scrutiny for compliance failures.

CCO liability often arises not from direct misconduct but from inadequate structure, such as being excluded from management discussions or lacking insight into business operations. Firms that empower their CCO and treat compliance as a shared duty reduce both personal and organizational exposure.

What Written Policies and Procedures Should Cover

Rule 206(4)-7 requires written policies and procedures tailored to each firm’s structure and risk profile. Effective RIA compliance programs focus on operational realities, not theoretical risks. Regulators expect firms to document how they manage core functions and to regularly test whether those controls work in practice.

Portfolio Management and Conflicts

Policies should explain how investment advice is formulated, approved, and monitored. Regulators look for evidence that:

Client recommendations are consistent with stated investment objectives.

Allocation methods are documented and applied consistently.

Conflicts of interest are disclosed and mitigated, such as:

Revenue sharing

Affiliated products

Algorithmic bias

For fintech firms using automated or AI-driven portfolio models, compliance should go further. Regular back-testing, human oversight of algorithms, and audit trails showing when models are updated are now standard expectations.

Privacy, Cybersecurity, and Data Protection

Strong compliance programs connect Regulation S-P with practical cybersecurity measures. Policies should describe how the firm controls access to sensitive data, handles encryption, and responds to breaches. Vendor oversight is critical, especially for fintechs that rely on cloud or API-based systems.

Some firms conduct annual “tabletop” exercises simulating data incidents. These simulations can demonstrate preparedness and provide material for the annual compliance review.

Trading and Best Execution

A firm’s trading policy should answer three questions:

How are trades executed?

Who oversees trade quality?

What documentation supports that process?

Advisors are expected to periodically review execution quality and broker performance. For digital or API-driven platforms, this includes verifying the accuracy of order routing logic and monitoring system-generated trades for anomalies. A review summary showing which metrics were tested and what actions followed strengthens credibility during an exam.

Accuracy of Disclosures and Filings

Compliance programs must verify that what appears in Form ADV, marketing materials, and client communications accurately reflects the firm’s operations. Regulators routinely cross-check these materials during exams.

Firms that build disclosure reviews into their compliance calendar, especially before annual ADV updates, reduce the risk of inconsistencies that can trigger deficiencies.

See also:

Fee Billing and Valuation Practices

Billing and valuation mistakes continue to trigger regulatory scrutiny more than almost any other compliance issue. Your policies need to spell out how fees are calculated, reviewed, and communicated to clients. They should cover valuation timing, acceptable data sources, and procedures for handling accounts that fall outside normal billing cycles.

For fintech advisors relying on automated systems, you still need real people checking the outputs. Periodic reconciliations and exception reports verify that your billing technology is operating as intended.

Personal Trading and Code of Ethics

A code of ethics is more than a disclosure form. It defines behavioral standards for everyone in the firm, not just portfolio managers. Strong policies include:

Pre-clearance procedures for employee trades

Reporting timelines for personal securities transactions

Methods for identifying and investigating potential insider trading

Technology can simplify this process. Automated trade-matching tools, for instance, can flag when an employee’s trades mirror client activity too closely.

Safeguarding Client Assets

Advisors with custody of client funds must document how they meet the Custody Rule. Procedures should outline how client assets are held with qualified custodians, how statements are reconciled, and when surprise audits are triggered.

For fintechs handling digital assets, regulators expect the same level of protection, documenting how wallets, private keys, or third-party custodians are secured and monitored.

Business Continuity Planning

Business continuity policies must explain how operations continue during disruptions like cyberattacks, vendor failures, or system outages. Key elements include:

Communication protocols for staff and clients

Data backup and recovery procedures

Contingency plans for critical vendors or cloud providers

Fintech advisors should test continuity plans through simulations, especially for scenarios involving data loss or downtime in integrated platforms.

Recordkeeping

The Marketing Rule (206(4)-1) expanded what advisors can do but also tightened expectations for documentation. Firms should outline how marketing materials are approved and retained, how performance data is verified, and how testimonials or third-party reviews are tracked.

For fintechs that publish content frequently, pre-approval workflows and automated archiving tools can help maintain compliance without slowing marketing operations.

Marketing and Advertising

Rule 204-2 requires firms to maintain accurate, accessible records. Policies should identify which documents must be retained, how they’re stored, and how retrieval requests are handled.

Firms that use multiple communication platforms like email, chat, and ticketing tools should integrate them into a unified recordkeeping system to prevent missing data during exams.

What Advisors Must Do for Annual Review

Rule 206(4)-7 requires each registered investment advisor to review the adequacy and effectiveness of its compliance program at least once a year. This review is how regulators assess whether the firm’s compliance systems genuinely work in practice.

SEC Expectations and Scope

The SEC expects annual reviews to evaluate three main areas:

Policy effectiveness: Are the firm’s written policies preventing and detecting violations?

Program design: Does the compliance structure still fit the firm’s size, services, and risks?

Business and regulatory changes: Has the firm accounted for new products, partnerships, or rule updates?

Firms that treat the review as a year-end checklist often miss key findings. The most credible reviews gather insights from throughout the year to show that compliance oversight is ongoing, not episodic, by tracking compliance exceptions, testing logs, or updates to vendor relationships.

2023 Amendment Requiring Written Documentation

The SEC’s 2023 amendment to Rule 206(4)-7 made one key change: the annual review must now be documented in writing. This closes a long-standing gap where firms could verbally claim a review occurred without evidence.

The written review should summarize:

What areas were tested

What issues were found, and how they were addressed

What changes are planned for the next period

Although the SEC allows flexibility in format, written documentation is now a non-negotiable part of RIA compliance. During an exam, regulators will request the latest report and may use it to guide the rest of their review.

Flexible Formats for Documenting Reviews

There’s no official template, but most firms use one of three approaches:

Format | Description | Best For |

|---|---|---|

Narrative Report | A structured written summary covering findings, corrective actions, and recommendations. | Established firms with multiple business lines. |

Matrix or Checklist | A table identifying key areas, tests performed, results, and next steps. | Small or growing advisors who need simplicity. |

Continuous Review Log | Quarterly or monthly entries compiled into an annual summary. | Fintechs operating in fast-changing environments. |

Regardless of format, the written review must be clear enough for regulators to trace how the firm evaluated risks and implemented improvements.

Practical Steps for Building an Effective Review Process

An effective review process is less about format and more about structure. Strong compliance teams:

Plan early. Set quarterly testing cycles so findings can be aggregated efficiently at year-end.

Document continuously. Keep notes on every compliance issue or change throughout the year.

Test key controls. Sample transactions, review marketing approvals, and validate access logs to confirm procedures are working.

Involve leadership. The chief compliance officer should present findings to management and record discussions about next steps.

For fintech firms, annual reviews should also assess technology controls, including data integrations, automated trade systems, and third-party vendor performance. Firms that document these reviews clearly demonstrate both regulatory diligence and operational maturity.

The Chief Compliance Officer’s Role in RIA Compliance

Under Rule 206(4)-7, every registered investment advisor must designate a chief compliance officer (CCO) to administer the firm’s compliance program. This role is central to how regulators evaluate the firm’s accountability and culture.

A strong CCO isn’t simply a policy manager. They are key decision-makers responsible for keeping the compliance function active, visible, and informed.

Qualifications and Authority Required

The SEC expects the CCO to have the competence, authority, and independence to manage the firm’s compliance program effectively. This means access to all business lines, unrestricted communication with senior management, and a deep understanding of both regulatory rules and the firm’s day-to-day operations.

In smaller or startup firms, the CCO often wears multiple hats, but the role still requires dedicated time and resources. Without those, even well-written compliance programs fail to operate effectively. Regulators take particular note when a CCO lacks genuine authority or when their recommendations are ignored by leadership.

Common CCO Challenges at Startups and Fintechs

Fintech advisors face unique challenges in this role. Fast product cycles, technology integrations, and partnerships with third-party service providers expand the scope of compliance risk. CCOs in these environments must:

Monitor regulatory implications of product updates or new tech integrations

Oversee vendor risk, particularly with data processors and trading platforms

Coordinate with engineering or product teams to confirm that automated systems align with compliance procedures

Because fintech operations often move faster than traditional advisory models, compliance leadership has to keep pace without becoming a bottleneck. The best-performing CCOs balance regulatory rigor with practical, risk-based prioritization, focusing on areas most likely to draw regulatory attention.

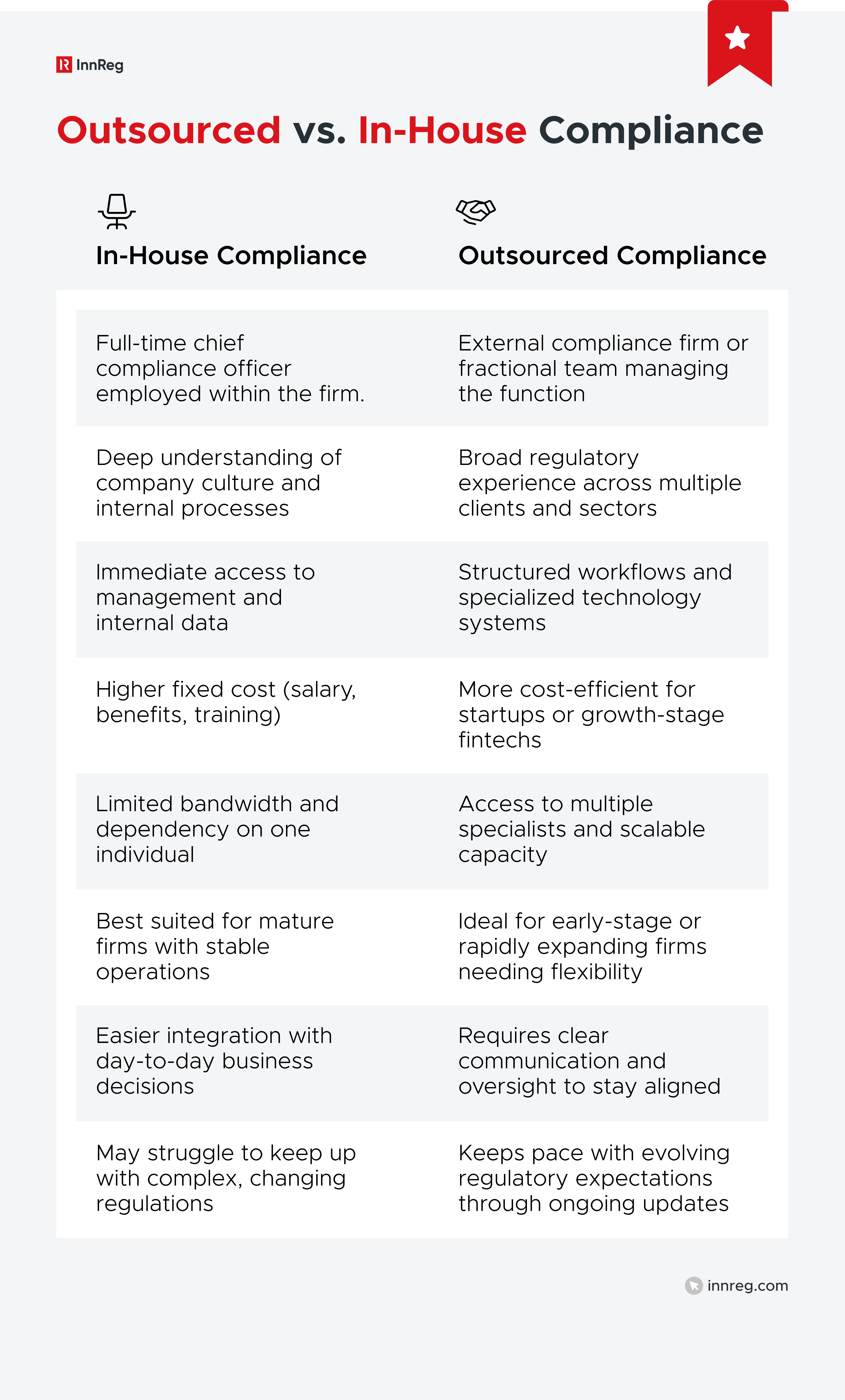

Outsourcing vs. In-House Compliance Leadership

Some firms appoint internal CCOs, while others outsource the role to specialized compliance providers. Outsourcing can make sense for early-stage or rapidly growing fintechs that lack internal regulatory expertise or the budget for a full-time officer.

A reputable outsourced team can provide:

A dedicated group of compliance specialists, instead of a single individual

Established testing frameworks and reporting templates

Flexible systems that integrate with the firm’s project management tools and operations

However, ultimate accountability still lies with the advisor. Even when the CCO role is outsourced, firms must stay involved by reviewing reports, approving recommendations, and supporting the compliance function with clear internal communication.

—

Rule 206(4)-7 remains one of the most important frameworks in the SEC’s regulatory structure, and for fintech advisors, it’s often where compliance maturity is tested first. A well-documented program, reviewed annually, and led by a capable chief compliance officer signals to regulators, partners, and investors that the firm takes its obligations seriously.

For fintechs, the challenge lies in keeping compliance aligned with innovation. As products evolve and operations scale, written policies, control testing, and documentation must evolve just as quickly. That’s where specialized expertise makes a difference.

InnReg helps fintechs and financial services firms build, operate, and manage RIA compliance programs that meet regulatory standards without slowing growth. If you need a full outsourced compliance department, our practical, tech-neutral approach can keep your operations organized, audit-ready, and built for long-term scalability.

How Can InnReg Help?

InnReg is a global regulatory compliance and operations consulting team serving financial services companies since 2013.

We are especially effective at launching and scaling fintechs with innovative compliance strategies and delivering cost-effective managed services, assisted by proprietary regtech solutions.

If you need help with RIA compliance, reach out to our regulatory experts today:

Last updated on Dec 5, 2025