FINRA BrokerCheck Guide: How to Research Brokers and Firms

Dec 2, 2025

·

11 min read

Contents

When choosing a financial professional or firm, trust and transparency are essential. That is why regulators created FINRA BrokerCheck, a public database to help investors and firms evaluate brokers, advisers, and brokerage companies.

BrokerCheck is not just an investor tool anymore. Fintechs now use it as part of their compliance framework that influences hiring choices, partnership decisions, and how the firm presents itself to clients and regulators.

This guide explains what BrokerCheck is, the type of information it reveals, and the limits of what it shows. We also explain how to use BrokerCheck while keeping in mind compliance and regulatory considerations.

At InnReg, we help broker-dealers navigate FINRA requirements with practical, experience-driven compliance support. Our team assists with registration, supervisory procedures, and ongoing compliance operations. Contact us to learn more about InnReg’s broker-dealer services.

What Is FINRA BrokerCheck?

BrokerCheck is a free online tool developed by the Financial Industry Regulatory Authority (FINRA). It allows anyone to review the registration, licensing, and disciplinary history of brokers, investment adviser representatives, and brokerage firms.

BrokerCheck was built to increase accountability in financial services. By making regulatory histories public, FINRA aims to protect investors and encourage higher compliance standards.

For firms, the system functions as both a safeguard and a reputational checkpoint. Clients, counterparties, and even regulators may review your profile. This makes accurate reporting and timely updates a compliance obligation, not just an administrative task.

Whereas for investors, it provides transparency before entrusting money to a professional.

How BrokerCheck Data is Collected

The data in BrokerCheck comes from the Central Registration Depository (CRD), FINRA’s licensing and registration database. The CRD extracts data from the following forms that firms and individuals must file:

Form U4: Registration form for individual brokers, which includes employment history, exam results, and disclosures of disciplinary or financial events.

Form U5: Termination from registration, which includes explanations for the termination.

Form BD: Registration form for brokerage firms, which records ownership, lines of business, and firm-level disclosures.

SEC IAPD: The Investment Adviser Public Disclosure system, which covers investment advisers. BrokerCheck connects directly to this database for advisers’ records.

Together, these sources create a consolidated view of a broker’s or firm’s professional registration history. Understanding this information flow is critical for fintechs, since missing or delayed updates to U4 or BD filings can expose firms to regulatory scrutiny, late fees, and public red flags on BrokerCheck.

Key Registration Forms Feeding BrokerCheck | ||

|---|---|---|

Form | Purpose | Information |

Form U4 | Registers an individual with FINRA and other regulators | Employment history, professional exams, licenses, residential history, disciplinary events, and financial disclosures |

Form BD | Registers a firm as a broker-dealer with the SEC and FINRA | Ownership and control persons, lines of business, firm disciplinary events, branch office locations, clearing arrangements, and financial disclosures |

Why BrokerCheck Matters to Fintech Firms

BrokerCheck functions as both a rule-driven requirement and a visible signal of trust when you are researching broker-dealers for your fintech startup. Here are some reasons why BrokerCheck is important:

Investor Due Diligence vs. Firm-Level Compliance Needs

Most people think of BrokerCheck as a tool for investors, but fintech firms use it differently. On one hand, investors use it to evaluate brokers before committing funds, focusing on past complaints, sanctions, or disciplinary history.

Firms, on the other hand, rely on BrokerCheck to confirm that employees and partners are properly registered and free of unresolved compliance issues. Both perspectives are important, but for fintech founders, the stakes often involve regulatory approval and credibility in the market.

Using BrokerCheck to Vet Hires, Partners, and Investors

Fintech companies move more quickly than other firm types. But hiring or partnering up with broker-dealers without conducting extensive background checks creates avoidable risks.

BrokerCheck reports show employment history, licenses, and any disciplinary records for brokers.

Reviewing these profiles is a practical way to identify patterns of complaints or regulatory sanctions that might compromise your business. A single oversight at the hiring stage can trigger regulatory inquiries later. For that reason, many compliance teams build BrokerCheck into their onboarding processes and vendor due diligence checklists.

How Your Own Firm’s BrokerCheck Profile Impacts Reputation

Once a firm is registered with FINRA, its profile becomes publicly visible on BrokerCheck.

As previously mentioned, that profile includes ownership, lines of business, and any firm-level disclosures such as fines or arbitration awards. Clients and partners can review this record as easily as regulators do.

Because clients, partners, and regulators all access the same record, compliance lapses quickly become reputation issues. A single disclosure can impact fundraising, strategic partnerships, or customer trust just as much as it can attract regulatory attention.

For a fintech startup, this means compliance lapses are also a reputational concern that can affect fundraising, partnerships, or customer trust.

Regulatory Requirement: Displaying a BrokerCheck Link

BrokerCheck obligations are also formalized through FINRA Rule 2210, which requires firms to display a clear BrokerCheck reference and link on their websites, with exceptions for firms that do not provide products or services to retail investors.

This rule applies to homepages and any pages that include professional profiles of registered representatives who conduct business with retail investors. The intent is to make BrokerCheck accessible to the public without barriers.

For fintech firms, it’s a simple but essential compliance step: the absence of a visible link may be treated as a violation during a FINRA exam.

See also:

How to Use BrokerCheck Step-by-Step

Using BrokerCheck is straightforward, but it helps to follow a structured process. Follow the steps below to start using BrokerCheck:

Need help with broker-dealer compliance?

Fill out the form below and our experts will get back to you.

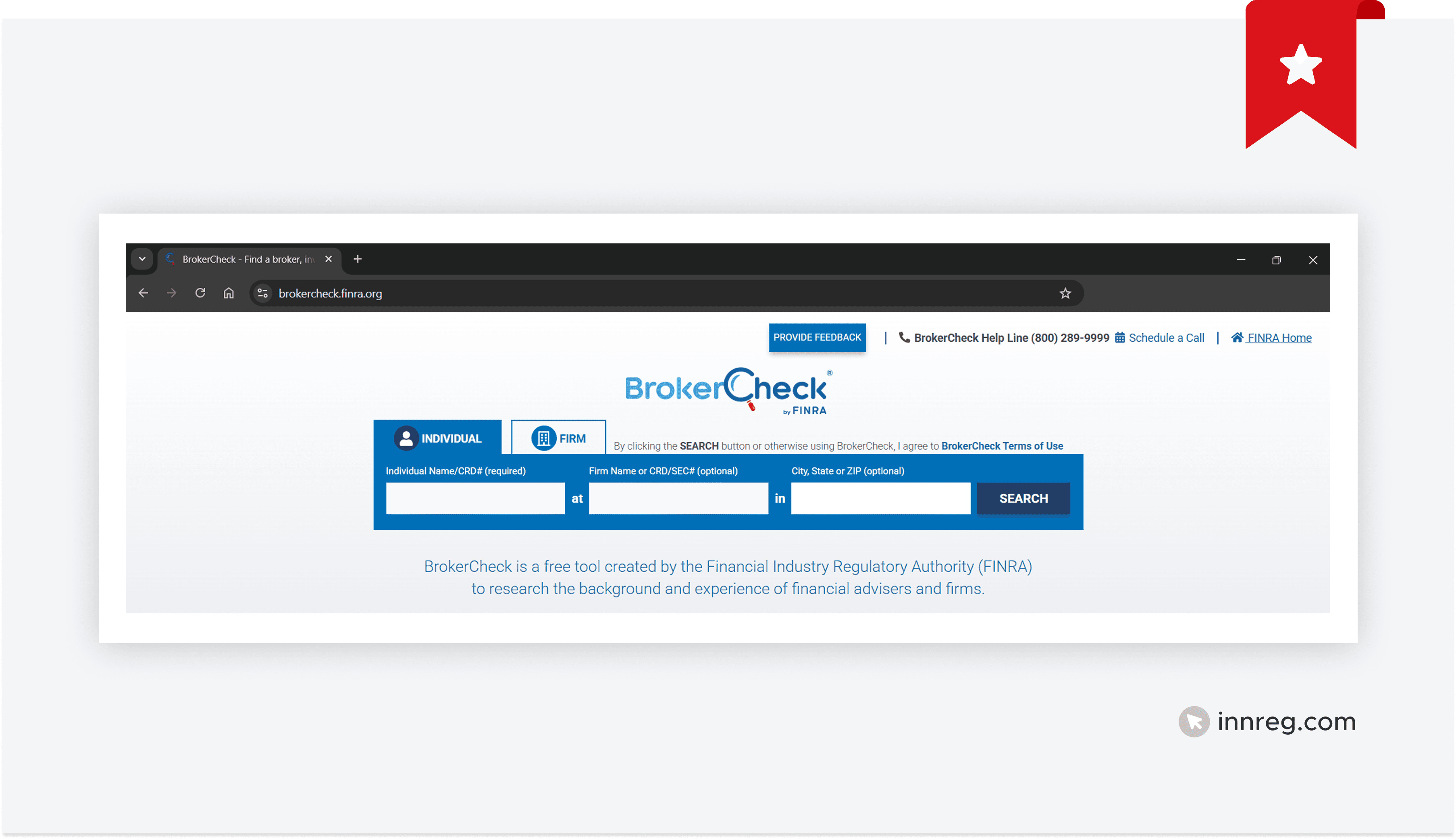

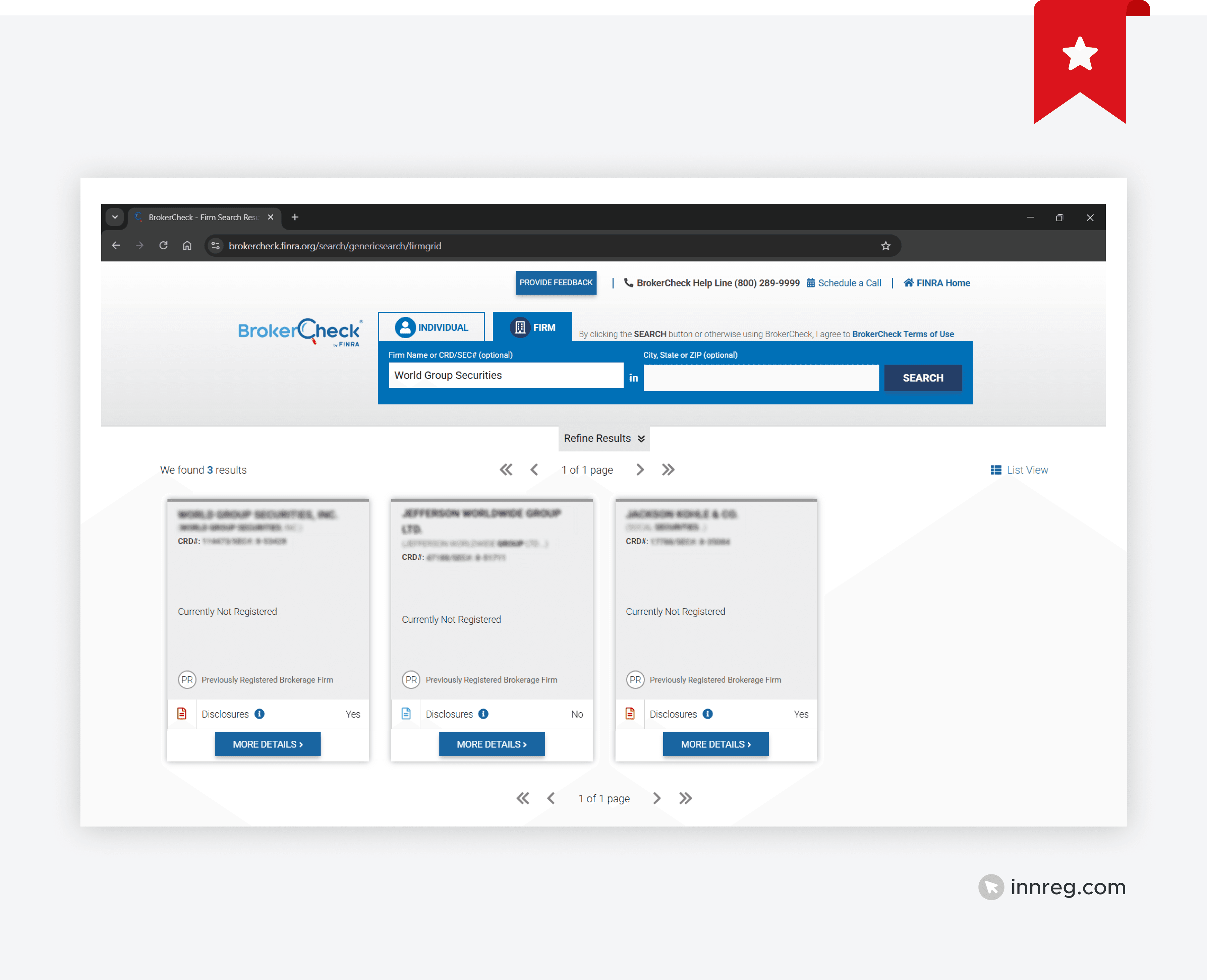

1. Search by Name or CRD Number

Open the FINRA BrokerCheck webpage. Enter the broker’s or firm’s name. If you have it, use the CRD number for a precise match.

2. Select the Correct Record

Check the results and focus on details such as middle initials, firm names, and locations to make sure you’re selecting the right record:

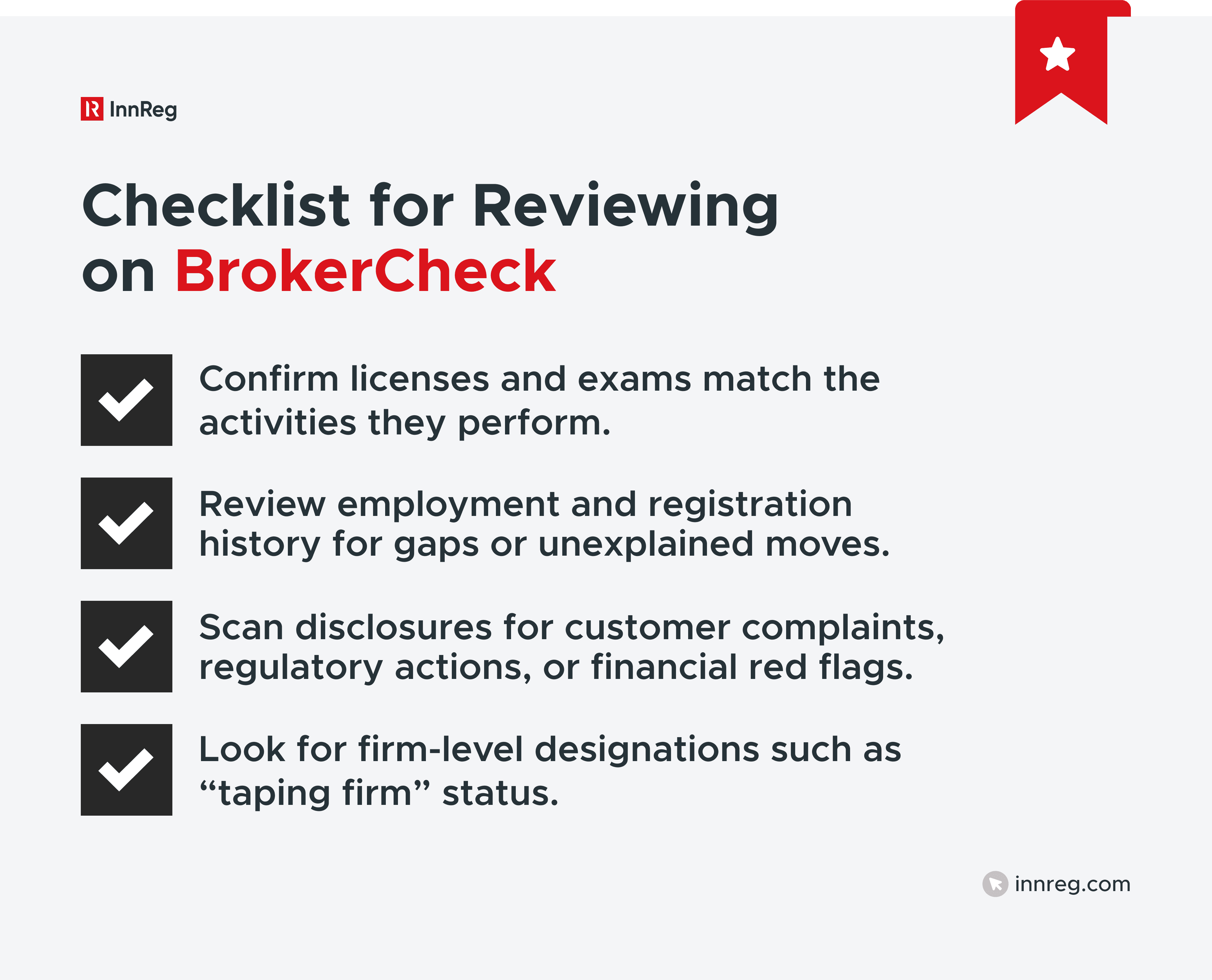

3. Review an Individual Broker Report

For individuals, the report will show:

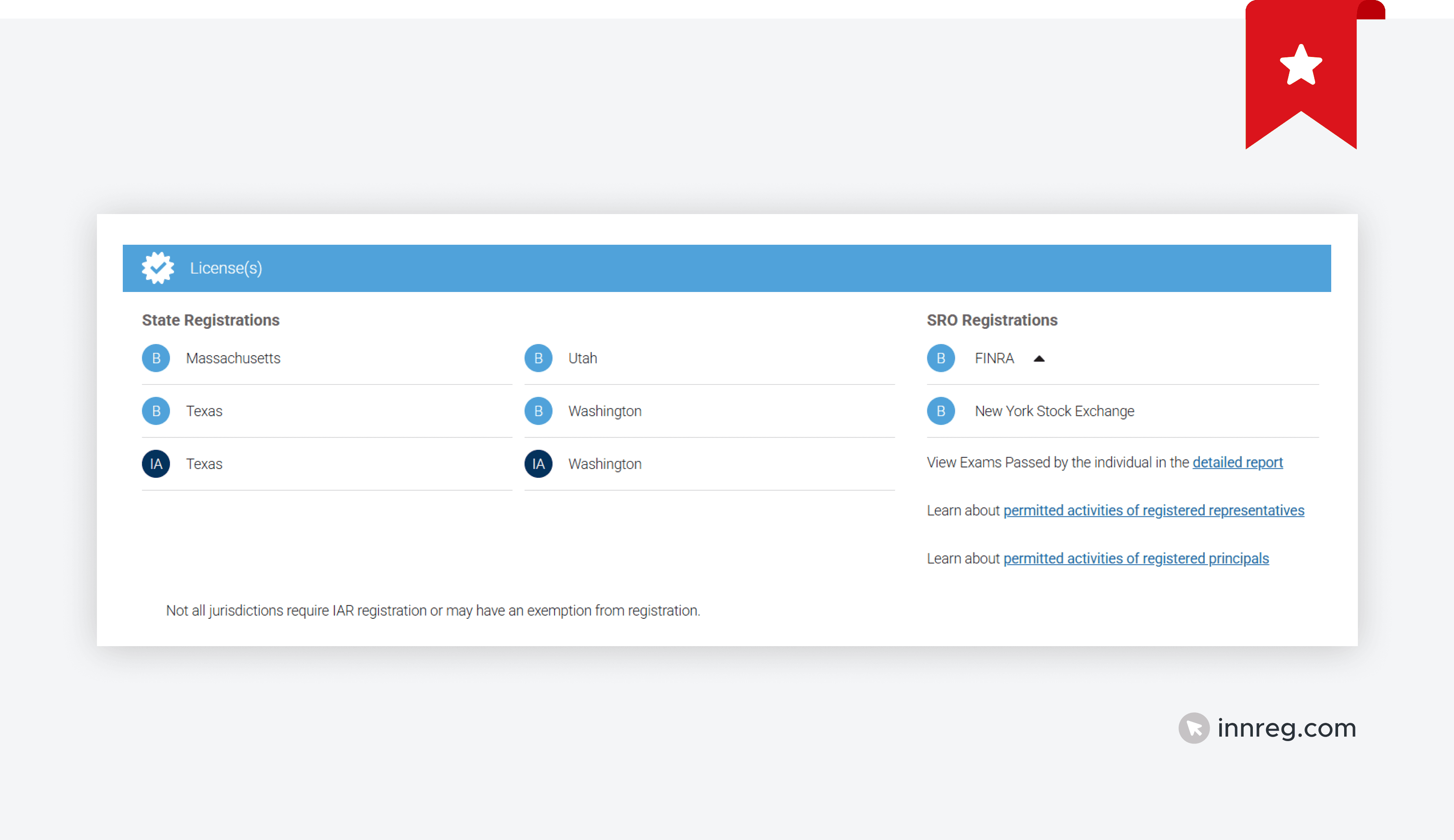

Licenses and exams completed (e.g., Series 7, Series 24):

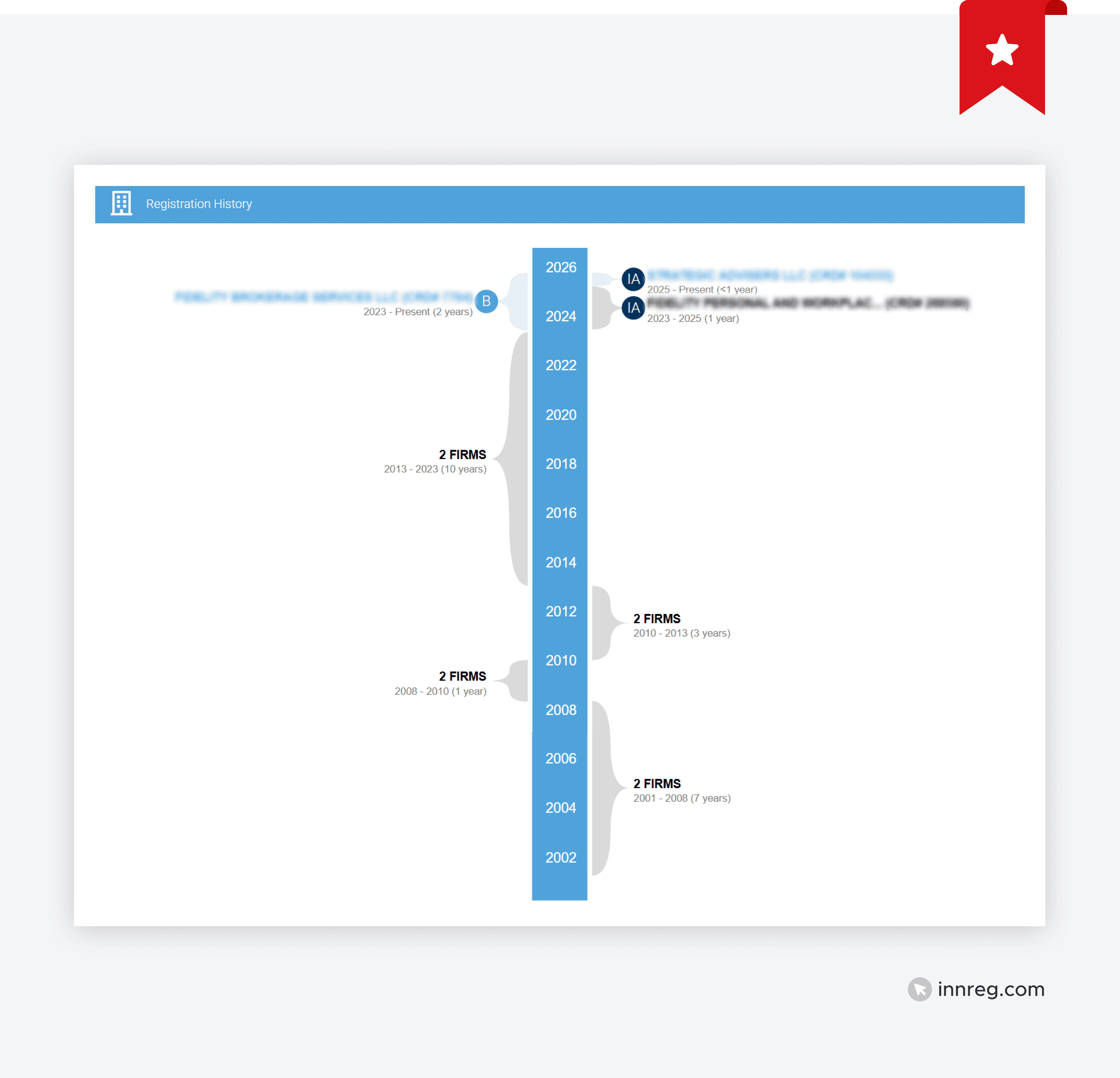

Employment and registration history:

Disclosure events such as complaints, disciplinary actions, or financial issues:

Read across sections, not just the summary. Context matters, especially with older or settled disclosures.

4. Review a Firm Report

Before signing with a broker-dealer firm, take a closer look at key details listed on BrokerCheck, such as:

ownership and control persons

other firm names in use

business lines and operations

states where the firm is registered

firm-level disclosures, including fines, arbitration outcomes, or bankruptcies

BrokerCheck will also flag if a firm is designated as a “taping firm,” meaning it employs a significant number of representatives with past misconduct.

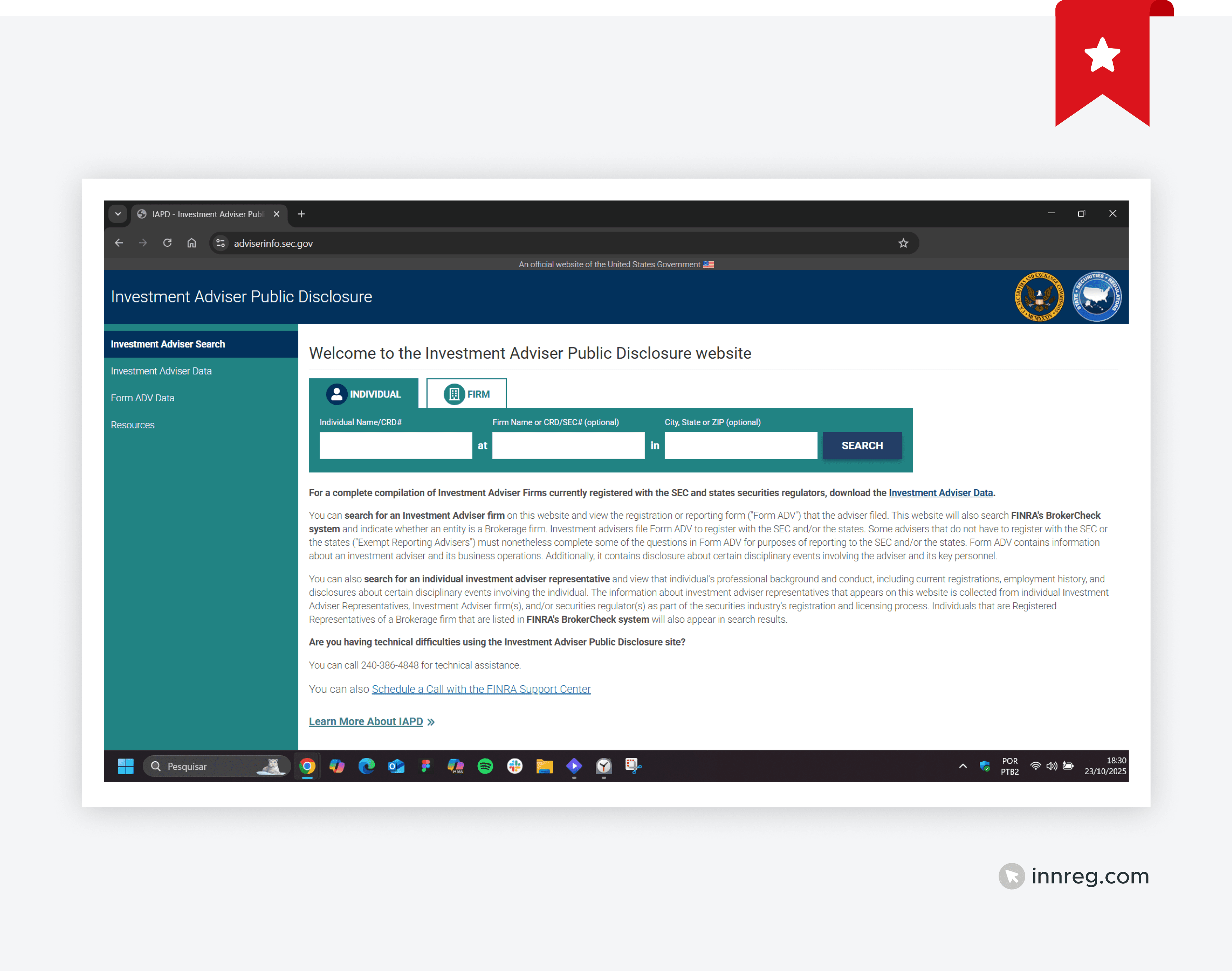

5. Check Investment Advisor Profiles

If the broker or firm is also registered as an investment adviser, BrokerCheck will link to the SEC’s Investment Adviser Public Disclosure (IAPD) system. This provides additional advisory details such as services, fees, and advisory-specific disciplinary history.

6. Watch for Red Flags

Pay particular attention to:

any unresolved customer disputes

regulatory sanctions or industry bars

criminal matters tied to fraud or dishonesty

patterns of employment terminations for cause

frequent firm name changes or “taping firm” status

See also:

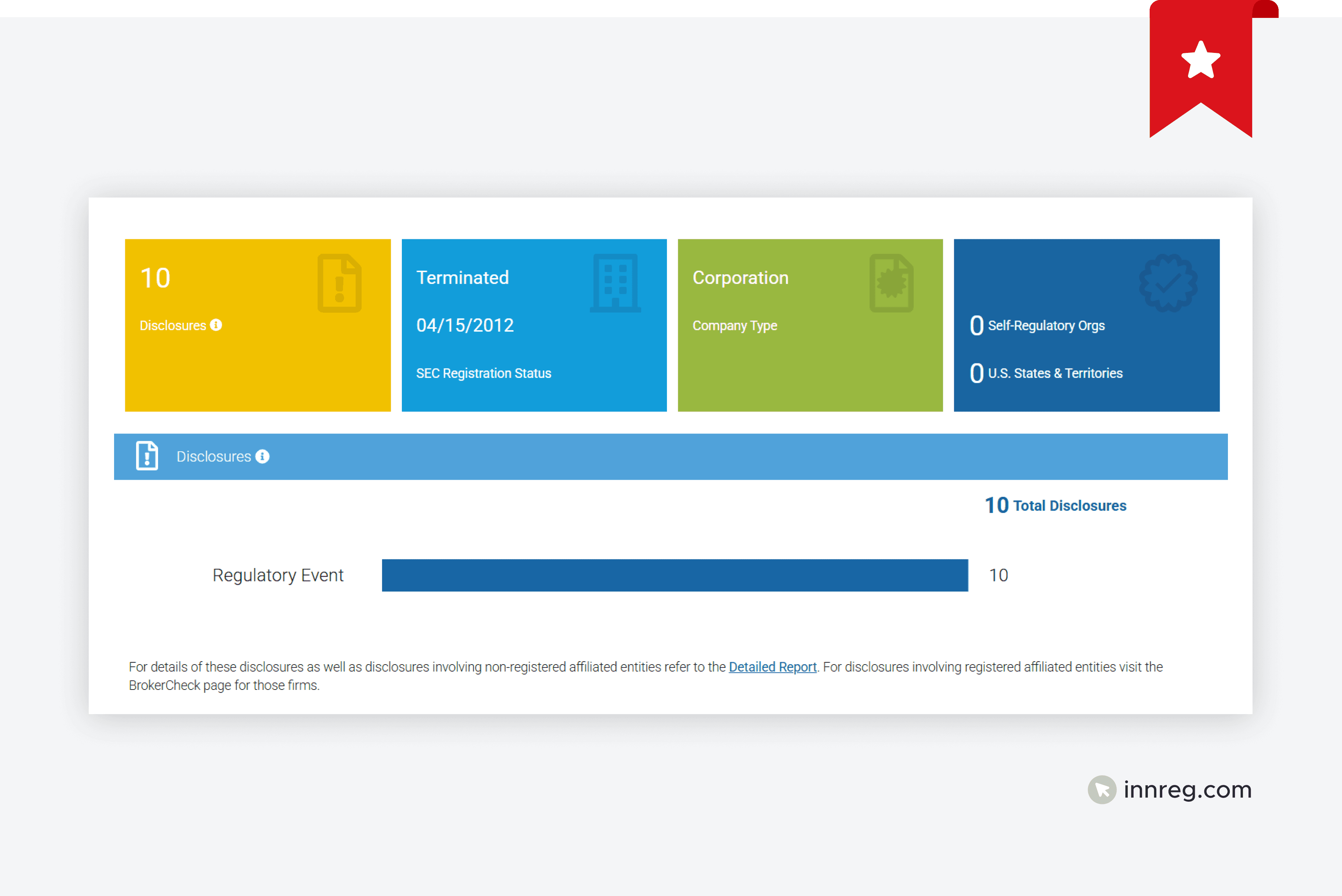

What BrokerCheck Discloses

BrokerCheck provides a detailed snapshot of a broker’s or firm’s regulatory and professional history. The information comes directly from filings and disclosures in FINRA’s registration system and includes:

Licenses, Exams, and Qualifications

BrokerCheck lists the exams a broker has passed and the registrations they hold with specific firms. This allows users to confirm whether a candidate or partner is authorized for the activities they claim to provide (e.g., a broker offering equity trading services should hold a Series 7 license).

Employment and Registration History

Reports display where a broker or firm has been registered, with dates of employment and the firms involved.

For individuals, it also includes a ten-year employment history. Reviewing this can highlight gaps, frequent moves, or changes in firm names that might require further questioning.

Events Covered in the Disclosure

The disclosure section covers serious events that may impact credibility or compliance risk, including:

customer disputes and arbitration outcomes

regulatory sanctions from FINRA, the SEC, or state authorities

criminal charges and convictions, especially those tied to fraud or dishonesty

financial problems such as bankruptcies, liens, or unpaid judgments

Each disclosure comes with a short description and outcome.

Permanent vs. Time-Limited Availability of Records

Most individual records remain in BrokerCheck for 10 years after leaving the industry.

Some disclosures, however, remain permanently, such as regulatory actions or certain criminal cases. Firm-level records are available indefinitely.

This means past issues can remain visible long after they occurred.

Limitations

BrokerCheck is not exhaustive. Certain matters are not included, such as personal disputes outside of securities activity, minor issues that do not meet reporting requirements, or disclosures that have been expunged.

A clean report does not always provide a complete picture of a broker-dealer’s history.

Compliance and Regulatory Considerations

BrokerCheck is not just a transparency tool. It is built into FINRA’s rulebook and tied to specific compliance obligations.

For fintech firms, this means BrokerCheck is both a resource and a responsibility:

See also:

Reporting Obligations

The accuracy of BrokerCheck depends on timely reporting through the required forms.

Form U4 must be updated when a broker’s information changes, such as changes in residential information, new disclosures, job changes, or financial events.

Form U5 must be filed when a broker leaves a firm, including the reason for termination.

Late or incomplete filings can lead to fines and, more importantly, create a misleading public record.

BrokerCheck Disclosures and Late Filing Penalties

FINRA imposes penalties for late disclosures. Even a short delay can trigger daily fines. Repeated or willful failures to disclose can escalate into suspensions or bars.

For fintech firms, this risk is not theoretical. Regulators monitor these filings closely, and missing updates may be treated as a red flag for supervisory weaknesses.

Website Requirements

As mentioned earlier, FINRA Rule 2210 requires firms to display a clear link to BrokerCheck on their website. This applies to the homepage and to any pages that list a profile of a registered representative who conducts business with retail investors.

The link must be easy to find, not hidden in small print. Failing to meet this requirement can be cited during regulatory exams.

BrokerCheck in Hiring: Rule 3110(e) and Background Checks

Firms are required to investigate the background of new hires who will be registered with FINRA. Rule 3110(e) directs firms to verify information on Form U4 and to check BrokerCheck as part of the process. Skipping this step increases the risk of bringing on individuals with disciplinary histories, which can later harm both compliance standing and firm reputation.

Learn more about FINRA Rule 3110(e) →

Ongoing Supervision and Monitoring

BrokerCheck is not a one-time check. Firms should periodically review the profiles of their registered personnel. New disclosures, such as complaints or regulatory actions, can appear at any time.

Treating BrokerCheck as part of ongoing supervision demonstrates a proactive compliance approach and reduces the likelihood of being caught off guard during an exam.

Considerations When Using BrokerCheck

BrokerCheck is valuable, but interpreting the reports correctly requires context. A clean record does not always mean low risk, and the absence of a record does not always mean someone was never active in the industry.

Fintech founders and compliance teams should understand these nuances before making decisions.

Why Someone May Not Appear in BrokerCheck

Not everyone working in financial services will appear.

A person may never have been registered with FINRA, may have left the industry more than ten years ago with no recordable events, or may only be licensed in areas outside securities. In these cases, “no record found” is not the same as a clean history.

Limits of a Clean Report

A profile with no disclosures is favorable, but it does not eliminate risk.

Some issues, such as small settlements below reporting thresholds or disputes resolved internally, may not be listed.

Firms should treat a clean record as one data point among others, not the sole basis for a decision.

What BrokerCheck Includes and Excludes

BrokerCheck covers regulatory disclosures, certain criminal matters, and financial events.

On the other hand, it does not include personal disputes unrelated to securities, minor issues outside reporting rules, or items removed through expungement.

Understanding these limits helps avoid overreliance on the database.

Impact of Time on Records

Some information stays visible permanently, such as regulatory actions or serious criminal cases. Other data, like standard employment records, may fall off after ten years. Knowing the retention rules can clarify why an older matter may or may not still be visible.

How Expungement Affects Visibility

Brokers can request expungement of certain disclosures, but the process is tightly controlled. Even when successful, the reputational effect may persist if the issue was publicized before removal.

For fintech firms, this means a “clean” report may not fully reflect public perception.

Relevance for Fintech Founders and Executives

Founders who register as principals of a broker-dealer will also have BrokerCheck profiles.

These records include financial disclosures, employment history, and any regulatory actions.

Fintechs should treat their own profiles as part of the company’s public reputation and manage them with the same care as firm-level records.

Tips for Fintech Founders and Compliance Teams

Fintech firms can use BrokerCheck to strengthen hiring, protect partnerships, and monitor the firm’s own record.

The following practices show how BrokerCheck can be applied in practical ways to mitigate risk and support credibility with investors, clients, and regulators:

BrokerCheck: Hiring and Partnership Decisions

Before hiring registered staff or entering a partnership, review the relevant BrokerCheck profiles. A clean report should be weighed alongside other due diligence, while repeated disputes or unresolved regulatory matters should raise caution. Documenting this review process also shows regulators that the firm is taking supervisory duties seriously.

Maintaining Your BrokerCheck Record

For fintechs that are themselves registered broker-dealers, the firm’s BrokerCheck profile becomes part of its public reputation. Staying on top of filings, updating Form U4 and Form U5 forms promptly, and addressing issues before they escalate will reduce the risk of public disclosures that could affect client trust or fundraising.

Using BrokerCheck in Compliance Workflows

BrokerCheck reviews should not be treated as a one-time task but as part of ongoing compliance workflows. They can be integrated into onboarding by verifying every new registered hire’s record, into supervision by scheduling periodic reviews of staff and firm profiles, and into vendor management by confirming the regulatory standing of service providers.

Learn how InnReg helps broker-dealers →

—

BrokerCheck is more than just a research tool for investors. It is a regulatory mechanism that shapes how clients, partners, and regulators perceive brokers, firms, and even fintech founders. Understanding how to use it helps firms manage compliance risk while building credibility in a competitive market.

For fintechs, incorporating BrokerCheck into hiring, partnerships, and ongoing supervision is both practical and necessary. Treating it as part of daily compliance operations strengthens oversight, reduces surprises during exams, and demonstrates a commitment to transparency.

In an industry where trust and compliance are closely linked, a well-managed BrokerCheck profile can be a valuable asset.

How Can InnReg Help?

InnReg is a global regulatory compliance and operations consulting team serving financial services companies since 2013.

We are especially effective at launching and scaling fintechs with innovative compliance strategies and delivering cost-effective managed services, assisted by proprietary regtech solutions.

If you need help with broker-dealer compliance, reach out to our regulatory experts today:

Last updated on Dec 2, 2025