15 Fintech Trends to Keep an Eye Out for in 2026

Dec 16, 2025

·

13 min read

Contents

2026 is shaping up to be a defining year for the fintech space. As financial technology continues to blend with AI, crypto, data infrastructure, and embedded experiences, companies face a dual challenge: staying innovative while keeping up with rising regulatory expectations.

This article breaks down the most relevant fintech trends driving change across the global financial services space. From AI-powered compliance and tokenized assets to stablecoin regulation and open banking mandates, we’ve identified 15 trends that are shaping how products are built, regulated, and scaled in 2026.

But this year’s fintech trends reflect more than just flashy tech. All of them will have operational implications for fintechs, banks, and the advisors who support them. No matter where you are in the fintech space, this article gives you a practical, forward-looking overview of what’s ahead.

At InnReg, we help fintech founders manage regulatory complexity as they scale. From initial registration to ongoing compliance operations, our team supports companies operating in high-scrutiny environments.

Fintech Trends Reshaping Innovation in 2026

Fintech innovation isn’t slowing down. What’s changing is the level of scrutiny, the complexity of integrations, and the speed at which new ideas need to be both deployable and defensible. As the market matures, so do the expectations from regulators, customers, and partners.

The next 15 sections cover the trends shaping that future. For each one, we’ll highlight what’s driving it, where the regulatory friction is, and what founders, legal teams, and compliance leaders should be watching.

1. AI-Driven Compliance and Risk Management

AI is changing how compliance gets done.

What used to require manual review and team-based oversight is now being partially or entirely automated with machine learning models supporting transaction monitoring, fraud detection, and policy enforcement.

That shift creates opportunities and risks. On the one hand, AI can help companies manage growing regulatory complexity without scaling headcount linearly. On the other, poorly governed models can introduce new liabilities. Bias, data integrity, and explainability are both regulatory and ethical concerns.

Regulators are watching closely. Agencies like the SEC, CFPB, and banking supervisors have made it clear: if a firm uses AI in compliance workflows or decision-making, existing rules still apply. For example, automated transaction review tools must meet Bank Secrecy Act requirements. Credit models must not violate fair lending standards.

Key elements regulators and compliance teams are focusing on:

Clear governance and documentation of how AI models are selected, trained, and updated

Defined thresholds for human intervention in decisions made or flagged by AI

Audit-ready outputs and version control, especially for high-risk processes like onboarding or fraud escalation

Founders often assume off-the-shelf tools are audit-ready. That’s rarely true. Fintech companies need internal ownership over model oversight.

Firms working with outsourced compliance partners, like InnReg, often benefit from added oversight here. When teams have practical, tech-neutral experience integrating into AI-powered environments, they can help evaluate not just functionality, but operational fit and risk exposure.

2. Autonomous Financial Operations and AI Agents

Fintech teams are beginning to shift from automation to autonomy.

Instead of just automating isolated tasks, companies are using AI agents that can handle entire workflows across operations, finance, and support. These agents can trigger actions, follow predefined rules, and adapt based on context without needing real-time human input.

Common use cases include:

Transaction reconciliation and exception handling

Real-time customer dispute resolution

Monitoring operational risk metrics and escalating anomalies

The benefits are clear: speed, scale, and reduced manual load. But the control frameworks aren’t always keeping up. When AI agents make decisions that affect customers or financial records, those actions are subject to regulatory oversight, even if the workflow is internal.

The key risk? Loss of traceability. If a regulator asks how a decision was made or who was responsible, there needs to be an answer. That means companies must build in audit trails, override capabilities, and clear accountability structures from the start.

3. Hyper-Personalization in Consumer Finance

Customer expectations have shifted. People want financial services that respond to their goals, habits, and behaviors in real time. Fintech companies are responding with hyper-personalization: AI-driven features that adapt interfaces, offers, and advice for each user.

This shows up across the board:

Budgeting apps that adjust notifications based on spending patterns

Investment platforms that tailor portfolio suggestions based on financial milestones

Credit tools that adapt recommendations based on user actions, not just static data

From a product standpoint, this creates stickier experiences. But from a compliance perspective, it raises new questions. What if a personalized feature produces inconsistent treatment across users? What if dynamic recommendations violate marketing rules or create unintended bias in lending?

Founders and product teams need to consider how personalization interacts with:

Fair lending and anti-discrimination obligations

Disclosure requirements tied to changing financial advice

Data usage rules and evolving consent standards (especially under open banking frameworks)

Personalization complicates compliance. The more reactive your system is to user behavior, the more controls and documentation are required. This is where outsourced compliance teams can help operationalize guardrails without slowing product velocity.

4. Embedded Finance and the Rise of Banking-as-a-Service

Financial services are no longer confined to banks or fintech apps.

With embedded finance, they’re showing up in e-commerce platforms, payroll systems, and even travel apps. Behind these experiences is a growing Banking-as-a-Service (BaaS) model that allows non-financial brands to offer regulated products without becoming licensed entities themselves.

For fintech builders, BaaS accelerates time to market. Instead of building core infrastructure, they can plug into a licensed partner to offer:

FDIC-backed checking accounts

Debit and credit card issuance

Lending products or money movement services

But this speed comes with a tradeoff: regulatory accountability doesn’t disappear just because a partner holds the license. BaaS clients are expected to comply with applicable laws as if they were running the program themselves.

Teams often assume the bank “owns” compliance. Regulators don’t see it that way. If you’re offering regulated products, you need internal controls, clear documentation, and ongoing monitoring.

5. Voice, Biometrics, and Conversational Finance

Interfaces are changing. Fintech companies are integrating voice recognition, facial authentication, and natural language tools into everyday workflows.

The goal is convenience. Users can speak commands, authenticate with a glance, or ask questions the way they talk to Alexa or Siri. But new interface layers mean new compliance surfaces, especially where financial access or decision-making is involved.

Key risk areas include:

Authentication accuracy: Voice and biometric errors can lead to unauthorized access or denial of service.

Data security: Biometric data is sensitive and subject to stricter handling standards.

Disclosure compliance: If chatbots provide financial advice or respond to customer disputes, those interactions may fall under regulatory review.

Some fintechs treat these channels as low-risk, assuming they’re just wrappers around core systems. That’s a mistake. If a voice assistant triggers a funds transfer or a chatbot fields a complaint, that’s part of the official service flow.

6. Stablecoin and Mainstreaming Regulated Crypto

Stablecoins are no longer on the fringe. With dedicated legislation now in place in the US and clearer rules emerging globally, regulated stablecoins are moving into mainstream financial infrastructure. After all, they are a regulated money movement tool with all the risk management, security, and BSA/AML expectations of a traditional payments product.

Banks, payments platforms, and fintechs are exploring the use of stablecoins for faster settlement, liquidity management, and cross-border payments. For fintechs, the key considerations are:

Licensing: Are you acting as an issuer, a custodian, or a facilitator?

Controls: Do you have real-time visibility into reserves, flows, and redemptions?

Supervision: Which agency will examine your crypto-related activity and how often?

The regulatory shift matters. In the US, the 2025 passage of the GENIUS Act created a framework for federally overseen payment stablecoins, requiring reserve backing, regular audits, and consumer protection. This has opened the door for more institutions to experiment with issuing or integrating stablecoins within the boundaries of existing financial rules.

See also:

7. Tokenized Assets and On-Chain Financial Infrastructure

Major institutions are now using blockchain to represent traditional assets like treasuries, real estate, or commodities as programmable tokens, often for purposes like settlement speed, fractional ownership, or operational efficiency.

Asset managers, broker-dealers, and even central banks are actively piloting on-chain structures that replicate traditional markets but with blockchain rails. Tokenized funds, treasury bills, and private equity stakes are becoming more common, especially in controlled, permissioned environments.

For fintechs, tokenization introduces key questions:

What is the token representing? (cash, equity, debt, or something synthetic?)

Is it a security, commodity, or something else? Your classification drives your obligations.

Which rules apply? SEC, CFTC, and state-level regimes may overlap.

Feature | Traditional | Tokenized |

|---|---|---|

Asset Type | Equity, Real Estate | Same, but on-chain |

Regulation | SEC, CFTC | Same + Blockchain-specific compliance |

Custody | Centralized | May be on-chain or hybrid |

Disclosure | Standard filings | Smart contract + disclosure layers |

One common misconception: tokenizing an asset doesn’t make it exempt. If you’re offering fractional real estate or tokenized bonds, you’re still dealing with securities law, investor disclosures, and custody requirements.

Need help with fintech compliance?

Fill out the form below and our experts will get back to you.

8. Institutional DeFi and the Future of Liquidity

DeFi is evolving. What began as retail-driven protocols running on public blockchains is now gaining traction with institutional players looking for programmable liquidity, automated settlement, and 24/7 market access, but with guardrails.

The new wave of DeFi isn’t about complete decentralization. It’s about selective integration: bringing core DeFi mechanics (like smart contracts, automated market making, and on-chain collateral) into regulated environments that meet institutional standards.

Key features of institutional DeFi include:

Permissioned access and KYC-layered participation

Real-world asset collateralization and on-chain settlement

Integration with custody providers, audit tools, and compliance reporting

From a regulatory standpoint, DeFi still presents gray areas. But regulators are watching closely, especially when firms build products that look like traditional securities or lending but execute via protocol. If a smart contract performs functions similar to an underwriter or clearinghouse, the responsibilities tied to those functions don’t disappear.

Fintechs exploring this space need clear answers to operational questions: Who can use the protocol? Who’s monitoring risk exposure? What happens if a counterparty defaults? Institutions can’t afford black boxes or unauditable logic.

Done right, institutional DeFi can improve capital efficiency and transparency. But it only works when it’s paired with controls, disclosures, and compliance inputs that meet both market and regulatory expectations.

9. Real-Time Fraud Prevention and Adaptive Security

As fintech infrastructure becomes more complex, so do the fraud tactics targeting it. Attackers are using AI to generate deepfakes, spoof identities, and bypass traditional verification.

Today’s security stacks are shifting toward dynamic models that monitor behavior and context continuously, not just at login. That includes:

Behavioral biometrics (typing speed, device patterns)

Continuous risk scoring during user sessions

Automated escalations when anomalies are detected

This shift improves response time, but it also demands stronger internal coordination between product, compliance, and engineering. When fraud defenses are tied to user data or financial behavior, companies must evaluate how those systems intersect with privacy law, customer disclosures, and regulatory expectations.

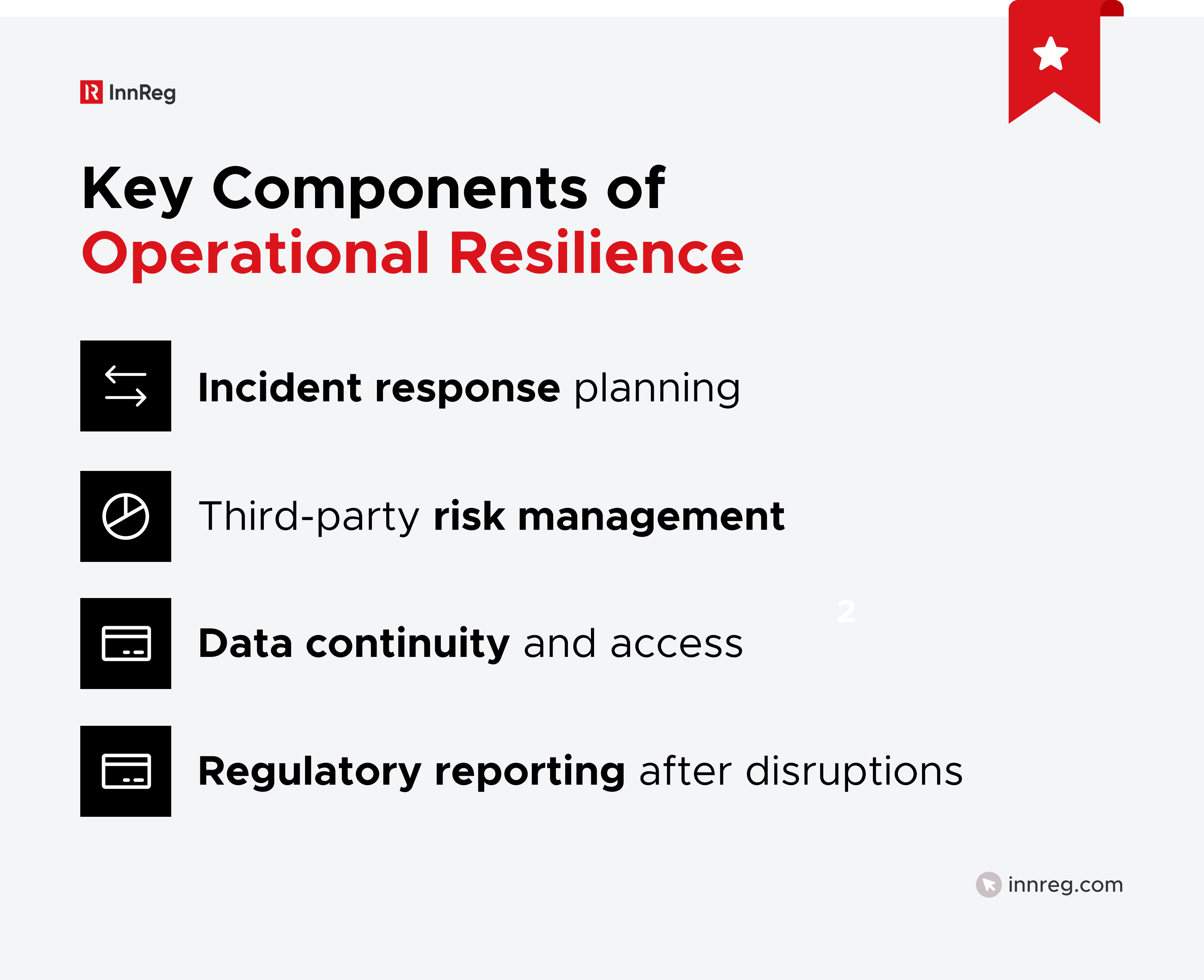

10. Operational Resilience as a Compliance Mandate

Regulators are no longer treating resilience as an IT issue. It’s now a core compliance expectation, especially for fintechs offering critical financial services or partnering with licensed institutions.

Operational resilience means more than uptime. It includes:

Disaster recovery and incident response planning

Third-party risk management, especially for cloud and infrastructure vendors

Maintaining access to critical data and functions during outages or attacks

In the US, banking regulators already require notification within hours of major incidents. In the UK and EU, formal resilience testing frameworks are rolling out under DORA and related guidance.

Many fintechs underestimate how quickly a minor disruption can escalate, especially when they rely on multiple vendors. If a service outage impacts users or transactions, regulators will want to know how you responded and what controls were in place.

Resilience isn’t just about systems. It’s about workflows, people, and contingency planning. That makes it a compliance priority, not just an engineering task.

11. RegTech as Core Infrastructure for Scaling Compliance

As fintechs prepare for growth in 2026 and beyond, compliance won’t be sustainable without automation. Manual reviews, scattered documentation, and reactive audits won’t scale. RegTech is becoming core infrastructure, not just a stopgap.

Next-gen compliance programs will rely on tools that automate:

KYC and onboarding flows

Transaction monitoring and suspicious activity flagging

Regulatory change tracking and policy management

Real-time audit readiness and reporting

The benefit isn’t just efficiency; it’s visibility. Future-fit compliance programs will be integrated into daily operations, not siloed off or tracked on spreadsheets.

But implementation still matters. The right tools depend on your product, risk profile, and jurisdictions. For teams without dedicated compliance ops, external partners who know the RegTech landscape can help build systems that actually hold up under scrutiny.

In the next phase of fintech, compliance won’t be a back-office function. It’ll be a core part of how products are launched, updated, and maintained.

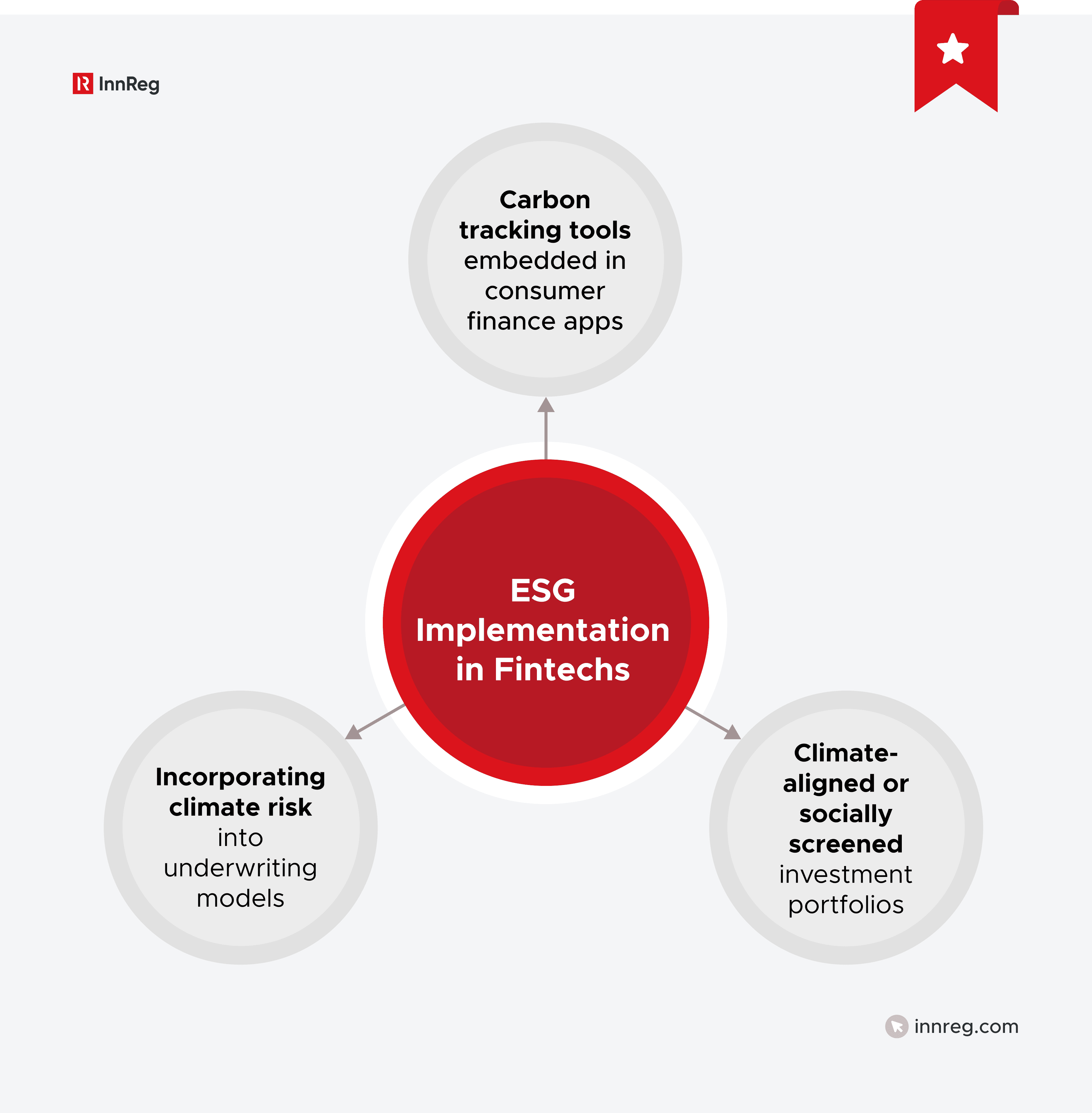

12. ESG-Focused Fintech and Climate Risk Tools

Environmental, social, and governance (ESG) considerations are moving from marketing to infrastructure. Investors, regulators, and customers increasingly expect fintechs to measure and disclose how their products intersect with climate and social impact, especially in lending, investing, and insurance.

Looking ahead, regulatory frameworks are catching up. Climate-related financial risk disclosures are gaining traction, particularly in the EU, UK, and increasingly in the US. That pressure will move downstream, from public companies to fintech partners that touch customer portfolios or credit systems.

ESG data isn’t easy to manage. It’s fragmented, subjective, and often expensive to verify. Still, fintechs offering ESG-related features will need internal controls around data quality, methodology transparency, and user-facing disclosures.

Building ESG into your product roadmap isn’t just about optics. It’s about preparing for a regulatory environment where climate risk becomes a standard input, not an optional narrative.

13. Quantum Computing and the Next Wave of Fintech Innovation

Quantum computing isn’t disrupting fintech yet, but it’s closer than most think. Several major banks and financial institutions are already testing quantum algorithms for risk modeling, asset optimization, and complex simulations that push beyond the limits of classical computing.

By 2026, early adoption will focus on:

Portfolio optimization across vast variables

Accelerated Monte Carlo simulations

Long-term cryptographic risk planning

The compliance angle? Post-quantum cryptography is already on the radar. Financial regulators and cybersecurity agencies are flagging today’s encryption as potentially vulnerable to future quantum attacks. Fintechs building for longevity will need to monitor these developments and prepare for eventual cryptographic upgrades.

There’s no immediate requirement to implement quantum-safe systems, but being late could become a liability. Forward-looking teams are already conducting risk assessments and working with vendors who are planning for quantum compatibility.

Quantum may not hit production environments next year, but it will influence how infrastructure decisions get made. Fintechs planning for scale and durability should start tracking quantum-readiness now.

See also:

14. Open Banking, Consumer Data Rights, and API Regulation

Open banking is moving from initiative to infrastructure. By 2026, more jurisdictions will require financial institutions and fintechs to offer secure, standardized access to consumer financial data via APIs. This will begin shifting data control to the user and tightening expectations around privacy and interoperability.

In the US, the CFPB’s long-awaited open banking rule under Section 1033 is advancing. Once finalized, it will:

Mandate data access standards across financial institutions

Set boundaries around data use, retention, and third-party sharing

Require clear consumer disclosures and consent management

For fintechs, this means designing around regulation, not just convenience. If your product relies on aggregating, storing, or analyzing user financial data, you’ll need controls that match evolving rules on access, transparency, and deletion.

15. Global Regulatory Shifts and Enforcement Priorities

Regulatory momentum is accelerating across every major fintech market. From crypto to credit to consumer data, new rules are being finalized, and enforcement priorities are tightening. By 2026, reactive compliance won’t cut it. Regulators expect fintechs to build for supervision from the start.

Key global developments to track:

US: CFPB open banking rules, stablecoin oversight (GENIUS Act), BNPL rulemaking

EU/UK: MiCA for crypto, DORA for operational resilience, Consumer Duty obligations

Asia: MAS and HKMA advancing digital asset licensing and AI governance frameworks

The trend is clear: regulators are no longer waiting for fintechs to mature. They’re stepping in earlier. That includes pre-licensing inquiries, partnership reviews, and scrutiny of embedded finance models.

Compliance teams should be preparing for:

Multi-jurisdictional coordination (especially for global products)

Documentation of internal controls and decision-making

Clear escalation paths and regulator-ready audits

Founders often underestimate how early regulators can get involved. But in 2026, being early with your compliance program becomes a strategic advantage.

What Founders and Compliance Leads Should Prioritize Now

The fintech landscape in 2026 demands operational discipline. With evolving expectations around AI, crypto, embedded services, and data rights, compliance can’t be bolted on later. It has to be built in from the start.

Founders and compliance leads should be focusing on:

Know your regulatory perimeter. If your product touches money movement, custody, lending, trading, or aggregates consumer data, you may be operating in a regulated category, whether or not you hold the license directly. That applies to embedded finance and partner-led models, too. You need to understand who’s responsible for what, and be able to show it.

Documentation matters more than ever. Policies should match what your product actually does. Workflows should reflect how decisions are made, not just how they’re supposed to be. If a regulator asks why a user was flagged, why a transaction was paused, or how a feature was approved, you need to be able to walk them through it cleanly.

Tooling helps, but only if it fits your risk profile. Generic automation won’t hold up in high-scrutiny categories like crypto, lending, or payments. The tools you use for KYC, transaction monitoring, or issue tracking should reflect the scale and structure of your business, and they should leave a trail.

Integrate compliance into product work early. That doesn’t mean slowing teams down. It means getting ahead of what might break. Too many teams launch features that later raise questions around disclosures, licensing, or oversight.

For lean teams, that often means looking beyond in-house capacity. Outsourced compliance programs with domain expertise can fill critical gaps, offering structure, reporting, and regulatory insight without slowing product velocity. The goal isn’t to get everything perfect. It’s to mitigate risks and make your business ready to scale.

Beyond 2026: What’s Next for Fintech Trends

The trends shaping 2026 won’t stop there. If anything, they’re laying the groundwork for deeper structural change. AI agents will get more autonomous. Tokenized assets will expand beyond pilot projects. Open banking will evolve into open finance, and regulators will keep closing the gaps between innovation and oversight.

What’s coming next? Expect closer scrutiny of AI decision-making, tighter controls on data usage, and increasing demand for real-time transparency from both users and regulators. Operational clarity, credible compliance, and risk-aware design won’t just reduce friction. They’ll become market advantages.

InnReg works with fintech companies building in complex, fast-moving spaces. We operate as an extension of your team, offering deep regulatory expertise, tailored policy development, and hands-on operational support. If you're ready to strengthen your compliance foundation, get in touch with InnReg to talk about how we can support your growth.

How Can InnReg Help?

InnReg is a global regulatory compliance and operations consulting team serving financial services companies since 2013.

We are especially effective at launching and scaling fintechs with innovative compliance strategies and delivering cost-effective managed services, assisted by proprietary regtech solutions.

If you need help with compliance, reach out to our regulatory experts today:

Last updated on Dec 16, 2025