FINRA KYC Rule: What Fintechs Need to Know

Jan 9, 2026

·

10 min read

The FINRA KYC rule is a cornerstone of regulatory compliance for broker-dealers and other firms operating in US financial markets.

For fintechs, it often represents the first serious encounter with securities regulation once a product moves from concept to customer onboarding. Knowing what the rule requires and what regulators expect in practice can make the difference between a smooth launch and a compliance roadblock.

This article explores FINRA’s Know Your Customer” obligations, explaining how the rule works, how it relates to other requirements like suitability and Regulation Best Interest, and why it matters in the fast-moving fintech space.

At InnReg, we work with fintechs and broker-dealers to turn FINRA KYC obligations into practical onboarding and monitoring processes. We assist with drafting KYC and CIP policies, integrating vendor tools, and building governance that supports examinations and reviews.

What Is the FINRA KYC Rule?

The FINRA KYC rule is formally known as FINRA Rule 2090, “Know Your Customer.” It requires broker-dealers to exercise reasonable diligence in learning and maintaining essential facts about each customer and their accounts.

These facts allow a firm to:

Service the account effectively.

Follow any special instructions.

Verify the authority of those acting on behalf of the customer.

Comply with applicable laws, regulations, and industry standards.

This obligation commences at the moment an account is opened and remains in effect throughout the duration of the relationship. It is not limited to identity checks. Firms are expected to understand the customer’s financial background, objectives, risk tolerance, and who is authorized to act on the account.

How It Differs from Suitability (Rule 2111) and Reg BI

Rule 2090 is often discussed alongside FINRA Rule 2111, the Suitability rule. While Rule 2090 focuses on gathering essential information, Rule 2111 governs how that information is used when making investment recommendations. In practice, suitability is only possible if the KYC rule is met.

Use our resources to learn more about FINRA Rule 2111 Suitability →

On top of these, the SEC introduced Regulation Best Interest (Reg BI) in 2020. Reg BI raises the standard for broker-dealers when serving retail investors, requiring them to act in the customer’s best interest when making recommendations. Like suitability, Reg BI builds on the foundation of the KYC rule: firms cannot evaluate best interest without accurate, current customer data.

Read our article to learn more about Reg BI →

For fintechs building or partnering with broker-dealers, this layering of requirements means KYC is not a one-time hurdle but a central element of long-term compliance.

Why the FINRA KYC Rule Matters for Fintechs

FINRA KYC rule sets the foundation for obtaining customer information before financial products are offered, supervised, and scaled in highly regulated markets.

Investor Protection and Risk Management

KYC is about collecting essential facts when opening every account. FINRA Rule 2090 requires firms to obtain information about each customer so they can identify who is authorized to act on the account and build a complete profile.

This information forms the foundation for assessing suitability under Rule 2111, since firms need to know a client’s income, objectives, and risk tolerance before recommending securities.

For investors with limited experience, capturing details about objectives and risk tolerance is critical to ensuring any recommendations are appropriate.

Intersection With Innovation in Financial Services

Fintech companies frequently operate at the edge of financial innovation.

Products may combine brokerage with payments, or link securities with digital assets. These models create complex compliance questions that hinge on KYC.

For example, a platform offering both stock trading and crypto wallets must align onboarding and monitoring processes with securities rules, AML laws, and state-level money transmission requirements.

Learn more about AML monitoring →

Understanding the KYC rule helps fintechs innovate responsibly without inadvertently creating regulatory gaps in their business model.

Relevance for Broker-Dealers

FINRA Rule 2090 directly applies to broker-dealers and establishes a baseline expectation for how they manage customer relationships.

Every brokerage account requires the firm to gather and maintain essential facts about the customer, regardless of whether investment recommendations are made.

For fintechs operating as broker-dealers, or partnering with them, this rule is central to both onboarding processes and ongoing account supervision. Getting it right is critical not only for compliance but also for maintaining the trust of customers and regulators.

InnReg provides tailored compliance services for broker-dealers →

Key Regulatory Requirements Behind KYC

The FINRA KYC rule is situated within a broader regulatory framework that encompasses securities laws, anti-money laundering obligations, and supervisory expectations:

FINRA Rule 2090 (Know Your Customer)

Rule 2090 requires broker-dealers to collect and maintain essential facts about each customer.

These facts allow the firm to service accounts, confirm authority, and comply with securities regulations.

The obligation begins at account opening and remains in effect throughout the client's relationship.

SEC Regulation Best Interest (Reg BI)

Reg BI applies when broker-dealers make recommendations to retail customers. It requires firms to act in the customer’s best interest, which depends on accurate, up-to-date KYC information.

Without a clear view of a client’s financial profile and objectives, firms cannot meet the standard of care expected under Reg BI.

FinCEN’s AML and CIP Rules Under the Bank Secrecy Act

The Bank Secrecy Act, administered by FinCEN, requires broker-dealers to maintain anti-money laundering programs.

A key part of this is the Customer Identification Program (CIP), which mandates collecting identifiers such as name, date of birth, address, and government-issued ID numbers.

Verification may be documentary or non-documentary, and it must be risk-based and reliable.

Customer Due Diligence (CDD) and Beneficial Ownership Requirements

Initial identity verification is only the first layer of KYC. Firms must also understand why a customer is opening an account and how it will be used.

Individual customers require data such as income, objectives, and investment background.

Business customers require additional diligence, including confirming beneficial owners with significant control or ownership and documenting how the business operates. This dual focus is central to AML compliance and to the ongoing obligations of the FINRA KYC rule.

Need help with fintech compliance?

Fill out the form below and our experts will get back to you.

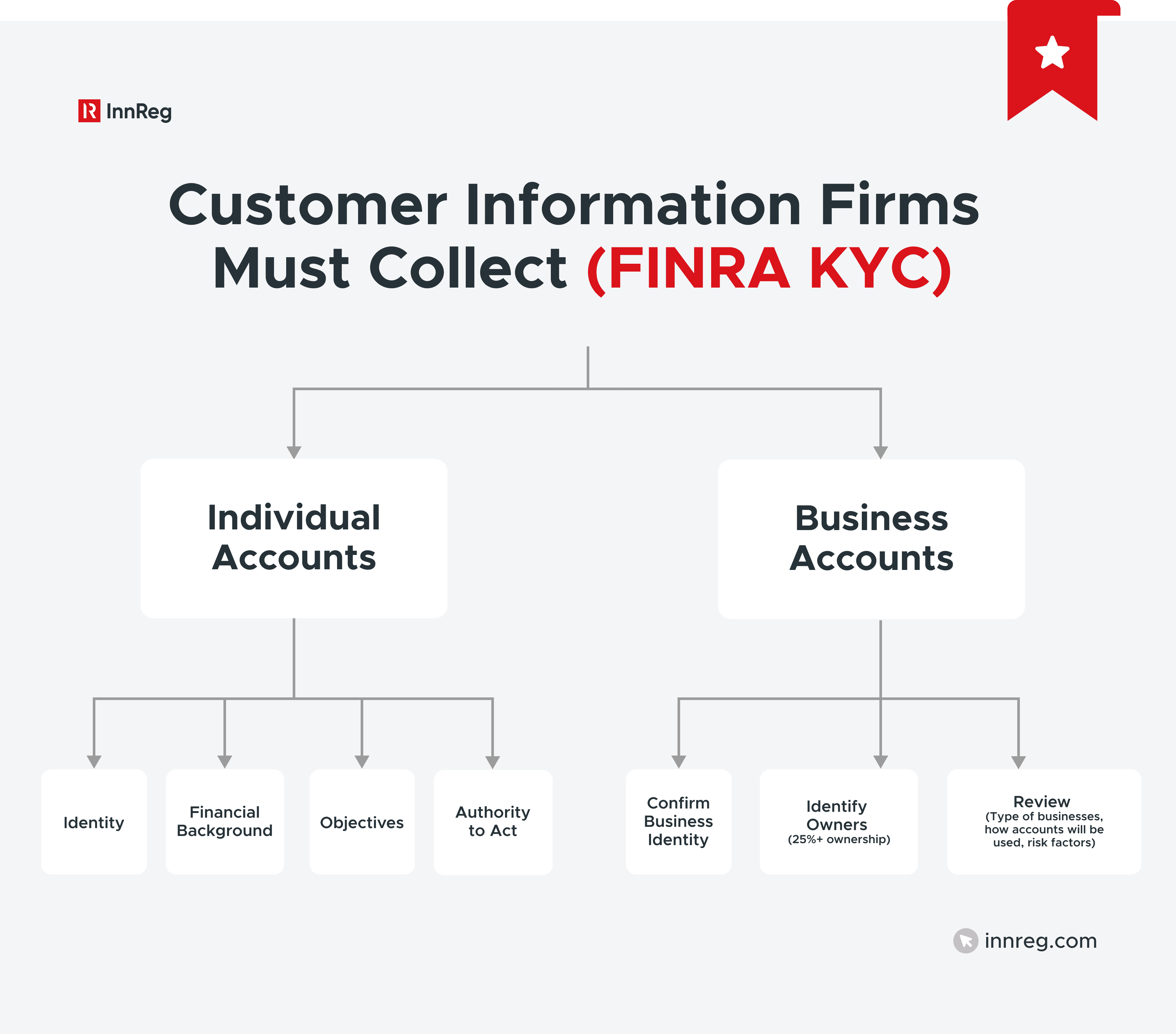

Essential Customer Information Firms Must Collect

The FINRA KYC rule requires broker-dealers to maintain a complete and accurate customer profile. This goes beyond verifying who a customer is:

Individual Accounts (Identity, Financial Background, Objectives)

Under the FINRA KYC framework, fintech broker-dealers are expected to collect and maintain a broad set of customer information spanning identity, finances, and investment profile:

Identity records such as name, birth date, address, and government ID

Financial background, including income, net worth, source of wealth, and tax profile

Investment objectives, risk preferences, expected time horizon, liquidity needs, and level of market knowledge

Authority to act, clarifying who may trade or make decisions on behalf of the account

Collected customer data underpins operational servicing of accounts and the suitability analysis that FINRA requires.

Business Accounts (KYB and Beneficial Owners)

KYC for businesses requires firms to evaluate both the entity and its controlling parties.

This involves:

Confirming business identity with registration documents and tax records

Identifying beneficial owners with 25% or greater ownership or those exercising significant control

Reviewing the type of business, how the account will be used, and associated risk factors

This process (also known as KYB) strengthens both AML compliance and adherence to FINRA’s expectations under Rule 2090.

Ongoing Updates and Monitoring Requirements

Know Your Customer obligations extend beyond account opening.

Firms must keep records current by updating customer data periodically and whenever material changes occur (e.g., shifts in employment, income, or account authority).

Ongoing monitoring also involves reviewing transactions against the customer’s established profile to spot unusual or suspicious activity.

Regulators require documented review cycles to show that KYC is treated as a lasting duty, not a box checked at onboarding.

Common Compliance Challenges with the FINRA KYC Rule

Fintech firms often run into obstacles when trying to balance regulatory expectations with the speed of innovation:

Balancing Onboarding Speed With Regulatory Data Collection

Collecting the customer data at onboarding is necessary, but it often conflicts with the desire for speed.

Regulators expect firms to collect a complete KYC profile, even when it creates friction.

Fintechs can use digital identity verification and KYC/KYB automation to make the process smoother, but those tools do not replace the need to comply fully with regulatory requirements.

Identity Verification and Fraud Prevention

Identity theft, account takeovers, and synthetic identities are rising concerns.

The KYC rule requires reliable verification, yet fraudsters often find ways to exploit gaps in fintech platforms.

Firms need layered verification methods and a risk-based approach to reviewing flagged accounts.

Ongoing Monitoring and Updating Client Profiles

One of the biggest compliance gaps occurs when firms treat KYC as a one-time event. Rule 2090 requires ongoing updates, meaning customer data must be refreshed regularly and whenever circumstances change. Without documented review cycles, firms risk missing red flags and falling out of compliance.

Integrating Compliance Into Fintech Tech Stacks

Fintechs often rely on multiple tools: trading engines, CRMs, payment processors, and third-party KYC vendors. When these systems do not connect, it becomes difficult to maintain a single, consistent view of the customer.

Resource and Expertise Constraints

For startups, the cost of bringing on seasoned compliance professionals can be prohibitive. That does not change the fact that KYC and AML requirements apply immediately.

Spreading tasks across other roles can introduce risk, since these teams may lack the depth of expertise regulators expect.

Working with outside compliance partners offers a way to scale capabilities without taking on the full cost of internal hires.

That's why InnReg helps fintech by providing KYC and AML compliance services →

Pitfalls to Avoid When Applying the FINRA KYC Rule

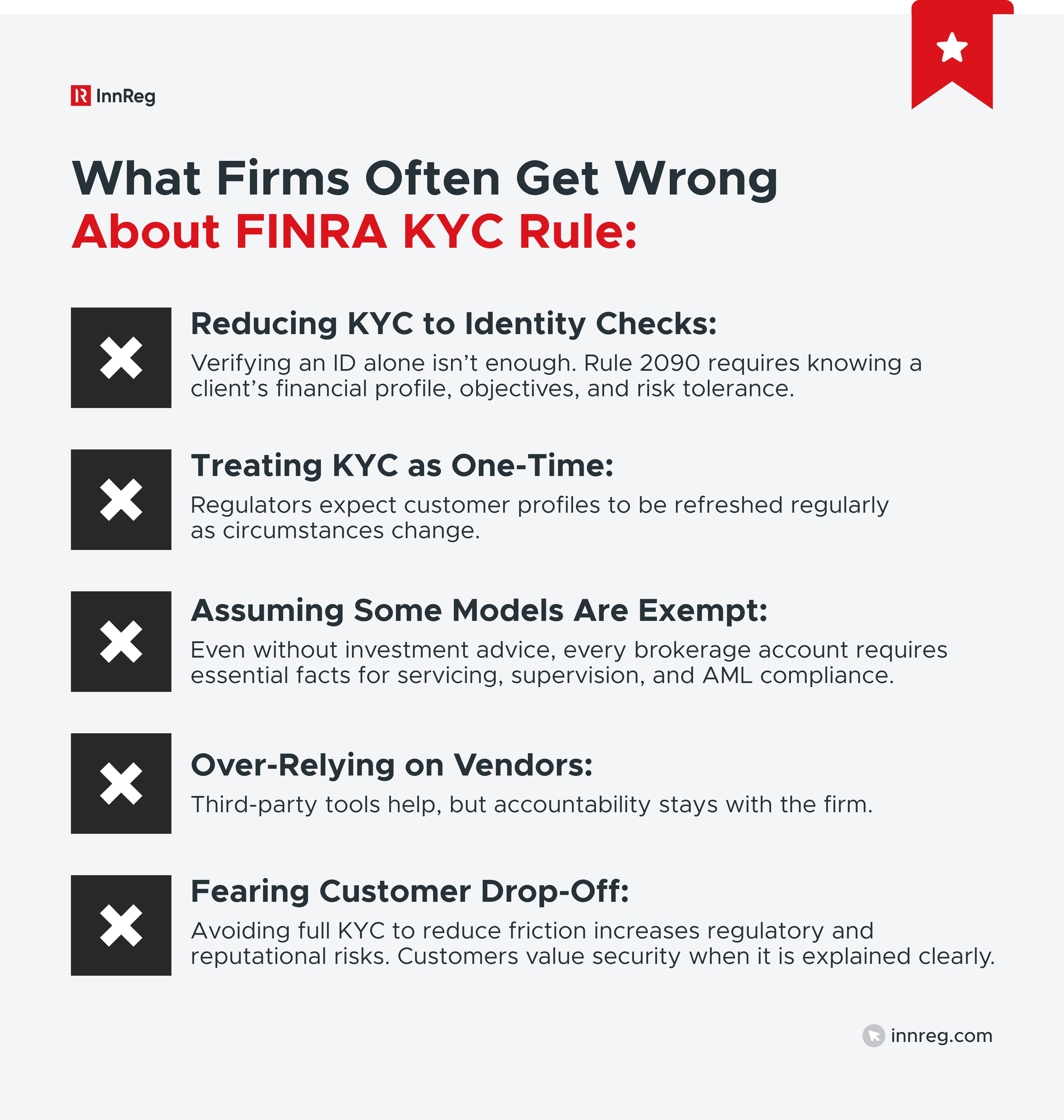

The following pitfalls are common among fintechs and can create unnecessary regulatory and operational risks:

Reducing KYC to Identity Checks

Some firms stop at verifying a driver’s license or passport.

In reality, FINRA Rule 2090 requires understanding a customer’s essential facts along with each person that can act on behalf of the customer, not just confirming their name and date of birth.

Treating KYC as a One-Time Event

Onboarding is only the beginning. Regulators expect firms to update customer information periodically and as circumstances change.

Failing to refresh client profiles leaves firms blind to evolving risks.

Assuming Non-Recommendation Models Are Exempt

Some fintech founders believe that if their platform does not make recommendations, they can sidestep KYC requirements.

That can be a costly misunderstanding. The FINRA KYC rule (Rule 2090) applies to every brokerage account, regardless of whether the firm provides advice.

At a minimum, firms must collect and retain essential facts about the customer: who they are, who has authority on the account, and enough information to service and supervise it properly.

Over-Relying on Third-Party Vendors

Fintech companies often rely on specialized vendors for identity verification, sanctions screening, and document authentication.

These services can be effective tools, but they do not eliminate regulatory accountability. FINRA and FinCEN hold the firm, not the vendor, responsible for compliance.

If a vendor fails to catch a fake ID or overlooks a red flag, regulators will not excuse the lapse.

Fearing Customer Drop-Off from Compliance

Some startups hesitate to collect detailed data, worried about user friction. But regulators mandate it, and customers often value transparency and security when it’s explained clearly.

Avoiding robust KYC to reduce friction exposes the business to regulatory and reputational risks.

See also:

Key Takeaways for FINRA KYC Rule Compliance

From day one, fintechs need to design compliance programs with the KYC rule in mind. The following best practices outline the areas that matter most for executives and compliance officers:

Drafting tailored KYC and CIP policies: Generic templates rarely cover the complexities of fintech models. Firms should develop written KYC and Customer Identification Program (CIP) policies that reflect their business operations, risk profile, and customer base.

Multi-source identity verification approaches: Identity checks should not depend on one document alone. Effective programs bring together government identification, third-party data, biometrics, and credit information to confirm accuracy and lower exposure to fraudulent accounts.

Ongoing monitoring and customer information refresh cycles: KYC does not end at onboarding. Firms must update customer records at set intervals and whenever circumstances change, while also monitoring accounts for unusual activity.

Escalation protocols for red flags and exceptions: Firms need clear procedures for handling incomplete or suspicious customer data. Escalation steps should include enhanced due diligence, senior compliance review, and, when required, filing Suspicious Activity Reports (SARs).

Leveraging automation without over-relying on vendors: Technology helps scale KYC programs, but regulators hold firms, not vendors, accountable. Automation should be combined with human oversight and documented review processes.

Building a compliance culture and training staff: Compliance responsibilities are not limited to the compliance team. Staff across operations, product, and customer support should be trained on KYC requirements and how to recognize warning signs. Senior leadership sets the tone by making it clear that KYC is a core part of customer trust and regulatory credibility.

—

The FINRA KYC rule is the foundation of how broker-dealers manage customer relationships.

For fintechs, the rule shapes onboarding, supervision, and monitoring practices from the earliest stages of growth. Treating KYC as an ongoing obligation, rather than a one-time formality, is essential to meeting regulatory expectations and building trust with investors.

While technology can streamline identity checks and monitoring, regulators make clear that accountability rests with the firm. Founders and compliance leaders must design programs that combine automation with policies, oversight, and training.

How Can InnReg Help?

InnReg is a global regulatory compliance and operations consulting team serving financial services companies since 2013.

We are especially effective at launching and scaling fintechs with innovative compliance strategies and delivering cost-effective managed services, assisted by proprietary regtech solutions.

If you need help with compliance, reach out to our regulatory experts today:

Last updated on Jan 9, 2026

Related Articles

Feb 25, 2026

·

22 min read

Feb 19, 2026

·

12 min read