Lending Regulation for Fintechs: A Compliance Guide

Dec 19, 2025

·

16 min read

Contents

Lending regulation defines the guardrails for how credit is extended, priced, and collected. For fintechs, those guardrails are tightening. Whether a company offers buy-now-pay-later options, small business loans, or embedded credit products inside an app, each model operates under rules designed long before fintech existed.

Understanding how those rules apply is critical not only to launch legally but to maintain trust with customers, partners, and regulators. This guide explains what lending regulation means for fintechs today, the main legal requirements that apply, and how oversight differs across markets and business models.

It also outlines the regulators involved, the compliance challenges that fintech lenders encounter most often, and the practical steps to build a scalable compliance framework. So, let's break down the regulatory environment into actionable insights for founders.

InnReg is a global regulatory compliance and operations consulting team serving financial services companies since 2013. If you need assistance with compliance or fintech regulations, click here.

What Lending Regulation Means for Fintechs

Lending regulation defines how credit providers must operate, from who can issue loans to how repayment terms are disclosed. For fintechs, these rules create the foundation for compliance and credibility.

Unlike traditional lenders, fintechs often blend technology, data analytics, and user experience into financial products that regulators still evaluate under existing lending laws.

Consumer vs. Commercial Lending Rules

Fintech lenders must first distinguish between consumer lending and commercial lending. Here is a quick overview of different examples of what counts as either:

Consumer Lending | Commercial Lending |

|---|---|

Personal loans for household or family needs | Small business loans or lines of credit |

Credit cards and personal installment loans | Equipment financing and merchant cash advances |

Buy Now, Pay Later (BNPL) and point-of-sale financing | Working capital or invoice financing |

Auto loans and student loans | Business-to-business (B2B) trade credit |

Mortgages and home equity loans | Commercial real estate and construction loans |

Now, let’s talk about the rules surrounding them. Consumer credit is subject to extensive federal and state protection, including rules around disclosures, advertising, interest caps, and collections. Key laws include the:

Truth in Lending Act (TILA)

Equal Credit Opportunity Act (ECOA)

By contrast, commercial lending faces fewer prescriptive laws but is not unregulated. States like California and New York have introduced disclosure requirements for small business and merchant cash advance providers, mirroring consumer transparency rules.

In addition, anti-discrimination provisions under ECOA apply to business credit as well. Founders often underestimate the intersection of commercial disclosure laws, fair lending rules, and fintech models serving small or sole proprietorship businesses.

Therefore, consumer lending triggers stricter, more uniform oversight, while commercial lending exposes fintechs to a growing patchwork of state-level rules.

Why Fintech Business Models Face Extra Scrutiny

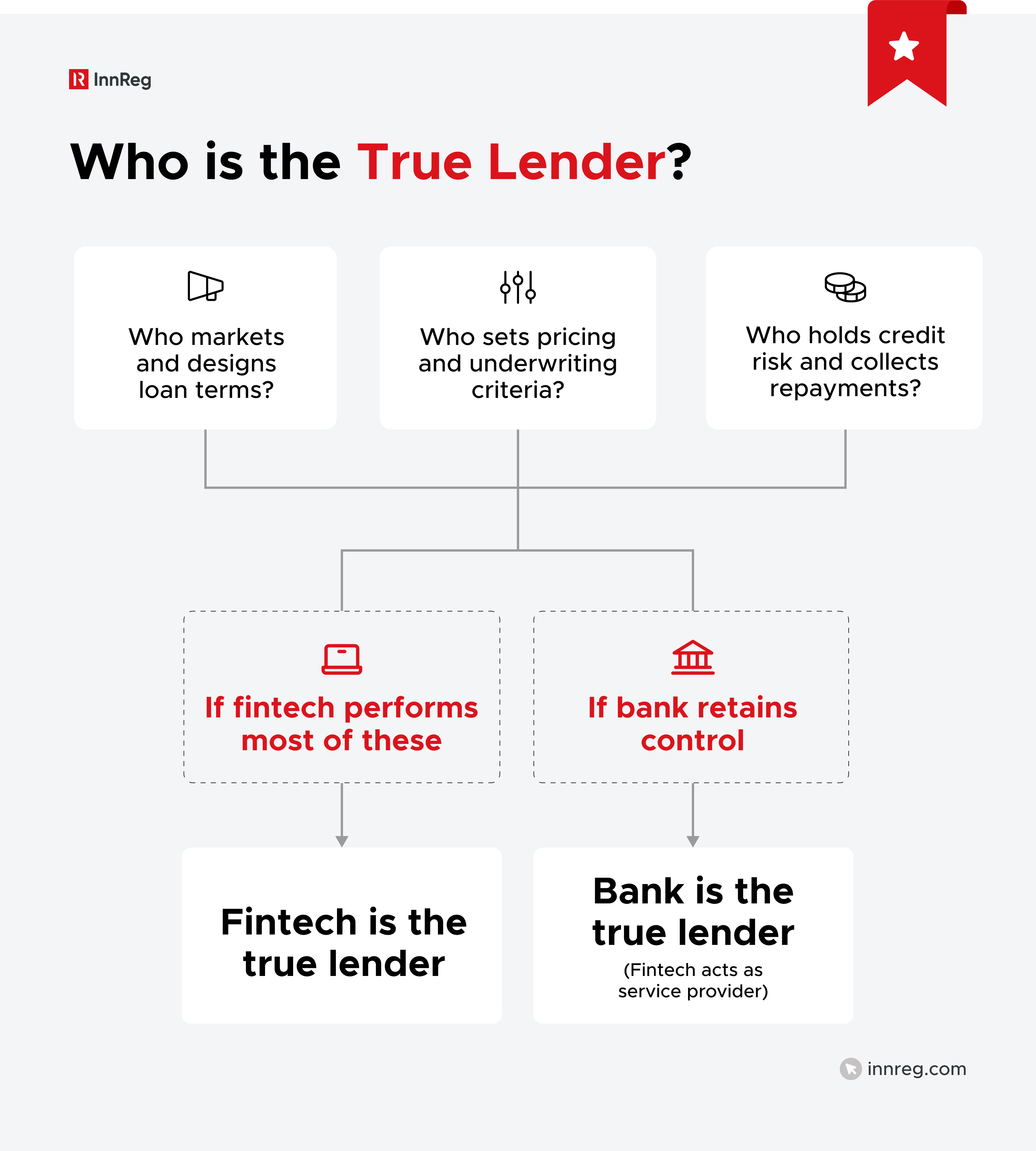

Fintechs attract attention from regulators because they frequently operate in hybrid models. A company might provide software to a bank, fund loans through investors, or embed credit directly into an e-commerce checkout flow. Each model changes who the “lender” legally is and which licenses or disclosures apply.

Partnerships with banks add another layer. While these arrangements can simplify licensing, regulators increasingly test whether the fintech or the bank is the “true lender,” i.e., the entity bearing credit risk and setting loan terms. A single misstep can trigger violations of state lending laws, even if a partner bank is involved.

Moreover, regulators now evaluate how fintechs use technology to make lending decisions. Algorithmic underwriting, alternative data sources, and automated marketing are efficient but can introduce risks of discrimination, privacy violations, or misleading representations. This is why fintech lenders face heightened oversight compared to traditional institutions.

Key Lending Regulation Requirements

Fintech lenders operate within a patchwork of federal, state, and international rules. These requirements govern how credit is issued, priced, and serviced. Knowing which laws apply and at what stage helps fintechs structure their programs responsibly and avoid regulatory gaps.

Licensing and State-Level Oversight

In the US, non-bank fintech lenders generally need state lending licenses in each state where they offer or arrange credit. These licenses define

Allowable loan amounts

Interest caps

Reporting obligations

Some fintechs rely on a bank partnership model, where a chartered bank originates the loans and the fintech handles marketing, underwriting, or servicing. This structure allows lending across multiple states but introduces scrutiny under “true lender” tests and rules used to determine which party actually controls the loan.

A strong compliance framework should map every state’s requirements and confirm where licensing, disclosures, or servicing obligations apply. Firms that grow fast without this groundwork often face delayed launches or enforcement actions once regulators notice the gap.

Interest Rates and Usury Laws

Each state enforces its own limits on interest rates and fees. These usury laws protect borrowers from excessive costs and vary significantly across jurisdictions. For fintechs, complexity arises when loans cross state lines or involve bank partners.

While a bank can sometimes “export” its home state’s rates nationally, several states like Colorado have recently opted out of federal rate exportation, meaning fintech loans to their residents must follow local caps.

Startups entering lending markets should model loan economics under the most restrictive state laws, not the most favorable ones. Ignoring this can lead to repayment disputes or accusations of predatory lending.

Truth in Lending Act (TILA) Disclosures

TILA requires standardized disclosure of credit terms such as APR, total repayment amount, and fees. Fintechs offering consumer loans must clearly integrate these disclosures into their apps and marketing flows before a borrower accepts an offer.

State laws often add their own disclosure templates or timelines. Integrating disclosure delivery into user experience design, rather than treating it as a legal add-on, makes compliance easier to maintain as the product evolves.

Read more about Regulation Z (Truth in Lending) in our article →

Fair Lending and ECOA Compliance

ECOA prohibits discrimination in any credit transaction, whether personal or business-related. Fintechs using algorithmic or alternative data for underwriting must regularly test for disparate impact, where neutral models unintentionally disadvantage protected groups.

Maintaining model transparency, clear adverse action notices, and documentation of credit decision factors are essential. Fair lending compliance is a business standard that builds investor and regulator confidence in a company’s data practices.

Credit Reporting and FCRA Obligations

Under the Fair Credit Reporting Act (FCRA), fintechs that pull or furnish consumer credit data must follow strict accuracy and disclosure standards. They can only access reports for permissible purposes, must notify applicants of adverse actions based on credit information, and must promptly correct reported errors.

This also applies when using alternative data or open banking APIs to assess creditworthiness. The compliance focus is on transparency, and borrowers need to know what information influenced a credit decision and how to dispute it.

See also:

Marketing Rules and UDAAP

Marketing and customer communication fall under the CFPB’s Unfair, Deceptive, or Abusive Acts or Practices (UDAAP) framework and the FTC Act. Fintech lenders must avoid overstating approval odds, concealing fees, or misrepresenting credit terms in a misleading manner.

From website copy to in-app notifications, every piece of promotional content should be reviewed for accuracy and fair presentation. Overlooking marketing compliance can result in regulatory action comparable to lending violations.

Need help with lender compliance?

Fill out the form below and our experts will get back to you.

Loan Servicing and Debt Collection Laws

Once loans are issued, servicing and collections become the next compliance layer. FDCPA restricts abusive or misleading collection conduct and governs how and when borrowers may be contacted.

Even fintechs that service their own loans should adopt FDCPA-aligned policies. This includes

Call time restrictions

Documented borrower communication logs

Clear dispute-handling procedures

Regulators assess whether a fintech’s collections process respects consumer rights as much as its lending process does.

Data Privacy and GLBA Requirements

The Gramm-Leach-Bliley Act (GLBA) requires financial institutions to safeguard nonpublic personal information (NPI) and issue privacy notices describing data use. Fintechs handling sensitive borrower data must implement administrative, technical, and physical controls to prevent misuse or breach.

Data privacy also extends to partner relationships; data shared with service providers or analytics vendors must follow the same security and disclosure standards. A single vendor gap can trigger compliance exposure for the entire operation.

AML and KYC in Lending Programs

Although often associated with payments or banking, Anti-Money Laundering (AML) and Know Your Customer (KYC) standards apply to lending activities as well. Fintech lenders must verify borrower identities, monitor transactions for suspicious behavior, and file Suspicious Activity Reports (SARs) when appropriate.

Fintechs that partner with banks usually adopt the bank’s AML framework, but direct lenders need their own controls. This includes automated ID verification, sanctions screening, and recordkeeping. Embedding AML and KYC checks during the onboarding reduces both fraud risk and regulatory scrutiny later.

Who Regulates Fintech Lenders

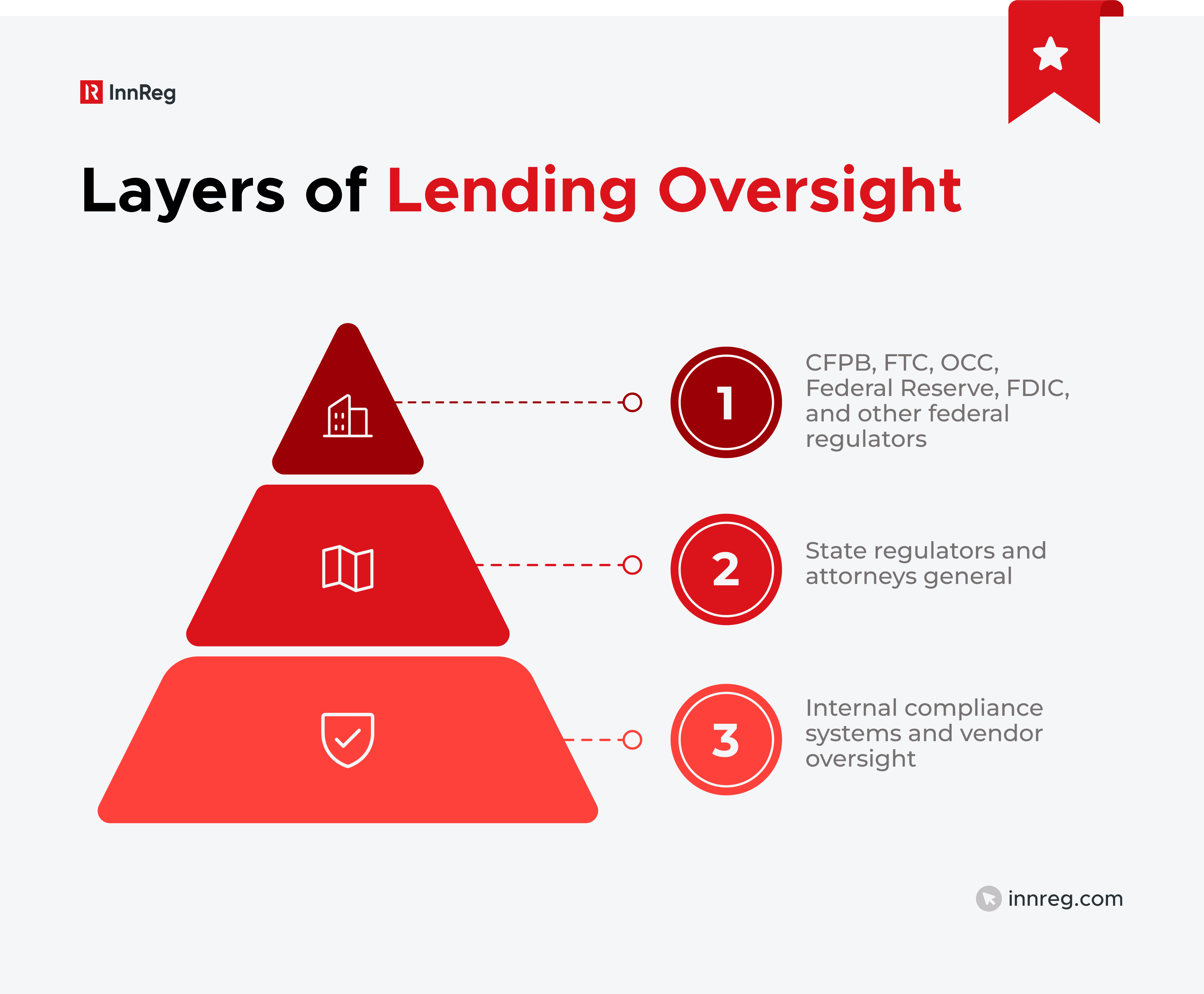

Fintech lenders operate across multiple jurisdictions, and oversight often depends on the nature of the product and the customers it serves. A single lending program may fall under various regulatory bodies, each focusing on different parts of the credit lifecycle.

Understanding these layers is essential for structuring compliant partnerships and anticipating examination requirements.

Federal Consumer Protection Agencies

At the federal level, two main authorities shape how fintech lending is regulated:

The Consumer Financial Protection Bureau (CFPB)

The Federal Trade Commission (FTC)

The CFPB supervises non-bank lenders that offer consumer credit products such as installment loans, BNPL, or lines of credit. It enforces laws like TILA, ECOA, and FCRA.

Its examiners focus on disclosures, fair lending practices, complaint management, and data accuracy. Fintechs that reach a certain size or risk profile may be directly subject to CFPB supervision.

On the other hand, the FTC acts as a broad consumer protection body for entities not under direct CFPB examination. It targets unfair or deceptive practices in marketing, servicing, and data privacy under the FTC Act and GLBA Safeguards Rule.

Smaller fintechs or those with hybrid models, such as marketplaces or embedded lending partners, often interact with the FTC before any other federal agency.

Prudential regulators, including the OCC, FDIC, and Federal Reserve, indirectly influence fintech lenders through oversight of bank partnerships. When a fintech works with a bank to originate loans, that bank’s regulator examines the partnership’s compliance performance.

This includes underwriting controls, data handling, and marketing materials that carry the bank’s brand. If gaps appear, regulators hold the bank accountable and banks, in turn, impose stricter compliance expectations on their fintech partners.

State Regulators and Attorneys General

Each state has its own lending regulator. These agencies license non-bank lenders, review disclosures, and investigate consumer complaints. They also enforce state-specific interest rate caps, advertising rules, and debt collection standards.

State attorneys general play a growing role in fintech oversight. They coordinate multi-state investigations and bring actions under both state consumer protection laws and federal statutes.

For example, a fintech operating nationwide might find its practices compliant at the federal level but out of line in one or two key states, triggering enforcement.

Because licensing, audits, and reporting differ across states, fintech compliance teams often manage a complex regulatory calendar. Some firms consolidate this work through internal tracking systems or outsource ongoing monitoring to specialized compliance partners like InnReg, which can maintain multi-state filings and respond to examination requests efficiently.International Regulators and Cross-Border Issues

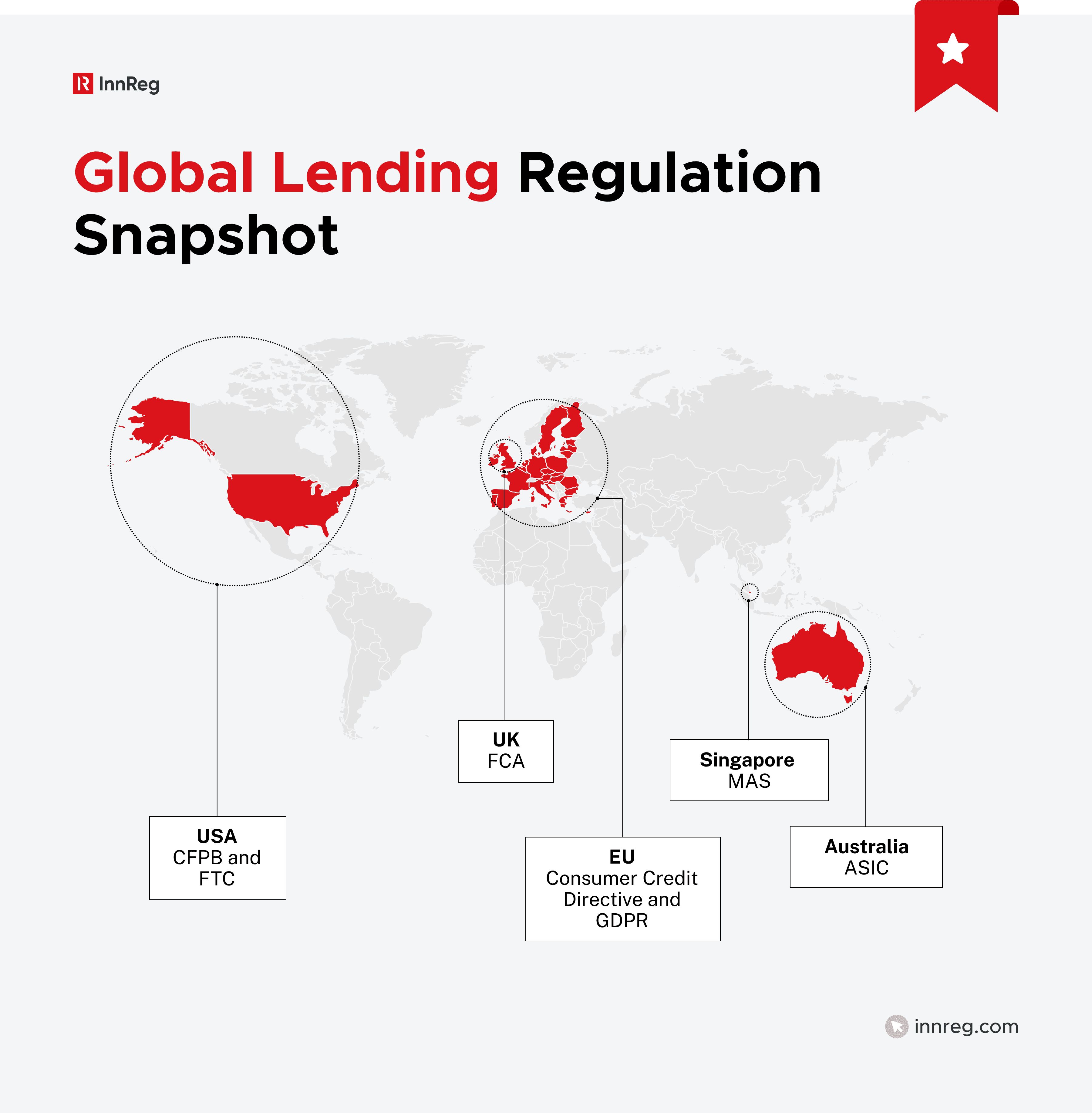

Fintechs expanding beyond the US must adapt to new frameworks that define how lending is regulated abroad:

Financial Conduct Authority (FCA): The FCA authorizes firms in the UK for consumer credit activities and applies strict conduct rules. Lending without authorization is a criminal offense, and the FCA’s Consumer Duty requires all credit products to deliver “good outcomes” for customers, focusing on pricing, transparency, and post-sale service.

European Union (EU Regulators): National regulators enforce the Consumer Credit Directive and data protection obligations under the General Data Protection Regulation (GDPR). Recent updates extend oversight to newer credit models like BNPL and digital microloans, aligning them with traditional lending standards.

Monetary Authority of Singapore (MAS): MAS supervises digital lenders and credit providers to promote responsible lending, clear disclosure, and financial system stability. Fintechs must meet strict licensing and reporting requirements before offering consumer or business loans.

Australian Securities and Investments Commission (ASIC): ASIC regulates consumer credit under the National Consumer Credit Protection Act, emphasizing affordability checks, transparent pricing, and fair treatment of borrowers across digital lending platforms.

Fintechs operating globally should design compliance frameworks that adapt to regional variations in licensing, consumer protection, and data handling requirements.

See also:

International Regulators and Cross-Border Issues

Fintechs expanding beyond the US must adapt to new frameworks that define how lending is regulated abroad:

Financial Conduct Authority (FCA): The FCA authorizes firms in the UK for consumer credit activities and applies strict conduct rules. Lending without authorization is a criminal offense, and the FCA’s Consumer Duty requires all credit products to deliver “good outcomes” for customers, focusing on pricing, transparency, and post-sale service.

European Union (EU Regulators): National regulators enforce the Consumer Credit Directive and data protection obligations under the General Data Protection Regulation (GDPR). Recent updates extend oversight to newer credit models like BNPL and digital microloans, aligning them with traditional lending standards.

Monetary Authority of Singapore (MAS): MAS supervises digital lenders and credit providers to promote responsible lending, clear disclosure, and financial system stability. Fintechs must meet strict licensing and reporting requirements before offering consumer or business loans.

Australian Securities and Investments Commission (ASIC): ASIC regulates consumer credit under the National Consumer Credit Protection Act, emphasizing affordability checks, transparent pricing, and fair treatment of borrowers across digital lending platforms.

Fintechs operating globally should design compliance frameworks that adapt to regional variations in licensing, consumer protection, and data handling requirements.

Regulatory Pressures by Business Model

Fintech lending takes many forms, each with its own compliance profile. The regulatory pressure depends on how the product is structured, who it serves, and how it’s funded.

Buy Now, Pay Later (BNPL) Providers

BNPL firms offer installment credit, often marketed as “interest-free” or “pay in four” options. While appealing to consumers, these products have attracted growing scrutiny.

Consumer Protection: Regulators focus on disclosure clarity, late fees, and credit reporting practices. Even if a product doesn’t charge interest, it can still be treated as credit under TILA if fees or repayment terms meet its definitions.

Data and Underwriting: Using soft credit checks or alternative data must align with FCRA and ECOA.

Emerging Oversight: The CFPB has signaled continued monitoring of BNPL firms for UDAAP risks, while regulators in the UK and EU are moving toward formal authorization requirements.

BNPL providers must treat short-term credit with the same rigor as traditional lending and build their compliance around disclosure, affordability checks, and clear borrower communication.

Peer-to-Peer and Marketplace Lending Platforms

Peer-to-peer (P2P) and marketplace lenders connect investors with borrowers, typically facilitating loan origination through a bank partner. These models introduce multiple compliance layers:

Licensing: Platforms often require state lending or broker licenses even if they don’t fund the loans themselves.

Securities and Investor Rules: When retail investors fund loans, securities regulations may apply, especially if loan notes are offered as investments.

Operational Oversight: P2P platforms must maintain strict segregation of investor funds, transparent loan-level data, and reliable servicing arrangements.

Regulators assess whether the platform’s structure clearly defines the lender of record, and whether investors receive accurate risk disclosures. Any mismatch between marketing claims and actual performance data can trigger enforcement or investor litigation.

Embedded Lending in Apps and Marketplaces

Embedded lending integrates credit into non-financial platforms, such as e-commerce, gig work, or digital wallets. These arrangements blur the line between technology and financial services.

Licensing and Partnerships: Most embedded lenders work with licensed financial institutions, but the fintech is still responsible for marketing accuracy, disclosure, and data handling.

True Lender and Servicing Risks: If the fintech designs the loan terms or bears credit risk, regulators may view it as the true lender, making it subject to lending laws directly.

Data and UX Considerations: Integrating lending into checkout flows or mobile apps requires compliance checkpoints for consent, privacy notices, and repayment terms.

Because embedded finance spreads lending functions across multiple systems, coordination between compliance, product, and technology teams is essential to maintain regulatory alignment.

Small Business and Merchant Finance

Lenders targeting small businesses or merchants face a different but expanding regulatory perimeter.

Disclosure Requirements: States like California and New York require standardized cost-of-credit disclosures for small business loans and merchant cash advances.

Fair Lending and ECOA: Anti-discrimination provisions still apply to commercial lending, and the CFPB’s Section 1071 small business data rule will require lenders to collect and report demographic data on business applicants.

Collection and Servicing: Even though the FDCPA applies mainly to consumer debt, regulators expect fair treatment of small business borrowers, especially in collections and renewals.

For fintechs in this category, balancing transparency with operational efficiency is key. Adapting systems early for 1071 data collection and consistent disclosure formatting helps avoid future disruption when rules take effect.

Common Compliance Challenges for Lending Fintechs

Fintech lenders face an uneven regulatory landscape that changes quickly and varies by state, partner, and product type. These are the most common obstacles fintech founders and compliance teams encounter when building lending programs:

Managing Multi-Jurisdictional Rules

Operating nationally means juggling 50 sets of state lending laws, each with unique licensing, disclosure, and interest rate requirements. Even if a product is fully compliant in one state, minor variations elsewhere can cause violations.

Fintechs need systems that map state-by-state obligations, track renewal dates, and log updates from regulators. Without centralized oversight, growth can outpace compliance, leading to examination delays or license suspensions.

Some firms handle this internally through automated tracking tools, while others outsource regulatory monitoring to compliance partners experienced in multi-state filings.

Keeping Up with Regulatory Changes

Lending regulation shifts frequently. New rulemakings, state-level amendments, and enforcement actions can all change compliance expectations overnight. Recent examples include Colorado’s opt-out from federal interest exportation rules and the CFPB’s Section 1071 data collection requirements for small business lending.

Fintech compliance teams must build routines for regulatory horizon scanning. This includes tracking proposed rules, consultation papers, and enforcement trends. Regular legal reviews and flexible product governance help teams adjust without major operational disruption.

Building Compliance into Product Design

Compliance cannot be an afterthought. Features like disclosures, consent flows, or credit decision logs should be built into the product from day one. Retroactive fixes, especially around TILA or fair lending, are time-consuming and costly.

Early collaboration between product managers, developers, and compliance officers is crucial. At InnReg, we often help fintechs translate regulatory obligations into functional design elements, such as dynamic disclosure screens, automated adverse action notices, or built-in audit trails. These integrations make compliance scalable rather than reactive.

Working Within Bank Partnerships

For fintechs that operate under a bank partnership model, the relationship itself is a primary compliance driver. Banks are accountable to federal regulators and, as a result, impose rigorous oversight on fintech partners.

Common requirements include:

Annual risk assessments

Policy reviews

Staff training

Marketing pre-approvals

While this structure provides regulatory cover, it also slows product changes if not managed efficiently. Successful fintech-bank partnerships maintain clear documentation, compliance playbooks, and frequent communication between both compliance teams.

Technology, AI, and Data Management Gaps

Automated decision-making and alternative data are now standard in fintech lending. But they introduce new risks. Models must be explainable, traceable, and tested for bias. Under laws like ECOA and FCRA, lenders are expected to justify every credit decision and issue accurate adverse action notices.

Data governance also extends to security and privacy. Weak access controls, poor recordkeeping, or inconsistent data retention can all attract scrutiny. Fintechs should document how data is used, stored, and deleted.

Resource and Expertise Constraints

Startups often underestimate the breadth of skills effective compliance requires:

Legal interpretation

Operational process design

Risk monitoring

Regulator communication and review

Many early-stage fintechs have only one compliance officer managing everything from licensing to AML.

This is where specialized support becomes valuable. Outsourced compliance teams, like InnReg’s, can function as an extension of the internal compliance department, managing daily workflows, regulator correspondence, and license renewals.

This approach keeps costs lower than hiring an entire in-house team while still maintaining professional oversight and accountability.

See also:

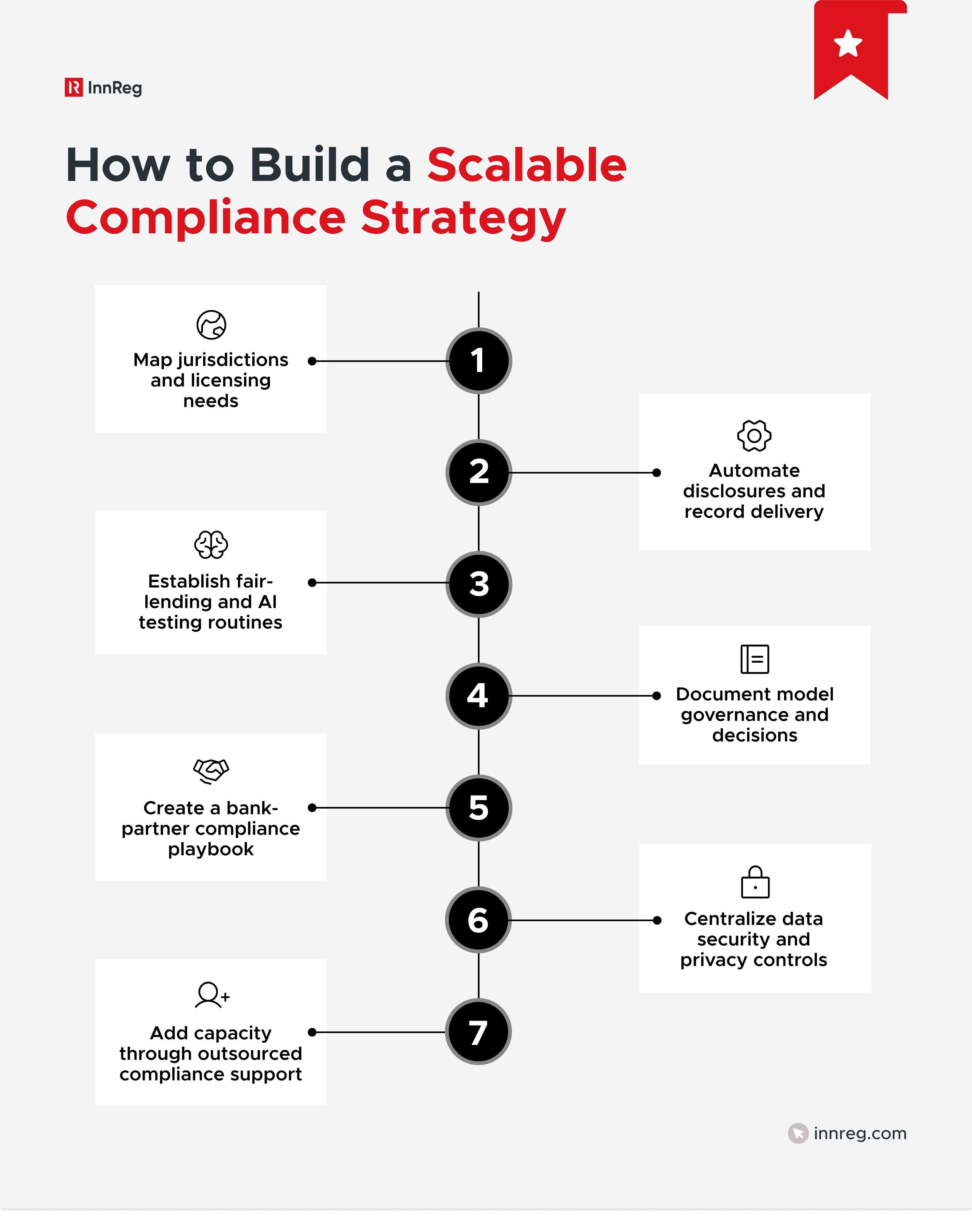

Building a Compliance Strategy That Scales

A scalable compliance strategy grows with the business rather than slowing it down. For fintech lenders, that means combining clear governance structures, practical workflows, and adaptable technology to manage regulatory expectations without creating bottlenecks.

The following pillars help build a compliance foundation that can expand across new products, states, or partners.

Mapping Jurisdictions and Licensing Obligations

Before scaling lending operations, fintechs should create a jurisdictional map that identifies every state or country where their product touches borrowers. This map should detail:

Licensing requirements and renewal timelines

Local interest rate caps or disclosure rules

Data retention and privacy standards

Applicable regulators and reporting schedules

This single source of truth helps compliance teams forecast which approvals or filings are needed before entering a new market. Many fintechs underestimate how much time licensing consumes; using a structured mapping process early prevents expansion delays and duplicate filings.

Designing Workflows Around Disclosures and Notices

Strong compliance programs integrate obligations directly into operational workflows. For lending, this includes:

Automated TILA disclosures within application flows

Predefined templates for adverse action notices under ECOA

Time-stamped records for fee and repayment communications

Embedding these features into the technology stack allows compliance to scale alongside customer volume. Instead of relying on manual reviews, the system itself prompts disclosures, logs delivery, and archives evidence for audits.

This process-driven approach is one reason fintechs often choose partners like InnReg, which specialize in designing compliance frameworks that align legal requirements with real-world workflows.

Monitoring AI Models and Alternative Data

Fintechs leveraging automation or alternative data must continuously monitor how those systems affect lending outcomes. Regular testing should confirm that underwriting models remain explainable and fair. This includes:

Reviewing training data for bias or proxy variables

Validating model outputs against protected characteristics

Documenting decision logic for examiner review

A structured model governance framework not only satisfies fair lending expectations but also builds credibility with regulators and investors. Clear documentation of how data influences credit outcomes demonstrates control and transparency—two factors regulators consistently emphasize.

When to Involve Advisors or Outsourced Compliance Teams

No compliance program scales alone. As lending operations grow, fintechs often reach a point where internal staff can’t manage every filing, policy update, or exam request. Engaging outside specialists can provide additional capacity and expertise.

Outsourced compliance partners, like InnReg, can act as an extension of the internal compliance function, handling licensing renewals, policy drafting, AML monitoring, and examiner correspondence. This hybrid approach offers fintechs access to senior compliance expertise without the overhead of building a large internal department.

—

Lending regulation is complex, and for fintechs, it becomes even more nuanced as innovation outpaces the speed of rulemaking. The firms that thrive are those that build compliance into their operations early, treating it as an ongoing discipline rather than a one-time exercise.

A clear understanding of how lending laws apply to your product, the right licensing strategy, and an adaptable compliance infrastructure are what separate scalable fintech lenders from those that face regulatory friction. Compliance is a foundation for credibility with investors, bank partners, and regulators.

At InnReg, we specialize in helping fintechs bridge the gap between fast growth and regulatory expectations. Our team works as an outsourced compliance department, designing processes, managing licensing, and monitoring ongoing obligations so founders and executives can focus on building their products.

How Can InnReg Help?

InnReg is a global regulatory compliance and operations consulting team serving financial services companies since 2013.

We are especially effective at launching and scaling fintechs with innovative compliance strategies and delivering cost-effective managed services, assisted by proprietary regtech solutions.

If you need help with lender compliance, reach out to our regulatory experts today:

Last updated on Dec 19, 2025