Payment Institution Guide: Services, Licensing, and Compliance

Jan 20, 2026

·

22 min read

Contents

The way money moves around the world is changing fast, and payment institutions are a big part of that story. They’ve become a driving force behind how fintechs, businesses, and consumers send and receive payments every day.

In a financial system once dominated by banks, payment institutions bring flexibility and innovation. They open the door for new business models, digital platforms, and cross-border financial solutions that make payments faster and more accessible.

This article walks you through what payment institutions are and why they matter. It also highlights their expanding role in today’s fast-evolving financial ecosystem.

At InnReg, we help payment institutions and fintechs navigate licensing and ongoing compliance in the EU, UK, and other key markets. Our team supports you with authorization applications, safeguarding frameworks, AML programs, and operational policies.

What Is a Payment Institution?

A payment institution is a licensed financial company that helps move money between people, businesses, and financial systems. It might process card payments, send money between accounts, or power the payment functions behind your favorite apps. While it operates within strict regulations, its primary goal is to make payments simple, fast, and reliable.

Unlike banks, payment institutions don’t take deposits or offer loans. Instead, they focus on payment-related services that keep the financial system running smoothly. In the European Union, they’re regulated under specific frameworks, such as the revised Payment Services Directive (PSD2), which sets the rules for how these companies operate.

For fintechs and financial startups, becoming a payment institution can open the door to exciting opportunities. It allows them to provide payment solutions without becoming a full-scale bank, giving them flexibility to innovate while staying within the boundaries of financial regulation.

Payment Institution vs. Other Financial Entities

Payment institutions are one part of a much wider network of regulated financial players. To understand what makes them unique, here’s how they compare to other types of institutions that also handle money.

Payment Institution vs. Banks

The biggest distinction between banks and payment institutions is in what each is allowed to do with customer funds.

Banks can take deposits, lend money, and offer a full suite of financial products such as savings accounts, loans, and credit cards. Because they manage and invest customer funds, they are subject to stricter capital and liquidity requirements and are closely supervised by central banks or equivalent regulators.

Payment institutions focus only on providing payment services. They help transfer funds, process transactions, and facilitate money movement between parties. However, they do not use customer money for lending or investment. Instead, they must keep client funds separate and typically partner with banks for storage and settlement.

Payment Institution vs. Electronic Money Institutions (EMIs)

Payment institutions and electronic money institutions (EMIs) often appear similar because both operate in the payments space, but their licenses allow them to do slightly different things. The key difference lies in how they handle and store customer funds.

A payment institution provides payment services such as:

Transferring money

Enabling cash to be placed on a payment account

Enabling cash withdrawals

Operations required for operating a payment account

Issuing of payment instruments and/or acquiring of payment transactions

It facilitates transactions between parties but does not create or hold monetary value. The money it handles moves from one account to another without being turned into a new financial product.

An EMI can go a step further. It is authorized to issue electronic money, which represents a stored value that customers can hold and spend. This allows EMIs to offer digital wallets, prepaid cards, or account balances that users can top up and use for multiple transactions. EMIs must safeguard those funds and make them redeemable at any time for their face value.

Payment Institution vs. Money Transmitters in the US

Payment institutions and money transmitters both help people move money, but they operate under different rules and serve slightly different purposes. Their key distinction lies in how each is licensed and supervised.

In the US, money transmitters are regulated at the state level. Each state has its own licensing process, which means a company often needs multiple licenses to operate nationwide.

Money transmitters typically handle domestic and cross-border transfers for individuals and businesses, such as sending funds between accounts or delivering remittances to another country. Companies like Western Union or MoneyGram are classic examples.

Payment institutions, on the other hand, are a category used mainly in the European Union and other jurisdictions that follow similar models (such as the UK). They are authorized under frameworks like the Payment Services Directive (PSD2) to provide a broader range of payment services, including transferring money, payment initiation and account information services, managing payment accounts, and issuing or acquiring payment instruments.

In the US, there is no single “payment institution” license. Instead, firms must register as money services businesses (MSBs) with FinCEN and obtain state money transmitter licenses if they want to offer similar services.

Financial Entity | Main Activity | Can Hold Customer Funds? | Regulator | License Scope |

|---|---|---|---|---|

Payment Institution | Provides payment services such as transfers and processing | Yes, but must safeguard them; cannot use for lending | National competent authorities (NCAs)under PSD2 or FCA in the UK | Broad EU/UK payment services |

Bank | Accepts deposits, offers loans, and other financial products | Yes, can use funds for lending and investment | Central banks or national banking regulators | Full banking license |

Electronic Money Institution (EMI) | Issues and manages electronic money | Yes, as stored value redeemable at par | Same as PIs (NCAs/FCA) but separate license | Electronic money issuance under PSD2 (EU) or EMRs/PSRs (UK); separate from banking license |

Money Transmitter (US) | Transfers funds between senders and recipients | Temporarily, for transfer only | FinCEN + State regulators | State-by-state (US) money transmitter license |

Services a Payment Institution Can Offer

Payment institutions can provide a wide range of services that help individuals and businesses move money, make purchases, and manage their financial activity. Here are the main types of services a payment institution can offer and how each one works in practice.

Payment Accounts and Transactions

Payment institutions can open and manage payment accounts that allow customers to send, receive, and store funds for payment purposes. These accounts are not the same as bank accounts, since they do not hold deposits or earn interest. Instead, they serve as a tool for making and receiving payments, such as paying bills, transferring money to other users, or receiving salaries.

Card Issuing and Acquiring

Many payment institutions issue payment instruments, such as debit or payment cards linked to a payment account, that can be used online or in stores. They can also act as acquirers, meaning they process transactions for merchants that accept card payments. This service helps businesses receive payments quickly and securely while giving consumers flexible payment options.

Money Remittance

Money remittance services involve transferring funds from one person to another, often across borders. Payment institutions offering this service allow customers to send money to family, friends, or business partners in different countries. These transfers are subject to anti-money laundering and know-your-customer (AML/KYC) requirements to keep transactions safe and traceable.

Payment Initiation Services (PIS)

With payment initiation services, payment institutions connect directly to a customer's bank account through secure authorization to initiate payments on their behalf. You see this a lot in e-commerce, where customers pay merchants straight from their bank accounts instead of pulling out a card. The result is quicker online payments with lower fees and clearer transaction trails.

Account Information Services (AIS)

Account information services allow payment institutions to access and consolidate a customer’s financial data from multiple accounts, with consent. This gives users a single view of their finances and helps businesses provide tools for budgeting, financial planning, or credit assessment. AIS has become a key part of open banking and data-driven financial innovation.

Together, these services make payment institutions a central player in the digital economy. They connect consumers, merchants, and banks, creating smoother payment experiences and supporting the rapid growth of fintech solutions around the world.

Payment Institution License Requirements

Operating as a payment institution in the EU or UK requires proper authorization from the relevant regulatory authority. Each jurisdiction follows its own framework, but they share a common goal of promoting innovation while protecting consumers and maintaining financial stability.

Below, we’ll look at how licensing works under the EU’s PSD2, the UK’s regulatory regime, and other jurisdictions with similar systems.

See also:

EU Framework: PSD2 and PSD3 Update

In the European Union, payment institutions are licensed and supervised under the revised Payment Services Directive, currently known as PSD2. This framework sets out the rules for how payment services are offered, who can provide them, and what obligations providers must meet to protect customers and financial stability.

Under PSD2, companies that want to operate as payment institutions need authorization from the national competent authority in an EU member state. The application asks for detailed information about your company structure, business plan, management team, internal controls, and your policies around risk management, anti-money laundering (AML), and data security.

Once licensed, a payment institution can offer its services across the European Economic Area (EEA) through a process called passporting, which allows it to operate in multiple EU countries without having to obtain new licenses in each jurisdiction. This is one of the biggest advantages of the EU framework and a major reason why fintech companies choose to establish their operations there.

The European Commission is currently updating this framework with PSD3 and the Payment Services Regulation (PSR). The goal for this update is to:

Strengthen consumer protection

Improve fraud prevention

Make open banking more secure and accessible

These updates are expected to streamline authorization requirements and enhance cooperation between national regulators, creating a more unified environment for payment service providers across Europe.

Need help with payments compliance?

Fill out the form below and our experts will get back to you.

UK Framework: FCA Payment Services Regulations

In the United Kingdom, payment institutions are regulated by the Financial Conduct Authority (FCA) under the Payment Services Regulations 2017 (PSRs 2017). These rules were introduced when the UK implemented the EU’s PSD2 framework and have remained in place since Brexit, with updates tailored to the UK’s own regulatory priorities.

To operate as a payment institution in the UK, a company must apply for authorization or registration with the FCA. There are two main categories of firms:

Authorized Payment Institution | Small Payment Institution |

|---|---|

Provides a full range of payment services and holds client funds | Handles lower volumes and operates within defined transaction limits |

The application process involves demonstrating that the business is financially sound, well-governed, and capable of managing risks. Applicants must provide information on the following:

Organizational structure

Capital levels

Management team

Safeguarding methods

AML procedures

Governance policies

Internal controls

Business continuity plans

Once approved, payment institutions can offer services such as processing payments, facilitating money transfers, and providing open banking access to customer accounts. Although the UK no longer participates in the EU passporting system, firms can still expand internationally by obtaining licenses in other jurisdictions or setting up local subsidiaries.

Other Jurisdictions

Outside the European Union and the United Kingdom, countries have been rolling out their own versions of payment institution licensing. The terminology varies, and so do the specific requirements, but most regulators are trying to accomplish the same thing: create space for payment innovation without letting consumer protection or financial integrity slip.

Singapore: The Monetary Authority of Singapore (MAS) regulates payment service providers under the Payment Services Act (PSA). The PSA introduced an activity-based licensing framework with two licence tiers (Standard and Major Payment Institution), letting companies apply based on the specific payment services they provide. The PSA is known for being forward-looking and adaptable to new technologies, making Singapore one of the most attractive markets for payment firms in Asia.

Australia: Payment and financial service providers are primarily regulated by the Australian Securities and Investments Commission (ASIC) under the Corporations Act, while the Reserve Bank of Australia (RBA) oversees payment systems under the Payment Systems (Regulation) Act. Businesses that handle payments or issue stored-value products need to obtain an Australian Financial Services (AFS) license, but new reforms will consolidate licensing under a unified Payments System Modernisation framework designed to streamline oversight and strengthen consumer protection.

Switzerland: Payment firms often fall under the supervision of the Swiss Financial Market Supervisory Authority (FINMA), depending on their business model. Companies offering cross-border or fintech-driven payment services often seek authorization as financial intermediaries, which allows them to operate while complying with anti-money laundering standards.

Other major financial centers, such as Hong Kong and Canada, have also introduced clear regulatory paths for payment service providers. Each framework has its own nuances, but most converge around similar principles, strong risk management, client fund protection, and transparent operations.

Key Regulators Over Payment Institutions

Payment institutions operate in a highly regulated environment where multiple authorities oversee their licensing, conduct, and ongoing compliance. The exact regulators vary by jurisdiction, but their shared mission is to keep the payment system safe, transparent, and fair for consumers and businesses.

Here’s how regulatory oversight works in the EU and UK.

EU Regulators

In the EU, payment institutions are supervised through a combination of national and regional oversight. Each member state has its own national competent authority (NCA) responsible for licensing and monitoring these firms. Examples include the Central Bank of Ireland, the Banque de France, or the BaFin in Germany.

These national regulators review applications, check compliance programs, and oversee ongoing operations to make sure companies follow the rules on capital, safeguarding, and reporting. They work closely with the European Banking Authority (EBA), which provides guidance and sets common technical standards to keep supervision consistent across all EU countries.

The EBA also pushes regulators toward consistent approaches on fraud prevention, customer authentication, and open banking. The EU ended up with one of the more coherent payment regulatory frameworks globally. While not perfect, it’s more unified than most. That consistency gives payment institutions room to scale across borders without constantly reinventing their compliance programs for each market.

UK Regulators

In the UK, the FCA is the main body that regulates payment institutions. It oversees the entire process from authorization to ongoing supervision, making sure that firms operate responsibly and protect customer interests.

When a company applies to become a payment institution, the FCA reviews its business plan, internal controls, management team, and approach to safeguarding client funds. It also looks at how the firm prevents financial crime, manages risks, and protects customer data. Once licensed, payment institutions must follow clear conduct standards, maintain strong governance, and report regularly to the regulator.

The FCA is known for encouraging innovation in financial services. Through initiatives like the Regulatory Sandbox, it gives fintech companies a space to test new products in a controlled environment before launching them widely. This has helped make the UK one of the most attractive markets in the world for payment startups.

The Prudential Regulation Authority (PRA), part of the Bank of England, also plays a role in overseeing financial stability, particularly for larger or more complex firms. Together, these regulators create a structured yet flexible environment where payment institutions can build trust, grow responsibly, and bring new payment solutions to market.

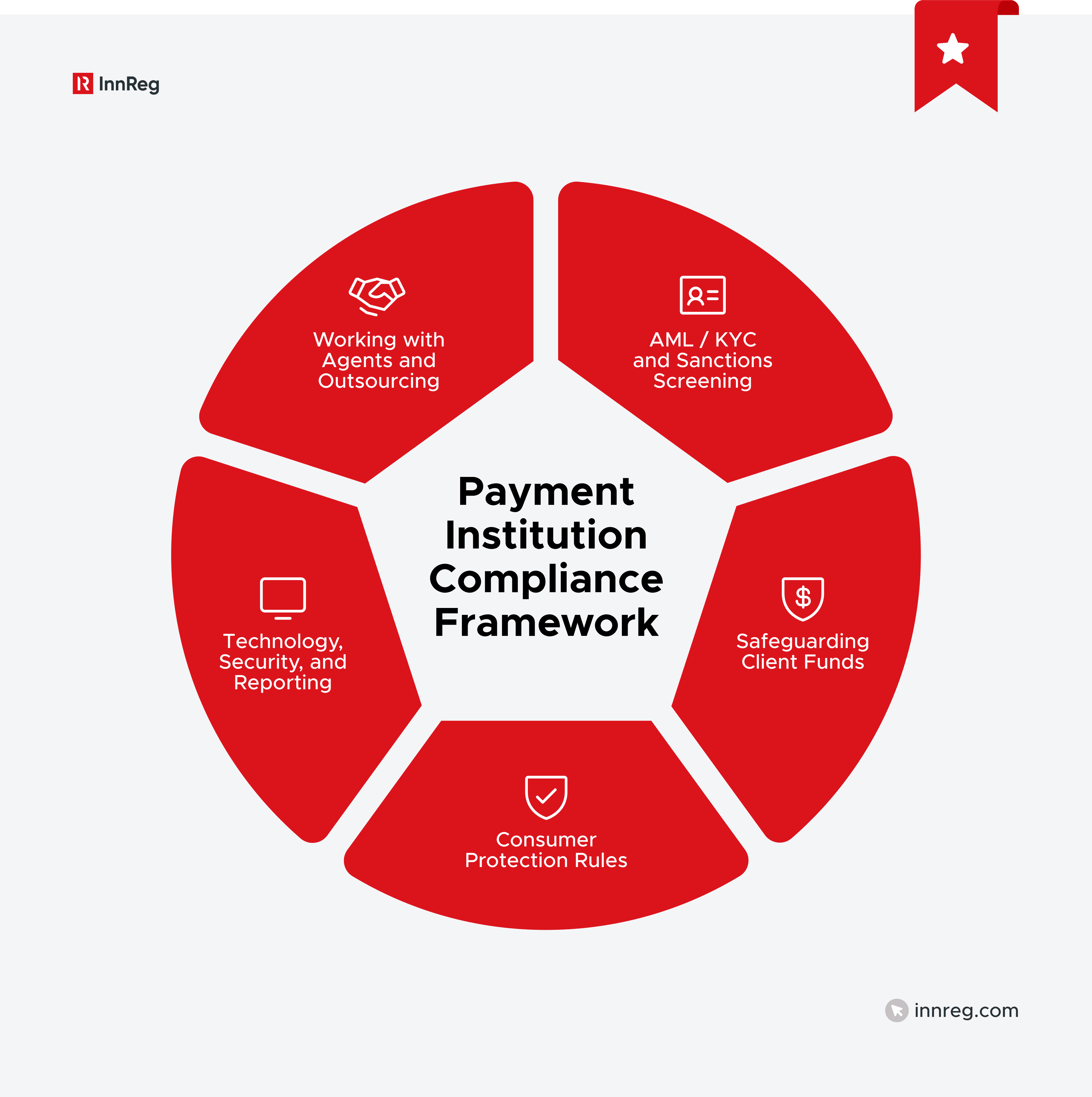

Compliance Obligations for a Payment Institution

Licensed payment institutions must follow strict compliance rules to protect customers, prevent financial crime, and maintain trust. Key areas include AML, fund safeguarding, consumer protection, security, and oversight of agents or providers.

See also:

AML/KYC and Sanctions Screening

AML and KYC programs are at the core of a payment institution’s compliance framework. These measures are designed to help prevent money laundering, terrorism financing, and other forms of financial crime.

Before onboarding a customer, payment institutions must verify their identity and understand the nature of their transactions. This includes:

Collecting identification documents

Checking ownership structures

Assessing the customer’s risk profile

Ongoing monitoring to detect unusual or suspicious activity

Sanctions screening is another critical part of the process. Payment institutions must screen customers and transactions against international sanctions lists, such as those issued by the Office of Foreign Assets Control (OFAC), United Nations, the European Union, or the UK’s Office of Financial Sanctions Implementation (OFSI). Any matches or red flags must be reviewed and reported to the relevant authorities when necessary.

Beyond compliance, strong AML and KYC programs also help payment institutions build credibility with banks, regulators, and partners. A well-designed program shows that the company is serious about integrity, risk management, and maintaining a safe financial ecosystem.

Safeguarding Client Funds

Safeguarding client funds means keeping customers’ money separate from the company’s own funds so that it remains protected at all times, even if the business faces financial difficulties.

In the EU and UK, regulators require payment institutions to place client funds into dedicated safeguarding accounts with approved banks or to protect them through an insurance policy or comparable guarantee. These funds cannot be used for company expenses, investments, or lending activities. The goal is to make sure that every customer’s money can be returned in full if needed.

Safeguarding rules also come with clear reporting and audit requirements. Firms must keep accurate records showing where client funds are held, how they are protected, and that the total amount always matches the outstanding obligations to customers. Regulators often review these records during inspections to confirm that proper controls are in place.

Consumer Protection Rules

Consumer protection rules exist to keep payment services from misleading or harming users. They spell out how institutions need to communicate with customers, handle complaints, and fix disputes when things go wrong.

Payment institutions have to give customers information that's both accurate and easy to understand. That covers:

Clear terms and conditions

Transparent fees

Accessible details about how long payments will take to process

Institutions are also required to give customers regular statements and updates about their transactions, helping them track their finances with confidence.

In the event of a problem or mistake, payment institutions must have procedures for investigating and resolving issues quickly. Customers should know how to submit complaints and what to expect in terms of timing and resolution. Regulators actively monitor how institutions handle these processes to make sure users are treated fairly.

Consumer protection also covers the security of personal data. Payment institutions must handle customer information responsibly, following privacy laws like the General Data Protection Regulation (GDPR). Protecting data helps prevent fraud and reinforces customer trust.

Technology, Security, and Reporting

Technology and data security are central to how payment institutions operate. Because they handle sensitive financial and personal information, regulators expect them to maintain strong systems that protect against fraud, cyberattacks, and operational failures.

Payment institutions must implement reliable IT infrastructures with access controls, encryption, and regular security testing. They are also required to have clear incident management procedures, so they can detect, report, and respond to issues such as data breaches or system outages.

In the EU, these requirements are now reinforced by the Digital Operational Resilience Act (DORA), which took effect in January 2025.

DORA establishes a unified framework for ICT risk management across all financial entities, including payment institutions. It works alongside the EBA’s guidelines on ICT and security risk management to maintain consistent standards across member states.

In the UK, the FCA emphasizes operational resilience. This means that a payment institution should be able to continue delivering its services even if it faces technical disruptions. Firms must test their systems regularly, document their response plans, and report major incidents to regulators within strict timeframes.

Reporting goes beyond security incidents. Payment institutions also have to submit periodic regulatory reports that cover their financial position, safeguarding arrangements, and key compliance activities. These reports help regulators monitor the health of the payments sector and detect potential risks early.

Working with Agents and Outsourcing

Many payment institutions rely on agents and outsourced partners to deliver their services efficiently. These arrangements can help a company grow faster, expand into new markets, or focus on core operations, but they also come with regulatory responsibilities.

When using agents, payment institutions must make sure those partners act under their supervision and follow the same compliance standards. Agents can carry out activities such as:

Onboarding customers

Distributing payment products

Providing customer support

The payment institution remains fully responsible for its conduct and must keep a register of all agents, updating regulators as new ones are added.

Outsourcing is another common practice in the payments industry. Institutions may outsource functions like IT management, transaction processing, or compliance monitoring to specialized providers.

However, outsourcing does not remove accountability. Regulators expect payment institutions to conduct proper due diligence, assess the risks, and have contracts that define clear responsibilities and service standards.

Both the EU and UK regulatory frameworks require institutions to maintain oversight and control over all outsourced activities. This includes monitoring performance, reviewing reports, and having backup plans in case a provider fails. The goal is to make sure that operations remain secure and compliant at all times.

Common Challenges for Payment Institutions

Running a payment institution can be rewarding, but it also comes with complex regulatory and operational challenges. These often arise as firms expand, introduce new technologies, or enter multiple markets with different rules. Here are some of the most common challenges payment institutions face and why addressing each of them is critical.

1. Licensing Complexity in the EU and UK

Applying for a payment institution license requires detailed documentation, including business plans, financial projections, and compliance frameworks. Each regulator has specific expectations, and approval can take several months. Many firms struggle to navigate the process without expert guidance, especially when applying across multiple jurisdictions. Understanding local requirements and maintaining clear communication with regulators can make the process smoother.

2. Securing and Maintaining Banking Partner Relationships

Even though payment institutions can process payments, they still depend on banks to hold safeguarded funds and settle transactions. Building these relationships can be difficult, as banks often have strict risk and compliance standards. Maintaining transparent operations, strong AML controls, and clear governance helps payment institutions build long-term trust with their banking partners.

3. Scaling from Small PI to Authorized PI

Some firms start as small payment institutions and later decide to expand. Moving to an authorized status means meeting higher capital requirements, developing more advanced compliance systems, and possibly restructuring internal teams. The transition works better when you phase it in rather than trying to flip everything overnight. Most firms keep operations running while building out new requirements in parallel.

4. Managing Cross-Border Operations

Offering services across borders introduces added complexity. Different countries have unique rules around customer onboarding, AML obligations, and consumer protection. Payment institutions must adapt their compliance programs to meet each jurisdiction’s standards while maintaining a consistent global approach. Working with local experts can be key to managing this successfully.

5. Meeting AML and Transaction Monitoring Expectations

Regulators want to see that you can catch suspicious transactions and report them quickly. The challenge is to build a monitoring system that actually works and doesn't drown your team in false positives, but still catches real risk. You'll need to keep updating your rules, train your team on new patterns, and analyze what your data is telling you about where financial crime tactics are headed.

6. Safeguarding Client Funds Consistently

Keeping customer funds protected comes down to tight operational discipline. Institutions reconcile accounts daily, maintain detailed records, and stay closely aligned with partner banks. If any part of that breaks down, you're looking at potential regulatory findings or customers losing trust in your platform. Independent audits and solid internal controls keep the system honest and catch problems before they become public issues. 7. Keeping Up with Evolving Regulatory Frameworks

Regulations in the payments sector change frequently as new risks and technologies emerge. Staying compliant means monitoring updates from bodies like the EBA, FCA, and MAS, and adapting policies accordingly. Institutions that build flexibility into their compliance structures are better equipped to respond to these changes and stay ahead of industry expectations.

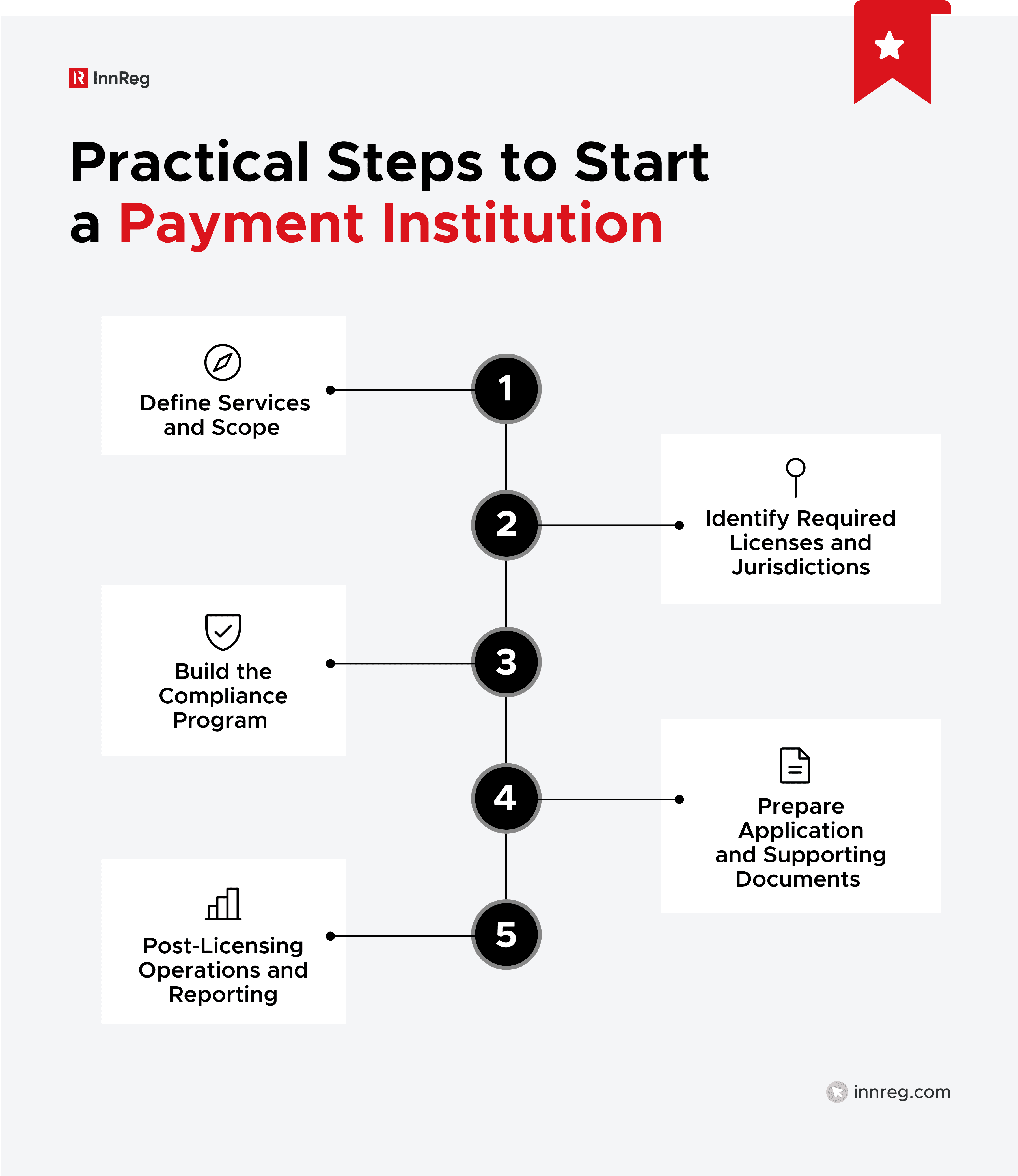

Practical Steps to Start a Payment Institution

Starting a payment institution involves more than just having a good business idea. It requires careful planning, strong compliance foundations, and a clear understanding of regulatory expectations. The process can vary by country, but most firms follow similar key steps to get licensed and begin operations successfully.

Below, we’ll walk through each of these steps in detail, from defining your services to managing your ongoing regulatory obligations after licensing.

See also:

Define Services and Scope

The first step in starting a payment institution is to clearly define what services you plan to offer and where you will operate. This step shapes everything that follows, from your licensing requirements to your compliance framework and business model.

Pinpointing which services to include from the start helps you determine the type of authorization you need. For example, a small firm handling limited transactions may apply for a lower-tier license, while a company offering multiple services across borders will need a full authorization.

It’s also important to define your geographic scope. If you plan to operate across the European Economic Area, you’ll want to take advantage of passporting once licensed under an EU member state. In the UK, expansion into other markets may require separate local approvals.

At this stage, you should also outline your target customers, pricing model, and delivery channels. A clear vision helps regulators understand your business and demonstrates that you have a well-structured plan. It also makes it easier to design systems, policies, and partnerships that support your long-term growth.

Identify Required Licenses and Jurisdictions

Once you have a clear picture of your business model, the next step is to identify which licenses you need and where to apply for them. Licensing is the foundation of your operation, as it gives you the legal right to provide payment services and builds credibility with customers, partners, and regulators.

If you plan to operate in multiple regions, you’ll need to assess whether each jurisdiction requires a local license or allows cross-border activity through partnerships. Some countries, such as Singapore or Australia, have comparable licensing systems for payment service providers, but each has specific requirements.

Taking the time to map out the right jurisdictions and licenses early on saves time later. It also helps avoid costly delays and sets a clear path for compliance as your company expands into new markets.

Build the Compliance Program

Regulators expect each company to have a structured, well-documented system that keeps operations safe, transparent, and aligned with financial laws. Building this program early helps you meet licensing requirements and sets the tone for how your institution will manage risk.

Your compliance framework should start with a clear governance structure. This means defining who is responsible for compliance, including key roles such as the Chief Compliance Officer and the Money Laundering Reporting Officer. These individuals must have the experience and authority to oversee regulatory matters and report directly to senior management.

The next step is to develop detailed policies and procedures covering all relevant areas:

AML

Transaction monitoring

Data protection

Complaints handling

Recordkeeping

These policies should reflect your business model and the risks specific to your operations. For example, a firm focusing on cross-border payments will face different risks than one providing domestic transaction services.

It is equally important to design effective training programs for staff. Every employee, from operations to customer service, should understand the regulatory obligations that apply to their role. Regular training sessions and updates keep the team informed about new laws and internal processes.

Finally, your compliance program should include monitoring and reporting systems to track activities and detect potential issues. These internal reviews help confirm that policies are being followed and that any gaps are addressed quickly.

Prepare Application and Supporting Documents

Once your services, jurisdictions, and compliance framework are in place, the next step is to prepare the formal application for authorization. This stage involves pulling together all the documents regulators need to assess your business.

A complete application usually includes a business plan describing your services, target markets, and financial projections. Regulators want to see that your business model is realistic, sustainable, and supported by sound financial management.

You will also need to provide detailed information about your organizational structure, key personnel, and governance arrangements, showing that your leadership team has the experience and qualifications to manage regulated activities.

Financial documents are a crucial part of the package. These include evidence of initial capital, funding sources, and financial forecasts. Regulators also require proof that you have the necessary safeguarding arrangements to protect client funds, such as dedicated accounts or insurance coverage.

Supporting documents should also cover your compliance and risk management policies, internal controls, IT systems, and security measures. Many regulators, including the FCA and EU national authorities, also ask for written procedures for AML, customer due diligence, and incident reporting.

Once filed, regulators may request clarifications or additional documents, so being responsive and transparent helps build confidence and speeds up the approval process.

Post-Licensing Operations and Reporting

After receiving authorization, the real work begins. Operating as a licensed payment institution means maintaining high standards of compliance, transparency, and governance every day. Regulators expect firms to treat licensing not as a finish line but as the start of an ongoing commitment to responsible operation.

Post-licensing obligations usually include regular reporting to regulators. This can cover financial statements, transaction volumes, and safeguarding reports that confirm client funds are protected.

Many authorities also require periodic compliance reports summarizing how the institution is meeting its regulatory duties. Submitting these reports accurately and on time helps maintain good standing and demonstrates accountability.

Payment institutions must also perform continuous monitoring of their business activities and internal controls. This includes keeping policies up to date, auditing processes, and addressing any findings from internal or external reviews.

Regulators may conduct on-site inspections or request specific information, so having well-documented systems and clear records makes these reviews much smoother.

Finally, maintaining open communication with regulators is essential. Whether it involves reporting incidents, submitting notifications, or asking for guidance, being transparent shows professionalism and builds trust.

—

Payment institutions have become a vital part of the modern financial system, helping to connect consumers, businesses, and banks through faster and more flexible payment services. As financial technology continues to evolve, these institutions play a central role in shaping how money moves in an increasingly digital world.

Building and operating a payment institution requires more than just a strong business idea. It demands a deep understanding of licensing requirements, compliance obligations, and ongoing regulatory expectations. From safeguarding client funds to preventing financial crime and maintaining secure systems, every detail matters when trust and transparency are at stake.

How Can InnReg Help?

InnReg is a global regulatory compliance and operations consulting team serving financial services companies since 2013.

We are especially effective at launching and scaling fintechs with innovative compliance strategies and delivering cost-effective managed services, assisted by proprietary regtech solutions.

If you need help with payments compliance, reach out to our regulatory experts today:

Last updated on Jan 20, 2026