Regulation CF Explained: Equity Crowdfunding Rules for Startups

Jan 7, 2026

·

18 min read

Raising capital in a regulated way is one of the biggest hurdles for early-stage startups. Regulation CF gives founders another way to do it, letting them invite everyday investors to take part in their growth. It’s a newer path that blends the spirit of crowdfunding with the structure of US securities law.

This article explains how Regulation CF works in practice. You’ll learn how offerings are structured, what rules apply to issuers and investors, and how compliance fits into each stage of the process.

By the end, you’ll have a clear picture of where Regulation CF fits in your fundraising strategy and what it takes to stay on the right side of compliance.

At InnReg, we help startups, funding portals, and broker-dealers navigate Regulation CF from both a regulatory and operational angle. Our team supports offering structure, Form C preparation, intermediary coordination, and ongoing reporting workflows.

What Is Regulation CF

Regulation CF (short for Regulation Crowdfunding) is a set of rules created by the US Securities and Exchange Commission (SEC) that lets startups raise money from the public online. Instead of relying only on wealthy or institutional investors, founders can offer small pieces of ownership to a broad group of supporters, often through a registered crowdfunding portal.

It was designed to make early-stage investing more open while still keeping investor protections in place. Under Regulation CF, companies can raise up to $5 million in a 12-month period, as long as they follow specific disclosure, filing, and reporting requirements. Investors, in turn, get a regulated way to back companies they believe in.

For many startups, Regulation CF offers a bridge between early friends-and-family funding and larger rounds under other exemptions like Regulation D or Regulation A. It helps founders test market interest, build community around their product, and access capital, all within a clear legal framework.

How Regulation CF Fits Into the JOBS Act

Regulation CF was born out of the Jumpstart Our Business Startups (JOBS) Act, a law passed in 2012 to help small businesses raise capital and grow. The JOBS Act aimed to make it easier for young companies to access funding while keeping investor protections in place.

Before this law, only accredited investors could invest in most private offerings. That meant that individual investors were left out, and early-stage founders had limited options. The JOBS Act changed that by creating new exemptions, including Regulation CF, which opened the door to equity crowdfunding.

Ultimately, Regulation CF turned crowdfunding into a regulated investment channel. It gave startups a way to raise funds online through registered intermediaries, with the SEC setting clear limits and disclosure rules and FINRA’s oversight. The result is a more accessible fundraising landscape that still operates within a structured, compliant framework.

Equity Crowdfunding vs. Traditional Fundraising

Aspect | Equity Crowdfunding (Regulation CF) | Traditional Fundraising |

|---|---|---|

Who Can Invest | Open to the public, including non-accredited investors | Limited to accredited investors or institutions |

Investment Size | Typically, smaller amounts from many investors | Larger investments from a few backers |

Process | Conducted online through a registered portal | Usually handled through private meetings and negotiations |

Compliance | Requires SEC filings, disclosures, and the use of an approved intermediary | Relies on exemptions like Reg D with less public disclosure |

Community Impact | Builds a group of early supporters and potential customers | Focuses on investor relationships and strategic value |

Control and Terms | Founders often retain more control | Investors may negotiate board seats or influence key decisions |

Funding Speed | Can move faster once the campaign is live | Often slower, with longer due diligence and negotiations |

Traditional fundraising often happens behind closed doors. Founders pitch to venture capital firms or accredited investors, negotiate terms, and give up equity for large checks. It can take months, and many early-stage startups struggle to get attention unless they already have traction or connections.

Equity crowdfunding under Regulation CF works differently. It lets startups raise smaller amounts from a larger group of investors through an online portal. Anyone can participate within certain limits, which makes fundraising more open and community-driven. Investors get a chance to own a piece of the company, and founders can build a loyal base of supporters who believe in their vision.

Both paths have their tradeoffs. Venture capital brings big checks and connections, but it can also mean giving up control. Equity crowdfunding offers flexibility and a broader reach, but it comes with strict compliance and disclosure requirements. For many startups, a Regulation CF campaign is a practical first step toward bigger funding rounds down the road.

How Regulation CF Works

Regulation CF turns the idea of online investing into a regulated process. It outlines who can raise funds, how offerings must be conducted, and what role intermediaries and investors play throughout the campaign.

The Basic Structure of a Regulation CF Offering

A Regulation CF offering starts with a company deciding how much it wants to raise. The company then works with a registered crowdfunding portal or broker-dealer to host the offering online.

Before going live, the issuer must file Form C with the SEC. This form includes details about the business, its financials, use of proceeds, and key risks. Once filed, the information becomes public so investors can review it before making decisions.

Throughout the campaign, the company shares updates and answers investor questions on the portal through transparent communication. When the funding goal is met and the offering closes, the issuer reports the final results to the SEC and begins its post-offering obligations, including annual reporting, if required.

Role of Funding Portals and Broker-Dealers

Funding portals and broker-dealers act as the official gatekeepers for Regulation CF offerings. They provide the structure, technology, and compliance oversight that make online fundraising possible under federal securities law.

Funding portals: These are online platforms registered with the SEC and regulated by FINRA. Their job is to host the offering, display company disclosures, and give investors a transparent place to review information before they invest. They manage investor onboarding, verify eligibility, collect funds through a third-party escrow service, and handle communication between issuers and investors during the campaign. While they cannot offer investment advice or handle securities directly, their systems help maintain order and fairness throughout the process.

Broker-dealers: They play a similar but often broader role. In addition to meeting the same regulatory requirements, they can provide strategic guidance to issuers, conduct due diligence, and handle marketing within the limits of securities law. Some broker-dealers also specialize in helping issuers structure their offerings or combine Regulation CF with other exemptions like Regulation D.

Choosing between a funding portal and a broker-dealer often depends on a company’s goals, budget, and level of experience. Funding portals are typically better for straightforward campaigns, while broker-dealers can offer deeper support for complex or larger-scale offerings. Both are, however, essential to keeping Regulation CF offerings accessible, compliant, and transparent for all parties involved.

How Investors Participate in Regulation CF Offerings

Investors can join a Regulation CF offering entirely online. The process is designed to be straightforward and transparent, giving people a chance to invest in startups they believe in.

To start, investors:

Create an account on the platform

Review offering details

Complete identity verification.

The crowdfunding portal provides key information such as the company’s business plan, financials, and risk factors. This helps investors understand what they are supporting before they commit funds.

Investment amounts are limited based on income and net worth. These limits are set by the SEC to keep participation proportional to an investor’s financial situation. Once the investment is made, funds are held in escrow until the campaign closes successfully. If the target is not met, the money is returned to investors.

When the offering closes, investors receive confirmation of their ownership, usually in the form of digital securities or shares recorded by a transfer agent. They may receive updates from the company over time, but unlike public stocks, these investments are generally illiquid and meant to be held long term.

See also:

Who Can Use Regulation CF

Not every company can launch a Regulation CF campaign. The rules outline exactly who qualifies to raise funds and who can invest. Here’s a look at which issuers are eligible, what restrictions apply, how investor limits work, and a few key terms that help define who participates in these offerings.

Need help with crowdfunding compliance?

Fill out the form below and our experts will get back to you.

Eligible Issuers (and Who’s Excluded)

Regulation CF is meant for small and emerging businesses that want to raise capital from the public. To qualify, a company must be based in the US and have its main business operations here. Most early-stage startups and growing private companies meet this requirement.

However, not everyone can use this exemption. Certain types of businesses are excluded, such as:

Investment companies

Blank check companies

Those that already report to the SEC under the Securities Exchange Act.

Companies that have failed to comply with previous Regulation CF reporting requirements are also disqualified until they correct those issues.

Foreign companies, public firms, and businesses without a defined plan or operations cannot use Regulation CF. These restrictions keep the exemption focused on legitimate, growth-oriented startups rather than speculative or high-risk ventures with little oversight.

Investor Eligibility and Investment Limits

Anyone can invest in a Regulation CF offering, but there are limits on how much unaccredited investors can contribute during a 12-month period. These limits depend on income and net worth to help balance access and protection:

If an unaccredited investor’s annual income or net worth is less than $124,000, they can invest up to the greater of $2,500 or 5% of the greater number.

If an unaccredited investor has both income and net worth that are $124,000 or more, they can invest up to 10% of the greater number, with a cap of $124,000 total across all Regulation CF offerings in that year.

Investors do not need accreditation, which makes Regulation CF more inclusive than most other fundraising exemptions. They only need to meet the platform’s onboarding requirements, which typically include identity checks, acknowledgment of the investment’s risks, and income and net worth disclosures.

These limits make it possible for more people to take part in early-stage investing without overexposing themselves financially. For startups, it means reaching a wider group of supporters who can become long-term advocates for the brand.

Key Definitions in Reg CF

To make sense of how Regulation CF works, it helps to understand a few key terms that appear throughout the filings and disclosures. These terms define who is responsible for the offering, who has control over the company, and how relationships between parties are viewed under the rules.

Issuer

This is the company raising money through Regulation CF. It’s responsible for filing Form C with the SEC, sharing accurate information about the business, and communicating with investors during the campaign. The issuer must also keep up with post-offering requirements, such as filing annual reports.

Beneficial owner

This is someone who owns or controls a meaningful portion of the company, even if the shares are held under another name. Usually, this means anyone who directly or indirectly owns 20% or more of the voting equity. Identifying beneficial owners helps investors and regulators understand who holds real influence over the business.

Affiliate

This is a person or organization closely tied to the issuer through ownership, management, or control. Affiliates often include founders, executives, large shareholders, or companies under common ownership. Their involvement matters because it can affect disclosure rules and determine whether certain transactions need to be reported.

Key Rules and Requirements Under Regulation CF

Regulation CF includes specific limits and disclosure obligations that shape how offerings are conducted. These rules set the framework for how much a company can raise, what it must report, and how it communicates with investors throughout the process.

Maximum Offering Amounts and Annual Limits

Under Regulation CF, companies can raise up to $5 million within a 12-month period. This cap applies to the total amount raised from all investors combined, no matter how many campaigns the company runs during that time.

There are no minimum amounts set by the SEC, so issuers can choose their own target and decide whether they want to accept investments above that goal, up to the limit. Many startups set a minimum amount they need to reach before the campaign closes successfully.

These limits make Regulation CF a practical option for early-stage companies that want to raise meaningful capital without moving into the more complex territory of larger exemptions like Regulation D or Regulation A. For investors, it keeps offerings focused on startups still in the growth stage.

Disclosure Requirements

Transparency is at the core of Regulation CF. Before launching a campaign, a company must file Form C with the SEC and publish it on the crowdfunding platform. This document tells potential investors who the company is, what it does, how it plans to use the funds, and what risks may be involved.

The filing includes details such as

Business description

Ownership structure

Target offering amount

Use of funds

Financial statements

It also lists any previous fundraising activity and outlines the rights attached to the securities being offered.

Throughout the campaign, issuers must update investors if there are material changes or new developments. Once the offering closes, the company files Form C-U to report final results. For ongoing compliance, many issuers must later submit Form C-AR, an annual report that keeps investors informed about progress and financial performance.

These disclosures help investors make informed choices and build trust between startups and their growing community of backers.

Financial Statement Requirements by Offering Size

Regulation CF adjusts its financial reporting requirements based on how much money a company wants to raise. The larger the raise, the more detailed the financial information needs to be.

For offerings up to $124,000, companies can provide financial statements certified by their principal executive officer, along with information from their tax returns. An independent public accountant must review financial statements for offerings between $124,000 and $618,000.

Issuers that have previously raised funds under Regulation CF and have offerings of over $618,000 are required to provide audited statements. These thresholds are designed to match the level of investor protection with the scale of the raise.

This tiered approach makes it easier for startups to begin with smaller raises while maintaining higher standards for larger offerings. It balances flexibility for early-stage companies with transparency for investors.

Communication and Advertising Rules

Communication during a Regulation CF offering is tightly controlled to keep the process fair. Companies can promote their campaign, but only within specific boundaries set by the SEC.

Before filing Form C, issuers cannot publicly discuss the offering or hint that one is coming. Once Form C is filed, they can share limited information known as a tombstone notice. This includes basic details like the company name, type of securities, funding goal, and a link to the crowdfunding portal.

All other communications about the offering must happen directly on the portal’s discussion board, where all investors can see and participate equally. Outside the portal, issuers can continue to market their business and brand as long as they avoid discussing the terms of the offering.

Following these rules keeps communication clear and consistent while giving every investor access to the same information. It helps startups promote their campaign responsibly without crossing into misleading or selective disclosure.

Bad Actor Disqualification

Regulation CF includes a bad actor rule that keeps individuals or companies with certain legal or regulatory problems from participating in offerings. This rule protects investors by making sure those involved in the raise have a clean track record.

A company is disqualified if it or its key personnel, such as officers, directors, major shareholders, or affiliates, have faced specific violations. These can include securities fraud, certain criminal convictions, court injunctions, or SEC orders that restrict participation in securities activities.

Before launching a campaign, issuers must review the backgrounds of everyone involved to confirm eligibility. This is often done through formal background checks and certifications. If a disqualifying event is discovered, the company cannot proceed with the offering until the SEC resolves or waives the issue.

Use of Registered Intermediaries

A company cannot sell securities directly to the public under Regulation CF. Instead, it must conduct its offering on one platform so that all investors receive the same information in the same place. This helps prevent confusion, selective disclosure, or misleading promotions.

Registered intermediaries handle key compliance steps such as verifying investor eligibility, collecting funds through escrow, and posting disclosures and updates. They also provide a space where investors can ask questions and engage with the issuer.

Working with an experienced intermediary can make the offering process smoother and more reliable. For startups, it means having a structured system that keeps the campaign organized and compliant from start to finish.

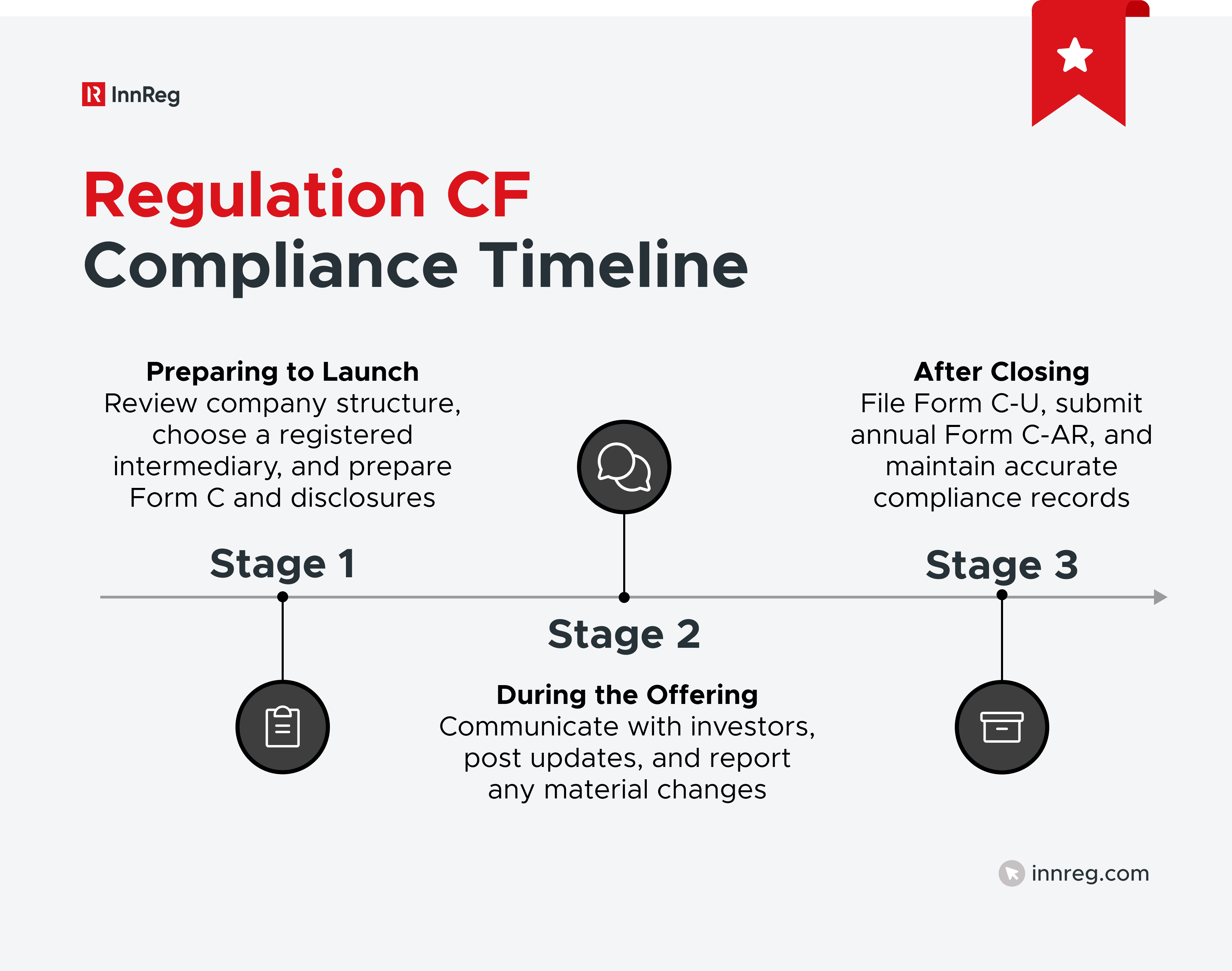

Regulation CF Compliance Timeline

A Regulation CF offering follows a defined sequence from preparation to post-closing reporting. Each stage has specific compliance tasks that help keep the process structured and transparent.

Preparing to Launch: What to Do Before Filing Form C

Before filing Form C, companies need to get their financial and legal details in order. This includes reviewing their corporate structure, confirming ownership information, and preparing financial statements that match the size of the planned raise.

Founders should also identify a registered intermediary early and review the platform’s onboarding requirements. Most intermediaries will ask for business details, management backgrounds, and copies of key documents.

It’s also smart to draft the core parts of the disclosure early, such as how the funds will be used, potential risks, and how the company plans to grow. Having these pieces ready makes filing smoother and helps investors see a complete, transparent picture once the campaign goes live.

See also:

During the Offering: Disclosure, Investor Q&A, and Updates

Once the offering is live, communication and transparency become the primary focus. All investor interactions and updates must happen through the registered portal so that everyone has equal access to the same information.

Companies are expected to answer investor questions promptly, post updates about campaign progress, and share any material changes as they happen. This helps keep investor confidence high and shows that the company is actively engaged in the process.

It’s also a good time for issuers to build community. Sharing milestones, product developments, or team news can make the campaign more engaging while staying within the rules. The goal is to keep investors informed, not to hype the offering.

After Closing: Reporting, Form C-U, and Ongoing Obligations

When the offering ends, the company must report the outcome by filing Form C-U with the SEC. This filing confirms how much was raised, how many investors participated, and whether the target goal was met.

After that, many issuers have to submit an annual report using Form C-AR. This keeps investors updated on the company’s financial health and progress. The report includes basic business updates, ownership information, and current financial statements.

It’s important for startups to track these deadlines and keep their records organized. Good reporting habits not only support compliance but also strengthen credibility with current and future investors.

The Role of the SEC and FINRA in Regulation CF

The SEC and FINRA work together to regulate equity crowdfunding. The SEC sets the rules for offerings, while FINRA oversees the platforms and intermediaries that make those offerings possible.

Oversight of Funding Portals

FINRA is responsible for regulating funding portals, which act as the main hubs for Regulation CF offerings. Every portal must register with both FINRA and the SEC before it can host campaigns.

FINRA reviews each platform’s operations, compliance systems, and management team to confirm they meet the required standards. Once approved, portals are subject to ongoing supervision that includes regular reporting and examinations.

This oversight confirms that the portals handle investor funds properly, post accurate disclosures, and maintain secure systems for communication and transactions. For startups and investors alike, it creates a level playing field built on trust and accountability.

SEC Reporting and Enforcement Authority

The SEC oversees all Regulation CF offerings and enforces the rules that keep them compliant. Companies must file their Form C and related disclosures directly with the SEC before they can raise funds. These filings are public, giving investors access to verified information about each issuer.

The SEC also monitors filings after the campaign closes, including updates and annual reports. If a company provides misleading information or fails to meet its obligations, the SEC can take enforcement action, which may include fines or restrictions on future offerings.

This oversight keeps the crowdfunding market credible and transparent. It helps honest startups raise money while discouraging bad actors from taking advantage of investors.

Interaction With State Securities Laws

Regulation CF simplifies compliance by giving federal preemption over state securities laws. This means companies do not need separate approval from every state where investors live, as long as they follow SEC and FINRA rules.

However, states still have some authority. They can require notice filings and collect fees, and they can take action if fraud or misconduct occurs within their borders. This balance allows startups to reach investors nationwide without facing multiple layers of regulation.

For growing companies, this preemption makes Regulation CF more practical. It reduces administrative hurdles while keeping strong protections in place for investors across all states.

Regulation CF vs. Regulation D vs. Regulation A

Regulation CF, Regulation D, and Regulation A each offer unique ways for startups to raise funds under SEC exemptions. Understanding their differences helps founders choose the best path for their growth stage and goals.

Key Differences in Offering Limits and Investor Access

The main differences between Regulation CF, Regulation D, and Regulation A come down to how much a company can raise and who can invest.

Regulation CF: It allows up to $5 million per year from both accredited and non-accredited investors. It’s the most inclusive option and is often used by early-stage startups.

Regulation D: It’s designed for private placements. It has no fundraising cap but is mainly limited to accredited investors. It requires less public disclosure but offers less visibility to the general public.

Regulation A: It sits between the two. It allows larger raises of up to $75 million, with more detailed disclosure and SEC qualification. It’s often used by more mature startups that want a broader investor base without going fully public.

Each exemption serves a different stage of growth. Startups often start with Regulation CF to test investor interest, then move to Regulation A or Regulation D as they scale and seek larger funding rounds.

Feature | Regulation CF | Regulation D (Rule 506) | Regulation A |

|---|---|---|---|

Maximum Raise | Up to $5 million in 12 months | No limit | Up to $20 million (Tier 1) or $75 million (Tier 2) |

Who Can Invest | Both accredited and non-accredited investors | Mostly accredited investors (some exceptions under 506(b)) | Accredited and non-accredited investors |

SEC Filing Required | Yes, Form C | Minimal filing (Form D) | Yes, Form 1-A with SEC qualification |

Disclosure Level | Moderate, public on the portal | Limited, private offering | High, similar to mini-IPO |

Marketing Restrictions | Limited and controlled by SEC rules | Limited, depending on the rule used | Broader marketing is allowed after qualification |

Secondary Trading | Limited resale options | Restricted | Freer resale for Tier 2 offerings |

Typical Use Case | Early-stage startups seeking community investors | Private companies raising funds from accredited investors | Growth-stage startups seeking large public raises |

When to Choose Regulation CF Over Other Exemptions

Regulation CF is a strong choice for startups that want to raise moderate amounts of capital while keeping their fundraising open to a broad group of investors. It’s especially useful for early-stage or growth companies that want to build awareness, validate their idea, and attract both funding and followers at the same time.

Compared to Regulation D, which is limited mainly to accredited investors, Regulation CF gives founders the opportunity to include customers, friends, and fans as shareholders. This community-driven approach often strengthens brand loyalty and creates a base of long-term advocates.

It’s also a more affordable and less complex option than Regulation D or A, which requires extensive financial audits, SEC qualification, and higher legal and marketing costs. Regulation CF offers a lighter compliance burden while still keeping investor protections in place.

Startups often choose Regulation CF when they need to:

Raise up to $5 million without going through a full SEC qualification process

Engage a wide audience of both accredited and non-accredited investors

Build a public track record before pursuing additional larger funding through exemptions like Regulation A or Regulation D

Create a transparent, community-focused brand experience

In short, Regulation CF is ideal for companies looking to combine fundraising with early market validation and brand growth, all within a clear, structured regulatory framework.

Combining Regulation CF With Other Offering Types

Many startups use Regulation CF as part of a larger fundraising strategy. Because it’s flexible and community-focused, it can complement other exemptions like Regulation D or Regulation A at different growth stages.

A company might start with a Regulation CF campaign to test investor interest and raise early funds. Once the business gains traction, it can move to a Regulation A round to attract larger accredited investors or later pursue a Regulation D offering to reach an even broader audience, which allows for offerings in excess of $75 million.

These combinations work best when the company keeps clear records, follows the limits for each exemption, and maintains consistent disclosure practices. If done correctly, this layered approach allows startups to scale their fundraising efforts while mitigating risk and building trust with both retail and professional investors.

See also:

Best Practices for Regulation CF Compliance

Running a Regulation CF campaign successfully requires more than meeting filing deadlines. It’s about building habits that keep your company organized, transparent, and ready for ongoing oversight. These best practices help founders balance compliance and growth.

Prioritize Investor Communication and Transparency: Keep investors informed throughout the process. Use the crowdfunding portal to post updates, answer questions, and clarify any changes. The more open and timely the communication, the stronger the investor confidence. It also helps avoid confusion or misunderstandings later.

Maintain Strong Recordkeeping and Transfer Agent Coordination: Every transaction, investor detail, and disclosure should be tracked carefully. Partner with a registered transfer agent to manage shareholder records and maintain a clean cap table. This becomes essential when preparing annual reports or future fundraising rounds.

Stay Consistent With Annual Reporting and Avoid 12(g) Triggers: After closing the campaign, continue filing your annual Form C-AR reports with current financials and company updates. Monitor your total number of shareholders and total assets to stay below thresholds that would trigger full SEC registration under Section 12(g).

Use Legal and Compliance Experts Effectively: Working with experienced compliance experts can simplify a complex process. Firms like InnReg help startups interpret regulatory requirements, prepare accurate filings, and build compliance programs that scale with growth. Their expertise reduces costly mistakes and saves valuable time.

Prepare Thoroughly Before Launch: A strong start begins with solid groundwork. Review your financials, ownership structure, and management backgrounds early. Clearly define how the funds will be used and make sure your disclosures reflect reality. Preparation helps build credibility from day one.

Build a Strong Relationship With Your Portal Team: Your crowdfunding portal is more than just a platform; it’s a key compliance partner. Understand its review process, communication tools, and investor verification steps. Staying in sync with the portal team helps keep the campaign compliant and running smoothly.

Develop Internal Compliance Systems and Audit Trails: Create systems that track filings, approvals, and communication in one place. Tools like Asana or other workflow software can help document tasks and deadlines. Having an internal audit trail makes future reviews easier and shows a clear commitment to compliance.

By following these steps, startups can approach Regulation CF with confidence, keeping their operations organized and investor relationships strong throughout the fundraising journey.

—

Regulation CF gives startups a practical way to raise funds while building relationships with a broad group of investors. It brings structure, transparency, and accountability to the crowdfunding process, helping founders grow within a clear regulatory framework.

While compliance can feel complex, it becomes manageable with good planning and organized systems. Staying transparent, keeping strong records, and communicating openly with investors go a long way toward building trust and credibility.

How Can InnReg Help?

InnReg is a global regulatory compliance and operations consulting team serving financial services companies since 2013.

We are especially effective at launching and scaling fintechs with innovative compliance strategies and delivering cost-effective managed services, assisted by proprietary regtech solutions.

If you need help with crowdfunding compliance, reach out to our regulatory experts today:

Last updated on Jan 7, 2026

Related Articles

Feb 25, 2026

·

22 min read

Feb 19, 2026

·

12 min read